Our Marketing Team at PopaDex

Top 12 Personal Finance Spreadsheet Templates for 2025

In an era of high-tech finance apps, the humble spreadsheet remains a powerhouse for managing your money. Its enduring appeal lies in offering unparalleled control, customization, and privacy, putting you firmly in the driver’s seat of your financial journey. A well-designed personal finance spreadsheet template allows you to track what truly matters to you-from granular budget categories and debt-snowball plans to complex investment portfolios and retirement projections.

Unlike rigid, one-size-fits-all applications, a spreadsheet can be tailored to your specific financial situation, whether you’re a gig worker with fluctuating income, an expat managing multiple currencies, or a young professional focused on aggressive wealth-building. To truly unlock financial clarity, understanding and implementing effective cash flow management techniques is crucial, a task made significantly simpler with a powerful, personalized spreadsheet. This guide cuts through the online clutter to help you find the perfect tool.

We have curated and analyzed the 12 best personal finance spreadsheet templates available today, covering everything from simple, free budget trackers on Microsoft Create to sophisticated, automated dashboards from Tiller Money. For each resource, you’ll find a detailed breakdown of its key features, practical use cases, honest pros and cons, screenshots, and a direct link for immediate access. This comprehensive list is designed to help you quickly identify the ideal template to build financial discipline, achieve your goals, and finally gain a true 360-degree view of your wealth.

Free template

Want to follow along?

Grab the free net worth tracker spreadsheet and apply these steps immediately.

1. Net Worth Tracker Google Sheet

Best For: Automated, multi-currency portfolio management.

The Net Worth Tracker from PopaDex secures its position as our featured choice by offering a rare combination of simplicity, power, and global accessibility. It stands out as a superior personal finance spreadsheet template for users who demand a comprehensive, real-time view of their financial health without the complexity of traditional software. Its core strength lies in its dual-access model, catering to both spreadsheet newcomers and seasoned investors.

Where many templates lock advanced features behind a paywall, PopaDex provides a robust free version for manual tracking. However, its premium tier is where the platform truly excels. The automated integration with over 15,000 banks across more than 30 countries is a game-changer for anyone managing a diverse portfolio, especially expats or digital nomads handling multiple currencies. This feature eliminates tedious data entry and provides an accurate, up-to-the-minute snapshot of your assets and liabilities.

Key Takeaway: PopaDex’s Net Worth Tracker bridges the gap between basic manual spreadsheets and expensive financial apps, offering automated, multi-currency tracking directly within a familiar Google Sheets environment.

Core Features & Analysis

- Automated Bank Integration: The premium version’s ability to sync with savings, investment, and loan accounts provides a live, consolidated dashboard. This is ideal for users who want to monitor their financial standing without daily manual updates.

- Multi-Currency Support: It automatically converts and tracks assets held in different currencies, a critical feature for international users that is often overlooked in other templates.

- Interactive Dashboards: The template doesn’t just list numbers; it translates them into clear, interactive charts and graphs. This visual approach helps you easily track net worth growth, asset allocation, and progress toward financial goals like retirement.

- Scalability: Its design accommodates users at any stage. A beginner can start with the free manual version to track their first savings account, while an advanced investor can use the premium features to monitor complex stock portfolios, real estate holdings, and international assets.

Implementation and User Experience

Getting started is straightforward. Users simply make a copy of the Google Sheet. The premium version requires connecting bank accounts via a secure third-party service, with clear instructions provided. The interface is clean and intuitive, making navigation and data interpretation feel effortless. PopaDex also offers a 30-day money-back guarantee, providing a risk-free opportunity to test the premium features. You can find additional details and usage tips by reviewing their guide to a net worth tracking spreadsheet on PopaDex.com.

| Feature | Availability & Details |

|---|---|

| Pricing | Free manual version; Premium at €5/month (or regional equivalent). |

| Bank Integration | 15,000+ banks in 30+ countries (Premium only). |

| Multi-Currency | Fully supported with automatic conversion (Premium only). |

| Support | Dedicated customer support included with the premium plan. |

| Access | Instant access via a link to copy the Google Sheet. |

Get the Net Worth Tracker Google Sheet on PopaDex.com

2. FinancialAha

FinancialAha offers a curated collection of premium personal finance spreadsheet templates designed exclusively for Google Sheets. This platform distinguishes itself by focusing on a one-time purchase model that grants users lifetime access and free future updates, eliminating the need for recurring subscriptions. It’s an ideal choice for individuals who prefer to own their tools outright and keep their financial data securely within their personal Google account.

The templates are particularly well-suited for users looking to manage various financial aspects in one integrated environment, from detailed budgeting to comprehensive financial planning and investment tracking. The design philosophy centers on user-friendliness and easy customization, allowing you to tailor the spreadsheets to your specific financial situation without needing advanced technical skills.

Key Features and User Experience

FinancialAha’s core strength lies in its specialized, comprehensive templates. Instead of offering a single, one-size-fits-all solution, it provides distinct spreadsheets for different needs, which can be purchased individually or as a bundle. This allows users to select only the tools relevant to them.

Our Take: The privacy-focused approach is a major benefit. Since these are Google Sheets templates, your sensitive financial information never touches FinancialAha’s servers; it remains stored securely in your own Google Drive, giving you complete control.

The user experience is straightforward: upon purchase, you receive immediate access to the template, which you can then copy to your Google account. While the lack of direct technical support is a downside, the templates are designed to be intuitive, and the one-time payment structure is a compelling advantage over subscription-based competitors.

- Best For: Google Sheets users who value data privacy and prefer a one-time payment over monthly fees.

- Pricing: One-time purchase per template or bundle.

- Platform: Google Sheets only.

Get the templates: FinancialAha Spreadsheet Templates

3. Payhip Ultimate Collection

Payhip serves as a digital marketplace where creators can sell products, and one standout offering is the Ultimate Personal Finance Collection. This comprehensive bundle features 16 distinct spreadsheet templates compatible with both Google Sheets and Excel. This platform is ideal for users who want a wide array of tools to cover nearly every aspect of their financial life, from basic budgeting to detailed financial planning, all acquired through a single, one-time purchase.

The collection is designed for individuals who appreciate having a cohesive set of tools that work together. Whether you are a young professional tracking irregular income or someone planning long-term goals, the variety ensures there is a specific personal finance spreadsheet template for your needs. The inclusion of both Google Sheets and Excel versions provides flexibility, catering to users across different ecosystems.

Key Features and User Experience

The primary strength of this collection is its sheer breadth and the inclusion of detailed instructional materials. Each of the 16 templates comes with sample data to demonstrate its functionality, a blank version for immediate use, and step-by-step video tutorials. This guided approach significantly lowers the learning curve, making advanced financial tracking accessible even to spreadsheet novices.

Our Take: The dual compatibility is a major advantage. You aren’t locked into a single platform, making it a versatile choice if you use Excel for work but prefer Google Sheets for personal finances, or vice versa. The one-time payment for lifetime access is another significant plus.

The user experience is direct: after purchasing on Payhip, you get instant access to download all files. While the initial cost is higher than buying a single template, the value comes from the volume and variety of tools provided. Some users might find they don’t need all 16 templates, but for those who want an all-in-one toolkit, it’s a powerful and cost-effective option.

- Best For: Users seeking a comprehensive, multi-template toolkit for both Google Sheets and Excel.

- Pricing: One-time purchase for the entire 16-template collection.

- Platform: Google Sheets and Excel.

Get the templates: Payhip Ultimate Personal Finance Collection

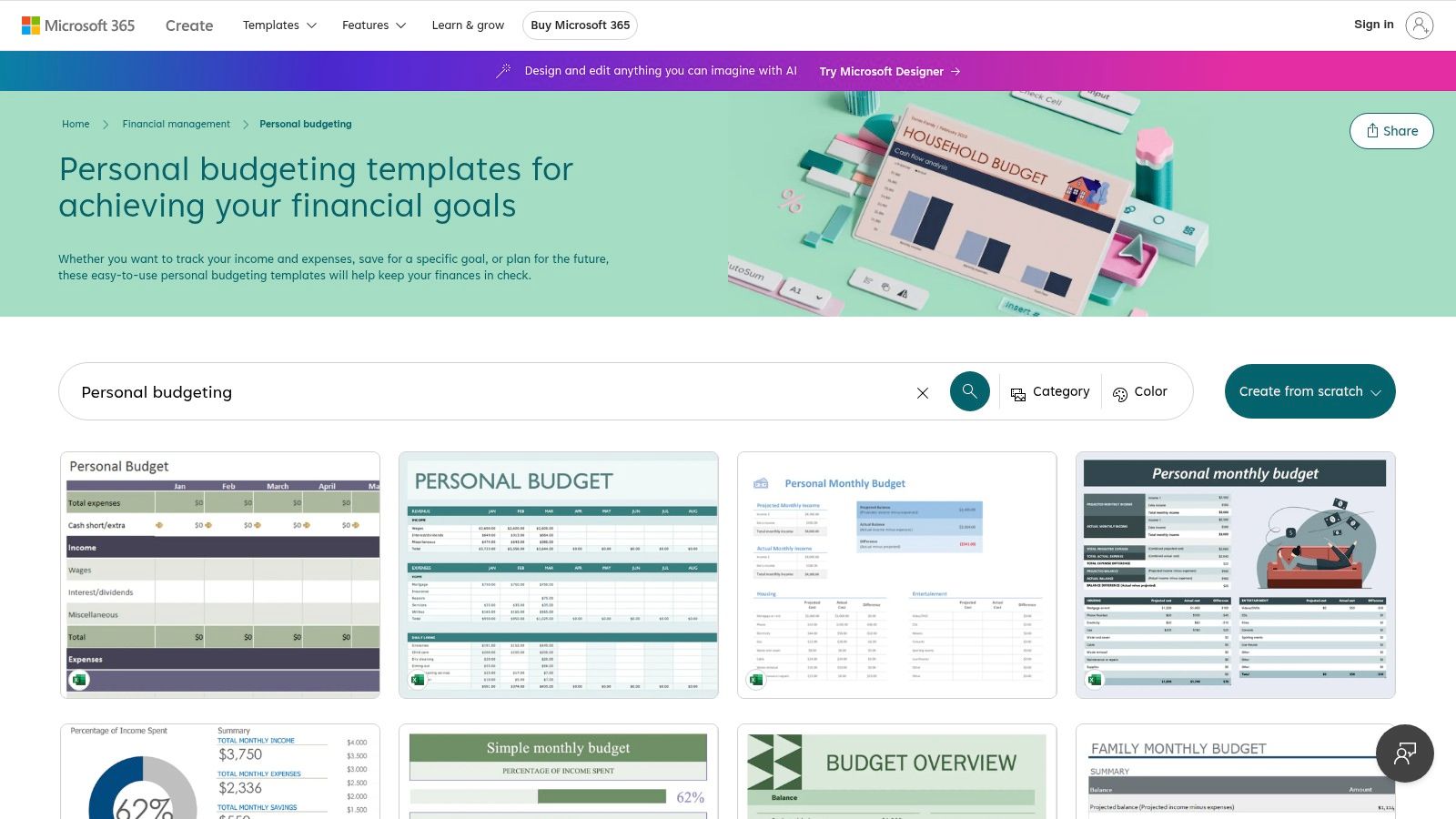

4. Microsoft Create

Microsoft Create serves as the official hub for free, high-quality templates directly from the creators of Excel. It offers a diverse range of personal budgeting and finance templates designed to help users track income, manage expenses, and plan for savings goals. This platform is the go-to source for anyone deeply integrated into the Microsoft Office ecosystem who wants a reliable, no-cost starting point for their financial management journey.

The templates are built to be immediately familiar and functional for Excel users, leveraging the software’s powerful features without a steep learning curve. Because they are native Excel files, customization is straightforward, allowing you to add, remove, or modify categories and formulas to perfectly match your financial situation. This makes it an excellent choice for those who prefer the robust capabilities of desktop software.

Key Features and User Experience

Microsoft Create’s primary strength lies in its accessibility and trustworthiness. As the official source, you can be confident the templates are well-constructed and free from malware. The selection includes everything from a simple personal budget to more specific tools like a household expense tracker or a savings goal calculator, providing a solid foundation for various needs.

Our Take: The seamless integration with the full Microsoft Office suite is a significant advantage. You can easily link your budget to other documents or presentations, and if you use OneDrive, your financial files are synced across all your devices for easy access.

The user experience is incredibly simple: browse the library, find a template you like, and download it with a single click. While these templates lack the automated bank connections or advanced dashboards of paid premium options, their simplicity is a key feature. They provide a clean, effective personal finance spreadsheet template without any unnecessary complexity or cost.

- Best For: Dedicated Microsoft Excel users who want free, reliable, and easily customizable budget templates.

- Pricing: Completely free.

- Platform: Microsoft Excel.

Get the templates: Microsoft Create Personal Budgeting Templates

5. Etsy

Etsy is a vast creative marketplace where individual designers and financial enthusiasts offer a massive variety of personal finance spreadsheet templates. Unlike platforms offering a single, standardized product, Etsy provides a sprawling collection of unique, handcrafted tools for both Google Sheets and Excel. This makes it an excellent source for users seeking a specific aesthetic, a niche budgeting method, or a highly personalized financial planner that reflects their individual style.

The platform is ideal for those who want to support independent creators while finding a template that perfectly matches their needs, whether it’s for tracking side hustle income, managing a wedding budget, or planning for a FIRE (Financial Independence, Retire Early) journey. The direct-to-creator model allows for a more personal purchasing experience, with some sellers even offering customization services for their templates.

Key Features and User Experience

The primary strength of Etsy lies in its sheer diversity. You can find everything from minimalist, single-tab budget trackers to elaborate, multi-dashboard financial life planners complete with charts, graphs, and automated calculations. Since each template is designed by a different seller, the features, complexity, and visual appeal vary dramatically, giving you endless options to explore.

Our Take: The quality and functionality can be inconsistent. It’s crucial to read seller reviews, check item descriptions carefully, and examine all provided images before purchasing. Look for sellers with high ratings and detailed, positive feedback to ensure you get a reliable and well-designed personal finance spreadsheet template.

The user experience is straightforward: find a template, purchase it, and receive an instant digital download link. Support is handled by individual sellers, meaning response times and help quality can vary. However, the low one-time cost for most templates makes it a low-risk way to experiment with different budgeting styles.

- Best For: Users who want a unique, aesthetically pleasing, or highly specific template and enjoy supporting independent creators.

- Pricing: One-time purchase per template, with prices varying by seller.

- Platform: Google Sheets and Excel (varies by listing).

Get the templates: Etsy Personal Finance Spreadsheets

6. Spreadsheet Life

Spreadsheet Life offers the “Personal Finance Power Pack,” a curated collection of Google Sheets templates designed to help users budget, reduce debt, save, and calculate net worth. This platform focuses on providing practical, interconnected tools that work together seamlessly. Instead of a single overwhelming sheet, it offers specialized templates that can be purchased in bundles, catering to different financial priorities. The model is a one-time purchase, which grants lifetime access and all future updates, appealing to those who dislike subscriptions.

The templates are built for clarity and action, guiding users through key financial tasks with a clean and intuitive design. They are ideal for individuals or couples who want a structured yet customizable system to manage their finances without the complexity of advanced accounting software. All data remains securely within your personal Google account.

Key Features and User Experience

Spreadsheet Life’s strength lies in its bundled approach. Users can choose from the Starter, Pro, or All-Star packs, each offering a different combination of templates for budgeting, debt management, and wealth tracking. This tiered system ensures you only pay for the tools you need, from basic budgeting to a complete financial overview.

Our Take: The 14-day money-back guarantee is a significant advantage, providing a risk-free opportunity to test the templates. This shows confidence in the product and gives users peace of mind, which is not always offered for digital spreadsheet products.

The user experience is designed for simplicity. After purchase, you receive the templates and copy them to your Google Drive. While there is no direct technical support line, the user-friendly nature of the sheets and the promise of free updates make it a compelling personal finance spreadsheet template for Google Sheets enthusiasts.

- Best For: Individuals and couples who use Google Sheets and want a bundled set of tools for budgeting, debt reduction, and net worth tracking.

- Pricing: One-time purchase for different bundles (Starter, Pro, All-Star).

- Platform: Google Sheets only.

Get the templates: Spreadsheet Life Power Pack

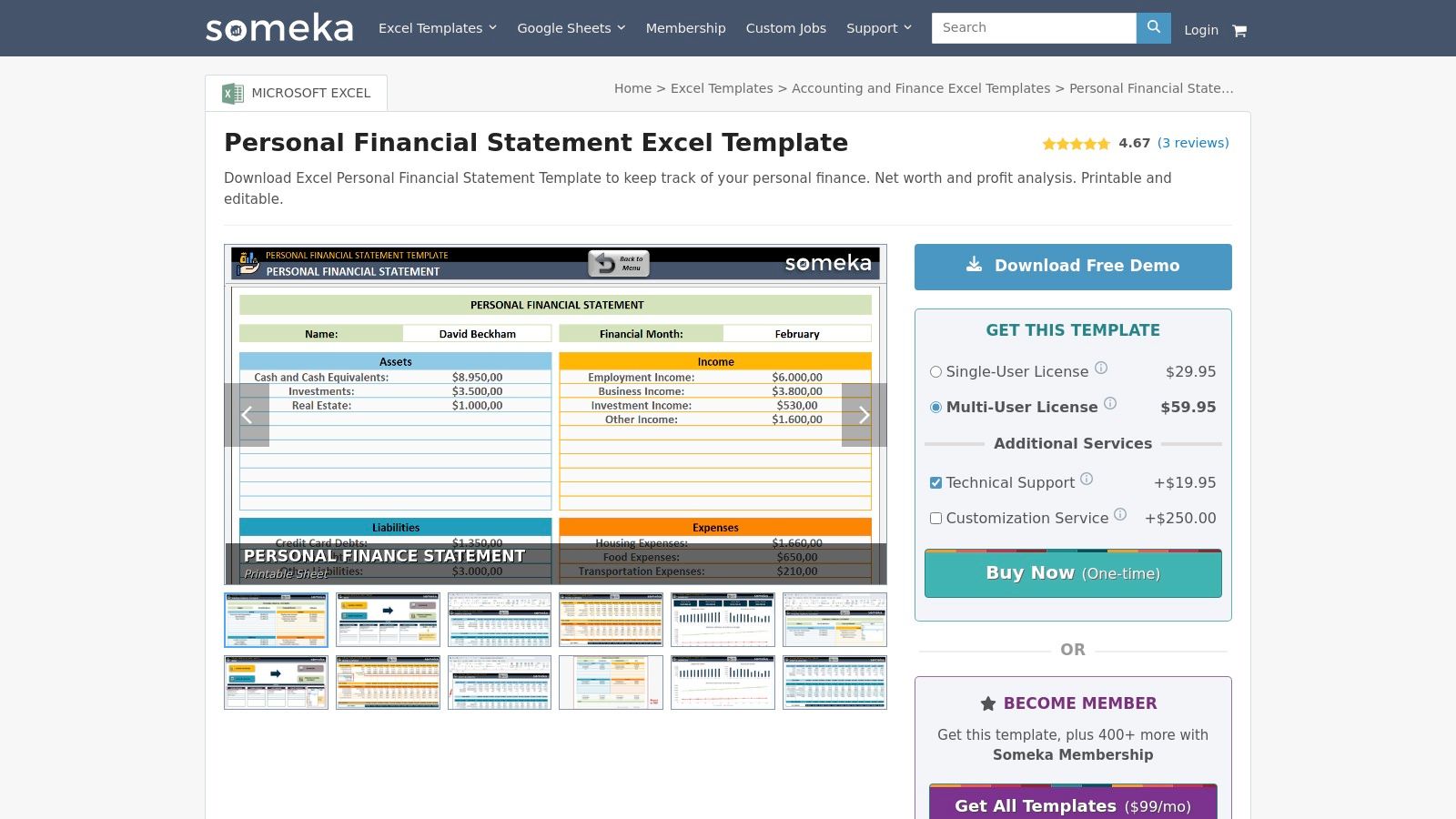

7. Someka

Someka provides a robust Personal Financial Statement Excel Template designed for users who want a clear and comprehensive overview of their financial health. This tool is built to meticulously track income, expenses, assets, and liabilities, presenting the data in a clean, professional format. It stands out by offering a powerful yet straightforward solution for those who are comfortable within the Microsoft Excel ecosystem and prefer a one-time purchase over a recurring subscription model.

The template is particularly useful for individuals preparing for loan applications, financial planning sessions, or simply seeking a detailed snapshot of their net worth. It emphasizes functionality and ease of use, ensuring that users can get started without a steep learning curve or needing to install complex add-ins.

Key Features and User Experience

Someka’s strength is its simplicity and focus on core financial statement creation. The template is fully editable and printable, providing a clear financial summary complete with visual charts and graphs for at-a-glance analysis. A key design choice is the exclusion of VBA or macro codes, which enhances security and ensures compatibility across different systems and Excel versions (2007 and later).

Our Take: The absence of macros is a significant advantage for security-conscious users. This design ensures the file is safe to use and won’t trigger security warnings, making it a reliable tool for generating a professional-looking personal finance spreadsheet template.

The user experience is guided by on-sheet instructions, making data entry intuitive. While it is limited to Excel and lacks a free version, its focused functionality provides excellent value. For those interested in exploring similar options, you can see how Someka’s approach compares to a personal budget spreadsheet template. The one-time payment delivers a polished, ready-to-use product that feels both professional and accessible.

- Best For: Excel users needing a formal personal financial statement for loans, planning, or net worth tracking.

- Pricing: One-time purchase for the template.

- Platform: Microsoft Excel only.

Get the template: Someka Personal Financial Statement Excel Template

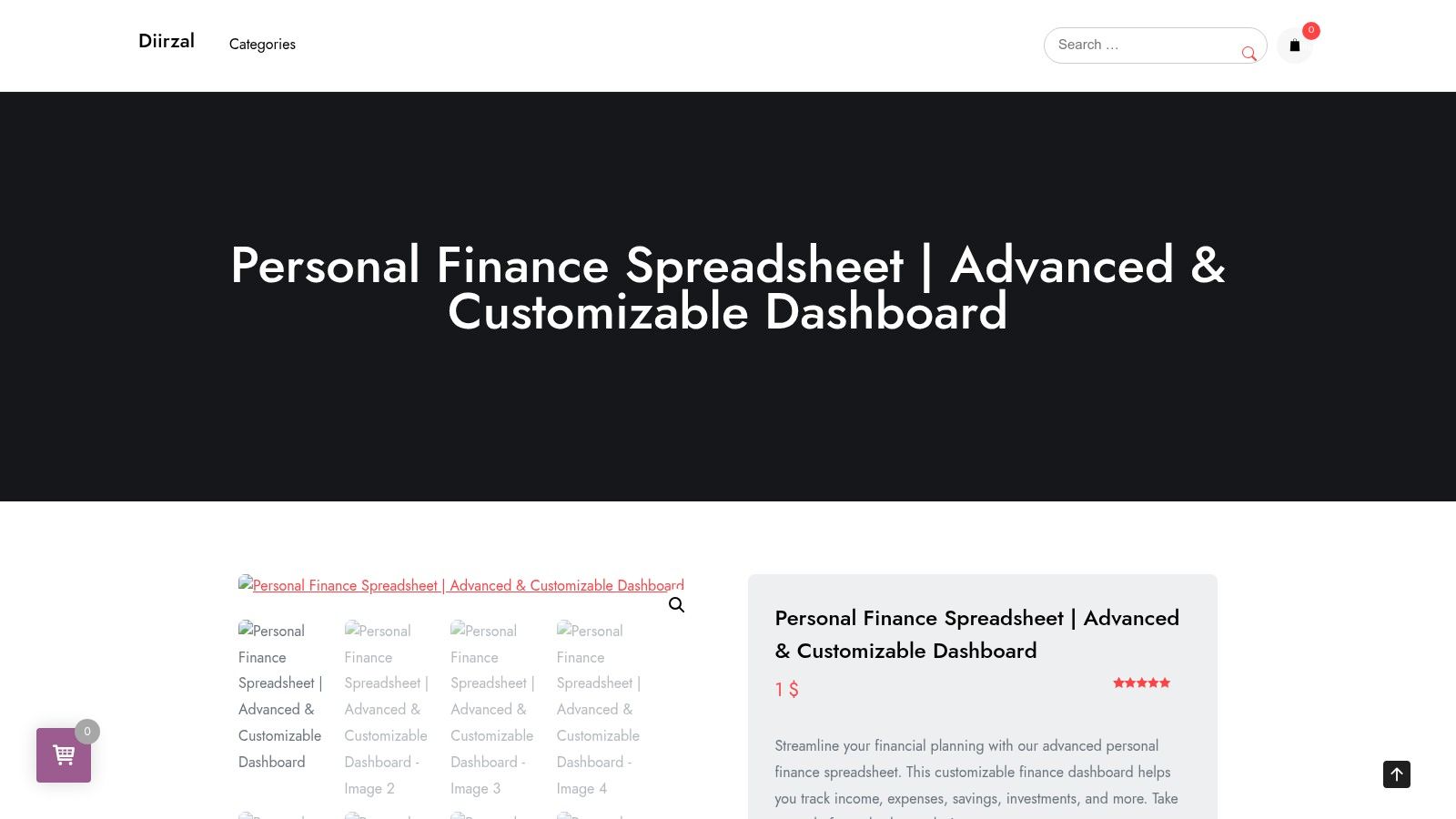

8. Diirzal

Diirzal provides a specialized and highly visual Personal Finance Spreadsheet template created specifically for Microsoft Excel users. The platform focuses on offering a single, powerful tool at an affordable one-time price, making it accessible for those who prefer working within the familiar Excel ecosystem. This template is designed to be an all-in-one dashboard, allowing users to track their income, expenses, savings goals, and investment performance in a cohesive and visually engaging format.

Its primary appeal is for individuals who want a comprehensive overview of their financial health without the complexity of multiple linked sheets or the commitment of a subscription service. The design prioritizes clarity and immediate insight through dynamic charts and graphs that update automatically as you input your data, making financial analysis less about numbers and more about visual trends.

Key Features and User Experience

Diirzal’s strength is its focused simplicity combined with powerful visualization. The template is engineered to be intuitive for anyone comfortable with Excel, enabling extensive customization of categories, currencies, and financial goals. This makes it a great personal finance spreadsheet template for users who want to adapt their tool to their specific needs.

Our Take: The emphasis on visual dashboards is a significant advantage. Seeing your financial progress through charts can be more motivating and easier to interpret than staring at rows of data, which is perfect for visual learners or anyone who wants a quick, at-a-glance financial check-up.

The user experience is direct: you purchase the template and receive an instant download link to the Excel file. While this model means there is no ongoing technical support, the template’s affordability and user-friendly design make it a strong contender. The primary limitation is its exclusivity to Excel, which may not suit Google Sheets users.

- Best For: Excel enthusiasts who need a visually-driven, customizable, and affordable all-in-one financial dashboard.

- Pricing: One-time purchase for instant download.

- Platform: Microsoft Excel only.

Get the template: Diirzal Personal Finance Dashboard

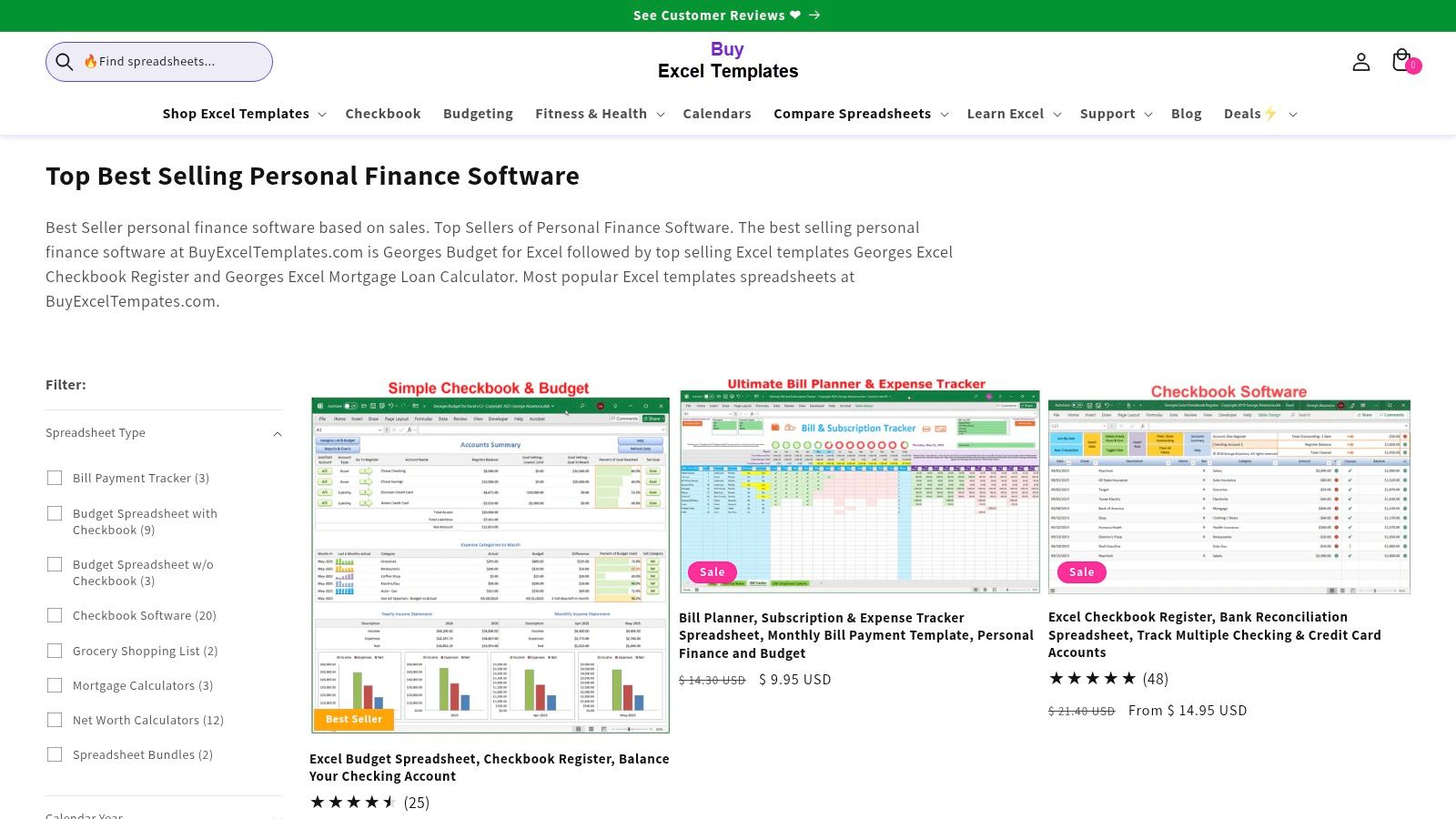

9. BuyExcelTemplates

BuyExcelTemplates offers a wide variety of personal finance spreadsheets designed specifically for Microsoft Excel users. This platform caters to individuals who prefer the power and familiarity of Excel for managing their finances, providing tools that range from detailed budgeting templates to comprehensive checkbook registers and net worth trackers. The model is straightforward: a one-time purchase provides instant digital download and lifetime access to your chosen template.

This approach is perfect for those who want to own their financial tools without being tied to a subscription. It focuses on providing practical, easy-to-customize spreadsheets that serve distinct financial management needs, from daily expense tracking to long-term wealth monitoring.

Key Features and User Experience

The primary strength of BuyExcelTemplates lies in its extensive selection of specialized Excel-based tools. Rather than offering a single, all-encompassing sheet, it allows users to pick and choose the exact personal finance spreadsheet template that fits their immediate goal, whether it’s a simple budget or a more complex financial statement.

Our Take: The one-time purchase model is a significant advantage for budget-conscious users. You pay once and can use the template forever without worrying about recurring fees, making it a cost-effective long-term solution for dedicated Excel fans.

The user experience is seamless. After purchase, you receive the file immediately and can begin using it in Microsoft Excel right away. While this means there are no cloud-based features or collaborative tools, it offers a secure, offline method for managing your financial data. The main drawback is its exclusivity to Excel, as Google Sheets users will need to look elsewhere.

- Best For: Microsoft Excel users looking for a wide range of affordable, single-purchase templates.

- Pricing: One-time purchase per template.

- Platform: Microsoft Excel only.

Get the templates: BuyExcelTemplates Personal Finance Spreadsheets

10. Sheetwalla

Sheetwalla provides a comprehensive bundle of spreadsheet templates through its “Full Access Pass,” targeting users who want an all-in-one solution for both personal and professional tracking. This platform stands out by offering a versatile package of 10 premium templates compatible with both Google Sheets and Microsoft Excel. The one-time purchase model includes lifetime access and all future updates, making it a cost-effective choice for those managing diverse financial and productivity needs.

The collection is designed for individuals and small business owners who need tools for everything from detailed budgeting and net worth tracking to habit formation and project management. This broad scope makes it a unique personal finance spreadsheet template resource, as it extends beyond just finances to include overall life organization.

Key Features and User Experience

Sheetwalla’s main appeal is the value packed into its bundle. Instead of purchasing templates individually, users get a curated suite of tools designed to work together seamlessly. The dual compatibility with Excel and Google Sheets offers flexibility that many competitors lack, catering to users regardless of their preferred software.

Our Take: The inclusion of non-financial templates like habit trackers and project planners is a significant plus. It allows users to consolidate their personal organization into a single, familiar spreadsheet environment, creating a more holistic dashboard for life management.

The user experience is direct and simple: a single purchase grants immediate access to all 10 templates. While the bundle is affordable, some users might find certain templates unnecessary for their specific needs. The lack of direct technical support is a potential drawback, but the templates are built to be intuitive and highly customizable.

- Best For: Users who want a comprehensive set of templates for both financial and general life management in either Excel or Google Sheets.

- Pricing: One-time purchase for the Full Access Pass.

- Platform: Google Sheets & Microsoft Excel.

Get the templates: Sheetwalla Full Access Pass

11. Spreadsheets Crafter

Spreadsheets Crafter delivers an All-in-One Personal Finance Package focused on empowering users to tackle debt, accelerate savings, and gain firm control over their spending. The platform stands out by bundling a suite of specialized tools into a single, affordable package, providing lifetime access and free updates with a one-time purchase. This model is ideal for users who want a comprehensive toolkit without committing to a recurring subscription.

A key advantage is the dual compatibility; each personal finance spreadsheet template is provided in both Microsoft Excel and Google Sheets formats. This flexibility ensures users can work within their preferred ecosystem, whether on a desktop with Excel or in the cloud with Google Sheets, without sacrificing functionality. The templates are designed for immediate use, catering to beginners while still offering enough depth for more experienced budgeters.

Key Features and User Experience

Spreadsheets Crafter’s strength is its bundled approach, which covers multiple financial goals in one go. The package includes dedicated templates for debt snowball or avalanche methods, savings trackers, detailed monthly budgets, and spending logs. This makes it a great starting point for someone looking to build a complete financial management system from the ground up.

Our Take: The inclusion of both Excel and Google Sheets versions is a significant benefit, offering a level of versatility not always seen in template bundles. It accommodates different user preferences and ensures long-term usability, even if you switch platforms later.

The user experience is seamless. After the one-time payment, you receive instant download links for all files. While the bundle is comprehensive, some users may not need every template included. However, given the affordable pricing, the value is strong even if you only use a few of the core tools. The lack of direct technical support is a trade-off for the low, one-time cost.

- Best For: Individuals seeking a multi-functional, affordable bundle compatible with both Excel and Google Sheets.

- Pricing: One-time purchase for the entire bundle.

- Platform: Microsoft Excel and Google Sheets.

Get the templates: Spreadsheets Crafter Personal Finance Package

12. Tiller Money

Tiller Money bridges the gap between manual spreadsheets and fully automated budgeting apps by syncing your financial accounts directly to Google Sheets or Microsoft Excel. This platform is built for those who love the flexibility of a personal finance spreadsheet template but hate the tedious task of manual data entry. It automatically imports daily transactions and balances, giving you an up-to-date financial picture without constant effort.

The service provides a gallery of pre-built, customizable templates for budgeting, net worth tracking, debt-snowball plans, and more. This combination of automation and customization makes Tiller a powerful tool for tech-savvy users who want complete control over their financial data and how it’s visualized.

Key Features and User Experience

Tiller’s main advantage is its automated bank feed. After a secure one-time connection to your accounts, it populates your chosen spreadsheet with fresh data each day. The platform’s Foundation Template is a great starting point, but you can easily install other specialized templates or even build your own from scratch.

Our Take: The automated transaction import is a game-changer for spreadsheet enthusiasts. It eliminates the single biggest pain point of using a spreadsheet for budgeting, saving hours of manual work while keeping your data securely in your own cloud environment.

While Tiller streamlines data collection, it still requires user engagement to categorize transactions and interpret the data, maintaining the hands-on nature of spreadsheet management. The initial setup can have a learning curve, but the time saved in the long run is a significant benefit. You can find more details in this in-depth comparison of Tiller and other tools.

- Best For: Users who want the power of a custom spreadsheet without manual data entry.

- Pricing: Annual subscription required after a 30-day free trial.

- Platform: Google Sheets and Microsoft Excel.

Get the templates: Tiller Money

Personal Finance Template Comparison

| Product | Core Features / Highlights | User Experience / Quality | Value & Pricing | Target Audience | Unique Selling Points |

|---|---|---|---|---|---|

| Net Worth Tracker Google Sheet | Manual & automated bank integration; Multi-currency; Interactive dashboards | Advanced insights, intuitive UI | Free manual / €5/month Premium | Beginners to advanced investors | 15,000+ banks, multilingual, AI co-pilot upcoming |

| FinancialAha | Budgeting & planning templates; lifetime updates | User-friendly, customizable | One-time payment | Google Sheets users | Privacy-focused, free updates |

| Payhip | 16 templates; tutorials; Google Sheets & Excel | Comprehensive & easy to use | One-time payment | Users needing diverse templates | Video tutorials, multi-platform support |

| Microsoft Create | Free budgeting templates for Excel | Simple, customizable | Free | Excel users | Free, easy Microsoft Office integration |

| Etsy | Wide, unique templates via marketplace | Varying quality | Varies | Excel & Google Sheets users | Direct creator communication, instant download |

| Spreadsheet Life | Budgeting, debt, net worth bundles; updates | Customizable, easy | One-time , 14-day refund | Google Sheets users | Money-back guarantee, bundle options |

| Someka | Excel personal finance statement; charts | User-friendly, no macros | Paid only | Excel users | Printable summary, no VBA needed |

| Diirzal | Excel finance dashboard; customizable, charts | User-friendly, affordable | Paid, affordable | Excel users | Instant download, visual analysis |

| BuyExcelTemplates | Excel personal finance templates | Customizable, lifetime access | One-time payment | Excel users | Wide variety, easy customization |

| Sheetwalla | 10 premium templates, Excel & Google Sheets | User-friendly, customizable | One-time payment | Mixed Excel & Google Sheets users | Bundle deal, comprehensive tools |

| Spreadsheets Crafter | Debt payoff, savings, budgeting tools | Customizable, lifetime access | One-time payment | Excel & Google Sheets users | All-in-One package, discounted pricing |

| Tiller Money | Automated bank syncing; budgeting & expense tracking | Time-saving, customizable | Subscription-based , 30-day trial | Users wanting automation | Automated data import, trial offered |

From Template to Transformation: Your Next Financial Steps

We’ve explored a comprehensive landscape of personal finance spreadsheet templates, from the automated power of Tiller Money and the robust features of Someka to the bespoke, creative options found on Etsy. The journey through these twelve distinct tools reveals a crucial truth: there is no single “best” personal finance spreadsheet template, only the one that is best for you. Your financial situation, technological comfort, and ultimate goals are the true determinants of the right tool.

The most powerful spreadsheet isn’t necessarily the one with the most pivot tables or conditional formatting. It’s the one you consistently use. The real transformation begins not when you download a template, but when you commit to the routine of tracking, reviewing, and acting on the data it provides.

Distilling Your Options: How to Choose Your Perfect Template

Choosing the right starting point can feel overwhelming. Let’s simplify the decision-making process by aligning your needs with the tools we’ve discussed.

-

For the Hands-On Beginner: If you’re new to detailed financial tracking and want to learn the fundamentals, a more manual template is your best ally. Consider options from Microsoft Create, Payhip, or a basic freebie from Spreadsheet Life. These force you to engage with every transaction, building a strong foundation of financial awareness.

-

For the Busy Professional Seeking Automation: If your time is limited and your primary goal is a high-level, real-time overview, automation is key. Tiller Money is the undisputed leader here, directly integrating with your bank accounts to eliminate manual data entry. This “set it and forget it” approach is ideal for tracking net worth and spending with minimal effort.

-

For the Visually-Driven Planner: Do you respond best to charts, graphs, and a clean aesthetic? Marketplaces like Etsy and specialized creators like Spreadsheets Crafter or Sheetwalla excel in this area. Their templates often prioritize intuitive dashboards and visual appeal, turning budgeting from a chore into an engaging activity.

-

For the Advanced Analyst and Multi-Currency User: If you manage complex investments, track multiple currencies, or run a small business, you need a more powerful and flexible solution. Templates from Someka, BuyExcelTemplates, or the more advanced options from Diirzal provide the sophisticated features required for in-depth analysis and customized tracking.

Implementation: Turning Your Spreadsheet into a Financial Command Center

Once you’ve selected your personal finance spreadsheet template, the next critical phase is implementation. A downloaded file sitting in a folder has no value. To unlock its potential, you must integrate it into your life.

- Schedule Your Financial Check-in: The single most important step is to create a recurring habit. Set a specific time each week, perhaps Sunday evening or Monday morning, to update your spreadsheet. Put it on your calendar like any other important appointment.

- Start Small, Then Expand: Don’t try to categorize 12 months of past transactions on day one. Start by tracking your finances from today forward. Once the habit is established, you can go back and fill in historical data if you find it necessary for year-over-year comparisons.

- Customize and Personalize: Your template is a starting point, not a rigid set of rules. Feel free to add, remove, or rename categories to reflect your unique spending habits. Does your “Entertainment” budget need to be split into “Streaming,” “Dining Out,” and “Events”? Make the change. The more the tool reflects your life, the more you’ll use it.

- Focus on Insights, Not Just Data: The goal goes beyond logging numbers; it is to understand what they mean. At the end of each month, ask yourself key questions: Where did I overspend? Where did I save? Is my net worth moving in the right direction? Use these insights to set clear, actionable goals for the following month.

Your financial journey is a marathon, not a sprint. The right personal finance spreadsheet template is your map and compass, guiding you toward your goals. By choosing a tool that aligns with your needs and committing to the simple habit of consistent use, you are taking a definitive step away from financial uncertainty and toward a future of clarity, confidence, and control.

Ready to elevate your financial tracking beyond a standard template? For those who want a dedicated, powerful, and beautifully designed net worth tracker that syncs with your portfolio, PopaDex offers a specialized solution. Explore how PopaDex can provide the real-time clarity and automated insights you need to confidently build and manage your wealth.