Our Marketing Team at PopaDex

Using a Retirement Income Calculator The Right Way

Think of a retirement income calculator as your financial GPS. It’s a tool that takes a snapshot of your current savings, investments, and how much you’re putting away, then projects it all into the future. It’s designed to answer that nagging question: “Am I actually on track to retire comfortably?”

Instead of just guessing or hoping for the best, a calculator gives you a concrete, data-driven look at where you’re headed.

What a Retirement Calculator Actually Shows You

Planning for retirement can feel like you’re trying to navigate a ship in the fog. A good retirement income calculator cuts through that uncertainty by doing more than just spitting out a single “magic number.” It builds a dynamic model of your financial future, letting you see exactly how the choices you make today will shape your financial freedom down the road.

First and foremost, it will give you a clear projection of your portfolio’s growth over time. You’ll see how your current nest egg, combined with your regular contributions, could realistically grow based on a set of assumed investment returns.

If you’re new to this, it’s a good idea to get a handle on the foundational concepts. Our guide on the basics of retirement planning provides great context for the numbers you’re about to plug in.

Beyond Simple Projections

Now, not all calculators are created equal. You’ll find basic versions that offer a simple, straight-line projection—and those are fine for a quick gut check.

But the real power lies in more advanced tools. These don’t just assume the market goes up in a perfect line. They stress-test your plan against the messy reality of market volatility, giving you a much more honest picture of what could happen.

The gold standard for this is a Monte Carlo simulation. Instead of one single outcome, these sophisticated models run thousands of different market scenarios—from best-case booms to worst-case busts. This shows you a range of possible portfolio values, not just one overly optimistic projection.

For example, a calculator running thousands of market performance trials can tell you the probability that your money will last through your retirement. Instead of just “yes” or “no,” you might see there’s an 85% chance your portfolio will last until age 95.

That kind of insight is invaluable. It moves you from abstract goals to an actionable plan, showing you the real-world likelihood of success.

Gathering the Right Financial Information

A retirement income calculator is an amazing forecasting tool, but it has one critical flaw: it’s only as smart as the numbers you give it. This is the classic “garbage in, garbage out” problem. To get a projection that’s actually useful, you need to spend a little time upfront gathering the right financial details. Trust me, this small effort pays off big time by giving you a result that reflects your actual financial reality.

First things first, pull up your primary retirement accounts. You’ll need the most recent statements for your 401(k), 403(b), IRA, or whatever plans you have. The two key numbers here are the current total balance and your exact contribution rate.

And don’t forget the employer match! This is free money and a huge driver of your savings growth. Make sure you know the full percentage your company chips in.

Documenting Your Savings and Income

Next, you need to get a handle on your total savings rate—not just what’s going into your retirement accounts. Think about all the places you’re stashing cash: taxable brokerage accounts, high-yield savings, CDs, you name it. The calculator needs to know the full picture of your savings habits.

Your household income is another essential piece of the puzzle. If your pay is pretty consistent, your last pay stub will do the trick. But if you’re self-employed or have income that bounces around, it’s much better to calculate an average from the last 12 months to get a more realistic figure.

You also need to list out all the money you expect to have coming in once you’re retired. This usually includes:

- Social Security: The best way to get this number is to create an account on the Social Security Administration’s website. They’ll give you a personalized estimate based on your earnings history.

- Pensions: If you’re lucky enough to have a pension, dig up the paperwork. You need to know if it’s a monthly payout or a lump sum and how much to expect.

- Other Income: Do you have rental properties, a side business, or other income streams you plan to keep? Tally up the net income from those sources.

For federal employees, it’s especially important to understand your specific retirement plan, like FERS. Accurately projecting your income means knowing the ins and outs of your benefits, which is why a guide to maximizing FERS benefits can be so valuable.

Understanding Your Spending Habits

Finally, you need a realistic idea of what you spend. You don’t have to track every single penny, but a solid estimate of your monthly expenses is non-negotiable. This number helps the calculator figure out the income you’ll actually need to maintain your lifestyle.

You’ve probably heard the rule of thumb that you’ll need 70-85% of your pre-retirement income. Frankly, that’s just a guess. A far better approach is to track your actual spending for a couple of months. That personalized number will make your calculator’s output dramatically more accurate.

Rounding up these documents might feel like a bit of a chore, but every number you input sharpens the focus of your financial picture. When you feed the calculator precise, real-world data, you’re building a projection you can actually trust—and that’s the foundation for making confident decisions about your future.

Setting Assumptions That Reflect Reality

Alright, you’ve got all your numbers lined up. Now comes the make-or-break moment: setting the assumptions in your retirement income calculator. This is where your plan evolves from a simple list of assets into a true forecast of your future.

The assumptions you choose for inflation, investment returns, and how long you’ll live are the engine of this whole process. Get them wrong, and you’re working with a financial fantasy. Get them right, and you have a realistic roadmap.

It’s a delicate balance between cautious realism and informed optimism. Don’t just accept the default settings; many calculators use conservative, often outdated figures. It’s up to you to tweak these numbers to reflect your personal situation and today’s economic realities.

Taming the Inflation Beast

Inflation is the silent thief that can wreck even the most carefully laid retirement plans. It quietly erodes your purchasing power, year after year.

A calculator that defaults to a 2% inflation rate might feel safe, but it could dangerously underestimate how much you’ll actually need to live on, especially after periods of high inflation. Take a look at the average inflation rate over the last 10-20 years to get a more grounded baseline.

Plugging in a slightly higher rate, maybe 3% or even 3.5%, isn’t being pessimistic—it’s building a smart buffer into your plan. This small tweak can be the difference that ensures your projected income still covers your expenses down the road.

Projecting Realistic Investment Returns

It’s tempting to slide that investment return dial all the way up. Who wouldn’t want to see their portfolio projections shoot for the moon? But basing your retirement on wishful thinking is a recipe for a massive shortfall later.

Your projected return needs to be anchored to your actual asset allocation.

A portfolio packed with equities has historically delivered higher returns, but it also comes with a lot more volatility. On the flip side, a portfolio heavy on bonds is more stable but will likely generate lower returns. Here are some reasonable starting points:

- Conservative Portfolio (mostly bonds): 4-5% average annual return.

- Balanced Portfolio (60/40 mix): 6-7% average annual return.

- Aggressive Portfolio (mostly stocks): 8-9% average annual return.

Remember, these are long-term averages. Your actual returns will swing up and down from year to year. That’s why a conservative estimate is always the smarter play for planning.

A classic retirement planning technique is to run multiple scenarios. What does it look like if you pair high inflation with low returns (the pessimistic case)? Or low inflation with high returns (the optimistic one)? This stress-testing gives you a confidence range, showing you the best- and worst-case savings you might need. You can dive deeper into how these financial models work and explore the top choices for Monte Carlo retirement calculators.

Estimating Your Longevity

This last big assumption is the most personal one of all: how long do you expect to live? The goal, after all, is to make sure your money lasts as long as you do.

No one has a crystal ball, but you can make an educated guess.

Start with the average life expectancies for your gender. Then, adjust that number based on your family’s history of longevity, your personal health, and your lifestyle choices. A common best practice in financial planning is to assume your income needs to last until at least age 90 or 95. Planning for a long life creates a vital safety net, protecting you from the very real risk of outliving your savings.

Making Sense of Your Results (and What to Do Next)

So you’ve plugged in all your numbers, double-checked your assumptions, and hit “calculate.” That moment when the results pop up can feel a lot like getting your grades back in school. But here’s the thing: this isn’t a final grade. It’s just a snapshot—a data-driven look at where you’re headed if you stay on your current path.

Most retirement calculators will give you one of two main results: you’re on track, or you have a shortfall. A successful projection is the green light, often shown as a graph where your money outlasts you. It’s a great sign that your plan is solid.

A shortfall, on the other hand, means the calculator predicts your money will run out sometime during retirement. This is your “gap”—the space between the money you’ll have and the money you’ll need.

Putting a Number on Your Retirement Gap

Seeing a projected shortfall can be a gut punch, but the first step is to get specific. Don’t panic; quantify it.

A calculator might tell you that you’re 20% short of your income goal. Let’s make that real. Imagine a couple, both 45, who want $80,000 a year in retirement. A 20% gap means their current plan is on track to generate only $64,000 annually.

Suddenly, that abstract percentage becomes a very concrete $16,000 annual deficit. Naming the number transforms a vague fear into a measurable problem you can actually solve. It’s no longer a scary unknown; it’s a target for your strategy.

Think of your calculator’s output as the starting line, not the finish line. It’s the raw data you need to make smarter decisions, whether that means saving more, rethinking your retirement date, or tweaking your investments.

It’s also helpful to see how you stack up. For instance, the average retirement balance for Americans aged 55 to 64 is $537,560. A good calculator helps you see where you stand in comparison and then lets you play with the numbers to close any gaps you find.

Reading Between the Lines: Charts, Graphs, and Probabilities

Modern calculators do more than just spit out a final number. They use visuals to tell the story of your financial future, and you need to know how to read them.

Pay close attention to these key elements:

- Portfolio Growth Curve: This chart shows your savings’ journey. You want to see a steep upward climb during your working years, but watch out for an equally steep drop once you retire. A sharp decline is a red flag.

- Income vs. Expenses Chart: Many tools will plot your income sources (pension, withdrawals, etc.) against your expenses year by year. This visual makes it incredibly easy to see exactly when and why a shortfall is projected to happen.

- Probability Score: More advanced tools use Monte Carlo simulations to give you a success probability, like an 85% chance your money will last. This single number tells you how well your plan might hold up against market ups and downs.

Once you have these numbers, the final piece of the puzzle is connecting them to your real-world financial life. Your projected income is one thing, but what does that look like after taxes? Getting a handle on understanding your retirees tax return is crucial for figuring out your true net income. This is how you move from just seeing a result to truly understanding what it means for your lifestyle.

Turning Your Calculator Insights Into Action

A retirement income calculator gives you a projection, not a final grade. Think of its output as a powerful starting point—a diagnostic tool that shows you where you can make the biggest impact. If your results show a gap between what you have and what you’ll need, don’t panic. That’s the first step. The numbers are just feedback, and you have complete control over how you respond.

Seeing a shortfall can actually be incredibly motivating. It takes a vague, nagging anxiety about the future and turns it into a tangible problem with clear solutions. Now you can get to work, making targeted adjustments to your financial plan that will directly impact your future wealth.

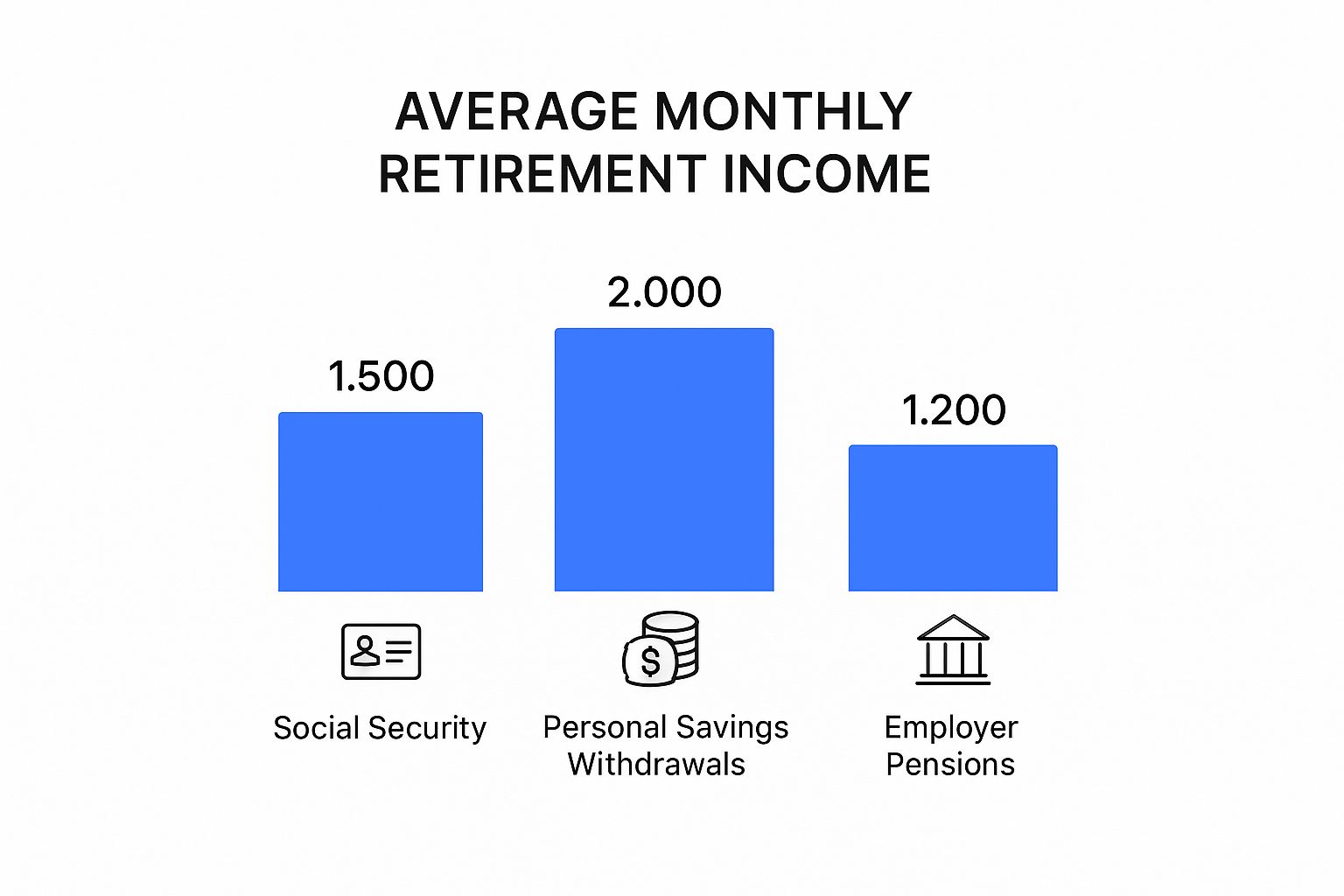

This chart breaks down the common income streams retirees rely on, and it really drives home the importance of having your own savings locked and loaded.

As you can see, for many people, withdrawals from personal savings have to do the heavy lifting to fund a comfortable retirement.

Practical Strategies to Close Your Gap

If your projection is coming up a bit short, you’ve got several powerful levers you can pull. The trick is to run the numbers through your calculator again after trying out each adjustment to see the real-time impact.

Here are a few of the most effective moves:

-

Systematically Increase Your Contributions: This is the most direct approach. Even small, consistent increases can have a massive effect over time thanks to the magic of compounding. For instance, just adding an extra $200 per month to your 401(k) starting at age 40 could tack on over $140,000 to your nest egg by age 65, assuming an average 7% annual return. It adds up fast.

-

Delay Your Retirement Date: The effect of working just a few more years is a triple-whammy. You have more time to contribute, your existing investments have more time to grow, and you shorten the number of years your savings need to fund. Pushing retirement from 65 to 67 can often erase a significant savings gap entirely.

-

Adjust Your Investment Mix: If you have a long time horizon, a portfolio that’s too conservative might be holding you back. Shifting a portion of your allocation from bonds to stocks could boost your potential for long-term returns. Of course, this strategy involves more risk, so it’s a change that requires careful thought.

Remember, the goal goes beyond piling up money; it’s to build a sustainable income stream that lasts. Your initial calculation is the first step. To dig deeper, it’s worth exploring tools designed specifically for modeling different withdrawal scenarios. You can learn more by checking out a dedicated retirement nest egg calculator.

Small Adjustments, Big Impact

Closing a retirement savings gap isn’t about one giant leap; it’s about making a series of smart, manageable adjustments. Below is a look at some common strategies and how they might fit into your plan.

Strategies to Bridge Your Retirement Savings Gap

| Strategy | How It Works | Potential Impact | Best For | | :— | :— | :— | :— | | Increase Savings Rate | Automate small, regular increases to your 401(k) or IRA contributions. | High, especially over a long time horizon due to compounding. | Anyone with available cash flow, even if it’s just a small amount. | | Delay Retirement | Working a few extra years allows for more contributions and investment growth. | Very High. Can significantly reduce the total savings needed. | Those who are able and willing to work longer and are close to retirement age. | | Adjust Asset Allocation | Shifting to a more aggressive investment mix (e.g., more stocks). | Medium to High, but with increased risk and volatility. | Younger investors with a long time horizon to recover from market downturns. | | Reduce Retirement Expenses | Lowering your estimated annual spending in retirement. | High. Directly reduces the size of the nest egg you’ll need. | Individuals who have flexibility in their future lifestyle or can downsize. |

Each of these strategies offers a different path forward. The best approach for you might even be a combination of two or three. The key is to find what works for your specific situation and start implementing it.

Revisit and Refine Your Plan Regularly

Your financial life isn’t static, so your retirement plan shouldn’t be either. Treat it as a living document that needs to evolve with you.

Make a point to revisit your retirement income calculator at least once a year. Life events like a salary bump, a new job with a better 401(k) match, or a change in your family situation are all perfect triggers to run your numbers again.

Each check-in keeps your plan aligned with your reality. This allows you to make small, proactive tweaks along the way instead of facing large, stressful corrections down the road.

Common Questions About Retirement Calculators

Even with the best tools at your fingertips, a few questions are bound to pop up. Using a retirement income calculator is a fantastic first step, but it’s totally normal to feel a bit uncertain as you dig into the numbers.

Getting these common questions answered will help you move from simply plugging in figures to truly understanding what they mean for your future. Let’s clear up some of the most frequent uncertainties people have.

How Often Should I Update My Calculation?

Your financial life isn’t set in stone, and your retirement plan shouldn’t be either. As a rule of thumb, you should fire up your retirement calculator at least once per year. This annual check-in keeps your plan tethered to your current reality, not a version of your life from years ago.

You’ll also want to run the numbers again after any major life event. These moments can significantly alter your financial trajectory.

Be sure to update your calculation if you:

- Get a promotion or a significant pay raise.

- Change jobs, especially if it affects your 401(k) or pension.

- Experience a big life change, like getting married or having a child.

- Receive an inheritance or another unexpected financial windfall.

Think of it like an annual financial physical. Consistent reviews let you make small, manageable tweaks instead of having to make drastic, stressful changes down the road. To keep things simple, you can follow our 2025 retirement planning checklist to guide your yearly review.

The biggest mistake you can make is treating your retirement calculation as a “one and done” task. Your initial projection is a snapshot in time, not a permanent prediction. Regular updates are what keep your plan relevant and effective.

Can I Trust Free Online Calculators?

For the most part, yes. Free online calculators from reputable financial institutions are great for getting a directional sense of where you stand. They are an excellent starting point for visualizing your financial future and getting a handle on the basic mechanics of saving for retirement.

But here’s the catch: their accuracy is only as good as the numbers you feed them and the built-in assumptions they use for things like inflation and investment returns. A free tool can give you a solid ballpark figure, but it might not capture the finer details of your situation, like complex tax strategies or income that varies year to year.

What Is the Biggest Mistake to Avoid?

By far, the most dangerous mistake is using overly optimistic assumptions. It’s incredibly tempting to plug in a high rate of return for your investments and a rock-bottom inflation rate—after all, it makes the final projection look amazing.

Unfortunately, this creates a false sense of security that can lead to a massive income shortfall when you actually retire.

Always, always err on the side of caution. Use a more conservative number for your investment returns and a slightly higher one for inflation. This builds a buffer into your plan. It’s far better to plan for a tougher scenario and be pleasantly surprised than to bank on a perfect one and come up short.

Ready to get a crystal-clear view of your financial future? Stop guessing and start planning with PopaDex. Our intuitive net worth tracker consolidates all your accounts—from savings and investments to property and loans—into one simple, powerful dashboard. Take control of your retirement journey today. Track your net worth with PopaDex