Our Marketing Team at PopaDex

Your Guide to Safe Withdrawal Rate Retirement

The safe withdrawal rate for retirement is the magic number that tells you how much you can spend from your savings each year without a high risk of your well running dry. It’s the core concept that turns a pile of assets into a steady, reliable paycheck for the rest of your life.

Unlocking a Stress-Free Retirement With a Safe Withdrawal Rate

So, how much can you actually spend from your retirement savings each year? This is the million-dollar question for every retiree, and getting it right is the difference between a secure future and a stressful one.

Think of your nest egg as a reservoir you’ve spent decades filling. The safe withdrawal rate (SWR) is all about managing the tap. You want to open it just enough to get the water you need to live comfortably, without draining the whole thing before its time.

Before we dive into the nitty-gritty, let’s get a quick lay of the land.

Quick Overview of Safe Withdrawal Rate Concepts

This table summarizes the core ideas behind the safe withdrawal rate to give you a quick reference before diving into the details.

| Concept | Simple Explanation | Why It Matters |

|---|---|---|

| Safe Withdrawal Rate (SWR) | The percentage of your portfolio you can withdraw annually without depleting it too soon. | It’s your personal “salary” in retirement. Getting it wrong means running out of money. |

| The 4% Rule | A common rule of thumb: withdraw 4% of your initial portfolio value, then adjust for inflation each year. | Provides a simple, time-tested starting point for retirement planning. |

| Sequence of Returns Risk | The danger of bad market returns early in retirement, which can cripple your portfolio’s longevity. | Your first few years of retirement have an outsized impact on whether your money will last. |

| Portfolio Longevity | How long your money is expected to last based on your withdrawal rate and market performance. | The goal is to make your money last for your entire lifetime (e.g., 30+ years). |

This framework helps you balance living well today with ensuring your money lasts for all your tomorrows.

At its heart, the SWR is a delicate balancing act. Withdraw too much, and you could burn through your savings faster than you think, leaving you high and dry in your later years. But withdraw too little, and you might live more frugally than you need to, failing to enjoy the wealth you worked so hard to build.

The Origin of the 4 Percent Rule

The most famous guideline in this world is the “4% Rule.” You’ve probably heard of it.

The idea is simple: withdraw 4% of your portfolio in your first year of retirement. After that, you just adjust that initial dollar amount for inflation each year. It’s a beautifully straightforward starting point.

This isn’t just some number plucked from thin air. It came from landmark research by financial planner William Bengen back in 1994. He stress-tested portfolios against historical market data and discovered that a 4% initial withdrawal rate held up over a 30-year retirement in almost every scenario he could find.

While it’s a powerful benchmark, it’s critical to know the assumptions it was built on before you just set it and forget it. Nailing this first step is a huge piece of our overall retirement planning checklist.

Deconstructing the Famous 4 Percent Rule

If you’ve spent any time looking into retirement planning, you’ve almost certainly bumped into the “4% Rule.” For decades, it’s been the go-to benchmark for figuring out how much you can safely spend from your nest egg. But what is it, really? And where did this magic number even come from?

This famous guideline wasn’t just plucked from thin air. It came out of a groundbreaking 1994 study by financial planner William Bengen. He set out to find a safe withdrawal rate for retirement that could survive the absolute worst moments in modern market history.

Bengen ran the numbers, stress-testing portfolios against data from 1926 to 1992. This wasn’t a calm period; it included the Great Depression and the soaring inflation of the 1970s. His conclusion changed retirement planning forever: a retiree could take out 4% of their starting portfolio, adjust that amount for inflation each year, and not run out of money for at least 30 years. This held up even if they had the worst possible luck and retired right before a massive market crash.

How the 4 Percent Rule Works in Practice

The mechanics are actually pretty straightforward. The key is that you only run the percentage calculation once. After that first year, you ignore your portfolio’s current value and just give your withdrawal amount a cost-of-living raise.

Let’s walk through an example. Say you retire with $1 million.

- Year 1: You withdraw 4% of your initial $1 million, which comes out to $40,000. This is your starting income.

- Year 2: Inflation was 3% last year. You don’t take 4% of whatever your portfolio is now. Instead, you adjust your original dollar amount by 3%. So, you withdraw $40,000 x 1.03 = $41,200.

- Year 3: If inflation ticks up by 2%, you adjust last year’s amount again: $41,200 x 1.02 = $42,024. This is what you take out for the year.

You just keep repeating this process. The goal is to give yourself a steady, predictable income that keeps up with the cost of living, no matter what the stock market is doing.

Key Takeaway: The 4% Rule is not about taking 4% of your current portfolio value each year. It’s about setting a baseline dollar amount in year one and then giving that amount an annual inflation adjustment.

This is a critical distinction. If you took 4% of your balance every year, your income would swing wildly. A bad market year would mean a huge pay cut, creating a very stressful retirement. The rule was designed specifically to avoid that volatility.

Understanding Its Limitations

While the 4% Rule is a fantastic starting point, it’s not a law of physics. It’s a guideline based on historical data, and it comes with a few important footnotes.

The original study made some assumptions that might not fit your situation:

- A 30-Year Retirement: Bengen’s analysis was built for a traditional retirement timeline. If you’re retiring early and need your money to last 40 or 50 years, 4% might be too high.

- A Specific Portfolio Mix: The model assumed a portfolio with 50-75% stocks and the rest in bonds. If your asset allocation is wildly different, your results will be, too.

- Past Performance: The rule is entirely backward-looking. It’s a bet that future market conditions will behave, on average, like they did in the 20th century.

Bengen’s research gave us an invaluable benchmark for thinking about a safe withdrawal rate. It offers a logical, historically-tested place to start. But in today’s world, it should be the beginning of your planning conversation, not the final word.

Is the 4 Percent Rule Still Relevant Today?

For a generation, the 4% Rule has been the bedrock of retirement planning. It’s a simple, powerful guideline that offered a clear path forward, but it was born from a deep dive into a very specific slice of U.S. financial history.

Relying on it blindly today is like trying to navigate a new city with a 30-year-old map. Sure, the main roads are probably still there, but so much of the landscape—the side streets, the new developments, the traffic patterns—has changed dramatically.

The world that William Bengen studied looks quite different from our own. A few key economic realities are putting some serious pressure on this traditional safe withdrawal rate retirement benchmark, forcing us to ask if it still holds up.

The Challenge of Lower Expected Returns

One of the biggest headwinds facing today’s retirees is the forecast for lower future returns from both stocks and bonds. Back when the 4% Rule was created, bond yields were much higher, giving portfolios a nice, safe cushion during stock market dips.

Today, it’s a different story. With interest rates scraping the bottom for years, bonds just don’t pack the same punch for reliable income or growth. At the same time, many financial experts believe stock market returns over the next decade won’t match the incredible performance we saw in the late 20th century.

This one-two punch means a 4% withdrawal could chew through your principal much faster than in the past. Your portfolio’s engine just might not have as much horsepower as it used to.

Starting Retirement with High Valuations

Another huge factor is what the market is doing right when you decide to retire. The original research was crystal clear: the most dangerous time to retire was when stock market valuations, like the Shiller CAPE Ratio, were sky-high.

Why? Retiring at a market peak makes you extremely vulnerable to a big downturn early on—that’s the dreaded sequence of returns risk. Unfortunately, many people retiring now are doing so after a long bull market, with valuations that are historically stretched.

Starting your withdrawals during a period like this means you might be forced to sell more shares when prices are low just to get the income you need. That can permanently damage your portfolio’s ability to grow back.

Modern Reality Check: The original 4% Rule was built to survive the absolute worst-case scenarios of the past. The problem is, today’s conditions—low bond yields and high stock valuations—look a lot like the starting points of those exact historical worst-case scenarios.

Evolving Perspectives from Financial Experts

This shifting landscape has led many financial institutions to rethink what a truly “safe” withdrawal rate looks like in the 21st century. The consensus is leaning toward a more conservative and, crucially, more flexible approach. One-size-fits-all rules are giving way to dynamic strategies that can adapt to what the market is actually doing.

Recent analysis from Vanguard really drives this point home. Their research highlights that while the 4% rule is a useful historical benchmark, it’s entirely backward-looking. Vanguard’s modeling shows that a “safe” rate can vary wildly, with some conservative scenarios suggesting a starting rate as low as 0.9% to almost guarantee your portfolio lasts. You can dive into the full analysis on Vanguard’s research to see their modern framework.

This doesn’t mean the 4% Rule is useless. It just means we need to see it for what it is: an optimistic upper limit, not a conservative starting line. A smarter approach for today’s retirees might look more like this:

- Starting Lower: Many experts now suggest a rate closer to 3.3% or 3.5% to build in a bigger safety buffer.

- Being Flexible: Adopting a strategy where you trim your withdrawals during down years can dramatically extend the life of your portfolio.

- Regularly Re-evaluating: Your plan can’t be on autopilot. You need annual check-ins to review your spending, portfolio performance, and the overall economic outlook.

Ultimately, the 4% Rule is still a valuable piece of financial history and a fantastic teaching tool. But for a truly secure safe withdrawal rate retirement plan today, it has to be treated as just one data point in a much larger, more personal conversation.

Finding Your Personal Safe Withdrawal Rate

The 4% Rule is a fantastic starting point—a solid historical benchmark. But treating it as the unbreakable law of your retirement is like using a generic map for a highly personal road trip. To really navigate your financial future with confidence, you have to tailor your withdrawal strategy to your own life.

Your personal SWR isn’t some magic number you just find. It’s a dynamic figure that comes into focus when you get brutally honest about four key variables.

This dashboard from PopaDex shows exactly where that journey begins: with a complete picture of your finances. You can’t personalize a plan without a crystal-clear, real-time understanding of what you own and how it’s invested.

Define Your Retirement Time Horizon

First things first: how long does your money need to last? This is the bedrock question. The original 4% Rule was built for a 30-year retirement, but that might not be your story at all.

- Traditional Retirement (25-30 Years): If you’re hanging up your hat in your mid-60s, a rate near 4% has historically been a pretty safe bet, assuming the market plays nice.

- Early Retirement (40+ Years): Planning to retire at 50? You could be looking at a retirement that spans four, or even five, decades. That massive time horizon demands a much more conservative starting point, likely closer to 3.0% - 3.5%, to ride out many more years of market bumps and inflation.

The longer you’re retired, the more chances a bad sequence of returns has to wreak havoc on your portfolio. A lower withdrawal rate is your safety buffer.

Assess Your Asset Allocation

The mix of stocks and bonds in your portfolio is the engine that will power your retirement income. Its design has a huge impact on how much you can safely pull out each year.

A portfolio heavy in stocks (say, 75%) offers more gas for long-term growth, potentially supporting a higher SWR. But it’s also a bumpier ride, making you more vulnerable if a market crash hits right after you retire. On the flip side, a conservative mix (40% stocks) is more stable but might not grow enough to keep up with 4% withdrawals for 30 years. For most, the sweet spot has historically been somewhere between 50-75% in stocks.

As you think about what makes a withdrawal strategy truly sustainable, it helps to look at different frameworks. A great place to start is understanding the Safe Yield Protocol, which digs into the principles of creating consistent returns.

Evaluate Your Spending Flexibility

Life isn’t static, and neither are the markets. Your ability to tighten your belt during a downturn is one of the most powerful levers you can pull to make your money last. This isn’t just a nice idea—it’s a core strategy.

Picture a retiree who can trim their annual spending by 10% after a year when their portfolio takes a hit. That simple adjustment means they sell far fewer shares when prices are low, preserving their capital and giving their portfolio a fighting chance to recover. In contrast, someone with rigid, non-negotiable expenses has to keep selling assets, no matter what the market is doing, which can put them on a fast track to running out of money.

The more flexible your budget, the more bulletproof your retirement plan.

Understand Your Risk Tolerance

Finally, it all comes down to you. Can you stomach watching your portfolio drop by 30% without panicking and ditching your entire strategy? The success of any withdrawal rate is completely dependent on your ability to stay the course.

If watching the market swing makes you lose sleep, then a lower SWR and a more conservative portfolio might be worth the peace of mind, even if it means a slightly leaner lifestyle. Knowing your own emotional triggers is just as critical as doing the math.

A great way to find your comfort zone is to model different scenarios. You can start playing around with PopaDex’s intuitive retirement income calculator to see exactly how these variables change the picture for your own numbers.

Exploring Smarter Withdrawal Strategies

The 4% Rule is famous for its beautiful simplicity. It’s a clean, rigid framework for your retirement income. But what if your plan could act more like a smart suspension system, automatically adjusting to the bumps in the road instead of hitting every pothole at full speed?

That’s the big idea behind dynamic withdrawal strategies.

These methods ditch the static, set-it-and-forget-it approach. They build flexibility in from the very beginning, letting your spending adapt to how the market is doing. This helps preserve your nest egg when it matters most. For a lot of retirees, that adaptability is the key to a more resilient and less stressful safe withdrawal rate retirement plan.

The Guardrail Method

Picture yourself driving down a long, winding road. The guardrails are there to keep you safely on the pavement, giving you a little nudge when you drift too far to one side. The Guardrail Method applies this exact same logic to your retirement portfolio.

You start with a target withdrawal rate—let’s say 4%. Then, you set upper and lower “guardrails” that trigger adjustments based on your portfolio’s performance.

- If the market soars and your withdrawal rate naturally dips below a certain point (like 3.2%), you give yourself a raise.

- If the market drops and your withdrawal rate climbs above a higher threshold (maybe 4.8%), you make a modest cut to your spending.

This keeps you from overspending during a downturn while letting you enjoy the fruits of a strong bull market. It’s a structured way to be flexible without making knee-jerk, emotional decisions.

The Bucket Strategy

Another popular route is the Bucket Strategy, which is all about mental accounting and managing risk. Instead of looking at your portfolio as one giant pot of money, you divide it into different “buckets” based on when you’ll need the cash.

A common setup looks something like this:

- Bucket 1 (Short-Term): This holds 1-3 years of living expenses in cash or things just like it. It’s your safety net, making sure you don’t have to sell stocks during a market dip just to pay your bills.

- Bucket 2 (Mid-Term): Here you’ll find 3-10 years of expenses, invested mainly in high-quality bonds. This bucket’s job is to refill your cash bucket when needed.

- Bucket 3 (Long-Term): This holds everything else, invested more aggressively in stocks for long-term growth.

This structure lets you invest for growth with confidence, because you know your immediate needs are covered by safer assets. It’s both a psychological and practical buffer against market swings.

Variable Percentage Withdrawal (VPW)

The Variable Percentage Withdrawal (VPW) method is a more direct, math-based approach to staying flexible. Instead of taking out a fixed dollar amount and adjusting for inflation, you recalculate your withdrawal as a percentage of your current portfolio balance each year.

The percentage you use is determined by a formula that considers your age and life expectancy. The main benefit? It’s mathematically impossible to run out of money; you’re always just taking a slice of whatever is left.

The Trade-Off: The huge downside of a pure VPW strategy is income volatility. A 20% market drop means an immediate 20% pay cut, which can be a tough pill to swallow for many retirees. Still, it’s a powerful way to preserve your portfolio.

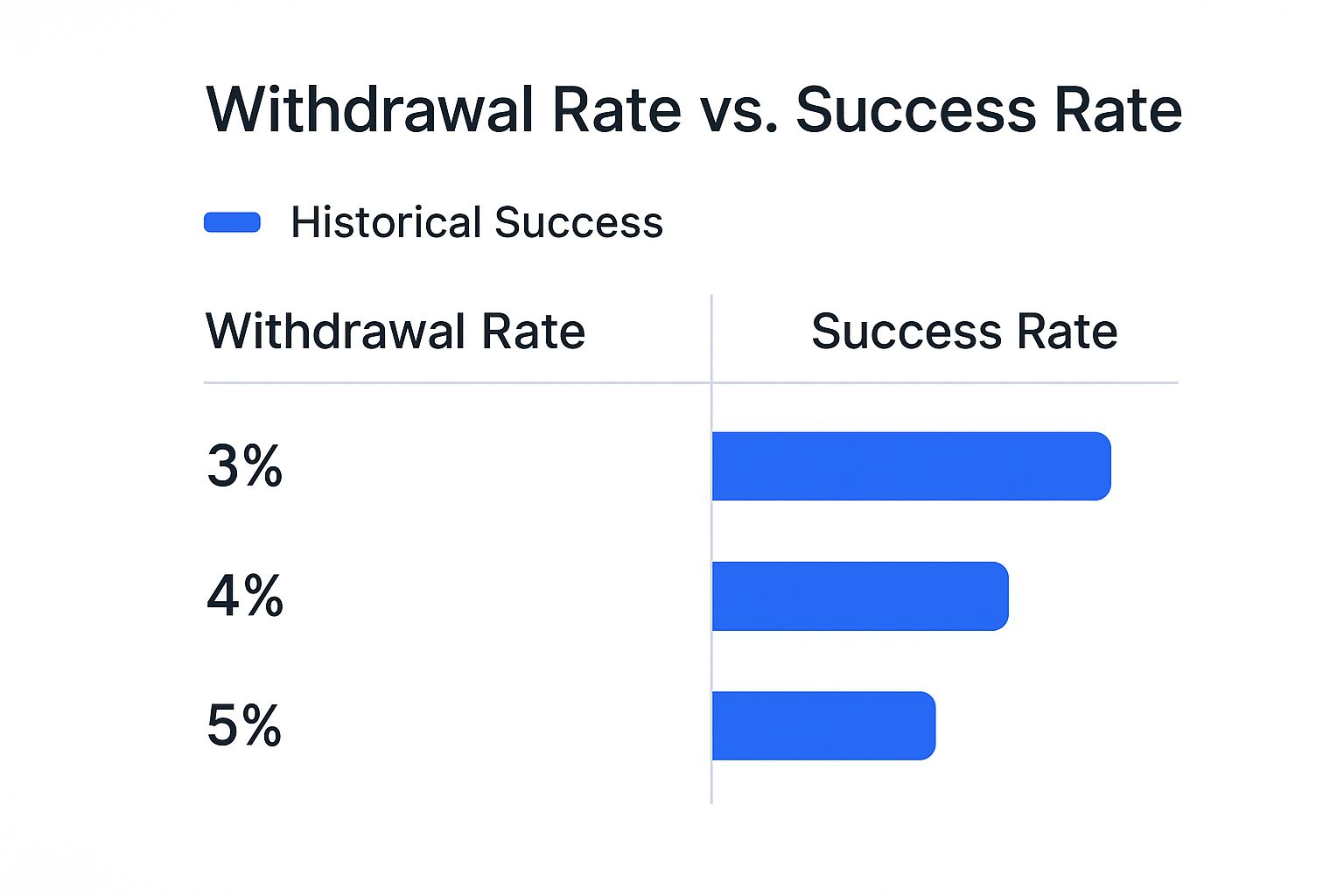

This simple chart highlights the historical success rates for different static withdrawal rates.

As the data shows, even a tiny reduction in your withdrawal rate can dramatically boost your plan’s chances of success over the long haul.

Choosing the right withdrawal strategy is a big decision, and what works for one person might not be the best fit for another. The table below offers a quick comparison to help you see how these different approaches stack up.

Comparison of Retirement Withdrawal Strategies

A side-by-side look at different withdrawal methods to help you choose the best fit for your goals and risk tolerance.

| Strategy | How It Works | Primary Benefit | Potential Drawback |

|---|---|---|---|

| The Guardrail Method | Set upper and lower portfolio value thresholds that trigger predefined spending increases or decreases. | Provides structured flexibility and protects against overreacting to market moves. | Can be more complex to manage than a static rule; may limit spending in strong markets. |

| The Bucket Strategy | Segment your portfolio into short-term (cash), mid-term (bonds), and long-term (stocks) buckets. | Creates a psychological buffer against volatility and helps avoid selling stocks in a downturn. | Requires regular rebalancing and might lead to slightly lower overall returns due to cash holdings. |

| Variable Percentage (VPW) | Withdraw a percentage of the current portfolio balance each year, based on a life-expectancy table. | Makes it mathematically impossible to deplete the portfolio. | Creates highly volatile income streams that directly mirror market performance. |

| The 4% Rule (Static) | Withdraw 4% of the initial portfolio value, then adjust that dollar amount for inflation each year. | Simple and easy to follow. | Inflexible; can lead to overspending in down markets or underspending in good ones. |

Each of these dynamic strategies offers a more sophisticated alternative to a rigid rule. They all acknowledge that markets are unpredictable and give you a framework for responding logically, not emotionally. To see how these different approaches might work with your own numbers, explore our in-depth guide to more retirement withdrawal strategies.

Building a Resilient Retirement Income Plan

All the theories and historical data are great, but now it’s time to put them to work. If there’s one thing to take away from all this, it’s that your safe withdrawal rate for retirement isn’t a number you calculate once and then ignore for the next 30 years. It’s a living, breathing part of your financial plan that needs regular attention.

Think of it like navigating a ship. You wouldn’t just plot a course and then go below deck for the entire voyage, would you? Of course not. You’d constantly check your position, watch the weather, and make small course corrections. Your retirement income plan demands that same level of active navigation to get you safely to your destination.

From Static Rule to Active Strategy

The old-school approach of just picking a number and hoping for the best is long gone. Modern financial tools allow us to transform a static, rigid plan into a dynamic strategy that can actually adapt to market swings and changes in your life.

This is exactly where a platform like PopaDex becomes your co-pilot. Instead of guessing, you get a real-time dashboard of your entire financial picture, letting you make decisions based on data, not fear.

You can finally start asking “what if” and get real answers.

- Test different withdrawal rates: What does your portfolio’s future look like if you start at 3.5% versus a more aggressive 4.5%?

- Simulate a downturn: How does a nasty bear market in your first few years of retirement impact your plan’s longevity?

- Factor in inflation: Can your withdrawal strategy handle a period of stubbornly high inflation without running out of steam?

Stress-testing your plan like this is incredibly empowering. It helps you find the potential weak spots before they become real-world emergencies, so you can build in the right amount of flexibility from day one.

Your retirement plan isn’t carved in stone; it’s drawn in the sand. Regular monitoring and periodic reviews are the keys to ensuring the tide of market volatility doesn’t wash it away.

Making Confident, Data-Driven Adjustments

Active monitoring isn’t about panicking every time the market has a bad day. It’s about having the right information to make calm, logical adjustments. And those adjustments matter—pushing your withdrawal rate just a little too high can have a massive impact down the road.

For example, a 2010 international study revealed that withdrawal rates above 4% were rarely successful over the long term in global markets. The research found that bumping an initial withdrawal rate to just 5% shot the risk of failure up to 22.5%. That’s a huge jump. You can dig into the specifics in these global safe withdrawal rate findings to see just how much market conditions matter.

This is precisely why having a clear view of your numbers is so crucial. Tools like PopaDex help replace anxiety with awareness. When you can clearly see how your strategy is performing, you can navigate the complexities of retirement with a steady hand, making the small, proactive tweaks that ensure your financial independence lasts a lifetime.

Common Questions About Safe Withdrawal Rates

As you dig into the details of your retirement plan, it’s totally normal for questions to pop up. The idea of a safe withdrawal rate is powerful, but let’s be honest, it has a lot of moving parts. Here are some straight-up answers to the questions people ask most when they’re trying to figure out their retirement income.

What Happens If I Need More Money in One Year?

Life happens. An unexpected medical bill, a roof that suddenly needs replacing, or that dream trip you just can’t pass up—all of these can demand more cash than your plan budgeted for. This is exactly why a flexible strategy is so important.

If you’re sticking to a rigid rule like the classic 4% guideline, taking one big, unplanned withdrawal can do some real long-term damage to your portfolio. But if you use a more dynamic approach, you can actually plan for these things. A common method is to simply balance out a high-spending year with a few years of slightly lower withdrawals, giving your portfolio a chance to breathe and recover.

Do I Need to Adjust My Withdrawal Rate for Taxes?

Absolutely. This is a big one that people often miss. The safe withdrawal rate numbers you see in historical studies are almost always pre-tax. The amount you can actually spend is what’s left after the tax man takes his cut. A 4% withdrawal from a traditional, pre-tax retirement account is a completely different beast than a 4% withdrawal from a post-tax Roth account.

In fact, a common source of confusion is understanding retirees’ tax returns, which has a direct impact on how much money you truly have to live on. If you forget to factor in taxes, you could end up withdrawing far more than you realize, seriously increasing the risk of your money running out too soon.

Key Insight: Your true safe withdrawal rate is your after-tax withdrawal rate. Always build your plan around the net figures you’ll actually have in your bank account.

How Often Should I Review My Plan?

A safe withdrawal rate retirement plan isn’t something you can just set and forget. It needs regular attention to make sure you’re staying on course. A good rule of thumb is to sit down for a thorough review at least once a year.

During this annual check-in, you should be looking at a few key things:

- Your Portfolio’s Performance: How did your investments do compared to what you expected?

- Your Spending: Did your actual expenses line up with your planned withdrawals?

- Economic Conditions: Have changes in inflation or the market outlook thrown a wrench in your long-term assumptions?

This yearly review lets you make small, proactive tweaks instead of waiting for a major problem to force a big, painful change. It’s the secret to navigating all the inevitable curveballs retirement will throw your way.

Ready to stop guessing and start seeing your financial future clearly? PopaDex gives you the tools to consolidate your accounts, track your net worth in real-time, and model your retirement strategy with confidence. Take control of your financial journey today at PopaDex.com.