Our Marketing Team at PopaDex

Salary Converter by Country Your Relocation Guide

So you’ve landed a job offer in another country. Congratulations! Before you start packing, let’s talk about the salary. It’s tempting to just plug that number into a currency converter and call it a day, but that’s one of the biggest rookie mistakes you can make.

A $70,000 salary in San Francisco feels a world away from the same amount in Lisbon, and the exchange rate barely scratches the surface of why.

Why a Currency Converter Just Doesn’t Cut It

Relying on a simple exchange rate gives you the nominal value of your salary, not its real value. It tells you what the number on your paycheck is, but it completely ignores the most important question: how much can your money actually buy?

This is where you need to get familiar with Purchasing Power Parity (PPP) and the Cost of Living. These aren’t just fancy economic terms; they’re the key to figuring out what your financial life will actually look like in a new country.

What Your Salary Is Truly Worth

Think of your salary as a bucket of water. The exchange rate tells you the size of the bucket, but the local cost of living determines how many plants you can water with it. In a city with a lower cost of living, that same bucket can go a whole lot further.

Getting this right is the foundation of smart expat financial planning. Your lifestyle, how much you can save, and your overall financial well-being hinge on understanding the real value of your income, not just the number in your contract.

The goal is simple: You need to compare what your potential new salary can buy in your new city versus what your current salary buys at home. That’s the only way to get a true apples-to-apples comparison.

Key Concepts for Accurate Salary Conversion

Before diving deeper, it helps to get a quick handle on the terminology. These are the concepts that truly matter when you’re trying to figure out if that foreign salary is a good deal.

| Term | What It Means for You | Why It Matters for Your Salary |

|---|---|---|

| Cost of Living Index | A score that compares everyday expenses (rent, groceries, transit) between two cities. | This shows you if your daily life will be more or less expensive than it is now. |

| Purchasing Power Parity (PPP) | An economic theory that compares what a “basket of goods” costs in different countries. | PPP reveals the true buying power of your new salary, equalizing currency differences. |

| Local Tax Rates | The percentage of your income that will go to federal, state, and local taxes. | Your net (take-home) pay can be drastically different, directly impacting your disposable income. |

These factors work together to paint a much more accurate picture than a simple currency swap ever could.

Looking Beyond the Exchange Rate

So, what should you be looking at? It’s a combination of a few key metrics:

- Cost of Living Index: This is your go-to for comparing day-to-day expenses. It covers everything from your morning coffee and groceries to rent and public transportation.

- Purchasing Power Parity (PPP): This is the great equalizer. It helps you understand what your salary is really worth in terms of buying power, side-stepping volatile exchange rates.

- Local Tax Rates: Don’t forget about taxes! Your gross salary might look amazing, but your take-home pay after deductions could tell a very different story.

It’s also useful to look at the median income in your target country for context. For example, the median income in the United States hovers around $70,000. Compare that to a country like Mexico, where the median is under $5,000 annually, and you start to see the huge economic disparities that raw numbers can hide.

How Purchasing Power Parity Unlocks Your Real Earning Potential

Just plugging a salary into a currency converter is a classic rookie mistake. You’ll see two different numbers, sure, but you won’t have a clue which one actually puts more money in your pocket at the end of the month. It’s like comparing apples to oranges.

This is exactly why you need to understand Purchasing Power Parity (PPP). Think of it as the ultimate economic equalizer.

PPP cuts through the noise of exchange rates to answer one critical question: how much cash do you need in one country to buy the same “basket of goods”—things like groceries, rent, and a haircut—as you would in another? Instead of just looking at currency values, it gets to the heart of what your money can actually buy.

A smart salary converter by country always leans on PPP to show you what your paycheck is truly worth. I’ve seen it time and again: a lower salary in a country with a cheap cost of living can easily lead to a better quality of life than a bigger paycheck in an expensive city.

A Tale of Two Job Offers

Let’s walk through a real-world scenario. Imagine you’re a software developer with two offers on the table: one for €85,000 in Berlin, Germany, and another for €60,000 in Lisbon, Portugal. At first glance, the Berlin offer looks like a no-brainer.

But once you bring PPP into the equation, the story completely flips. The cost of living in Lisbon is way lower than in Berlin. That €60,000 in Portugal could mean a bigger apartment, eating out whenever you want, and a healthier savings account than the €85,000 in Germany.

This is the magic of PPP. It forces you to stop focusing on the number on your contract and start thinking about the lifestyle that number can actually support. It’s all about the true economic value of an offer.

The data backs this up. When you look at PPP-adjusted salaries, the global picture becomes much clearer. For example, Luxembourg leads the pack with an average monthly salary equivalent to $7,200 in PPP terms, with Belgium close behind at $6,400. These figures aren’t high just because of the salaries; they’re high because that income goes a long way locally.

Of course, getting the full picture means looking beyond PPP and factoring in taxes. Understanding your local tax situation is the final, crucial step. To really know your take-home pay, you have to account for deductions like the specific income tax in Turkey or wherever else you plan to live. It’s the only way to get a true sense of your financial reality.

Putting a Salary Converter to the Test

Theory is one thing, but let’s see how this works in the real world. Using a salary converter isn’t rocket science, but knowing how to interpret the results is where the real value lies. Let’s walk through it with a hypothetical software developer, Alex, who’s weighing a job offer that would take him from Austin, Texas, to Berlin, Germany.

Right now, Alex makes $110,000 a year in Austin. The first move is plugging that number into a tool like the PopaDex salary converter, specifying Austin as the current city and Berlin as the new one. From there, the converter does the heavy lifting—it crunches the numbers on currency exchange, tax rates, and, most critically, the cost-of-living differences between these two booming tech hubs.

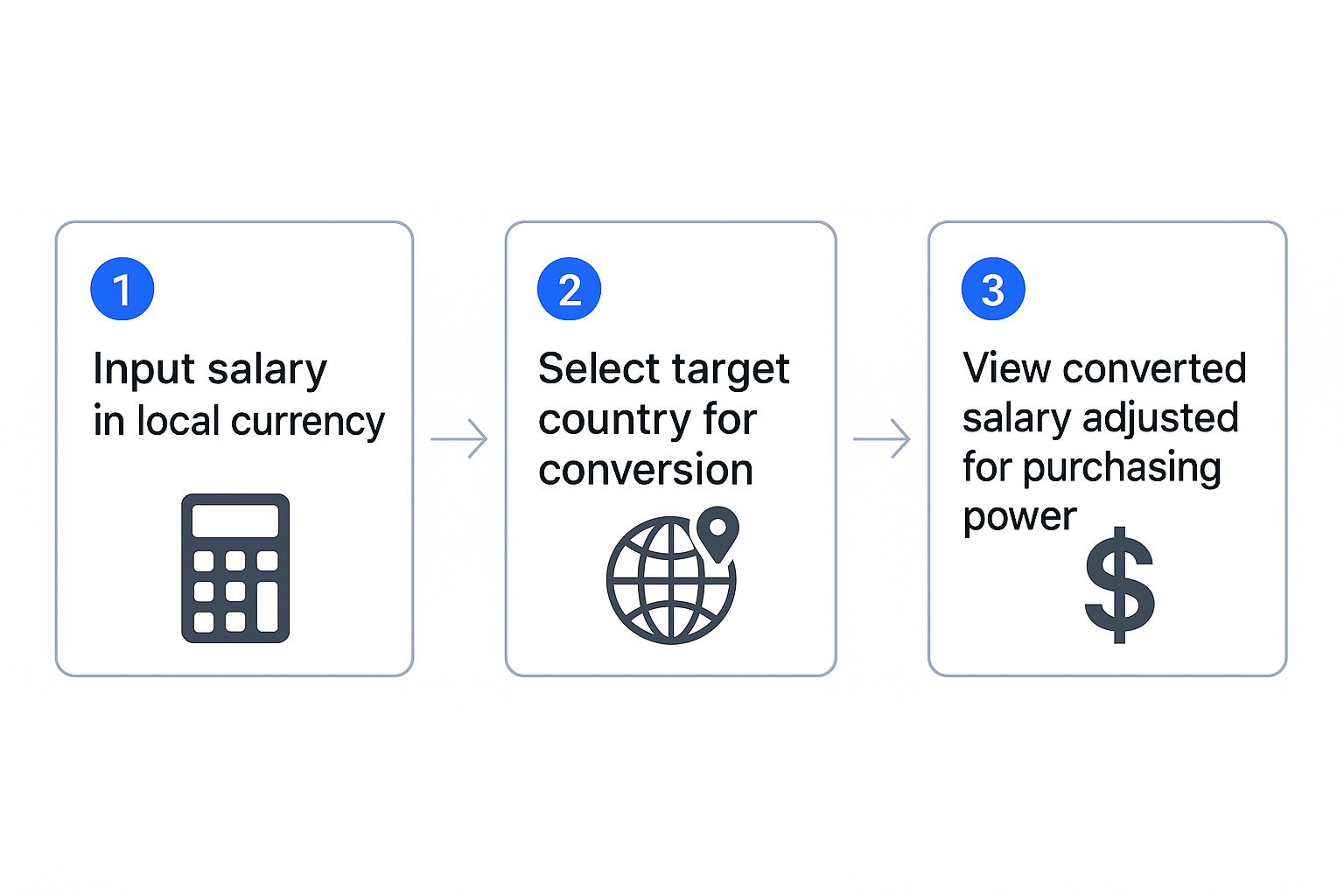

How It Works: From Your Salary to Real-World Value

The process is incredibly simple. You pop in your salary, pick your destination, and get a PPP-adjusted result that tells you what your money is actually worth there.

This goes beyond a simple currency swap. It’s a full financial translation that shows you what your income can truly buy in a new city, which is far more useful.

What the Results Really Mean

After running the numbers, the converter suggests that to keep his current lifestyle in Berlin, Alex would need a salary of about €75,000. At first glance, that might feel like a significant pay cut, especially after a straight currency conversion. But the magic is in the details.

The tool provides a breakdown that explains the why behind that number. It digs into major spending categories and shows where the real differences are.

- Rent: Turns out, it’s a lot cheaper in Berlin compared to Austin. A huge win.

- Groceries: A bit less expensive in Berlin, which adds up over a year.

- Transportation: Berlin’s public transit is more affordable and efficient, reducing the need for a car.

- Healthcare: The costs are completely different because of Germany’s public healthcare system.

This detailed breakdown is the most powerful part of the whole process. It moves you beyond a single, abstract number and helps you understand exactly how your budget will shift. You see precisely where your money will stretch further and where it might not.

By looking at this, Alex can see that even with a lower salary figure, his disposable income and quality of life would likely stay the same, thanks to the lower cost of living. That kind of data-driven insight turns a scary, abstract career move into a concrete financial plan.

If you want to run your own numbers, our salary comparison by country calculator offers even more data layers to help you map out your own relocation scenarios.

How to Interpret Your Salary Conversion Results

So, you’ve run the numbers through a salary converter. Now what? You’ll see a big, bold “equivalent salary,” but that’s just the headline. The real story—the one that helps you make a life-changing decision with confidence—is buried in the details.

Don’t get fixated on that one final number. A good salary converter by country will give you a full breakdown of how it got there, comparing major spending categories side-by-side. This is your roadmap to understanding what a move would actually feel like for your wallet.

For example, the report might show your housing costs dropping by 30% while your grocery bill climbs by 10%. These specifics are infinitely more helpful than a single averaged-out number. They let you start picturing exactly how your budget and spending habits will need to shift.

Weighing the Financial Trade-Offs

The most revealing insights often pop up when you compare taxes, healthcare, and social benefits. A higher gross salary in one country might look incredible until you see how much disappears to taxes. Meanwhile, a lower salary in another place could come bundled with nearly free public healthcare and incredible family leave policies.

Let’s say you’re looking at a move from the US to Germany. The converter shows your healthcare premiums will plummet, but your income tax rate is going to be noticeably higher. This isn’t a simple win or loss—it’s a trade-off. Your take-home pay might be a bit lower each month, but your out-of-pocket health expenses could practically vanish.

It’s not just about the money you make; it’s about the essential services that money no longer needs to cover. A detailed conversion result helps you see the full picture of your financial obligations and benefits.

Aligning Data with Your Personal Priorities

At the end of the day, making sense of these numbers is deeply personal. What looks like a deal-breaker to one person might be a dream scenario for another. It all comes down to what you value most.

Before you make the final call, use the converter’s breakdown to ask yourself a few critical questions:

- Savings Goals: If your rent and transportation costs are way down, will that free up enough cash to hit your savings targets, even if your net pay is a little less?

- Family Needs: How do things like paid parental leave or childcare costs change the equation for your family? A country like Sweden offers over a year of paid leave—a benefit with massive financial value that won’t show up in a simple salary figure.

- Lifestyle: Are you a big foodie, an avid traveler, or someone with expensive hobbies? See how the costs for these discretionary categories change and figure out if your new budget matches the lifestyle you want to live.

When you connect the data to what actually matters to you, you stop comparing abstract numbers and start building a real, practical financial plan for your new life abroad.

Common Mistakes That Skew Your Salary Comparison

Using a salary converter is a great start, but it’s easy to fall into a few common traps that can give you a misleading picture of a job offer. I’ve seen it happen time and time again: someone gets fixated on the gross pay number and completely ignores the massive impact of local taxes and social security.

What looks like a fantastic salary on paper can shrink in a hurry once all the deductions are taken out. The only number that really matters for your budget and savings is your take-home pay.

Another classic pitfall is relying on data for a major capital city when you’re actually moving to a smaller town. The cost of living in Berlin is worlds away from what you’d find in a smaller German city like Leipzig. You have to drill down to the specific city or region you’re heading to, otherwise your numbers will be way off.

Overlooking the Hidden Financial Details

Beyond the obvious day-to-day costs, people often forget to distinguish between one-time and ongoing expenses. A relocation package might cover your initial moving costs, but it’s not going to help you out with surprisingly high utility bills or mandatory annual fees that pop up later.

It’s also crucial to look at your entire financial life, not just your salary. For instance, if you’re an aspiring entrepreneur, you can’t just focus on your new income without factoring in other major commitments, like the complete cost of setting up a business in Dubai. Similarly, you need a solid plan for managing your money across borders. Our guide to expat banking is a great resource for navigating how to set up accounts and transfer your funds without getting hit with crazy fees.

To help you sidestep these common errors, I’ve put together a quick checklist. Think of it as a summary of best practices to keep your salary comparison grounded in reality.

Salary Conversion Checklist Do’s and Don’ts

| Action | Do This | Don’t Do This |

|---|---|---|

| Focus on Pay | Prioritize take-home pay (net income) after all taxes and deductions. | Only look at the gross (pre-tax) salary figure. |

| Location Specificity | Use cost-of-living data for your specific city or region. | Apply data from a capital city to a smaller town. |

| Tax Research | Research local, regional, and national income tax rates. | Assume your home country’s tax rules apply. |

| Expense Planning | Distinguish between one-time moving costs and recurring living expenses. | Forget to budget for ongoing costs like high utilities or annual fees. |

| Holistic View | Consider your entire financial picture, including savings, investments, and other obligations. | Isolate the salary from your broader financial life. |

Following these simple rules will save you from major financial surprises down the road.

A salary is just one piece of a much larger financial puzzle. To avoid surprises, you need to account for taxes, location-specific costs, and your broader financial obligations from the very beginning.

Frequently Asked Questions

When you start playing around with salary converters, a few questions almost always come up. Let’s tackle them so you can move from a rough estimate to a confident financial plan for your next big adventure.

How Accurate Are Online Salary Converters?

Think of online salary converters as a fantastic starting point, but never the final word. Their accuracy really depends on how fresh their cost-of-living data is. They give you a solid ballpark figure to begin with.

To get the full picture, you have to do a little homework. Supplement the converter’s numbers by digging into local tax laws, what healthcare typically costs, and even rental prices in the specific neighborhoods you’re eyeing. This is how you add that crucial, real-world context to the numbers.

What Is the Difference Between PPP and a Cost of Living Index?

It’s easy to mix these two up, but they tell you different things.

- Purchasing Power Parity (PPP) is more of an economic theory. It compares the cost of a standard “basket of goods” between countries to show you the true buying power of one currency versus another. It’s the big-picture view.

- A Cost of Living Index is the more practical tool for personal planning. It directly compares typical expenses like rent, groceries, and transportation in one city against another, often shown as a simple percentage.

For your own financial planning, the Cost of Living Index is usually more immediately helpful. PPP gives you the economic foundation behind those comparisons.

Here’s a pro tip: a salary converter’s results can be a powerful negotiation tool. If an offer comes in below the equivalent salary suggested by a good converter, you can use that data as leverage. Frame the conversation around what it takes to maintain your current standard of living.

Ready to see your complete financial picture, no matter where you are? PopaDex helps you track all your accounts, investments, and assets across 30+ countries in one simple dashboard. Take control of your global net worth today.