Our Marketing Team at PopaDex

Salary Equivalent By Country A Global Guide

A $100,000 salary in New York feels worlds apart from the same amount in Lisbon, and it has nothing to do with currency conversion. The local cost of living is the real game-changer—it dictates the actual value of your income and the lifestyle you can afford. Nailing this concept is the first, most critical step in figuring out a true salary equivalent from one country to another.

What Your Salary Is Actually Worth Globally

It’s a common mistake to think your salary is a fixed, absolute number. It’s not.

Imagine your income is a bucket of water. In a low-cost city like Lisbon, that bucket could fill a large swimming pool, easily covering your rent, groceries, and entertainment with cash to spare. But in an expensive city like New York, that very same bucket might only fill a small bathtub, barely covering the essentials. The amount of water never changed, but its impact did.

This is the core idea of purchasing power. It’s not about how much you make, but about how much your money can buy right where you live. Simply converting your salary using an exchange rate is a rookie move that completely misses the massive differences in day-to-day expenses.

To put this in perspective, let’s look at how a salary can stretch—or shrink—based on location.

Quick Look At Salary vs. Purchasing Power

| Location | Example Annual Salary | Key Living Cost (e.g., Rent) | Effective Purchasing Power |

|---|---|---|---|

| San Francisco, USA | $120,000 | High (e.g., $3,500/month) | Moderate |

| Berlin, Germany | $80,000 | Moderate (e.g., €1,200/month) | High |

| Lisbon, Portugal | $60,000 | Low (e.g., €900/month) | Very High |

| Bangkok, Thailand | $40,000 | Very Low (e.g., ฿15,000/month) | High |

This simple table shows that the highest salary doesn’t always win. The person in Berlin or Lisbon might enjoy a much higher quality of life than the high-earner in San Francisco, all because their money goes further.

Why Your Paycheck’s Power Varies

So, what’s behind these huge global differences? A few key factors are at play. A recent 2025 analysis throws some of these contrasts into sharp relief, with Switzerland leading the pack with an average monthly net salary of $8,218. Luxembourg follows at $6,740, with the United States at $6,562. Explore more global salary comparisons and see where other countries stand.

These numbers are heavily shaped by:

- Cost of Living: This is the big one. It covers everything from rent and utilities to your daily coffee and transportation. A monster salary in an expensive city can easily result in a lower quality of life than a modest salary somewhere more affordable.

- Local Economy: Strong economies with high demand for skilled workers tend to pay higher nominal salaries. It’s simple supply and demand.

- Taxes and Social Contributions: The chunk of your paycheck that goes to taxes and social security varies wildly between countries, directly hitting your take-home pay.

Understanding your true earning potential means looking far beyond the number on your payslip. Your salary’s real value is defined by the lifestyle it can actually support in a specific place.

Whether you’re negotiating a remote job, thinking about moving abroad, or just plain curious, getting a handle on salary equivalence is a must. For a more hands-on feel, you can use PopaDex’s salary comparison by country calculator to see these concepts in action with real numbers.

Decoding Purchasing Power Parity and Cost of Living

To figure out what a salary in one country is really worth in another, you have to look past simple currency exchange rates. They just don’t tell the whole story. The two most important concepts you need to grasp are Purchasing Power Parity (PPP) and Cost of Living Indices. These are the tools that pull back the curtain on the true economic value of your income.

Think of PPP as a universal price tag. It’s all about measuring what your money can actually buy. It answers a simple but powerful question: How much cash would you need in Berlin to buy the same stuff you get in Boston? It levels the playing field by comparing the prices of identical goods, revealing the true strength of a currency.

The Big Mac Index: A Simple PPP Analogy

The most famous—and frankly, the most fun—example of PPP is The Economist’s Big Mac Index. Now, it’s not a super-scientific financial model, but it’s brilliant at explaining the core idea. The logic is simple: a Big Mac is the same product no matter where you are in the world, so it should cost the same after you convert currencies.

But we all know it doesn’t. A Big Mac might set you back $5.69 in the United States but only the equivalent of $3.50 in Mexico. What does that tell us? It suggests the Mexican peso is undervalued compared to the US dollar. In this simplified view, your dollar has way more “burger-buying power” in Mexico.

Key Takeaway: Purchasing Power Parity helps equalize the value of different currencies by comparing the cost of a standard item or “basket of goods.” It shows you the real strength of a currency, not just its exchange rate.

This is the foundational idea for understanding your salary’s true global value. If everyday items are cheaper, your paycheck effectively stretches further, giving you a higher standard of living even if the number on your payslip looks smaller.

Moving to Cost of Living Indices

The Big Mac Index is a great starting point, but let’s be honest, you can’t build a financial plan on burgers alone. For a serious salary analysis, you need something much more robust. This is where Cost of Living Indices come into play.

These indices take the basic idea of PPP and expand it from a single product to a comprehensive basket of goods and services that reflect real life. A typical Cost of Living Index pulls together hundreds of data points to paint a clear picture of what it actually costs to live somewhere.

They compare prices for things like:

- Housing: Rent for different-sized apartments in various neighborhoods.

- Groceries: The cost of staples like milk, bread, eggs, and fresh produce.

- Transportation: Bus fares, gas prices, and the expense of owning a car.

- Utilities: What you’ll pay for electricity, heating, water, and internet.

- Entertainment: The price of a movie ticket, a gym membership, or a nice dinner out.

By comparing this wide-ranging list against a baseline city (often New York City, set at an index of 100), you can see exactly how much more or less expensive another location is. A city with an index of 70 is 30% cheaper than New York, which means your money goes a whole lot further. When you’re thinking about a global salary, it’s also vital to understand how economic factors like inflation can erode your purchasing power over time. For example, knowing some strategies for investing during inflation can help protect your wealth no matter where you are.

Hidden Factors That Impact Your Real Income

A big, flashy salary offer is always exciting, but the number on your contract is just the start of the story. If you really want to figure out a salary equivalent by country, you have to look past the gross figure and dig into the hidden deductions that determine what you actually take home.

These factors—taxes, social security, and healthcare—are wildly different around the world. They can make a $100,000 salary in one country feel completely different from the same amount somewhere else. Honestly, failing to account for them is one of the biggest mistakes people make when looking at international job offers.

The Great Divide of Taxes

Your biggest deduction, without a doubt, will be income tax. But not all tax systems are built the same, and understanding the difference is the key to estimating your real net income.

They generally fall into two buckets:

- Progressive Tax Systems: In places like Germany and the United States, the more you earn, the higher the percentage you pay. The system uses brackets, so your tax rate climbs as your income goes up.

- Flat Tax Systems: Other countries, such as Estonia and Hungary, keep it simple. They apply a single tax rate to everyone, no matter how much they earn.

A 20% tax rate sounds simple enough, but its real-world impact depends entirely on the system. In a progressive system, that rate might only apply to a portion of your income. In a flat tax system, it applies to every dollar you make.

Take a look at this screenshot, which gives you a quick visual of how much personal income tax rates can vary.

As you can see, the top personal income tax rates are all over the map—from over 50% in some European countries to a clean 0% in places like the UAE.

Social Security and Healthcare Costs

Beyond income tax, mandatory social security contributions will take another big bite out of your paycheck. These payments are what fund public pensions, unemployment benefits, and disability insurance. While they lower your immediate income, they also create a critical safety net that you might otherwise have to pay for out-of-pocket.

In many European countries, for example, these contributions can run anywhere from 10% to over 20% of your gross salary. The trade-off? They often come with comprehensive public healthcare coverage.

Crucial Insight: A country with higher taxes and social contributions might offer free healthcare and education, ultimately saving you thousands per year compared to a low-tax country where these are major out-of-pocket expenses.

On the flip side, a country like the United States has lower social security deductions, but you’re on the hook for private health insurance—a substantial and often confusing extra cost. This is a vital distinction; what you save in taxes could easily be eaten up by healthcare premiums and deductibles.

These deductions directly shape your disposable income and are a massive piece of the salary equivalent puzzle. And of course, the global economy is always in motion, affecting what you can expect to earn. Projections for 2025 show salary growth varying worldwide, with an average increase around 4.5%. North America is looking at more modest growth (3.6% in Canada and 3.7% in the U.S.), while India is set for a massive 9.3% jump. You can discover more insights about global salary outlooks for 2025 to stay ahead of the curve.

A Practical Guide to Calculating Your Salary Equivalent

Theory is one thing, but let’s put it into practice. Figuring out your true salary equivalent by country isn’t magic; it just requires a clear, step-by-step approach. We’ll walk through a realistic scenario to show you exactly how it’s done.

Imagine a marketing professional in Chicago, USA, earning $90,000 a year. She gets an offer for a similar role in Berlin, Germany. A simple currency conversion won’t cut it. She needs to calculate her actual salary equivalent to know if the offer is truly a good one.

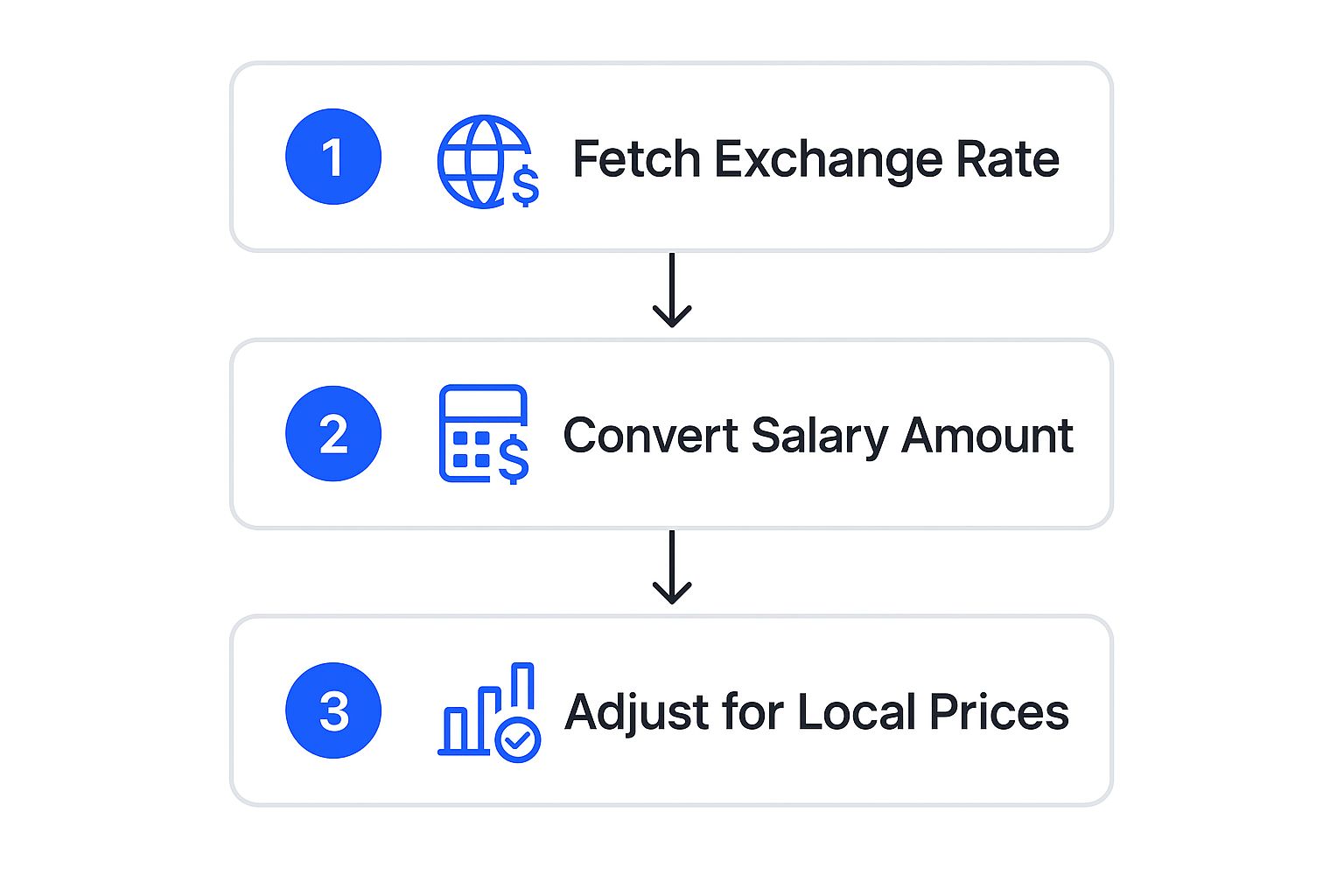

This practical example follows a simple three-step process to adjust a salary for local prices after converting the currency.

As you can see, after a basic currency swap, the real work begins. Adjusting for local purchasing power is what reveals a salary’s true value.

Step 1: Find a Reliable Cost-of-Living Index

First up, she needs a solid Cost of Living Index. You can’t just guess. Reputable sources like Numbeo show that Berlin is significantly cheaper than Chicago. For our example, let’s say the index reveals Berlin’s overall cost of living is about 35% lower than Chicago’s.

This single data point is the cornerstone of the entire calculation. It tells her that every dollar she earns will stretch much further in Berlin, covering rent, groceries, and entertainment more easily than it would back home.

Step 2: Adjust the Salary for Living Costs

Next, it’s time for some simple math to find her Berlin equivalent. If her $90,000 salary in Chicago needs to be adjusted for a 35% lower cost of living, the calculation is straightforward:

$90,000 x (1 - 0.35) = $58,500

This tells us that a salary of $58,500 in Berlin should offer a lifestyle comparable to her $90,000 life in Chicago. Converting this to Euros at a sample exchange rate of 1 EUR = 1.08 USD, the equivalent is roughly €54,167.

Heads Up: This initial figure is the gross salary needed to maintain her current purchasing power. It’s a great baseline for negotiation, but it is not her final take-home pay.

Step 3: Estimate Taxes and Social Contributions

The final, and arguably most crucial, step is to account for deductions. Germany’s tax and social security system is a completely different animal from the one in the US. Her gross salary of €54,167 will be hit with progressive income tax, a solidarity surcharge, and contributions for health insurance, pension, and unemployment.

These deductions in Germany are no joke, often totaling around 40% of gross income for a single person. After those are subtracted, she’ll have her estimated net income. Understanding the gap between gross and net pay is critical; for a deeper look, check out this guide on how to calculate your disposable income.

To illustrate this, here’s a quick breakdown of how the numbers might look as we move through the process.

Sample Salary Conversion Chicago to Berlin

| Calculation Step | Chicago (USD) | Berlin (EUR) | Notes |

|---|---|---|---|

| Current Gross Salary | $90,000 | N/A | Starting point in the home country. |

| Cost-of-Living Adjustment | $58,500 | €54,167 | Adjusted for Berlin’s 35% lower cost of living and converted to EUR. |

| Estimated Deductions | N/A | ~€21,667 | Estimated ~40% for taxes and social security in Germany. |

| Estimated Net Salary | N/A | ~€32,500 | The approximate annual take-home pay in Berlin. |

This table makes it clear that a €54,167 offer isn’t what lands in your bank account. The final net amount is the number you need to build your budget around.

Using Online Calculators Wisely

Trying to crunch all these numbers manually can get complicated, fast. Thankfully, several online tools can help you find a salary equivalent by country.

- Numbeo: Fantastic for detailed cost-of-living comparisons. You can get super granular, looking at prices for a liter of milk, a monthly transit pass, or an apartment in the city center.

- PopaDex: Offers a suite of tools that help you track net worth and manage your finances across different currencies, which is a must-have for any expat or global professional.

While these calculators are great starting points, always treat their results as educated estimates. Tax laws change, exchange rates fluctuate, and your personal spending habits are unique. Use these tools to establish a strong baseline, then do your own research to fine-tune the numbers for negotiation.

Common Myths About Global Salaries Debunked

It’s easy to get starry-eyed over a big salary offer from another country. But falling for common myths about international pay can be a seriously expensive mistake. Before you can figure out a true salary equivalent by country, you have to look past the number on the contract.

Let’s cut through the noise and tackle these myths head-on.

The biggest one? Believing a higher gross salary automatically means a better life. This completely misses the massive impact of cost of living and what your money can actually buy. A $120,000 salary in Zurich might sound amazing, but it could leave you with less cash at the end of the month than $70,000 in Valencia after you’ve paid for sky-high rent and groceries.

Another classic mistake is fixating on income tax alone. People often forget that social security contributions—for things like pensions, unemployment, and healthcare—can take a huge bite out of your paycheck.

A country with high taxes might offer free healthcare and education, ultimately saving you more money than a low-tax country where those are major out-of-pocket expenses. This holistic view is essential for true financial clarity.

For instance, a 35% tax rate in a Nordic country might seem steep. But that rate often covers world-class public services that could cost you thousands in a low-tax nation. It’s all about the complete picture.

Dispelling Financial Misunderstandings

Let’s bust a few more myths that can trip you up when comparing jobs around the world. Getting these straight is the key to making a smart financial move.

- Myth: “Currency exchange rates tell you what your salary is worth.” The exchange rate is just one small piece of the puzzle. It says nothing about local prices, which is what really shapes your day-to-day lifestyle.

- Myth: “Salary growth is the same everywhere.” A pay bump can be totally misleading if it doesn’t beat local inflation. A 5% raise in a country with 6% inflation actually means you’ve lost purchasing power. You’re going backward.

- Myth: “Benefits packages are universally similar.” The value of perks like parental leave, vacation time, and health coverage varies wildly from one place to another. In Sweden, parents get 480 days of paid leave. In the U.S., there’s no federal mandate for paid leave at all.

Recent OECD data on real wage growth drives this point home. While things are looking up in many economies, the reality is that real wages in half of these countries still haven’t bounced back to pre-pandemic levels.

In places like Australia and New Zealand, real wages are still more than 3% below where they were in early 2021. This just goes to show that the headline salary number rarely tells the whole story. You can explore the complete OECD employment outlook to dig deeper into the data.

Making Your Next Move With Financial Confidence

Figuring out what a salary is really worth in another country goes way beyond a simple currency conversion. It’s about getting the full financial picture. Your true earning potential isn’t just a number on a contract; it’s the lifestyle that number can actually buy you. This means you have to dig into purchasing power, local living costs, taxes, and even social benefits.

When you look past the big, flashy gross salary figure, you can start to see what your actual take-home pay will be. This clarity helps you make choices that line up your career ambitions with the quality of life you want. Approaching it this way gives you the power to negotiate effectively and plan your future with real certainty, no matter where you’re headed next.

A true salary comparison isn’t about the number itself, but what that number can do for you. It turns a complex financial puzzle into a clear, actionable plan for your life and career.

As you plan an international move, remember that your salary is just one piece of the puzzle. It’s crucial to factor in the practical costs of getting there, like the true cost of moving between cities, to ensure a smooth transition. For a deeper dive into managing your finances across borders, our guide to cross-border financial planning offers more valuable insights.

A Few Final Questions

Navigating global salaries always kicks up some practical questions. Let’s tackle a few of the most common ones that pop up when you start digging into what your salary is really worth in another country.

How Reliable Are Online Calculators, Really?

Online cost-of-living calculators are a fantastic starting point, but they’re not all created equal. Reputable ones like Numbeo are crowd-sourced and updated pretty frequently, giving you a decent snapshot of current prices. But you have to remember that data, especially in fast-moving economies, can get stale.

Think of these tools as powerful guides for getting your bearings, not as gospel. They give you a crucial baseline for your research, but you’ll want to cross-reference them with other sources to get the full picture.

Key Insight: Use online calculators to get a solid directional estimate. But always, always back it up with on-the-ground research for specifics like rent in the neighborhood you want to live in or costs related to your personal hobbies.

How Do I Negotiate a Remote Salary?

When you’re negotiating a remote salary for a role in another country, data is your superpower. The salary equivalent you’ve calculated isn’t just a number—it’s your most powerful negotiation tool.

Instead of just asking for a specific figure, frame your request around maintaining a certain lifestyle or purchasing power. Present your research clearly, showing how you landed on your desired number by factoring in the local cost of living, taxes, and other regional costs. This data-driven approach proves you’ve done your homework and elevates the discussion from a simple currency swap to a real conversation about your value.

Do These Calculations Factor in Lifestyle Choices?

Not usually, and this is a big one. Standard salary equivalent calculations are almost always based on the average spending habits of a single person. They rarely account for major lifestyle differences, like the massive costs that come with raising a family, which can completely change your financial reality.

For example, things like childcare, international school tuition (which can be astronomical), and needing a larger home are almost never baked into default index calculations. You have to manually adjust for these huge life expenses to build a budget that actually reflects your situation. It’s an extra step, but it’s the only way to ensure your salary supports the life you actually want to live.

Ready to see your entire financial world in one place, no matter where you are? With support for over 15,000 banks and multiple currencies, PopaDex helps you track your whole portfolio with ease. Start making confident financial decisions today by visiting https://popadex.com.