Our Marketing Team at PopaDex

Using a Salary Equivalent Calculator to See Your True Pay

A salary equivalent calculator isn’t just a simple math tool; it’s more like a financial translator. It takes all the different ways you can get paid—hourly, annually, project-based—and converts them into a single, understandable figure: your true take-home pay.

It’s the key to comparing an hourly wage to an annual salary or figuring out what a job offer in a new city is actually worth after all the hidden costs are factored in.

What a Salary Equivalent Calculator Actually Reveals

Let’s say you’re weighing two job offers. One is for $80,000 a year in Austin, Texas. The other is a very tempting $95,000 in San Francisco, California. On paper, the choice seems obvious, right? But is it really an upgrade?

This is exactly the kind of question a salary equivalent calculator helps you answer. It translates those raw numbers into their real-world value.

Think of a salary offer as just the tip of an iceberg. The number you see is what’s visible, but beneath the surface lie dozens of variables that truly determine your purchasing power and financial life. A good calculator brings all of those hidden factors to light.

Beyond the Paycheck Stub

A basic pay converter will tell you that $40 per hour equals an $83,200 annual salary. That’s correct, but it’s an incomplete story. A true salary equivalent calculator goes much deeper, looking at all the pieces that make up your financial reality.

These tools are crucial for making smart career moves, especially when you’re:

- Comparing Job Offers: Accurately weigh competing offers by adjusting for the cost of living in different cities.

- Negotiating a Raise: Arm yourself with data that shows your market value, adjusted for your specific location.

- Freelancers Setting Rates: Convert the annual income you want into a practical hourly or project rate that covers your taxes, benefits, and business costs.

- Considering Relocation: Get a clear picture of how far your current salary would actually stretch in a new city or even another country.

To give you a quick idea, let’s look at how a standard salary breaks down.

Common Salary Conversions at a Glance

This table shows common salary conversions to quickly understand your equivalent earnings across different pay periods.

| Pay Frequency | Equivalent Earnings (Based on $50,000/year) | Calculation Method |

|---|---|---|

| Hourly | $24.04 | Annual salary ÷ 2,080 hours |

| Daily | $192.31 | Annual salary ÷ 260 workdays |

| Weekly | $961.54 | Annual salary ÷ 52 weeks |

| Bi-Weekly | $1,923.08 | Annual salary ÷ 26 pay periods |

| Monthly | $4,166.67 | Annual salary ÷ 12 months |

While helpful, these numbers are just the starting point. The real magic happens when you account for everything else.

The Hidden Factors That Matter

A comprehensive salary calculation goes way beyond gross income. When you’re looking at your total compensation, the real costs of benefits—like health insurance premium costs—are just as important as your base salary, because they can take a huge bite out of your net pay.

A salary equivalent calculator’s main purpose is to transform an abstract number—your salary—into a concrete measure of lifestyle and financial health by accounting for taxes, benefits, and location-specific costs.

Ultimately, this tool helps you see past the headline number. It allows you to understand your compensation not just as a figure on a page, but as the resource that actually funds your life, giving you the clarity to make confident career and financial choices.

Why Salary Equivalence Is More Than Just Math

Knowing what your salary is really worth is the bedrock of smart financial planning. It’s about more than just a simple calculation—like turning an hourly wage into an annual figure. It’s about understanding your actual purchasing power out in the real world.

A quick conversion completely ignores the tangled web of taxes, benefits, and local living costs that truly shape your financial life.

Think about a freelancer weighing a full-time job offer. The salary looks great on paper, but how does it actually compare to their current project income? You have to account for self-employment taxes, the cost of health insurance, and retirement contributions. This is exactly where a salary equivalent calculator becomes your best friend, cutting through the noise to give you real clarity.

These calculations are essential for making strategic career moves. They give you the confidence to negotiate, the accuracy to budget for a relocation, and the foresight to choose opportunities that genuinely support your financial goals.

Revealing Your True Financial Power

A salary equivalent calculator lets you peer behind the curtain of a gross salary to see what you’ll actually take home. It translates that big, exciting number into what you can realistically spend, save, and invest. It’s less about your income and more about your financial capacity.

For example, two people earning $75,000 a year in different states can lead wildly different financial lives. One might be battling high state income taxes and an eye-watering cost of living, while the other enjoys lower taxes and affordable housing. Their salaries are identical, but their financial power isn’t even in the same league.

Using a salary equivalent calculator is like switching from a standard map to a topographical one. It reveals the financial hills and valleys—taxes, costs, and benefits—that determine the actual difficulty of your financial journey.

This level of insight is crucial. It stops you from jumping at a seemingly bigger salary that ultimately leaves you with less cash in your pocket each month. It also helps you make an apples-to-apples comparison between an hourly contract and a salaried role by factoring in the real value of things like paid time off, insurance, and retirement plans.

From Income to Lifestyle

At the end of the day, your salary is just a tool to build the life you want. Understanding its true value is how you make sure your career decisions line up with your personal and financial dreams. It’s about ensuring your paycheck actually supports the life you want to live.

This means looking at the whole picture. Once you’ve figured out your potential take-home pay, the next logical step is to see how it fits into your daily budget. To do that, you can learn more about how to calculate your disposable income to see what’s left after all the bills are paid. That’s the number that truly defines your financial freedom.

Comparing Salaries in a Global Workforce

In a world where your next job could be anywhere, figuring out what a salary offer is really worth has gotten tricky. Whether you’re a remote worker, an expat, or managing a global team, you’ve probably faced the same puzzle: how does a salary in New York stack up against one in London, Tokyo, or Sydney?

It’s tempting to just plug the numbers into a currency converter. But that’s a classic mistake. Knowing that £70,000 is more than $85,000 today doesn’t tell you the whole story. The real question is, what can that money actually buy you in each city?

This is exactly where a smart salary equivalent calculator becomes your best friend. It’s designed to cut through the noise of exchange rates and give you a clear picture of international pay. These tools go way beyond simple conversions, layering in financial data to show you what your standard of living will actually look like.

It’s More Than Just a Currency Swap

The best salary calculators understand that your income’s true value is shaped by the place you live. Think of your salary as a raw ingredient; the local economy is the recipe that determines the final meal.

A proper salary equivalent calculator dives deep into factors like:

- Cost of Living: This isn’t just rent. It’s everything from your morning coffee and weekly groceries to your commute and a night out. A huge salary in an expensive city might leave you with less cash in your pocket than a smaller one somewhere more affordable.

- Local Tax Laws: Income tax, social security, and other deductions can take a massive bite out of your paycheck, and they vary wildly from country to country. A good calculator estimates your actual take-home pay after the government gets its share.

- Purchasing Power Parity (PPP): This is the secret sauce. PPP is an economic yardstick that compares the price of a standard “basket of goods” in different places. It’s the most accurate way to measure what your money is actually worth in its local context.

A salary equivalent calculator is like a universal financial translator. It doesn’t just convert the currency; it translates the entire economic reality of a salary. It answers the one question that truly matters: “How well will I actually live on this income?”

A Real-World Example

Let’s make this concrete. A software engineer in the United States might pull in an average salary of $120,000 a year. Meanwhile, the same role in India averages around $25,000. On the surface, that $95,000 gap looks like an open-and-shut case.

But this is where context is king. A direct comparison is incredibly misleading. That’s why salary equivalent calculators have become so essential for evaluating global wages fairly. They adjust for the enormous differences in living costs and tax burdens, using country-specific data from over 150 countries to paint a much clearer picture of global wage fairness. You can discover more insights about these global salary comparisons and the data behind them.

This kind of detailed analysis stops you from making a huge career decision based on a number that looks good on paper but doesn’t hold up in reality. That seemingly smaller salary might actually offer a significantly better quality of life once all the local factors are baked in. Our guide on using a salary comparison by country calculator can help you dig into these details yourself. For anyone thinking about an international career move, this isn’t just nice to have—it’s essential.

Understanding Global Pay Disparities

A job offer never exists in a vacuum. Its real value is always tied to the local economy, the job market, and what it actually costs to live wherever the role is based. These factors create massive differences in average salaries around the world, making it easy to misjudge an offer if you don’t have the right context.

This is exactly why a sharp salary equivalent calculator is so crucial for anyone thinking about an international career. It goes way beyond a simple currency conversion, digging into the economic realities that determine your actual purchasing power. When you understand the global pay benchmarks, you can put any salary offer into proper perspective.

Benchmarking Global Salaries

A quick look at global salary rankings shows just how wide the pay gap is between countries. A nation’s economic muscle, its dominant industries, and its labor laws all play a huge part. For example, data shows Switzerland leading the pack with an average monthly net salary of $8,218 after taxes. Luxembourg comes in next at $6,740, with the United States close behind at $6,562. These top-tier salaries are a direct reflection of their advanced economies and high-value sectors like finance and tech.

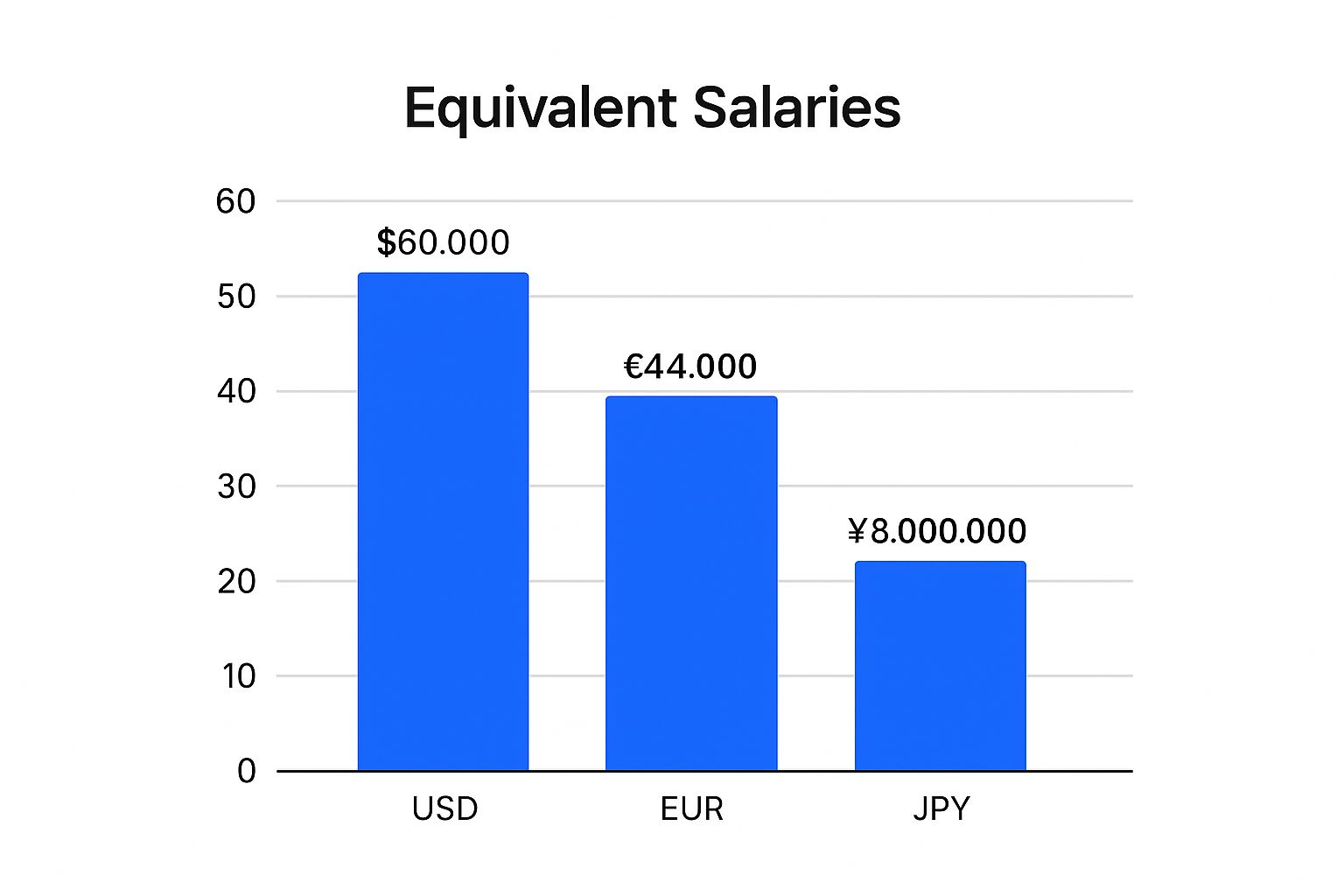

This chart gives a basic idea of how a salary converts across major currencies, but it only scratches the surface.

As you can see, a $60,000 USD salary looks very different when converted into Euros, British Pounds, or Japanese Yen. But this simple conversion doesn’t tell you a thing about what that money can actually buy you in those places.

Then there are the ever-shifting exchange rates, which add another layer of complexity. A strong dollar today could be weaker tomorrow, directly hitting the value of your earnings if you’re paid in one currency but live in another. To protect your international income, it’s a smart move to learn about https://popadex.com/managing-foreign-exchange-risk/ and how it can affect your financial stability.

Understanding global pay disparities isn’t about chasing the highest number. It’s about finding the salary that delivers the best quality of life in a specific location. A calculator reveals this by translating a nominal paycheck into its real-world value.

To provide a clearer picture of these global differences, here’s a look at the top 10 countries by average monthly net salary after taxes.

Top 10 Countries by Average Monthly Net Salary

A comparative look at the average monthly net salaries after tax in leading global economies.

| Country | Average Monthly Net Salary (USD) |

|---|---|

| Switzerland | $8,218 |

| Luxembourg | $6,740 |

| United States | $6,562 |

| Singapore | $6,375 |

| Iceland | $5,841 |

| Qatar | $5,640 |

| Denmark | $5,459 |

| Netherlands | $5,321 |

| Australia | $5,245 |

| Norway | $5,123 |

This table clearly illustrates the stark contrast in earning potential from one developed economy to another, reinforcing why context is everything when comparing salaries.

Why the Gaps Exist

So, what’s behind these huge differences in pay? A few key factors are at play, making a simple currency swap totally inadequate for a real comparison.

- Economic Development: It’s no surprise that mature economies with a high GDP per capita, like those in North America and Western Europe, can support higher wages.

- Industry Focus: Countries that are hubs for high-margin industries—think technology, pharmaceuticals, or finance—naturally have higher average salaries.

- Labor Laws and Unions: Places with strong worker protections and widespread union membership tend to have higher wages and better benefits, pushing up the national average.

The global crypto job market is a perfect example of where this gets tricky, with its diverse and often complex pay structures. Using a salary equivalent calculator is absolutely essential here. It helps professionals in new and emerging fields make smart, informed decisions when weighing offers from completely different economic landscapes.

How to Get a Precise Salary Comparison

Let’s be honest, not all salary calculators are built the same. A basic tool might swap one currency for another, but if you want a comparison that actually means something, you need to dig a whole lot deeper. This is where an advanced salary equivalent calculator—like the one we’ve built at PopaDex—really shines. It gives you the kind of detailed insight you need to make confident decisions, especially when you’re looking at jobs in different countries.

These tools go way beyond your gross pay to give you a true net-to-net comparison. They factor in all the little financial details that chip away at your salary before it ever hits your bank account, giving you a real sense of your purchasing power.

Inputting Your Financial Details for Accuracy

The old saying “garbage in, garbage out” is especially true here. The accuracy of any salary comparison comes down to the quality of the information you provide. A really solid calculator will ask for specific details to customize the results to your exact financial life. This way, you’re not just getting a vague estimate; you’re getting a personalized look at your potential disposable income.

You’ll typically need to provide a few key pieces of information:

- Gross Annual Salary: This is your starting point, the big number on the offer letter.

- Country of Residence and Employment: This is critical because it tells the calculator which tax laws and social security rules to apply.

- Filing Status and Dependents: Your tax situation can change dramatically based on whether you’re single, married, or have kids.

Plugging in these details allows the calculator to apply the right tax rates and deductions, which can be wildly different from one country to the next.

Going Beyond Gross Pay

Here’s where an advanced salary comparison tool really proves its worth: it understands the complex web of deductions that stand between your gross salary and your actual take-home pay. This is the stuff that simple converters just ignore. A comprehensive tool considers everything from income taxes and social security contributions to daily exchange rate swings to give you a real net-to-net salary picture.

For example, imagine a full-time employee moving from Germany to Canada. They’re facing completely different tax brackets and social charges. A powerful calculator incorporates all of that to show what their disposable income will actually be.

This detailed approach gives you a clear, actionable bottom line you can trust.

Interpreting the Results Side-by-Side

One of the best features of a tool like the PopaDex calculator is seeing multiple scenarios laid out next to each other. This is an absolute game-changer when you’re trying to weigh job offers from different countries.

Here’s a look at the PopaDex Salary Comparison Calculator interface in action.

The side-by-side layout makes it immediately obvious how things like income tax and social security contributions affect your final net income in each place. This visual breakdown turns a bunch of abstract numbers into a simple, direct comparison, helping you see where your money would really go. You can instantly spot how one country’s lower taxes might be cancelled out by higher social security costs—or vice versa—giving you the full story behind the numbers.

Frequently Asked Questions

Digging into the world of compensation can feel like learning a new language. But a good salary equivalent calculator is like a universal translator for your paycheck. Here are some common questions we hear, broken down to help you get a clear picture of what you’re really earning.

Pay Converters Versus Salary Calculators

At a glance, a simple pay converter and a true salary equivalent calculator look like the same thing. But that’s like comparing a pocket calculator to a full-blown financial modeling spreadsheet. They operate on completely different levels.

A basic pay converter just does simple math. It might multiply your hourly rate by 2,080 hours to spit out an annual number. It’s fast, sure, but it completely misses the bigger picture of your actual financial life.

A genuine salary equivalent calculator, on the other hand, is much smarter. It digs into the variables that actually determine your financial reality—things like federal and state taxes, cost-of-living differences between cities, benefit contributions, and even purchasing power. It gives you a complete view of your disposable income.

A pay converter shows you what you earn. A salary equivalent calculator reveals what your earnings are actually worth. It translates a raw number into your true standard of living.

This deeper analysis is what turns a simple tool into a powerhouse for making sharp career decisions.

Using a Calculator for Job Negotiations

A salary equivalent calculator is one of the most powerful tools you can bring to the negotiating table. Why? Because it replaces guesswork with cold, hard data, empowering you to advocate for what you’re worth with total confidence.

Before you even talk numbers, run the offer through a calculator to benchmark it against your current situation. Plug in the differences that matter: a longer commute, new state taxes, or the higher cost of groceries in a new city. You might find that a “bigger” salary offer actually leaves you with less take-home pay.

For freelancers, this is non-negotiable. A good calculator helps you set an hourly or project rate that’s genuinely on par with a full-time salary, once you factor in self-employment taxes, health insurance, and retirement savings on your own.

When you walk into a negotiation with a counteroffer backed by this kind of analysis, it shows you’ve done your homework. The conversation shifts from what you want to what the numbers prove is fair, giving your position a whole lot more weight.

Accuracy of International Salary Comparisons

The reliability of any online salary calculator comes down to one thing: the quality of its data. The best tools don’t just guess; they pull from credible, up-to-date sources like the OECD and local tax authorities.

A key feature to look for in a trustworthy international calculator is its use of Purchasing Power Parity (PPP). This concept goes way beyond a simple currency conversion. PPP measures what your money can actually buy in another country by comparing the cost of a standard “basket” of goods and services.

This is the only way to truly understand your potential quality of life. While no online tool can be perfect down to the last cent, a well-built calculator provides a highly reliable estimate. It gives you the clarity you need to compare international job offers and make a choice that truly works for your financial goals.

Ready to see your true financial picture? PopaDex offers intuitive tools to help you track your net worth and understand your earnings with clarity. Start your free trial today and take control of your financial future.