Our Marketing Team at PopaDex

What Is the Average 401k Balance by Age in 2024?

Ever wonder how your 401(k) stacks up against others your age? It’s a natural question. We all want to know if we’re on the right track, and comparing our balance is one of the quickest ways to get a feel for where we stand.

The numbers vary quite a bit, from an average of $6,899 for savers under 25 all the way up to $271,320 for those between 55 and 64. But here’s the thing: these figures are just reference points, not a complete picture of retirement readiness.

A Snapshot of 401(k) Savings Across Generations

Think of these averages as a compass, not a detailed map. They can tell you the general direction you should be heading, but they don’t show the specific twists and turns of your own financial journey.

Your personal situation is unique. Your income, the industry you work in, and—most importantly—when you started saving all play a huge role. So, while it’s helpful to see what others are doing, don’t let these numbers define your success.

Average 401(k) Balances at a Glance

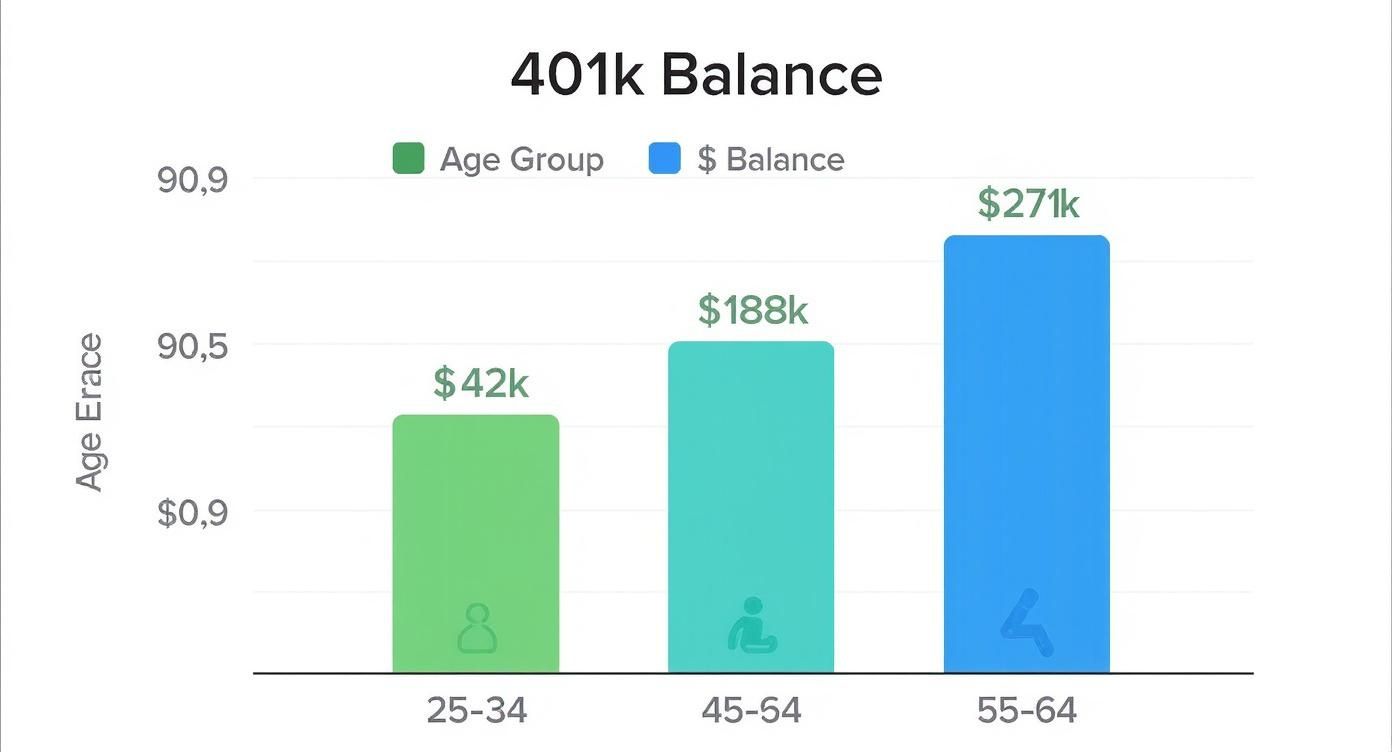

So, what does the data actually say? Recent reports give us a clear breakdown of average 401(k) balances, and they show a steady climb as people move through their careers.

The numbers show that for individuals under 25, the average is $6,899; for those 25-34, it’s $42,640; for ages 35-44, it’s $103,552; for the 45-54 group, it’s $188,643; and for those nearing retirement at 55-64, the average balance is $271,320. You can explore more insights on NerdWallet.com to dig deeper into these figures.

This chart gives you a quick visual of how those savings tend to grow over time.

No surprises here—the chart shows a big jump in savings from one decade to the next. It’s a perfect illustration of how powerful consistent contributions and compound interest really are over the long haul.

But there’s a catch with using the “average” balance. Let’s look at why that can be a bit misleading.

Average vs Median 401(k) Balance by Age Group

The term “average” can be skewed by a handful of super-savers with massive balances. To get a more realistic picture of the typical saver, it’s often better to look at the median balance. The median is the midpoint—meaning half of the people have saved more, and half have saved less.

This table shows both the average and median balances side-by-side, which tells a more complete story.

| Age Group | Average 401(k) Balance | Median 401(k) Balance |

|---|---|---|

| 20–29 | $19,200 | $6,400 |

| 30–39 | $67,900 | $25,000 |

| 40–49 | $170,100 | $55,000 |

| 50–59 | $297,700 | $91,000 |

| 60–69 | $357,900 | $112,000 |

Notice how the median balance is significantly lower in every age group? That’s because the average is pulled up by high earners, while the median gives us a much better sense of what the person in the middle has actually saved.

Key Takeaway: While useful, remember that “average” balances can be skewed by a small number of super-savers with extremely high balances. The median balance often gives a more realistic view of what a typical person has saved.

In the next sections, we’ll break down what these numbers mean for you and give you some practical steps to boost your savings, no matter where you’re starting from.

Why Averages Only Tell Half the Story

Looking at the average 401(k) balance by age can feel a bit like glancing at the scoreboard at halftime. It gives you a general idea of who’s ahead, but it completely misses the nuances of the game—the star players, the unexpected fumbles, and the momentum shifts that are actually shaping the outcome. A simple average can be a seriously misleading benchmark for your own retirement savings.

Here’s a quick thought experiment. Imagine ten people in a room talking about their savings. Nine of them have a solid $50,000 tucked away. The tenth person is a tech billionaire with $10 million in their 401(k). If you do the math, the average savings per person is over $1 million.

So, is everyone in the room a millionaire? Not even close. This is the classic problem with averages: they get yanked way out of proportion by outliers. In the world of retirement savings, these outliers are the super-savers whose massive accounts drag the average up, creating a number that feels completely out of reach for most of us.

Unpacking the Difference Between Average and Median

If you want a more realistic picture, you need to look at the median balance instead. The median is the true middle number. If you lined up every 401(k) balance from smallest to largest, the median is the one sitting right in the center. Half the accounts are bigger, and half are smaller.

Unlike the average, the median isn’t thrown off by that one billionaire in the room. This makes it a much better yardstick for what a “typical” person has actually managed to save. The bigger the difference between the average and the median, the more you know about wealth inequality in savings.

When the average is way higher than the median, it’s a clear sign that wealth is concentrated at the very top. It shows that a few people are saving incredible amounts, while many more are just trying to keep up.

This gap is crystal clear in the data. For savers in the 35-44 age bracket, the median retirement savings is $45,000, but the average (or mean) flies up to $141,520. The difference is even more dramatic for those 55-64, where the median is $185,000, but the average is an eye-watering $537,560.

What Creates Such a Wide Savings Gap?

So, why is there such a huge divide? A few key factors are at play, and understanding them can help you put your own progress into perspective.

- Income Disparity: It’s no surprise that higher earners can save more. They can max out their 401(k) contributions and often get larger employer matches, which turbocharges their growth.

- Access to Plans: Not everyone gets a 401(k) at work. If you work for a small business or are part of the gig economy, you might not have access to a workplace plan at all, putting you on the back foot from day one.

- Savings Habits: The power of starting early can’t be overstated. Someone who begins saving 10% of their income at age 25 will end up in a vastly different place than someone who starts saving that same amount at 40.

- Financial Literacy: Simply knowing how things like compound interest, employer matches, and different investment options work gives you a massive advantage in making smart decisions for your future.

While average 401(k) balances offer a starting point, they don’t tell the whole story about your financial health. To get a better handle on where you stand, it helps to look at resources that break down your net worth by age percentile. Seeing your total financial picture gives you a much clearer sense of how you’re tracking toward your long-term goals.

And to see how these savings trends evolve as people approach retirement, don’t miss our guide on the average retirement savings by age 65.

Actionable Savings Goals for Every Decade

Seeing the numbers behind the average 401(k) balance by age is one thing. Turning that knowledge into a real plan is where the magic happens. Your retirement journey is a marathon, not a sprint, and your strategy needs to evolve as you move through life. What works in your 20s just won’t cut it in your 50s.

Let’s break down some practical, decade-by-decade savings goals. This isn’t about obsessing over an exact number, but about building the right habits for where you are right now. The idea is to create momentum that will carry you through to the finish line, no matter when you get started.

Your 20s: Harnessing the Power of Time

When you’re in your 20s, your biggest financial asset isn’t your paycheck—it’s time. Every single dollar you invest has decades to grow, making this the most critical window for tapping into the power of compounding. Think of it like planting a tree; the sooner you get it in the ground, the taller it will grow.

Your mission, should you choose to accept it, is simple: start now. It truly doesn’t matter if the amount feels small. At this stage, consistency beats volume every single time.

A few key moves will build a powerful foundation for the future:

- Capture the Full Employer Match: This is the closest thing to free money you will ever find. If your company offers a 401(k) match, contribute at least enough to get every last dollar of it. Leaving that on the table is like turning down a raise.

- Automate Your Contributions: Set it and forget it. Arrange for automatic deductions from your paycheck so that saving becomes a non-negotiable expense, just like your rent or phone bill.

- Aim for a 10% Savings Rate: If you can swing it, try to save at least 10% of your pre-tax income. If that feels like too big of a jump, start smaller and commit to increasing it by 1% every year.

Your 30s: Balancing Growth with Life’s Milestones

The 30s often feel like a financial juggling act. You might be buying a house, starting a family, or chipping away at student loans. With so many new responsibilities, saving for a distant retirement can easily get pushed to the back burner.

The key is to not let short-term pressures derail your long-term goals. It’s all about finding a balance and keeping your momentum alive. Fidelity’s data shows just how much consistent savings matter, with the average 401(k) balance jumping from around $35,000 at age 30 to $91,000 by age 40.

Don’t pause your retirement contributions, even when life gets expensive. Stepping back for even a few years can have a surprisingly large negative impact down the road due to lost compounding.

Your main focus should be on bumping up your contributions as your income grows. Every time you get a raise or a bonus, funnel a piece of it directly into your 401(k) before you even get used to seeing it in your bank account. This simple trick helps you save more without feeling the pinch.

Your 40s: Maximizing Your Peak Earning Years

For most people, the 40s represent their peak earning years. This is the decade to really double down and make serious progress. If you feel like you fell behind in your 20s or 30s, now is the time to play catch-up with purpose.

Your primary goal should be to get as close as you can to the annual IRS contribution limit. For 2024, that limit is $23,000. While maxing it out might not be realistic for everyone, making it your target will push you to save more aggressively than ever before.

To make that happen:

- Review Your Portfolio: Check that your investments still match your risk tolerance. You’ve still got plenty of time for growth, so being too conservative now could mean leaving money on the table.

- Conduct a Budget Audit: Take a hard look at your spending. Where can you trim the fat to free up more cash for your 401(k)? Small cuts can add up to big savings over time.

- Evaluate Your Goals: As retirement gets closer, your vision for it becomes clearer. Use that clarity to refine your savings plan. Check out our guide on how much to save for retirement to help dial in your specific numbers.

Your 50s and Beyond: The Final Push

Once you hit your 50s, retirement isn’t some far-off idea anymore—it’s right around the corner. This is the decade for supercharging your savings while starting to shift your focus from pure growth to wealth preservation.

Thankfully, the government gives you a great tool for this final stretch: catch-up contributions. Starting the year you turn 50, you can contribute an extra amount to your 401(k) over the standard limit. For 2024, that bonus amount is $7,500.

Taking full advantage of this can give your final balance a massive boost. This is also the right time to re-evaluate your investment mix. While you still need some growth to beat inflation, you’ll likely want to start moving some of your portfolio into more conservative assets, like bonds, to protect the nest egg you’ve worked so hard to build.

What Really Drives Your 401(k) Balance?

While age is a handy yardstick for checking your progress, it’s not the whole story. The real size of your 401(k) comes down to a handful of powerful factors you control. Think of it this way: age is just the time your money has to grow, but the final outcome depends on the ingredients you put in and how you manage them.

Your retirement savings journey isn’t passive. It’s an active game where your decisions on contributions, investments, and fees dictate the final score. That’s why two people with the same age and salary can end up with wildly different 401(k) balances.

Your Contribution Rate: The Engine of Your Savings

The single most important lever you can pull is your contribution rate—the percentage of each paycheck you funnel into your 401(k). This is the fuel for your retirement engine. The more you put in, especially early on, the more powerfully compounding can work its magic.

Even a tiny bump makes a massive difference over time. Pushing your contribution from 6% to 7% might not feel like a big deal today, but that extra 1% can balloon into tens of thousands of extra dollars by the time you retire.

Your first goal should always be to contribute enough to get the full employer match. Anything less is turning down free money.

The Employer Match: Your First Big Win

Think of the employer match as a bonus your company pays you just for saving. A common setup is a 50% match on the first 6% you contribute. So, if you save 6% of your salary, your employer kicks in another 3%, instantly getting your total savings rate to 9%.

This is the easiest win in all of personal finance. Nailing the full match should be your absolute minimum goal. It’s an immediate, guaranteed return that kickstarts your account’s growth from day one.

Your Investment Choices: Steering Your Growth

Your 401(k) is more than a piggy bank; it’s an investment account. The funds you pick inside it determine how your money grows. Most plans offer a menu of options, from conservative bond funds to more aggressive stock funds.

For those who prefer a simple, hands-off approach, target-date funds are a fantastic choice. These funds automatically shift from aggressive to more conservative investments as you near your planned retirement date.

But if you’re comfortable being more hands-on, you can build your own mix of funds that aligns with your risk tolerance. The crucial thing is to make sure your investments match your long-term goals.

The Hidden Drag of Fees

Fees are the silent killer of investment growth. They look tiny on paper—often just a fraction of a percent—but their corrosive effect over decades can be shocking. This fee, known as the expense ratio, is skimmed off your balance every year.

Imagine two people each invest $100,000 for 30 years, both earning a 7% average annual return. One pays 0.25% in fees, while the other pays 1.25%. That seemingly small 1% difference would cost the second person over $100,000 by retirement.

Always check the expense ratios on your investment options. Choosing low-cost index funds is one of the smartest and easiest ways to keep more of your money working for you, not for Wall Street.

Career Moves and Life Events

Naturally, your career and life path play a big role. A salary increase is the perfect time to bump up your contribution rate before you even get used to the extra cash. Changing jobs is another pivotal moment—you have to decide whether to roll your old 401(k) into your new plan or an IRA to keep it from getting lost in the shuffle.

Life events, like taking a leave of absence, can also pause your savings momentum. The key is to be aware of these moments and plan for them. Beyond your own contributions, understanding superannuation contribution limits can be another important piece of the puzzle, as these regulations directly shape your retirement savings potential.

How to Track and Grow Your Retirement Savings

Knowing the average 401(k) balance for your age group is a great starting point, but let’s be honest—those numbers are just trivia without a way to measure your own progress.

Think about it. You wouldn’t set off on a cross-country road trip without a GPS. So why navigate your entire financial future without a dashboard showing you exactly where you are and where you’re going?

Consistent tracking is what connects your goals to reality. It turns abstract financial targets into a real, tangible score. This keeps you motivated, helps you catch problems before they grow, and lets you make decisions based on facts, not feelings. This is where the right tool can change everything.

Bringing Your Financial World into Focus

First things first: you need a complete, real-time picture of your financial life. That means looking beyond just your 401(k) and pulling everything together in one place—savings accounts, other investments, and yes, even your debts. You can only make smart moves when you can see the whole board.

PopaDex was built for this exact job. Instead of juggling a dozen different logins and messy spreadsheets, you can link all your financial accounts and see it all in one central hub. It gives you a single, clean snapshot of your total net worth, updated automatically.

Here’s what that consolidated view actually looks like inside PopaDex.

The dashboard instantly clarifies your asset allocation and shows you how your net worth is trending, giving you the at-a-glance confidence to know if you’re truly on the right path.

Set Goals and Visualize Your Growth

Once you can see everything in one place, you can start setting specific, measurable goals. A vague idea like “save more” doesn’t cut it. With PopaDex, you can set a concrete target, like hitting a certain 401(k) balance by your next birthday.

Key Insight: Seeing your progress visually is a huge motivator. Watching that net worth chart climb over time reinforces good financial habits and makes the distant goal of retirement feel much more real and achievable.

PopaDex gives you the tools to not only set these goals but also to project your future growth based on what you’re doing right now. Your retirement plan stops being some dusty document and becomes a dynamic, interactive roadmap you can actually use.

Here’s how to use it to stay on course:

- Track Against Your Own Benchmarks: Forget just comparing yourself to the averages. Measure your balance against the personalized retirement goals that matter to you.

- Analyze Your Portfolio: Get a clear look at your asset allocation. Does it still match your risk tolerance and how much time you have until retirement?

- Model Different Scenarios: Play around with tools like our retirement nest egg calculator to see what would happen if you bumped up your contributions or tweaked your investment strategy. You might be surprised how small changes can speed up your journey.

Ultimately, tools like this empower you to shift from just passively saving to actively managing your financial future. They create the feedback loop you need to adjust your course, celebrate small wins, and build the kind of confidence that only comes from knowing you’re in total control of your destination.

Frequently Asked Questions About 401(k) Balances

Even after digging into all the data and strategies, it’s totally normal to have a few questions rattling around. The world of retirement planning is full of little details, and figuring out how the “average 401(k) balance” applies to your life is what really matters.

Let’s clear up some of the most common questions that pop up. Think of this as your quick-reference guide for building the confidence to move forward.

![]()

How Much Should I Have In My 401(k) By Age 30?

While you’ll see national averages floating around $35,000 to $42,000, there’s a much better benchmark to use: aim to have one year’s salary saved for retirement by the time you hit 30. This simple rule of thumb shifts the focus from keeping up with the Joneses to measuring progress against your own income.

For instance, if you earn $60,000 a year, your target across all retirement accounts would be $60,000. Getting there boils down to a few key habits: start early, consistently save 10-15% of your pay, and—most importantly—always, always get your full employer match.

That match is the single most powerful tool you have in your 20s. It’s free money.

What If My 401(k) Balance Is Below Average?

First off, don’t panic. Seeing your balance trailing the average isn’t a sign of failure; it’s a signal to take action. The very first thing to check is your contribution rate. Are you putting in enough to get your company’s full match? If not, that’s priority number one.

Next, look into setting up an automatic escalation for your contributions. Bumping your savings rate by just 1% each year is a small change you likely won’t even feel in your paycheck, but the long-term impact is massive.

A small, consistent increase is far more sustainable and powerful than a drastic, short-lived change. This “auto-increase” strategy puts your savings growth on autopilot.

If you’re over 50, you have another tool in your belt: catch-up contributions. The IRS allows you to save an extra amount above the standard limit, which can give your balance a serious boost in your final working years.

Should I Roll Over My 401(k) When I Change Jobs?

This is a huge decision that too many people just ignore. While you can leave your 401(k) with your old employer, it’s rarely the best move. Trying to keep track of multiple old 401(k)s is a headache and can easily lead to you forgetting about your own money.

You generally have two much better options:

- Roll it into an IRA (Individual Retirement Account): This usually opens up a much wider world of investment choices and often comes with lower fees than your old 401(k) plan. It also puts all your old accounts in one easy-to-manage place.

- Roll it into your new employer’s 401(k) plan: This is another great way to simplify your financial life by consolidating all your active retirement funds into a single account.

The one thing to almost always avoid is cashing out your old 401(k). You’ll get hit with a nasty combination of taxes and penalties that can completely wipe out a huge chunk of your hard-earned savings.

How Do Market Fluctuations Affect My Balance?

Your 401(k) balance is going to go up and down with the stock market—that’s just part of the deal. The most important thing is to avoid making rash, emotional decisions, like selling all your investments when the market takes a nosedive. Think of volatility as the price you pay for long-term growth.

For younger investors with decades to go, market dips are actually a good thing. Your regular contributions are now buying more shares at a lower price, a strategy known as dollar-cost averaging. Over the long haul, this can seriously juice your returns.

As you get closer to retirement, your strategy needs to evolve. It becomes much wiser to gradually shift your investments to be more conservative, with more bonds and fewer stocks. This helps protect the nest egg you’ve built from the shock of short-term market swings right when you need the money most. It’s all about having a long-term plan and sticking to it.

Ready to stop guessing and start tracking? PopaDex gives you a clear, real-time view of your entire financial world, so you can measure your progress, set meaningful goals, and take control of your retirement journey. Get started for free and see your complete net worth in one place at https://popadex.com.