Our Marketing Team at PopaDex

Mastering Budgeting for Freelancers

When you’re a freelancer, the idea of “budgeting” can feel like a joke. How are you supposed to plan when you have no idea what you’ll make next month? The truth is, budgeting with a fluctuating income isn’t about rigid rules—it’s about creating a system that gives you stability and control.

It all starts with getting real about your numbers. Instead of guessing, you need to look at your past performance to forecast what’s coming. This isn’t about finding a crystal ball; it’s about building a reliable financial foundation.

Finally Tame Your Unpredictable Income

Let’s be honest: the biggest hurdle for freelancer finances isn’t a lack of willpower. It’s the wild income rollercoaster. One month you’re flying high, the next you’re scraping by. To get off this ride, you have to move beyond simple guesswork.

Start by digging into your own data. Look at your project pipeline, your client payment history, and any seasonal ebbs and flows you’ve noticed over the years. This historical information is your single best tool for predicting what you can realistically expect to earn. From there, you can calculate a conservative baseline income—a number you can truly count on each month. This figure is the bedrock of your budget, informing everything from your spending to your savings goals.

The whole point is to use your “feast” months to build up a cash cushion. That way, you can breeze through the inevitable “famine” periods without breaking a sweat.

This isn’t about restriction. It’s about creating the stability you need to make confident financial moves, whether that means investing in new gear or finally taking that guilt-free vacation.

Establish Your Financial Baseline

This isn’t just a “nice-to-have” strategy; it’s essential for survival and growth. In the U.S. alone, freelancer incomes can swing from $31,000 to over $275,000 a year. That massive range shows exactly why having a solid plan is non-negotiable. You need a system to manage the peaks and valleys.

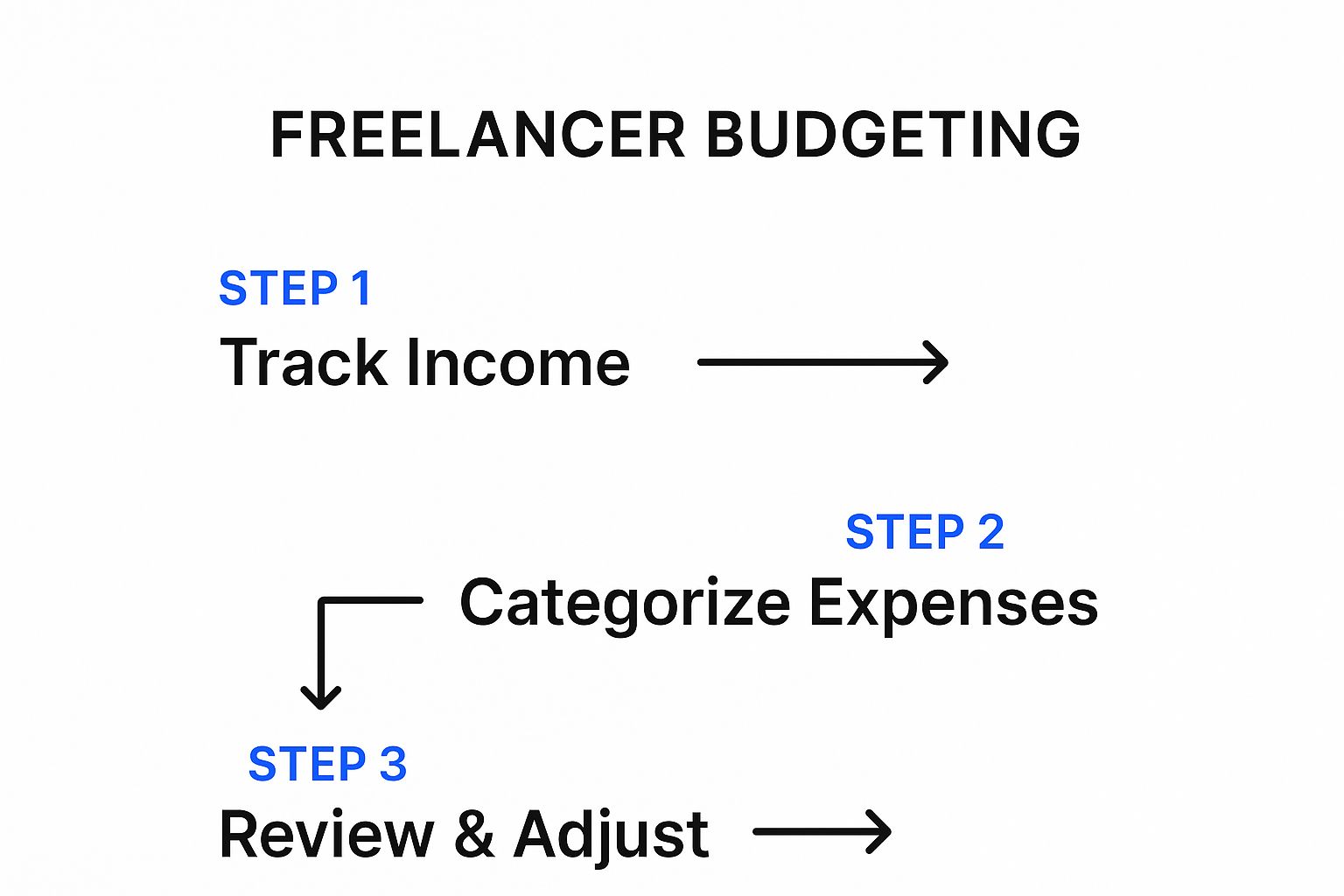

A great way to begin is by tracking your finances with a clear, repeatable process. This is the fundamental flow for getting a handle on your money:

As you can see, everything starts with knowing what’s coming in before you can decide what goes out. Once you have a grip on this, you can build a system that truly works for you.

To get you started, grab our free irregular income budget template and put these ideas into action right away. This is how you stop just surviving the swings and start thriving because you were prepared for them.

Practical Income Forecasting Methods for Freelancers

Estimating your income doesn’t have to be complicated. Here are a few straightforward methods I’ve seen freelancers use successfully to get a handle on their monthly earnings.

| Method | How It Works | Best For |

|---|---|---|

| Three-Month Average | Add up your total income from the last three months and divide by three. This gives you a recent, rolling average. | Freelancers with relatively consistent, short-term project work who want a simple, up-to-date baseline. |

| Lowest Month Method | Look at your income over the past 6-12 months and identify your single lowest-earning month. Use that number as your baseline income. | New or cautious freelancers who want an ultra-conservative budget that ensures all essential bills are covered, even in the worst-case scenario. |

| Project-Based Forecast | List all confirmed projects for the upcoming month, along with any highly probable leads. Total the expected invoice amounts. | Freelancers with long-term contracts or a very predictable client pipeline. This requires more active management. |

Choosing the right method depends on your business and your risk tolerance. The key is to pick one, stick with it, and adjust as you gather more data about your own earning patterns.

Give Every Dollar a Job Before It Arrives

Knowing your baseline income is a huge step forward. But the real magic happens when you start telling your money where to go before it even lands in your bank account. This is how you trade financial chaos for calm control.

Get started by sorting your money into clear categories. Think of them as dedicated ‘buckets’ for every part of your freelance life. This simple organizational habit gives you a crystal-clear picture of your financial health at a glance.

This isn’t just about paying bills. It’s a complete mindset shift—you stop reacting to your finances and start intentionally directing them. Every single dollar you earn gets a specific purpose, whether that’s building security, funding growth, or paying for your life.

Differentiate Your Business and Personal Costs

First things first: you have to draw a hard line between your business and personal expenses. Mixing the two is a classic freelance mistake and a guaranteed recipe for a financial mess, especially come tax season.

Your spending will generally fall into one of these buckets:

- Fixed Business Costs: These are the predictable, non-negotiable expenses that keep your business running. We’re talking about things like your accounting software subscription, web hosting, or professional insurance.

- Variable Business Costs: These costs fluctuate with your workload. Think about what you spend on advertising, project-specific software, or hiring a subcontractor for a big gig.

- Personal Spending: This is everything else—your rent, groceries, travel, and savings goals. You cover this with the “paycheck” you draw from your business account.

Implement the Pay Yourself First Method

The single most powerful strategy for building wealth as a freelancer is to pay yourself first. This means you treat saving and taxes not as afterthoughts, but as your most critical, non-negotiable bills.

Before a single dollar goes toward a coffee or a new gadget, you must allocate money to these key areas:

- Tax Savings: The moment a client payment hits your account, immediately move 25-30% of it into a separate, high-yield savings account just for taxes. This isn’t your money; it’s just visiting before you send it to the government. Don’t touch it.

- Emergency Fund: Your goal is to build a safety net that covers at least six months of essential living expenses. This is your “lean month” account, and it’s what will let you sleep at night when a client pays late.

- Retirement & Investments: Make consistent contributions to a retirement account like a Solo 401(k) or a SEP IRA. The power of compounding is too good to ignore.

- Business Growth: Earmark a small percentage for future business investments. This could be for a new laptop, a professional development course, or a much-needed website redesign.

By funding these buckets first, you guarantee you’re always making progress on your most important financial goals, no matter how lumpy your income is.

Conquer Self-Employment Taxes Without Fear

For a lot of freelancers, just hearing “self-employment tax” is enough to send a shiver down their spine. It can feel like this big, scary beast that comes with being your own boss. But here’s the truth I’ve learned over the years: it doesn’t have to be. The trick is to stop treating taxes as a once-a-year panic attack and start handling them like any other predictable business expense.

The single best habit you can build is to open a separate bank account just for taxes. Seriously, do it today. Then, every single time a client pays you, immediately transfer 25-30% of that income into your tax account. Don’t touch it. Don’t even think about it. It’s not your money to spend—it’s just being held for the government. This one change completely removes the shock of a massive tax bill in April.

This simple move shifts your entire mindset. You stop viewing your gross income as your personal paycheck and begin operating like a real business, with your obligations covered from the get-go.

Pay Your Taxes Quarterly, Not Annually

This leads to your next secret weapon for staying sane: estimated quarterly tax payments. Instead of one giant payment in April that can drain your cash flow, you’ll make four smaller payments throughout the year. It’s much easier to manage and helps you avoid nasty underpayment penalties from the IRS.

A key part of this process is the IRS Form 1040-ES for estimated taxes, which is what you’ll use to calculate and submit those payments on time. It sounds official, but it’s really just a worksheet to keep you on track.

Uncover Every Deduction You Deserve

Now for the fun part: deductions. Think of deductions as your best friend in the freelance world because they directly lower the amount of income you have to pay taxes on. This is huge. While nearly 60% of freelancers report making more than they did in their traditional jobs, about 55% still earn under $50,000 annually, so making every dollar count is critical.

So many freelancers miss out on deductions they’re entitled to. The most common ones are right under your nose:

- Your Home Office: A percentage of your rent or mortgage, utilities, and internet bill.

- Software & Subscriptions: That project management tool you love? Your accounting software? All deductible.

- Professional Development: Any courses, workshops, or industry events you attend to sharpen your skills.

When you start tracking these expenses diligently, you can dramatically reduce what you owe. For a complete checklist, check out our guide on 8 key freelancer tax deductions for 2025. Make this a routine, and tax season will feel less like a final exam and more like just another Tuesday.

Find a Budgeting Method That Actually Sticks

Let’s be honest: the best budget isn’t some complex spreadsheet masterpiece. It’s the one you actually use. If you’ve tried and failed with budgets before, it’s probably because you were forcing a system that didn’t fit your life or personality.

The secret is finding a system that clicks with how you think. A visual-minded graphic designer might love an app with colorful charts and simple categories. On the other hand, a data-obsessed developer might get a thrill from a custom spreadsheet where they can track every single metric down to the penny. A method you dread is a method you’ll abandon.

Adapt a System for Your Freelance Life

Most traditional budgeting advice falls apart for freelancers because it’s built for a predictable, bi-weekly paycheck. The trick is to take a popular method and tweak it for our world of variable income.

Here are a few solid frameworks you can adapt:

- Modified 50/30/20 Rule: This one’s a classic for a reason. Once you’ve figured out your baseline monthly income and set aside 25-30% for taxes, you split what’s left. Aim for 50% for needs (rent, bills, groceries), 30% for wants (dining out, hobbies), and 20% for savings and paying down debt.

- Zero-Based Budgeting: This approach gives every single dollar a job. When you get paid, you allocate your entire baseline income to expenses, savings, and debt until your income minus your outgoings equals zero. It’s perfect if you crave structure and want to know exactly where your money is going.

- Profit First Model: This completely flips the script. Instead of the usual

Sales - Expenses = Profit, you useSales - Profit = Expenses. You decide on a profit percentage and pay yourself first. This forces you to run your business leanly on whatever is left over.

The goal isn’t to cram you into a rigid box. It’s about finding a sustainable system that makes money management feel less like a chore and more like a strategic part of running your freelance business. Pick one, give it a real try for a couple of months, and don’t ever be afraid to ditch it if it’s just not working.

Use Modern Tools to Automate Your Finances

Let’s be honest: you probably didn’t get into freelancing because you love spending evenings wrestling with spreadsheets. The great news is, you don’t have to. Technology has come a long way, and it’s your secret weapon for turning tedious financial chores into a smooth, automated process that just hums along in the background.

This isn’t just a “nice-to-have” anymore. It’s essential. The freelance workforce is massive, making up about 47% of the global labor force. That’s a staggering 1.57 billion people, each one acting as their own finance department. With that many people navigating the freelance life, smart budgeting for freelancers becomes the bedrock of stability. You can dive deeper into these freelance statistics and see for yourself why having a grip on your finances is non-negotiable.

Let Technology Do the Heavy Lifting

Modern accounting software isn’t just for big corporations anymore. There are now powerful, user-friendly tools built specifically for solo operators like you. Think of them as your personal finance department, ready to take on the most frustrating parts of managing your money.

Here’s how these platforms can change the game for you:

- Track Expenses in Real-Time: Simply connect your business bank account, and the software gets to work, automatically categorizing every transaction. This makes finding tax deductions almost effortless.

- Send Professional Invoices: Forget clunky Word templates. You can create, send, and track client invoices in just a few clicks. The best part? Many tools will even send out polite, automatic payment reminders, so you don’t have to play bill collector.

- Generate Simple Reports: Instantly pull up your profit and loss statement, see your cash flow, and analyze your spending habits—all on a clean, easy-to-read dashboard. This gives you hard data to make smarter business decisions.

By automating these tasks, you’re not just saving time; you’re reclaiming your energy and focus. You can pour that back into what you actually love doing—your creative work—instead of moonlighting as a bookkeeper.

These tools also provide powerful dashboards that visualize your income streams. You can see at a glance which clients are your most valuable, or get a heads-up when your cash flow might dip in the coming months. Having this kind of insight is invaluable when deciding whether it’s time to raise your rates or invest in that new piece of gear.

To see how this works in practice, explore how PopaDex helps automate finances and gives you a crystal-clear overview of your entire financial picture.

Even with a solid system, the real world has a way of throwing curveballs that test your financial footing. The true mark of a successful freelance budget isn’t just having a plan; it’s knowing how to pivot when things don’t go according to that plan. Let’s walk through some of the most common questions that pop up.

What if I Have a Month with Zero Income?

This exact scenario is why your emergency fund is non-negotiable. It’s your “lean month” lifeline, specifically designed to cover 3-6 months of essential living expenses without you having to rack up debt or hit the panic button. When a dry spell hits, this is the account you’ll draw from to keep the lights on and pay your core bills.

This is also where building your budget on a conservative baseline income—not your best month ever—really pays off. That discipline keeps your regular expenses lean enough to survive a downturn. Use the unexpected free time to focus on what I call ‘income generation’ activities: ramp up your marketing, jump back into networking, and follow up on old leads. Fill that pipeline for the months ahead.

The single biggest mistake I see new freelancers make is co-mingling their business and personal finances. Do yourself a favor and open a separate business checking account from day one. It gives you a crystal-clear view of your business’s actual financial health and, just as importantly, protects your personal assets.

What Percentage of My Income Should I Actually Be Saving?

The old 50/30/20 rule is a decent starting point, but for freelancers, it needs a critical first step: taxes.

Before you do anything else, skim 25-30% right off the top of every single payment you receive. Move it immediately into a separate savings account dedicated to taxes. Don’t even think of it as your money; it was never yours to begin with.

Then, you can apply a savings goal—say, 20% or more—to what’s left over. This freelance savings fund should be split strategically:

- Retirement: Make consistent contributions to a SEP IRA or Solo 401(k).

- Emergency Fund: Focus on building and then maintaining that crucial 3-6 month buffer.

- Business Reinvestment: Set aside funds for future growth, whether it’s for new software, a conference, or a professional course.

For many self-employed professionals, another major budgeting hurdle is finding affordable health coverage. Making sure you explore the best health insurance for the self-employed is a vital part of your financial planning. This locks in coverage for one of your biggest potential costs before you decide what’s left for personal spending.

Ready to stop guessing and get a real-time, consolidated view of your entire financial world? PopaDex helps you track your income, savings, and investments in one place, making freelance budgeting feel effortless. Sign up for free today and build your financial command center.