Our Marketing Team at PopaDex

12 Best Budgeting Apps for Young Adults in 2025

Welcome to your financial turning point. As a young adult, navigating the world of personal finance can feel like a complex puzzle. You’re juggling student loans, rent, new career opportunities, and the desire for a social life. The key to not just surviving but thriving is mastering your money, and technology is your most powerful ally.

Gone are the days of tedious spreadsheets and guesswork. A world of powerful, intuitive budgeting apps is at your fingertips, designed to address the unique financial challenges and goals of your generation. From tracking daily spending and managing subscriptions to building your first investment portfolio, these tools offer clarity and control. While managing your expenses is critical, boosting your income can accelerate your progress; consider exploring these 9 Easy Ways to Make Extra Money in 2025 to further enhance your financial standing.

This guide cuts through the noise. We provide a detailed breakdown of the 12 best budgeting apps for young adults, exploring their unique features, practical use cases, and honest limitations. Each review includes screenshots and direct links to help you find the perfect partner for your financial journey. Let’s dive in and find the app that will empower you to build a secure future.

Free to start

Ready to track your net worth?

Connect your accounts and see your complete financial picture in under 2 minutes.

1. PopaDex

PopaDex establishes itself as a premier financial command center, particularly for young adults aiming to build a comprehensive understanding of their net worth. Unlike many apps that focus solely on day-to-day spending, PopaDex provides a holistic view by consolidating everything from bank accounts and investments to property and liabilities into a single, intuitive dashboard. This macro-level perspective is crucial for making informed, long-term financial decisions beyond simple expense tracking.

Its standout feature is the exceptional international support, connecting to over 15,000 banks in 30+ countries. This makes it an indispensable tool for expats, digital nomads, or anyone managing multi-currency assets, a common scenario for today’s globally connected young professional. The platform effectively visualizes your financial progress, transforming abstract numbers into clear, actionable insights.

Key Strengths & Use Cases

PopaDex excels as one of the most versatile budgeting apps for young adults who have graduated from basic expense management and are ready to focus on wealth accumulation.

- Holistic Wealth Tracking: Instead of just monitoring cash flow, you can track the growth of your entire portfolio, including stocks, real estate, and retirement funds, against your debts. This is ideal for setting and measuring progress toward major goals like a down payment or financial independence.

- Global Financial Management: Young adults studying or working abroad can seamlessly link international and domestic accounts, getting a true net worth calculation without manual currency conversions.

- User-Centric Design: The interface is clean and modern, with a dark mode option and a multilingual interface that enhances usability. The interactive dashboards make complex financial data easy to digest.

Practical Tip: Start with the free tier to manually input your accounts and get a feel for the platform. This helps you organize your financial picture before deciding if the automated sync features of the premium plan are necessary for your workflow.

Pricing and Platform Details

| Feature | Free Tier | Premium Tier (€5/month) |

|---|---|---|

| Connections | Manual Data Aggregation | Automated Integrations (15,000+ banks) |

| Insights | Basic Net Worth Tracking | Advanced Financial Insights & Visualizations |

| Tools | Access to Calculators & Templates | All Free Tier features included |

| Support | Standard Support | Dedicated Customer Support |

| Guarantee | N/A | 30-Day Money-Back Guarantee |

- Pros:

- Comprehensive support for international and multi-currency accounts.

- Affordable premium tier with powerful automated features.

- Excellent supplemental resources like calculators and spreadsheet templates.

- Cons:

- Full automation and advanced insights are locked behind the premium subscription.

- The promising AI co-pilot feature is still in development and not yet available.

2. You Need A Budget (YNAB)

You Need A Budget, or YNAB, operates on a powerful philosophy: give every dollar a job. This proactive, zero-based method makes it one of the most effective budgeting apps for young adults who are serious about gaining total control over their finances. Unlike apps that simply track past spending, YNAB forces you to plan ahead, which is transformative for managing irregular income or paying down debt.

The platform’s strength lies in its methodology, supported by real-time sync across devices and extensive educational resources like live workshops. While there’s a definite learning curve, mastering its system provides unparalleled financial clarity. The premium subscription cost is higher than many alternatives, but its dedicated user base often says the financial turnaround is worth the investment. For a deeper dive into this method, you can explore more about budgeting for young adults on popadex.com.

Key Information

| Feature | Details |

|---|---|

| Best For | Individuals committed to a hands-on, structured budgeting method. |

| Pricing | Subscription-based; offers a 34-day free trial. Costs are approximately $99/year or $14.99/month. |

| Unique Trait | The “Four Rules” methodology that reshapes how you think about money. |

| Website | youneedabudget.com |

3. Simplifi by Quicken

Simplifi by Quicken is designed for young adults who want a powerful yet intuitive tool without a steep learning curve. It excels at providing a real-time, consolidated view of your finances by automatically syncing with your bank accounts, credit cards, and loans. The app automatically categorizes transactions and creates a personalized spending plan, making it one of the most accessible budgeting apps for young adults who are just starting to manage their money seriously. Its clean interface helps you quickly see where your money is going and identify opportunities to save.

Unlike more rigid budgeting systems, Simplifi focuses on a flexible spending plan rather than strict, zero-based rules. It tracks your income, bills, and subscriptions, then shows you what’s left to spend, empowering you to make smarter daily decisions. The platform also includes features for setting and tracking savings goals, from building an emergency fund to saving for a down payment. While it lacks a free tier and has less robust investment tracking compared to its parent company’s flagship software, its simplicity and focus on cash flow make it a top contender.

Key Information

| Feature | Details |

|---|---|

| Best For | Beginners seeking a comprehensive, automated financial overview. |

| Pricing | Subscription-based; offers a 30-day free trial. Costs are approximately $47.88/year (billed annually). |

| Unique Trait | A personalized spending plan that shows you how much you have left to spend after bills and savings. |

| Website | quicken.com/simplifi |

4. PocketGuard

PocketGuard’s main goal is to simplify your financial life by answering one critical question: “How much is in my pocket?” It calculates your disposable income after accounting for bills, savings goals, and recurring expenses. This straightforward approach makes it one of the most accessible budgeting apps for young adults who feel overwhelmed by complex systems and just want to avoid overspending day-to-day. The app helps you see exactly what’s safe to spend at a glance.

The platform shines by automatically identifying recurring bills and subscriptions, helping you spot and cancel services you no longer need. PocketGuard even offers a bill negotiation service to potentially lower costs on things like your phone or internet plan. While the free version is functional for basic tracking, its most powerful features are behind the PocketGuard Plus subscription. For those who want a simple, automated view of their spendable cash, this app is an excellent starting point.

Key Information

| Feature | Details |

|---|---|

| Best For | Beginners seeking a simple way to see their spendable cash and cut expenses. |

| Pricing | Free basic version available. PocketGuard Plus is about $7.99/month or $79.99/year. |

| Unique Trait | The “In My Pocket” feature that clearly shows your available disposable income. |

| Website | pocketguard.com |

5. Goodbudget

Goodbudget brings the time-tested envelope budgeting system into the digital age. This method is perfect for young adults who want to be more intentional with their spending by allocating specific amounts of money into virtual “envelopes” for categories like groceries, rent, and entertainment. It operates on a manual-entry basis, which encourages mindfulness about every transaction rather than passively tracking after the fact. This hands-on approach makes it one of the most effective budgeting apps for young adults looking to build discipline.

The platform’s strength is its simplicity and its focus on planned spending, which is ideal for couples or families who need to share a budget, thanks to its device-syncing capabilities. While the lack of automatic bank syncing may be a drawback for some, it is a deliberate feature for those who prefer privacy and manual control. The free version is quite robust, making it a great entry point. For a more detailed look at similar tools, you can explore the best free budgeting apps on popadex.com.

Key Information

| Feature | Details |

|---|---|

| Best For | Users who prefer the manual envelope budgeting method and want to share a budget with a partner. |

| Pricing | Free version with limited envelopes and one account. Plus plan is approximately $8/month or $70/year. |

| Unique Trait | A digital version of the traditional cash envelope system that syncs across multiple devices. |

| Website | goodbudget.com |

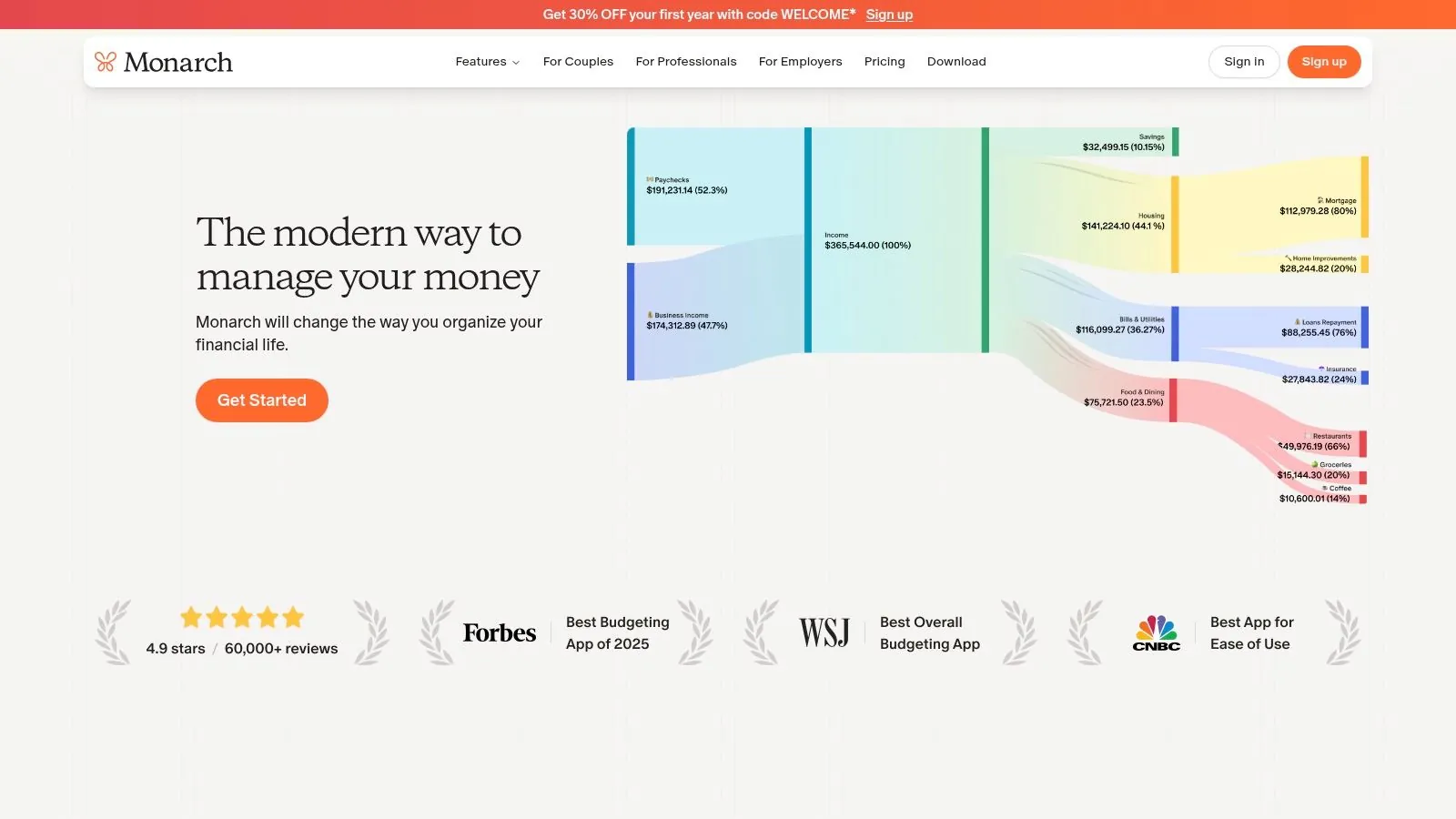

6. Monarch Money

Monarch Money positions itself as a modern, all-in-one financial dashboard, making it an excellent choice for young adults who want to see their full financial picture in one place. It seamlessly integrates budgeting, tracking investments, and setting long-term goals. Unlike many apps that focus solely on spending, Monarch provides a holistic view that connects your daily budget to your net worth and future plans, which is a powerful motivator.

The platform is particularly strong for collaborative finance, allowing users to invite a partner or financial advisor to view and manage the budget together with customizable permissions. Its clean interface and customizable dashboard make it one of the most user-friendly budgeting apps for young adults who are ready to move beyond simple expense tracking. While it comes at a premium price with no free version, its continuous updates based on user feedback and comprehensive features justify the cost for those seeking a powerful financial hub.

Key Information

| Feature | Details |

|---|---|

| Best For | Couples or individuals seeking a holistic view of their finances, including investments. |

| Pricing | Subscription-based; offers a 7-day free trial. Costs are approximately $99.99/year or $14.99/month. |

| Unique Trait | An all-in-one dashboard that tracks spending, goals, and investment performance together. |

| Website | monarchmoney.com |

7. EveryDollar

EveryDollar, developed by financial guru Dave Ramsey’s team, is built on a straightforward zero-based budgeting principle: plan where every single dollar will go before the month begins. This makes it an excellent choice among budgeting apps for young adults who want a clear, no-nonsense path to financial accountability. The app simplifies the process of creating a monthly budget, tracking expenses against it, and making sure your income minus your outgoings equals zero.

The platform’s major appeal is its simplicity and its integration with Ramsey’s popular “Baby Steps” for getting out of debt and building wealth. While the free version is fully functional, it requires you to manually input all transactions, which can be a powerful exercise in mindfulness about your spending. The premium version automates this by linking to your bank accounts, saving time and reducing manual errors. It’s ideal for those who appreciate a structured, goal-oriented approach without a steep learning curve.

Key Information

| Feature | Details |

|---|---|

| Best For | Beginners and followers of Dave Ramsey’s financial principles seeking a simple zero-based budget. |

| Pricing | A functional free version is available. Premium subscription (Ramsey+) costs from $59.99 to $129.99 per year. |

| Unique Trait | Its direct alignment with the “Baby Steps” method for debt reduction and wealth building. |

| Website | everydollar.com |

8. Honeydue

Honeydue is designed specifically for couples, making it one of the most practical budgeting apps for young adults navigating shared finances for the first time. The app promotes transparency by allowing partners to see all their bank accounts, credit cards, and loans in one place, while also giving the option to keep certain accounts private. This balance between shared visibility and individual autonomy is crucial for building financial trust and collaboration.

The platform shines with features like shared expense tracking, bill reminders, and a built-in chat for discussing transactions. Instead of awkward money conversations, you can simply comment on a specific expense to ask your partner about it. While it lacks the deep, individual-focused budgeting tools of other apps, its strength lies in facilitating teamwork. It’s an excellent free tool for partners looking to coordinate bill payments, track joint spending, and get on the same financial page without complicated spreadsheets.

Key Information

| Feature | Details |

|---|---|

| Best For | Couples who want to manage shared expenses and improve financial communication. |

| Pricing | Free to use. |

| Unique Trait | In-app messaging and features designed exclusively for financial collaboration between partners. |

| Website | honeydue.com |

9. Empower Personal Dashboard

Empower Personal Dashboard (formerly Personal Capital) transcends simple expense tracking by offering a complete 360-degree view of your financial life. It excels at aggregating all your accounts-checking, savings, credit cards, loans, and investments-into a single, unified interface. This makes it one of the top budgeting apps for young adults who want to see the big picture, connecting daily spending habits with long-term wealth-building goals like retirement.

The platform’s real power is its robust, free investment analysis and retirement planning tools, which are typically found in premium services. While its budgeting features are more for tracking than proactive planning, its ability to calculate your net worth in real-time is incredibly motivating. Be aware that the free tools are a gateway to their paid advisory services, so you may receive occasional outreach, but the dashboard itself remains a powerful, no-cost resource for holistic financial management.

Key Information

| Feature | Details |

|---|---|

| Best For | Young adults focused on tracking net worth and managing investments alongside their budget. |

| Pricing | The dashboard and tracking tools are free. Optional wealth management services are available for a fee. |

| Unique Trait | A holistic view that combines budgeting with powerful, free investment and retirement planning tools. |

| Website | empower.com |

10. Rocket Money (formerly Truebill)

Rocket Money, which was formerly known as Truebill, is a powerful ally for young adults looking to trim their financial fat with minimal effort. Its primary strength goes beyond tracking where your money goes; it’s actively finding ways to save it. The app excels at identifying and canceling forgotten subscriptions, a common financial drain for many. This automated approach makes it one of the standout budgeting apps for young adults who want to optimize spending without manual oversight.

The platform’s standout feature is its bill negotiation service. Rocket Money will attempt to negotiate better rates on your behalf for bills like cable, internet, and phone services, taking a percentage of the savings as its fee. This focus on expense reduction and subscription management provides a unique, proactive path to a healthier budget. To get the most out of these features, you can learn more about how to automate your finances on popadex.com.

Key Information

| Feature | Details |

|---|---|

| Best For | Individuals who want to cut recurring costs and find “leaks” in their budget automatically. |

| Pricing | Free basic version. Premium subscriptions range from $4-$12/month, unlocking most features. |

| Unique Trait | Automated subscription cancellation and bill negotiation services that actively work to lower your expenses. |

| Website | rocketmoney.com |

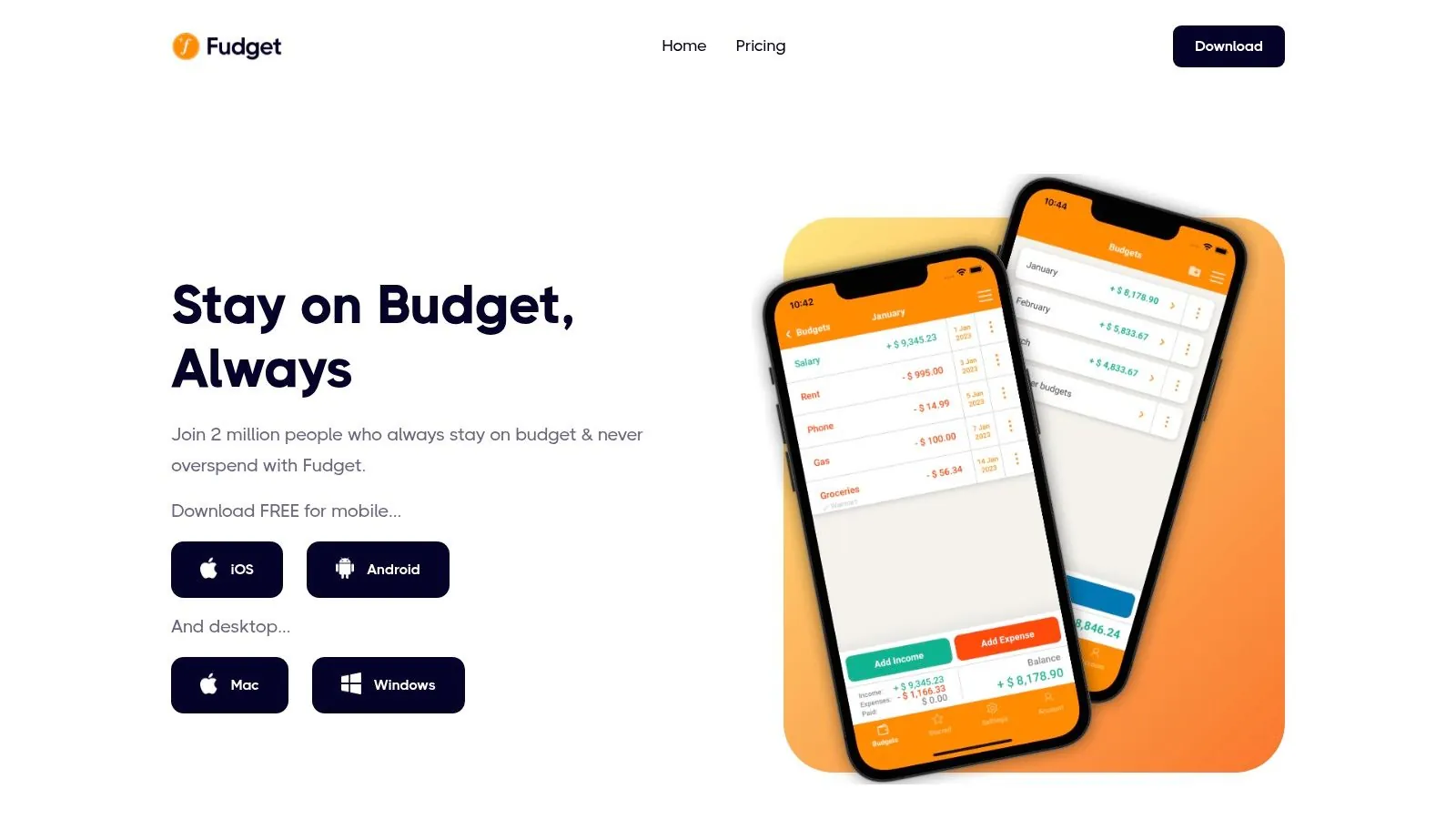

11. Fudget

For those overwhelmed by complex financial tools, Fudget offers a refreshing return to basics. It operates like a simple, digital list, allowing you to quickly add income and expenses without the fuss of connecting bank accounts or categorizing every transaction. This straightforward approach makes it one of the most accessible budgeting apps for young adults who need a quick way to manage a short-term budget, like for a vacation, a specific project, or a single pay period.

The platform’s strength is its pure simplicity and speed; you can create a budget in seconds. Because it requires manual entry, it forces you to be mindful of each dollar you spend, which can be a powerful habit-building exercise. While the free version is impressively functional and ad-free, a one-time Pro upgrade unlocks useful features like Dropbox syncing to share budgets across devices. Fudget is perfect for anyone who finds traditional budgeting apps too bloated with features they will never use.

Key Information

| Feature | Details |

|---|---|

| Best For | Short-term budgeting, event planning, and users wanting a simple, manual-entry digital ledger. |

| Pricing | Free to use. A one-time purchase of around $3.99 unlocks Pro features like exporting and syncing. |

| Unique Trait | A bare-bones, list-based interface that avoids account linking and complex categorization entirely. |

| Website | www.fudget.com |

12. Acorns

Acorns brilliantly fuses saving and investing by rounding up your daily purchases and putting the spare change to work. While not a traditional expense tracker, it’s one of the most effective budgeting apps for young adults looking to build wealth passively. This “set it and forget it” approach helps cultivate consistent saving and investing habits without requiring a deep knowledge of the stock market, making financial growth feel effortless and accessible.

The platform automatically invests your rounded-up change into diversified ETF portfolios tailored to your risk tolerance. Acorns excels at making investing a background activity, removing the intimidation factor for beginners. However, its budgeting capabilities are minimal compared to dedicated apps, and the monthly subscription fees can be significant for users with very small balances. It’s best viewed as an automated wealth-building tool rather than a comprehensive budgeting solution.

Key Information

| Feature | Details |

|---|---|

| Best For | Beginners wanting to automatically invest spare change without active effort. |

| Pricing | Subscription-based; plans start at $3/month for Personal. |

| Unique Trait | “Round-Ups” feature that automatically invests your spare change from purchases. |

| Website | acorns.com |

Budgeting Apps for Young Adults: Feature Comparison Chart

| Product | Core Features/Characteristics | User Experience / Quality | Value Proposition | Target Audience | Unique Selling Points |

|---|---|---|---|---|---|

| ** PopaDex** | Net worth tracking, 15,000+ banks, multi-currency, manual & automated aggregation | Interactive dashboards | Free plan + €5/month Premium | All financial stages: young pros, expats, investors | Multilingual, extensive bank support, AI co-pilot (coming), privacy first |

| You Need A Budget (YNAB) | Zero-based budgeting, real-time sync, educational content | Strong learning focus | Higher subscription cost | Young adults & planners | Educational workshops, proactive budgeting |

| Simplifi by Quicken | Auto categorization, bill tracking, customizable plans | Beginner-friendly | No free version | Beginners wanting budgeting + overview | Automatic transaction sorting |

| PocketGuard | Disposable income display, subscription/bill tracking | Easy to use | Free + limited premium | Expense-sensitive users | Bill negotiation, subscription cancellation |

| Goodbudget | Envelope budgeting, manual entry, device sync | Manual, disciplined | Free version available | Manual budgeters | Virtual envelopes for spending control |

| Monarch Money | Budgeting, investment tracking, collaborative features | Holistic financial view | No free version | Users wanting all-in-one platform | Collaborative budgeting, portfolio tracking |

| EveryDollar | Zero-based budgeting, customizable categories | Simple, intuitive | Free + premium | Fans of Dave Ramsey approach | Easy goal tracking |

| Honeydue | Shared expense tracking, bill reminders, messaging | Couple-focused | Free | Couples managing joint finances | In-app financial discussions |

| Empower Personal Dashboard | Budgeting, investment & retirement tools | Comprehensive overview | Free | Users managing short & long-term goals | Retirement planning, portfolio analysis |

| Rocket Money (Truebill) | Subscription & bill tracking, negotiation | Expense optimizer | Free + premium | Users wanting expense control | Bill negotiation, subscription savings |

| Fudget | Simple income/expense lists, no account linking | Minimalist, easy | Free | Users wanting no-frills budget | No ads, customizable currency |

| Acorns | Round-up micro-investing, diversified portfolios | Beginner-friendly | Monthly fees may add up | New investors/young adults | Auto investing spare change |

Your Next Move: Choosing the Right App and Building Your Financial Future

We’ve journeyed through a comprehensive landscape of the best budgeting apps for young adults, each offering a unique approach to financial management. From the disciplined, proactive philosophy of YNAB to the effortless “invest-the-change” model of Acorns, the diversity of tools available means there is a perfect fit for every financial personality and goal. You’ve seen apps like Empower Personal Dashboard that provide a high-level, 30,000-foot view of your net worth, and others like Fudget that champion simplicity with manual, no-frills tracking.

The key takeaway is that the “best” app is entirely subjective. It’s the one that aligns with your habits, addresses your specific pain points, and motivates you to stay engaged with your finances. Making the right choice requires a moment of honest self-assessment.

How to Select Your Ideal Budgeting App

Before you commit, consider which of these user profiles best describes you. Your answer will point you toward the right tool.

- For the Hands-On Tactician: If you gain clarity from manually categorizing every dollar and want total control, a zero-based budgeting app like YNAB or EveryDollar will be your greatest ally. These tools transform budgeting from a passive report into an active, forward-looking plan.

- For the Automation-Seeker: If your goal is to “set it and forget it,” you’ll thrive with apps that do the heavy lifting. Simplifi by Quicken and Rocket Money excel at automatically tracking spending, identifying trends, and flagging unwanted subscriptions, giving you insights with minimal daily effort.

- For the Goal-Oriented Investor: If your primary focus goes beyond managing expenses but actively growing your wealth, platforms like Empower Personal Dashboard and Monarch Money are built for you. Their powerful investment tracking and net worth dashboards help you see the big picture and plan for long-term goals like retirement.

- For Collaborative Couples and Groups: Managing money with a partner introduces another layer of complexity. Dedicated apps like Honeydue are designed specifically for shared finances. While this guide focuses on individual budgeting apps, you might also find it useful to explore the 7 Best Shared Expense Tracker App Options for managing group finances with friends or roommates.

From Choice to Habit: Making It Stick

Choosing an app is just the first step. The real transformation happens when you integrate it into your routine. Start by taking advantage of free trials. Connect your accounts, spend a week categorizing transactions, and see how the workflow feels. Does it clarify your financial picture or create confusion?

Remember, the ultimate goal goes beyond tracking spending. It’s to build the powerful habit of financial awareness. By directing your money with intention, you are laying the foundation for a secure and prosperous future. This consistent practice is what turns financial stress into financial confidence, paving the way for achieving independence and realizing your most ambitious goals.

Ready to see your entire financial world in one place? For those who want to move beyond basic budgeting to comprehensive wealth management, PopaDex offers a powerful dashboard to track your net worth, investments, and assets, giving you the clarity needed to build lasting wealth. Explore PopaDex today and take the next step in your financial journey.