Our Marketing Team at PopaDex

A Guide to Modern Collection Tracking

Collection tracking is all about cataloging, valuing, and managing a group of valuable items. Done right, it transforms a simple hobby into a structured, understandable financial portfolio. Think of it as a dynamic command center for your assets, giving you a real-time, comprehensive view of everything you own—from physical art and trading cards to digital currencies.

What Is Collection Tracking

Imagine trying to manage a stock portfolio without a dashboard. All you have is a messy pile of notes and old receipts. You’d have no real clue what it’s worth, how it’s performing, or which assets are actually driving growth. That’s exactly what managing a valuable collection without a proper system feels like.

Modern collection tracking goes way beyond a simple list. It creates that crucial financial command center for your assets. This “dashboard” approach gives you a live, all-encompassing view of everything you own, whether it’s physical stuff like vintage watches and rare books or digital assets like NFTs. Everything is in one place.

Beyond the Basic Spreadsheet

When starting out, most collectors naturally turn to a simple spreadsheet. They’re accessible and seem easy enough for logging a handful of items. But as a collection grows in size and value, spreadsheets always start to crack under the pressure. They create frustrating blind spots that can cost you both money and peace of mind.

The key limitations of trying to track manually are obvious once you hit them:

- Manual Data Entry: Every single purchase price, sale date, and market value update has to be typed in by hand. This is a recipe for human error.

- Static Valuations: Spreadsheets can’t automatically pull in current market values. You’re left with an outdated and inaccurate picture of your collection’s true worth.

- Lack of Visual Insight: It’s nearly impossible to visualize trends, asset allocation, or performance without building complex, clunky charts from scratch.

This is where the principles of financial data aggregation become so important for collectors. Pulling all your scattered data points into a single, cohesive view is the only way to get true clarity.

The core problem with manual methods is that they require constant effort to stay accurate. A dedicated tracking system does the heavy lifting for you, turning data management from a tedious chore into a strategic advantage.

The need for a better system is only getting bigger. The total volume of data created globally is forecasted to reach an incredible 149 zettabytes. This data explosion just highlights why a robust collection tracking system is no longer a nice-to-have—it’s essential for managing assets effectively in our data-rich world.

The Real Benefits of a Modern Tracking System

Moving to a dedicated system for collection tracking is the single biggest step you can take to shift from being a passive owner to an active manager of your assets. It’s like switching from a shoebox full of receipts to a live financial dashboard for your collection. The upsides ripple out, touching everything from your net worth calculations to your overall peace of mind.

At its core, it’s all about gaining true financial clarity. Without a central hub, the total value of your collection is just a fuzzy guess. A proper tracking platform changes that by syncing with real-time market data, finally giving you an accurate, up-to-the-minute answer to the big question: “What is all this actually worth?” This number is the bedrock of any smart financial plan.

That clarity directly fuels smarter, data-driven decisions. Instead of going with your gut, you can analyze performance, pinpoint your star assets, and see market trends as they happen. You’ll know exactly when to buy, sell, or hold an item based on hard data, not just a hunch.

Strengthening Security and Reclaiming Time

Beyond strategy, a solid tracking system offers a crucial layer of security. Just imagine the nightmare of trying to file an insurance claim after a fire or theft with nothing but scattered emails and faded receipts. A detailed digital inventory—complete with photos, purchase dates, and verified values—is the irrefutable proof you need.

This log ensures you can recover the full value of what you’ve lost, turning a simple list into a powerful security document.

A well-maintained tracking system is one of the most effective forms of financial protection you can have for your physical assets. It provides the detailed, verifiable evidence needed for insurance claims and estate planning.

Finally, let’s talk about your time. Manually updating spreadsheets, hunting down market prices, and organizing paperwork are tedious, thankless jobs. A dedicated system puts all that grunt work on autopilot.

- Automated Valuation: The system fetches current market data, saving you from hours of research.

- Centralized Records: Every purchase detail, photo, and bit of history lives in one secure spot.

- Instant Reporting: Need a report for your insurer or financial planner? It’s just a few clicks away.

This automation hands you back countless hours you can spend enjoying your collection or finding that next great piece. The system works for you, turning tedious chores into effortless oversight and transforming your hobby into a seriously well-managed portfolio.

Of course, you could try to build this yourself. But the reality is that manual methods just can’t keep up.

Manual Spreadsheets vs Dedicated Tracking Software

Here’s a quick look at why so many collectors are moving away from DIY spreadsheets and embracing specialized software.

| Feature | Manual Spreadsheet (e.g., Excel/Sheets) | Dedicated Tracking Software (e.g., PopaDex) |

|---|---|---|

| Data Entry & Updates | 100% manual. Prone to errors, tedious to maintain. | Automated. Syncs accounts, pulls market data, and updates values live. |

| Valuation | Requires manual research for every single item. | Real-time valuation powered by integrated market data sources. |

| Security & Documentation | Records are scattered, hard to verify for insurance. | Centralized digital vault with photos, receipts, and history. |

| Reporting & Insights | Basic charts; requires complex formulas for any real analysis. | Instant, detailed reports on performance, allocation, and growth. |

| Time Investment | Hours per month just to keep it current. | Minutes per month to review and manage. |

| Accessibility | Tied to a specific file; difficult to access or share securely. | Secure cloud access from any device, anywhere. |

While a spreadsheet is better than nothing, it’s a static, high-effort tool. Dedicated software like PopaDex is dynamic, turning your collection data into a living, breathing financial tool that saves you time and empowers better decision-making.

Essential Features of Collection Tracking Software

When you start looking for the right collection tracking tool, the number of options can feel overwhelming. The trick is to ignore the flashy extras and focus on the core features that separate a genuinely powerful platform from a glorified spreadsheet. These are the functions that turn a simple inventory into a dynamic system for managing your assets.

The single most important feature? Automated market value updates. Without this, you’re still stuck hunting down prices manually, which completely defeats the purpose of the software. A great tool hooks into live market data, making sure the value of your assets is always up-to-date. This takes the guesswork out of the equation and gives you a real-time snapshot of your collection’s worth.

Core Functionality for Smart Management

Next up is an intuitive and visual dashboard. Nobody wants to stare at a wall of numbers. A well-designed dashboard, like the one you’ll find in PopaDex, lays out your collection’s total value, how your assets are allocated, and their performance over time using clean charts and graphs. This kind of at-a-glance insight is crucial for making quick, smart decisions.

Another feature you can’t live without is a robust set of sorting and filtering tools. As your collection gets bigger, you’ll need to slice and dice the data in different ways.

- Filter by Category: Instantly pull up all your “Vintage Watches” or “First Edition Books.”

- Sort by Value: Quickly see your most valuable pieces or pinpoint which ones have appreciated the most.

- Track by Purchase Date: Analyze how items bought during different periods have performed over time.

This level of organization helps you dig into your portfolio and spot trends you’d otherwise miss entirely. It’s especially powerful when you connect these details to your broader financial strategy; our guide on using a net worth tracker shows how these pieces fit into the bigger picture.

Security and Reporting Capabilities

Secure cloud access is another non-negotiable. Your collection’s data is both valuable and private, so the platform absolutely must protect it with strong encryption. Cloud access also gives you the freedom to manage your assets from any device, anywhere in the world, without being chained to a single computer.

Finally, look for solid reporting tools. You need to be able to generate professional, detailed reports for insurance, financial planning, or estate settlement with just a couple of clicks. This is the feature that gives you the hard-copy proof needed to protect your assets and communicate their value clearly.

Think of these features as the pillars of effective collection tracking. Without automation, visual dashboards, smart filtering, and secure reporting, a platform is just a digital shoebox. A great system provides the structure and intelligence to actively manage your assets.

This kind of real-time visibility is becoming the standard everywhere. Just look at logistics—the market for live package tracking is expected to jump from $4.92 billion to $10.95 billion by 2032, all because people demand transparency. You can read more about this trend at Coherent Market Insights. Just like in shipping, collectors need clear, live data to manage their high-value assets with confidence.

How to Set Up Your Tracking System

Alright, let’s move from theory to action. This is where the real power of collection tracking comes alive, and getting started is less of a chore than you might think. We’ll break it down into simple, manageable steps to build a system that’s accurate, automated, and genuinely useful for managing your assets.

The first move is to round up all your scattered data. Think about where information on your collection currently lives—old spreadsheets, email receipts, scribbled notes, and auction house records. Your goal is to get all of this into one place. Centralize everything first to create a single source of truth before you even think about importing.

With your data wrangled, it’s time to pick your software. Based on the essential features we talked about, choose a platform that gives you automated valuations, a clean dashboard, and solid security. The right tool makes everything that follows a whole lot smoother.

Importing and Organizing Your Collection

Once you’ve chosen your platform, you can start importing your data. Most modern systems have tools to make this pretty painless, like CSV importers that pull everything straight from your spreadsheets.

For example, you could organize your data in a structured template first. If you’re not sure where to begin, looking at something like a net worth tracking spreadsheet can give you a great idea of how to structure your information for an easy import. This approach cuts down on manual entry and the inevitable errors that come with it.

After the import, the next job is to organize and categorize everything. Don’t just dump it all in. Create logical categories (like “Vintage Comics,” “Modern Art,” or “Rare Coins”) and use tags for extra detail (think “Graded,” “Signed,” or “For Sale”). This structure is what makes filtering and reporting so incredibly powerful down the line.

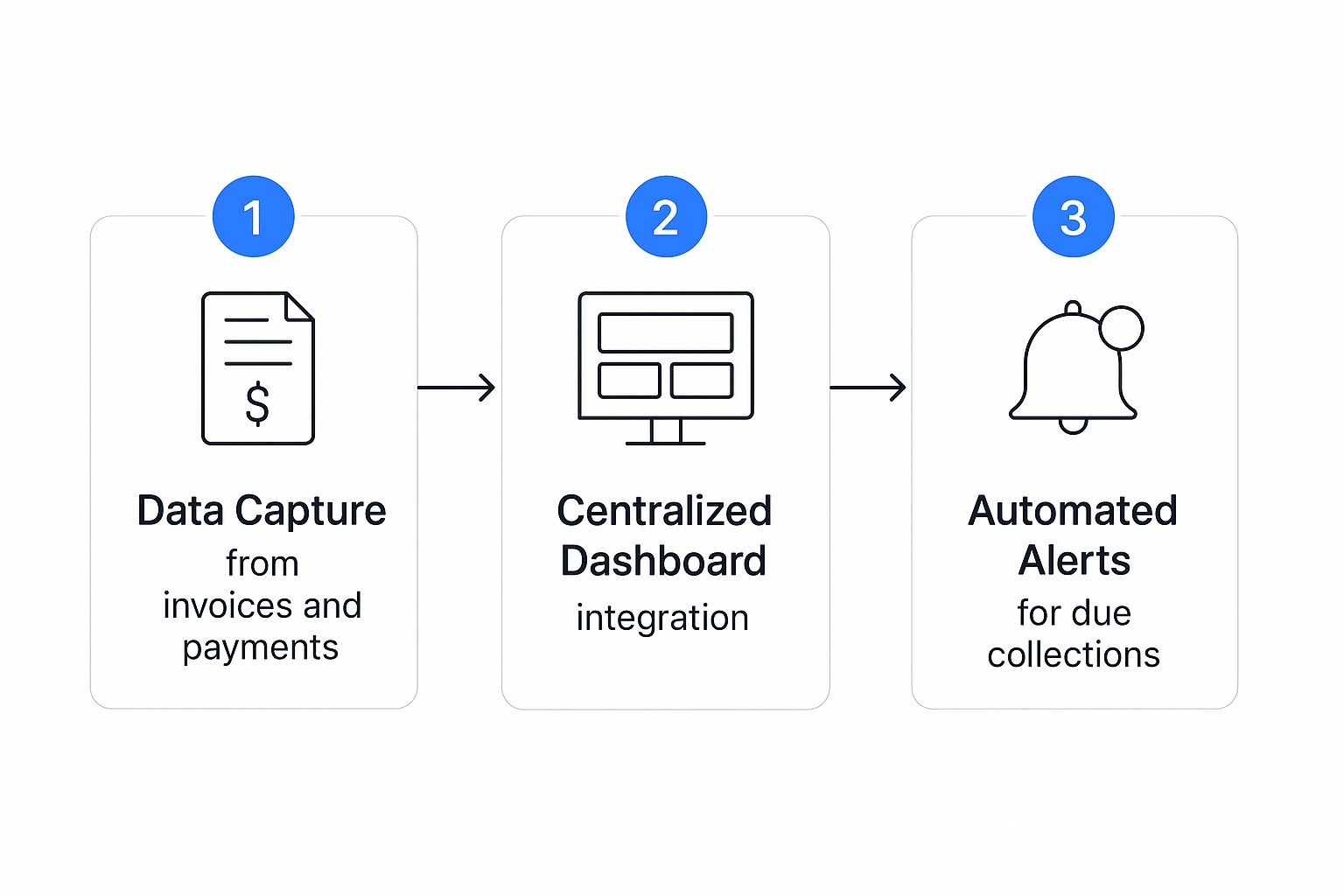

The image below shows how a good system takes your financial data, centralizes it, and turns it into actionable information.

This visual perfectly captures the flow from raw data to a useful alert—that’s the core benefit of an automated tracking system.

The initial setup is a one-time investment that pays dividends indefinitely. By dedicating a few hours to properly gathering, importing, and categorizing your collection data, you create a foundation for years of effortless and insightful asset management.

Finally, set up a simple routine for keeping things up to date. Your tracking system should be a living record, not a dusty archive. Set a reminder to log new purchases right away and update any sales information promptly. Just a few minutes of upkeep each month ensures your data stays accurate and ready for any financial decision you need to make. It’s this simple habit that separates a useful tool from a forgotten one.

How to Maintain and Maximize Your Collection’s Value

Getting your system set up is a huge first step, but the real magic of collection tracking happens over time. A great tracking platform isn’t a dusty archive you fill once and forget. It’s a living, breathing tool. To truly get the most out of your collection, you need to build habits that keep your data sharp and active. This means shifting your mindset from just cataloging stuff to actively managing a dynamic portfolio.

The bedrock of this whole approach is the regular audit. At least once or twice a year, set aside some time to physically check your items against your digital inventory. This simple act of reconciliation keeps your records airtight, catching any small errors before they can spiral into bigger problems for insurance claims or financial planning. Think of it as a regular health checkup for your collection.

Best Practices for Ongoing Accuracy

Keeping your records pristine is all about consistency. Get into the habit of logging new acquisitions the moment they happen. Don’t let receipts pile up until the end of the month. Snap photos, enter the purchase price, and upload any relevant documents right away. The same goes for sales—record the transaction as soon as it’s done to keep your portfolio’s value and performance metrics up-to-the-minute.

This obsessive level of detail is what empowers you to make smart moves. With current, reliable data at your fingertips, you can confidently:

- Analyze Performance: Use reporting features to see which assets are climbing in value the fastest.

- Spot Market Trends: Notice patterns in value changes across different categories in your collection.

- Inform Decisions: Lean on hard data to decide if it’s the right time to sell a piece or buy another.

It’s not so different from the logistical puzzles faced by global e-commerce. To handle the mind-boggling complexity, the parcel delivery industry leans heavily on advanced tracking. Projections show global parcel delivery volume hitting around 217 billion parcels in the next year—a scale that would be utterly impossible to manage without precise, real-time data. Your collection deserves that same level of detailed oversight.

Turning Data into Growth

At the end of the day, meticulous collection tracking and financial management are about building and protecting value. By focusing on identifying the most important numbers to track when growing your business, you can treat your collection as the serious asset it is. It’s a tangible part of your financial life, and the data inside your tracking system is the key to unlocking its full potential.

Think of your tracking system as an advisor. It provides the objective insights needed to balance your passion for collecting with smart financial strategy, ensuring your collection not only brings you joy but also grows as a valuable asset.

By embracing these habits for the long haul, you transform your collection from a passive hobby into an actively managed portfolio. You’ll gain the clarity and confidence to protect what you own and make strategic moves that boost its value for years to come.

Have Questions? Let’s Clear a Few Things Up

Adopting a new system for managing your prized possessions naturally brings up a few questions. It’s smart to think about security, timing, and how it all works in the real world. Let’s tackle some of the most common concerns to help you feel confident about making the move.

Getting these questions answered upfront takes the mystery out of the process, making it much easier to see how a dedicated platform fits into your financial life. The goal is to swap uncertainty for clarity.

When Is It Time to Ditch the Spreadsheet?

The moment your spreadsheet starts causing more headaches than it solves—that’s your sign. It’s a tipping point almost every serious collector hits eventually.

If you’re spending hours on manual updates, can’t get a quick, accurate view of your collection’s total value, or struggle to piece together an item’s history, it’s time. A spreadsheet is fine for a handful of items, but as your collection grows in value and complexity, its limits become painfully obvious.

Think of it this way: a spreadsheet is a static shopping list. Dedicated software is a dynamic dashboard. When your assets become significant enough to need active management, you’ve outgrown the list and need the dashboard.

Worrying about having accurate records for insurance is another huge red flag. If you’re serious about protecting your investment, a platform with automation and real-time data isn’t just a nice-to-have; it’s essential.

How Secure Is My Data Online?

This is a big one, and rightly so. The short answer is that top-tier collection tracking platforms treat your security like a fortress. They use the same industry-standard tech that banks and financial firms rely on to keep sensitive information locked down.

This includes things like SSL/TLS encryption, which essentially scrambles your data as it travels between your computer and their servers, making it gibberish to anyone trying to snoop. Your information is then stored in highly secure cloud environments from providers like Amazon Web Services (AWS) or Google Cloud, which are protected by layers of both physical and digital security.

For an extra lock on the door, always look for a service that offers two-factor authentication (2FA). This requires you to confirm your identity on a second device (like your phone), making it exponentially harder for someone else to get into your account. A transparent, easy-to-understand privacy policy is another non-negotiable.

Can This Really Help With Insurance and Estate Planning?

Absolutely. In fact, this is where a dedicated system truly shines, providing crucial paperwork that can be a nightmare to pull together during a crisis.

For insurance, the platform is your digital proof-of-ownership. It’s a single, organized place for photos, receipts, and market valuations—exactly what you need to back up a claim for loss, theft, or damage. This can be the difference between a quick, painless payout and a long, drawn-out dispute with your provider.

It’s just as valuable for estate planning. A well-kept digital record gives your heirs and executor a clear, indisputable catalog of your assets. This eliminates confusion, ensures everything is valued correctly, and helps preserve the legacy of your collection for the next generation, just as you intended.

Ready to move beyond spreadsheets and get a true financial handle on your collection? PopaDex gives you the automated tools, secure platform, and visual clarity you need to manage your assets with total confidence. Start your free trial today and build your financial command center.