Our Marketing Team at PopaDex

Using an Emergency Fund Calculator to Build Your Safety Net

An emergency fund calculator helps you figure out exactly how much cash you need to set aside for life’s curveballs. The standard advice is to aim for 3 to 6 months of essential living expenses, but we’ll get into the specifics of what that really means for you.

This isn’t just about saving money; it’s about creating a financial safety net so a sudden job loss or medical bill doesn’t send you spiraling into debt.

Why an Emergency Fund Is Your Financial Foundation

Think of your emergency fund as the financial shock absorber for your life. It’s not just another savings account—it’s a dedicated buffer that stands between an unexpected crisis and your long-term dreams.

Without this cushion, a surprise car repair or a sudden layoff could force you to raid your retirement accounts or rack up high-interest credit card debt. That kind of setback can take years to recover from.

What this fund really gives you is peace of mind. It allows you to make clear-headed decisions during a stressful time instead of desperate ones. The goal here is building resilience, giving you the stability to weather financial storms without derailing your entire life plan. This is a core concept we dive into in our guide to https://popadex.com/financial-planning-for-beginners/.

What an Emergency Fund Is Not

It’s just as important to understand what this money isn’t for. This isn’t an investment account meant for growth. It’s not a slush fund for a vacation, and it’s definitely not for a down payment on a house.

Its sole purpose is to be there, liquid and accessible, for true emergencies.

This distinction is vital because it protects your other financial goals. By having a dedicated emergency fund, you’re essentially creating a firewall that keeps your retirement savings, investment portfolio, and other long-term assets safe from short-term crises.

To make this crystal clear, let’s break down how an emergency fund differs from your other savings accounts.

Emergency Fund vs. Other Savings Accounts

This table provides a quick comparison to clarify the unique purpose of an emergency fund.

| Savings Type | Primary Purpose | Accessibility | Typical Time Horizon |

|---|---|---|---|

| Emergency Fund | Cover unexpected, essential expenses (e.g., job loss, medical bills) | High (liquid, easy to withdraw) | Short-term (immediate access) |

| General Savings | Short-term goals (e.g., vacation, new car, down payment) | Moderate to High | 1-5 years |

| Retirement Account | Long-term growth for post-work life (e.g., 401(k), IRA) | Low (penalties for early withdrawal) | Decades |

| Investment Account | Wealth accumulation and long-term growth | Varies (can be sold, but risk of loss) | 5+ years |

As you can see, each account has a specific job. Trying to make one account do everything is a recipe for financial stress.

The Stark Reality of Financial Preparedness

Despite how crucial this is, many people are living on the edge without this safety net. As of mid-2025, a sobering statistic from Bankrate.com shows that only 46% of U.S. adults have enough emergency savings to cover three months of expenses.

That means more than half the population is financially vulnerable to a sudden income loss or unexpected bill.

An emergency fund isn’t about being pessimistic; it’s about building a foundation strong enough to handle life’s inevitable surprises. It transforms financial anxiety into financial confidence.

As you build this solid foundation, it’s also smart to think about all potential risks. While an emergency fund provides a general safety net, understanding international private medical insurance can help you see which specific health-related emergencies are covered by your policy, allowing your fund to be there for other unforeseen expenses.

Gathering the Right Numbers for Your Calculator

Before you even touch an emergency fund calculator, you’ve got to get your numbers straight. We’ve all heard the old saying, “garbage in, garbage out,” and it’s never been more true than right here. Any calculator is only as good as the data you give it, so nailing this part is non-negotiable if you want a result that actually means something.

What we’re after is your true bare-bones monthly expenses. This isn’t your everyday budget; it’s the absolute rock-bottom amount you’d need to get by if your income suddenly vanished.

Identifying Your Essential Expenses

Think of this as packing your financial survival kit. It’s all about separating the “must-haves” from the “nice-to-haves.” Your must-haves are the bills that absolutely, positively have to be paid to keep a roof over your head and the lights on.

Here’s a quick list to get you started on what counts as essential:

- Housing: Your mortgage or rent payment.

- Utilities: The basics like electricity, water, gas, and trash service.

- Food: A realistic grocery bill—think home-cooked meals, not takeout.

- Transportation: Car payments, insurance, and a conservative guess for fuel.

- Debt Payments: The minimum payments on student loans, credit cards, and any other loans.

- Insurance: Health, life, and homeowners or renters insurance premiums.

- Basic Necessities: Things like critical medications, essential childcare, and a basic phone/internet plan.

Anything that doesn’t make that list gets cut, at least for this calculation. Streaming services, gym memberships, new clothes, and brunches are all on the chopping block. Be brutally honest with yourself about what you truly need versus what you just want.

Real World Calculation Scenarios

How you arrive at this number really depends on your life. If you have a steady, predictable paycheck, figuring out your essential costs might be as simple as looking over the last couple of months of your bank statements.

But if you’re a freelancer or have an income that bounces around, you’ll need to be a bit more deliberate. I always recommend averaging your essential costs over the last six to twelve months. This smooths out the peaks and valleys, giving you a much more reliable baseline to plug into the emergency fund calculator.

Your emergency fund isn’t designed to maintain your current lifestyle; it’s designed to protect it. The goal is to cover your fundamental needs so you can navigate a crisis without making your financial situation worse.

The importance of getting this right can’t be overstated. Recent data shows that in the last year alone, 37% of U.S. adults had to dip into their emergency savings for things like monthly bills or unexpected costs. This just goes to show how often these funds are needed for basic survival.

Even more concerning, 33% of people currently have more credit card debt than emergency savings—a really dangerous spot to be in. An accurately calculated fund is your best defense. You can dig into more of these stats in this emergency savings report from Bankrate.com.

Once you’ve added up all your essential monthly costs, you have it: the single most important number for the calculator. This figure is the foundation you’ll build your entire financial safety net on.

How to Use an Emergency Fund Calculator Effectively

This is where the rubber meets the road. After carefully tallying up your bare-bones expenses, it’s time to plug those numbers into a calculator and see what you’re really aiming for.

Don’t let the final figure scare you. Seeing it laid out in black and white is the first step—it transforms a fuzzy, stressful concept into a clear, powerful goal you can actually work toward.

An emergency fund calculator is a simple machine. You’ll typically find two main fields to fill in: your “Essential Monthly Expenses” (the survival number we figured out earlier) and your “Current Emergency Savings” (whatever you’ve already stashed away).

Pop in those two numbers, and the calculator handles the math.

Choosing Your Savings Target

Next, you’ll usually be asked to pick a savings target, typically between three and six months’ worth of expenses. Which one is right for you? It really depends on your life circumstances.

- Three Months: This is a fantastic starting point. Think of it as the minimum safety net. It’s an achievable first goal, especially if you have a stable job or live in a dual-income household.

- Six Months: For most people, this is the gold standard. A six-month cushion offers a much more comfortable buffer, making it ideal for single-income earners, freelancers, or anyone with dependents relying on them.

If you’re just starting out, shooting for three months makes the goal feel much less intimidating. You can always level up to six months later. For now, pick your timeframe and let the calculator work its magic.

The real power of an emergency fund calculator isn’t just the final number. It’s how it reframes a huge, daunting goal into a series of small, manageable steps, giving you a clear roadmap to financial security.

From a Big Number to a Small Monthly Habit

Let’s walk through an example. Imagine the calculator spits out a six-month emergency fund goal of $18,000. You look at your savings and see you already have $3,000.

That means you have a $15,000 shortfall. Staring at that number can feel like a punch to the gut. But don’t get discouraged—this is where you break it down into something you can actually tackle.

Decide on a realistic timeline. Let’s say you want to close that gap in two years, or 24 months. Now your mission is simple:

$15,000 / 24 months = $625 per month

All of a sudden, an intimidating five-figure sum becomes a clear, actionable monthly savings goal. This is a number you can build right into your budget. For a deeper dive into making that work, check out our guide on how to budget your money.

This simple piece of math is the most important part of the whole process. It turns financial anxiety into a concrete action plan, giving you a tangible target to hit every single month.

How to Personalize Your Savings Goal

The old “three to six months of expenses” rule is a decent starting point, but let’s be honest—it’s just a starting point. Your life isn’t standard, so your emergency fund shouldn’t be either. This is where you transform a generic financial guideline into a safety net that’s actually built for you.

An emergency fund calculator will spit out the raw numbers, but you’re the one who provides the all-important context. Your personal circumstances, career stability, and family situation are the most critical variables in the equation. At the end of the day, the right goal is the one that lets you sleep soundly, knowing you have a realistic buffer against whatever life throws your way.

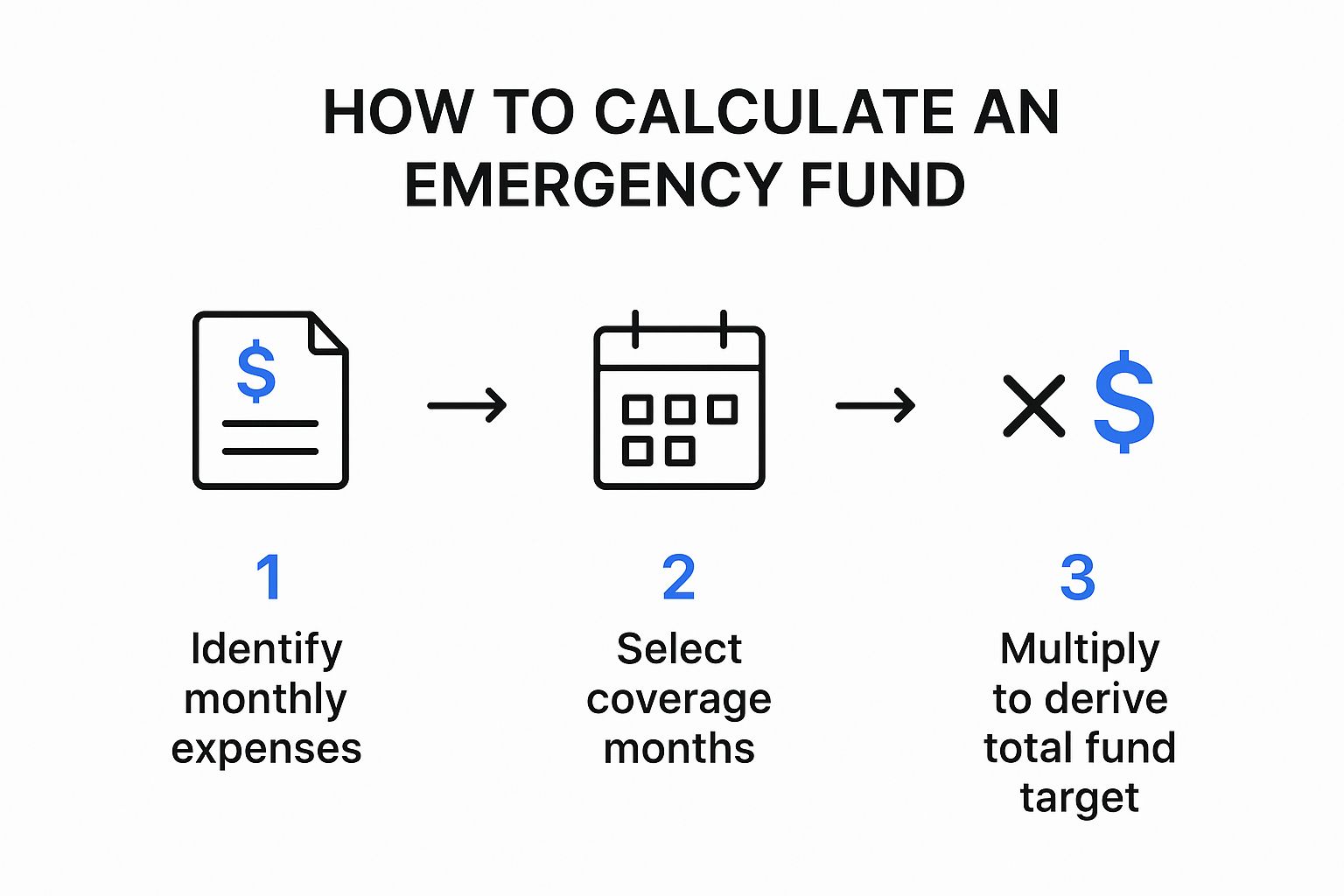

This is the basic roadmap for figuring out your initial target.

It’s a simple path: identify your essential costs, assess your personal risk, and set a final savings goal. This makes the whole calculation feel less abstract and a lot more actionable.

Assess Your Personal Risk Factors

Let’s move beyond the basics and get into what this looks like in the real world. A dual-income couple with secure government jobs might feel perfectly comfortable with a four-month fund. Their combined job stability dramatically lowers their risk of a complete income loss.

On the other hand, a freelance graphic designer who is also a single parent is living a completely different reality. Their income can be unpredictable, and they are the sole provider for their family. For them, aiming for a six-to-nine-month fund is a much more prudent strategy. It gives them a longer runway to navigate client droughts or handle unexpected family needs without panic.

So, where do you fall on the savings spectrum? Thinking through these factors will give you your answer:

- Job Security: Are you in a stable industry with high demand, or is your field known for layoffs and volatility?

- Income Streams: Does your household rely on a single paycheck, or are there multiple sources of income?

- Dependents: Supporting children or other family members increases your financial responsibility and, naturally, the need for a larger cushion.

- Health: Do you or a family member have chronic health conditions that could lead to unexpected (and expensive) medical bills?

How Many Months of Savings Do You Really Need?

Everyone’s situation is unique. Use this table to assess your own personal risk factors and get a better feel for whether you should aim for the lower or higher end of the savings range.

| Your Situation | Lower Risk (Consider 3-4 Months) | Higher Risk (Consider 6-9+ Months) |

|---|---|---|

| Job Stability | You’re in a high-demand field or have a very secure job (e.g., government, tenured professor). | Your job is in a volatile industry, you’re a freelancer, or you work on commission. |

| Household Income | Your household has two or more stable, independent incomes. | Your household relies on a single income source. |

| Dependents | You have no children or other financial dependents. | You are a single parent or financially support other family members. |

| Health | You and your dependents are in good health with excellent insurance coverage. | You or a family member have chronic health issues or a high-deductible health plan. |

| Cost of Living | You live in a low-cost-of-living area with a strong social safety net. | You live in a high-cost-of-living city with minimal family support nearby. |

This isn’t about being perfect; it’s about being prepared. The more “Higher Risk” boxes you check, the more you should lean toward a larger emergency fund for true peace of mind.

Your emergency fund goal isn’t set in stone. It’s a living number that should adapt as your life changes. Getting married, changing careers, or having a child are all excellent reasons to revisit your emergency fund calculator and adjust your target.

Financial advisors have traditionally recommended a three-to-six-month fund, a timeframe often based on the average job search. But history has taught us a few things. Severe economic downturns, like the 2008 recession, showed that financial hardship can stretch well beyond six months. This is why many experts now advocate for a larger six-to-nine-month cushion. You can see this recommendation echoed on Fifth Third Bank’s website. Understanding this context is crucial for setting a savings goal that’s truly resilient.

Simple Strategies to Build Your Fund Consistently

Alright, you’ve used the calculator and you have your target number. That’s a huge first step. But now comes the real work: actually building that cash cushion.

The most effective way I’ve seen people succeed is by making saving a thoughtless habit, not a daily chore. And for that, automation is your absolute best friend.

It’s a simple idea, but it works wonders. Set up an automatic, recurring transfer from your checking account to a separate, dedicated savings account. The trick is to have this transfer happen right after you get paid—that way, the money is tucked away before you even see it or have a chance to spend it.

The Power of Automation

This “pay yourself first” approach isn’t just a catchy phrase; it’s a fundamental shift in how you handle your money. Instead of trying to save whatever’s left at the end of the month (which, let’s be honest, is often nothing), you prioritize your financial security from the get-go.

Treat this savings transfer like any other non-negotiable bill. It doesn’t matter if you start with $25 or $250 per paycheck. The key is consistency. This small, regular action builds momentum and grows your fund without draining your willpower.

The secret to successful saving isn’t making massive, heroic deposits every few months. It’s about creating a small, consistent, and automated habit that works for you in the background, rain or shine.

This consistency is more important than ever. With the cost of living on the rise, many are struggling. In fact, 73% of Americans reported saving less for emergencies in 2025 because of inflation or income changes. You can dig into the numbers and see how people are adapting in this Bankrate emergency savings report.

Beyond Automatic Transfers

While automation is the foundation, you can definitely speed things up with a few other smart moves. Think of these as savings boosters that work alongside your regular contributions.

- Bank Your Windfalls: Get a surprise work bonus, a tax refund, or some birthday cash? Before you start shopping, make a personal rule to immediately send at least 50% of it straight to your emergency fund.

- Trim and Transfer: Take five minutes to review your monthly subscriptions. If you cancel a streaming service that costs $15 a month, don’t just let that money get absorbed back into your budget. Immediately set up a new recurring $15 transfer to your savings. You won’t even miss it, because you were already spending it.

- Track Your Progress: Honestly, seeing your fund grow is one of the best motivators out there. Watching that balance climb closer to your goal reinforces all your good habits. Using a tool to see all your accounts in one dashboard, like PopaDex’s net worth tracker, gives you a clear, satisfying picture of how far you’ve come.

Answering Your Top Emergency Fund Questions

Okay, so you’ve crunched the numbers and have a target for your emergency fund. That’s a huge first step. But almost immediately, a few practical questions pop up. Answering these is just as crucial as knowing your savings goal because it’s all about putting that plan into action confidently.

Let’s dig into the common sticking points people run into after doing the math. This is your roadmap for navigating what comes next on the path to real financial security.

Where Should I Keep My Emergency Fund?

This is a classic balancing act. You need the money to be liquid—meaning you can get your hands on it fast without paying a penalty—but you don’t want it so accessible that you’re tempted to raid it for a non-emergency.

It’s a huge mistake to just leave it in your everyday checking account. When that cash is mixed in with your regular spending money, it’s way too easy to “accidentally” spend it on groceries or a spontaneous weekend trip.

Your emergency fund should be out of sight but not out of reach. The perfect home for it is a high-yield savings account (HYSA), ideally at a bank separate from your primary one. This creates a psychological barrier, keeps the funds distinct, and lets your money earn a much better interest rate than a standard account.

What Officially Counts as an Emergency?

You have to be strict about this, or your fund will evaporate. A true emergency is an expense that is unexpected, essential, and urgent. It’s not for vacations, planned purchases, or a fancy dinner you feel you “deserve.”

Here’s what we’re talking about:

- Sudden Job Loss: Your main income stream vanishes, and you need to cover your bills while you hunt for a new role.

- Urgent Medical Bills: An unexpected injury or illness results in a hefty out-of-pocket medical expense that can’t wait.

- Necessary Home Repairs: Your furnace dies in January, or a pipe bursts and floods your kitchen. These are things that need immediate attention.

- Major Car Trouble: Your only car needs a massive repair to stay on the road, and you need it to get to work.

These are the kinds of financial fires that would otherwise send you spiraling into debt. That new 70-inch TV or concert tickets? Definitely not an emergency.

Should I Save for Emergencies or Pay Off Debt First?

Ah, the million-dollar question. This is a classic financial dilemma, and there’s no single right answer. While getting aggressive with high-interest debt is an amazing goal, going all-in without a cash buffer is a recipe for disaster.

Most financial pros will tell you to strike a balance. Before you throw every spare dollar at your debt, focus on building a small “starter” emergency fund first. A target of $1,000 to $2,000 is a great place to begin.

Think of this small fund as your financial shock absorber. It prevents a minor crisis, like a flat tire or a broken appliance, from forcing you to whip out the credit card and rack up more high-interest debt. That would just undo all your hard work. Once that starter fund is solid, you can pivot and attack your debt with everything you’ve got, knowing you have a small safety net to catch you.

Ready to get a complete, real-time picture of your financial life? With PopaDex, you can track your growing emergency fund alongside all your other accounts, investments, and assets in one simple dashboard. Start building your financial clarity today. Get started for free at popadex.com.