Our Marketing Team at PopaDex

12 Best Financial Management Tools for 2025

In a world of complex finances, choosing the right tools is crucial for achieving clarity and control. From tracking your net worth to managing business expenses, the digital landscape is filled with powerful financial management tools designed to simplify your life. However, navigating the options, from dedicated net worth trackers and budgeting apps to comprehensive accounting software, can be overwhelming. This guide cuts through the noise.

We’ve curated a list of the 12 best platforms for 2025, breaking down their specific use cases, strengths, and limitations. Whether you’re an individual investor aiming for financial independence, a freelancer managing invoices, or a small business scaling up, you’ll find a solution here to help you make smarter financial decisions with confidence.

Each entry in this resource guide provides a detailed analysis, including:

- Feature breakdowns: What does the tool actually do?

- Practical use cases: Who is this platform best for?

- Honest pros and cons: A balanced look at what works and what doesn’t.

- Pricing details: Clear cost structures to fit your budget.

- Integration capabilities: How well it connects to your existing financial ecosystem.

We’ve included screenshots for a visual preview and direct links to get you started immediately. Our goal is to equip you with the insights needed to select the ideal financial management tools for your unique financial journey, saving you time and preventing costly trial-and-error. Let’s find the platform that will bring you financial clarity.

1. PopaDex

PopaDex establishes itself as a premier choice among financial management tools by offering an exceptionally comprehensive and intuitive net worth tracking experience. It’s engineered for individuals who require a holistic view of their financial landscape, from everyday savings to complex international investments. The platform excels at consolidating a diverse array of assets and liabilities into a single, cohesive dashboard, providing clarity and empowering users to make informed decisions.

Its standout feature is its vast global reach, supporting over 15,000 banks in more than 30 countries. This makes it an indispensable tool for expats, digital nomads, and global investors managing multi-currency portfolios. The platform offers a flexible, two-tiered approach: a robust free Standard plan for manual tracking and an affordable Premium plan for automated bank syncing and advanced analytics.

Key Strengths and Use Cases

PopaDex shines with its meticulous design and user-centric features. The interactive dashboards and visualizations transform raw data into actionable insights, helping users track their financial progress over time. For a deeper dive into its capabilities, explore how PopaDex functions as a powerful net worth tracker.

- For the Global Citizen: Expats can seamlessly track accounts, property, and investments across different countries and currencies, eliminating the complexity of manual conversions and fragmented financial views.

- For the Diligent Investor: Users can monitor their entire investment portfolio, including stocks, real estate, and other assets, alongside their liabilities to get a real-time, accurate net worth calculation.

- For the Budget-Conscious Professional: The disposable income calculator and detailed reporting tools help young professionals and freelancers manage irregular income streams and plan for long-term goals.

Platform Breakdown

| Feature | Details |

|---|---|

| Primary Function | All-in-one net worth tracking and financial consolidation. |

| Best For | International users, expats, investors with diverse portfolios. |

| Pricing | Standard: Free (manual entry). Premium: €5/month (automated syncing, advanced features). |

| Unique Selling Point | Extensive international bank support (15,000+), multi-currency/multilingual interface. |

| Website | https://popadex.com |

Pros & Cons

Pros:

- Exceptional international support for banks and currencies.

- Flexible and affordable subscription tiers.

- Comprehensive tracking of all asset and liability types.

- User-friendly interface with powerful visualization tools.

- Risk-free trial with a 30-day money-back guarantee.

Cons:

- Automated bank integration is exclusive to the Premium plan.

- The AI co-pilot assistant is an upcoming feature, not yet fully available.

2. Intuit QuickBooks Online

Intuit QuickBooks Online is a powerhouse among financial management tools, especially for small businesses scaling from solo operations to full teams. It serves as a comprehensive accounting hub, handling everything from core bookkeeping with automated bank feeds to detailed invoicing and bill management. For businesses with physical products, the Plus and Advanced plans introduce essential inventory tracking and project profitability features.

Its primary advantage is its ubiquity; most U.S.-based accountants and bookkeepers are proficient with the platform, simplifying collaboration and tax preparation. The platform’s vast integration marketplace allows it to connect seamlessly with hundreds of other business applications, from payment processors to CRM systems.

Key Details & Considerations

While powerful, new users without an accounting background may face a learning curve. The tiered pricing structure, which often requires upgrading to access a single needed feature, can also become costly. However, frequent promotional discounts for new subscribers can ease the initial investment.

- Best For: Small to medium-sized businesses needing a scalable, accountant-friendly accounting solution.

- Pricing: Plans range from Simple Start (~$30/mo) to Advanced (~$200/mo).

- Key Feature: Extensive third-party app integration and widespread accountant familiarity.

- Website: https://quickbooks.intuit.com/products

3. Quicken (Classic desktop) and Quicken Simplifi (web/mobile)

Quicken has been a cornerstone of personal finance software for decades, offering a powerful desktop application for meticulous financial tracking. Its ecosystem now includes two distinct products: the traditional Quicken Classic for detailed budgeting and investment management, and the modern Quicken Simplifi, a mobile-first app designed for streamlined, on-the-go financial planning. This dual offering caters to users who want deep historical reporting on a desktop and the convenience of a modern cloud-based tool.

The primary advantage of the Quicken ecosystem is its depth. Quicken Classic is renowned for its robust investment tracking, comprehensive tax reporting, and even add-ons for managing rental properties. Simplifi, by contrast, focuses on simplicity with an automated monthly spending plan, savings goals, and reliable bank syncing, making it one of the more user-friendly financial management tools for daily use.

Key Details & Considerations

While the dual-product approach offers flexibility, it can be confusing; Classic remains primarily a desktop-centric tool with limited cloud functionality. Simplifi is more accessible but less powerful than its desktop counterpart, and some users have noted concerns over recent subscription price changes. However, the combination provides a solution for nearly any personal finance management style, from beginner to expert.

- Best For: Individuals and families wanting either a detailed, desktop-based financial hub or a simple, mobile-first budgeting app.

- Pricing: Quicken Simplifi is ~$4/mo (billed annually). Quicken Classic ranges from Deluxe (~$60/yr) to Home & Business (~$120/yr).

- Key Feature: Offers two distinct products catering to both deep-dive desktop users (Classic) and modern mobile-first budgeters (Simplifi).

- Website: https://www.quicken.com/products/pricing-comparison-personal

4. YNAB (You Need A Budget)

YNAB, short for You Need A Budget, is a highly acclaimed personal finance tool built on a proactive, zero-based budgeting philosophy. Unlike other tools that simply track past spending, YNAB forces you to assign every dollar a “job” before you spend it, transforming how you manage cash flow. This forward-looking approach is renowned for helping users gain control over their finances, reduce debt, and break the paycheck-to-paycheck cycle.

Its core strength lies in its educational resources and structured methodology, which promote powerful habit-building. The platform offers bank syncing for most U.S. institutions, robust goal-setting features, and the ability to share a budget with up to six users, making it ideal for couples and families. This dedication to method makes it one of the most effective financial management tools for those serious about mastering their spending.

Key Details & Considerations

The rigid, rule-based system can be a significant adjustment for new users and is less suitable for tracking investments or complex small-business accounting. While its subscription fee is higher than many free alternatives, its strong track record for producing tangible financial results often justifies the cost for its dedicated user base. For more insight, you can learn about mastering net worth tracking with YNAB.

- Best For: Individuals and families wanting to eliminate debt and proactively control their spending.

- Pricing: A single plan at $14.99/mo or $99/year, with a 34-day free trial.

- Key Feature: The unique “Four Rules” zero-based budgeting methodology.

- Website: https://www.ynab.com/pricing/

5. Monarch Money

Monarch Money positions itself as a modern, all-in-one personal finance dashboard designed for individuals and couples who want a powerful, customizable view of their entire net worth. It excels by using multiple data aggregators (Plaid, MX, and Finicity) to ensure reliable connections to an extensive range of financial accounts, from standard banking to investments and loans. The platform allows users to track all their assets and liabilities in one place, set up collaborative budgets with a partner, and monitor progress toward specific financial goals.

Its key differentiator is the combination of a clean, intuitive user interface with deep customization options. Users aren’t locked into a single budgeting method; they can choose what works for them, create custom categories, and generate insightful reports. The ability to invite a partner or financial advisor to collaborate on the same dashboard without sharing login credentials makes it one of the most flexible financial management tools for households.

Key Details & Considerations

While its multi-aggregator approach improves connectivity, users may still encounter occasional syncing issues inherent to third-party financial data platforms. Furthermore, while it offers a solid overview of investment performance, it lacks the in-depth portfolio analysis tools found in dedicated investment-tracking software. Its subscription-based model ensures an ad-free experience focused entirely on the user.

- Best For: Individuals or couples seeking a highly flexible, collaborative dashboard to track their complete financial picture.

- Pricing: A single premium plan is available for $14.99/mo or $99.99/year, with a free trial.

- Key Feature: Multi-aggregator connectivity for reliable bank syncing and robust collaboration tools for partners.

- Website: https://partners.monarchmoney.com/pricing

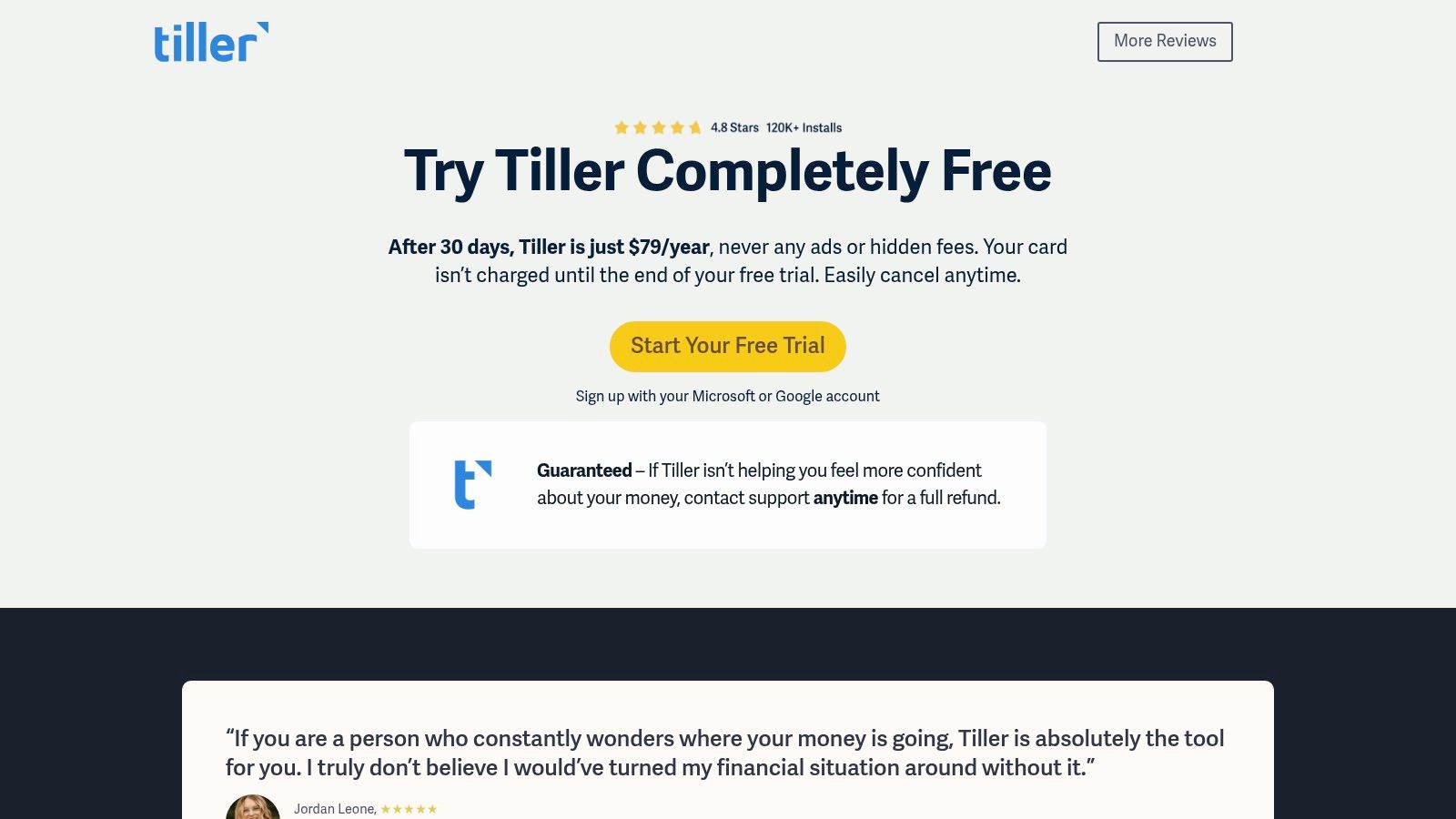

6. Tiller

For individuals who love the control and flexibility of spreadsheets but hate manual data entry, Tiller is the perfect hybrid solution. It bridges the gap between traditional budgeting apps and DIY methods by automatically feeding your daily financial transactions directly into Google Sheets or Microsoft Excel. This approach makes it one of the most customizable financial management tools available, allowing you to build completely personalized dashboards for budgeting, net worth tracking, and debt repayment.

The platform’s strength lies in its foundation of templates, which provides a solid starting point that can be modified to fit any financial situation. Users have complete ownership and control over their data, a significant advantage for privacy-conscious individuals. To explore how it stacks up against other spreadsheet-based methods, see our detailed comparison of Tiller and Google Sheets.

Key Details & Considerations

While Tiller offers unparalleled flexibility, it requires a basic comfort level with spreadsheet functions to unlock its full potential. It is not a comprehensive accounting system for small businesses but rather a powerful tool for personal finance management. The platform operates on a simple, flat-fee subscription model, avoiding ads and the selling of user data.

- Best For: Tech-savvy individuals and spreadsheet enthusiasts who want granular control over their financial data and reporting.

- Pricing: A single plan at $79/year (around $6.58/mo) after a 30-day free trial.

- Key Feature: Automated daily transaction and balance feeds directly into Google Sheets and Microsoft Excel.

- Website: https://www.tillerhq.com/pricing/

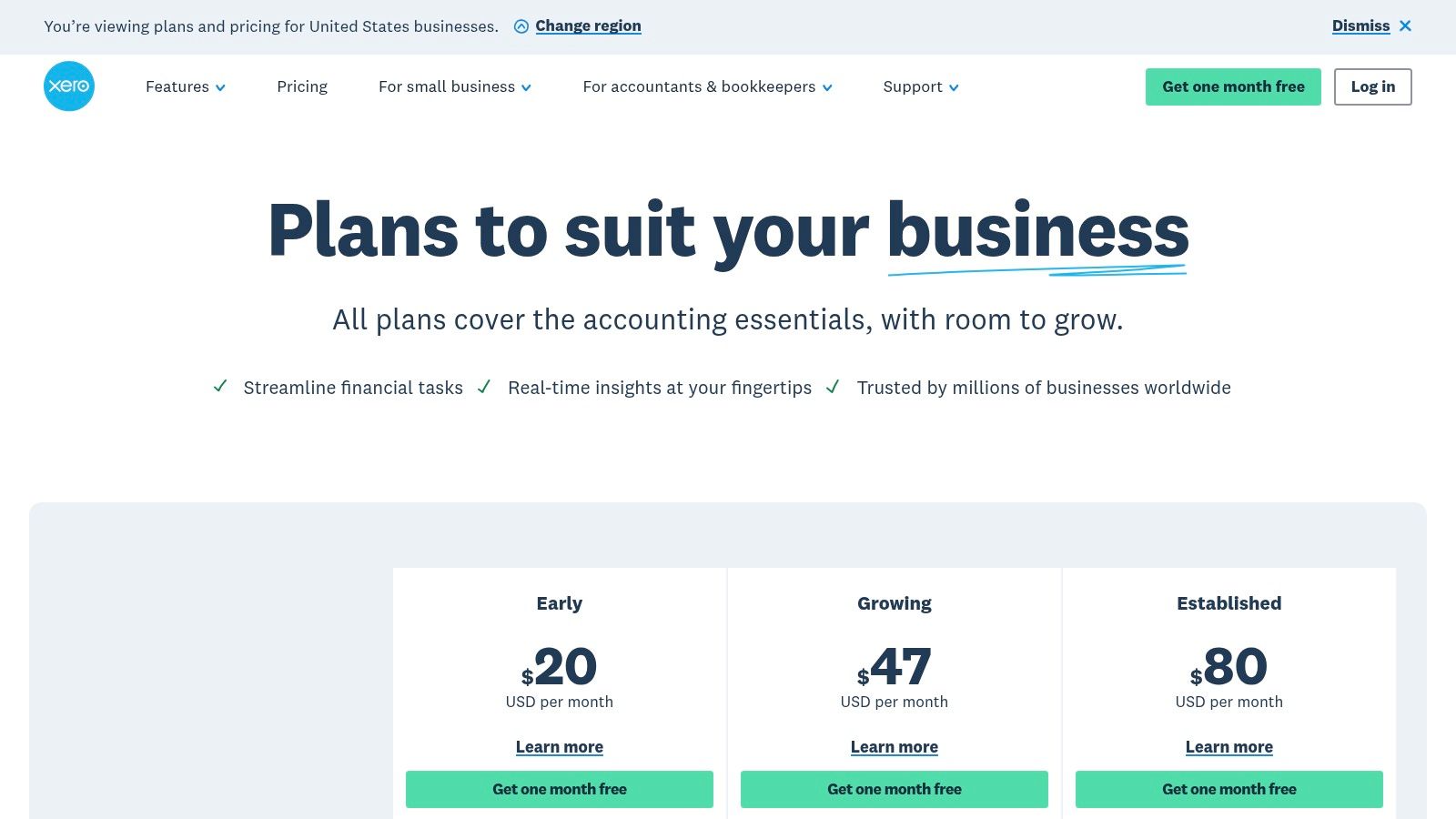

7. Xero (US)

Xero presents a compelling alternative in the cloud accounting space, particularly for small businesses and startups seeking a clean, user-centric interface. As one of the leading financial management tools, it excels at core accounting functions like invoicing, bank reconciliation, and expense tracking. Its design philosophy emphasizes ease of use, making daily bookkeeping tasks feel less like a chore.

The platform’s key strength lies in its intuitive bank reconciliation workflow and a vast app marketplace that allows for deep integration with point-of-sale, e-commerce, and payroll systems. This makes it a highly adaptable hub for businesses with diverse operational needs. Higher-tier plans also introduce valuable features like multi-currency support, project tracking, and expense claims, catering to growing and international businesses.

Key Details & Considerations

While globally popular, some U.S.-specific workflows can feel less developed compared to entrenched competitors like QuickBooks. The platform also announced future price increases for U.S. subscribers, which is a key consideration for long-term budget planning. However, its strong collaboration features make it a favorite for businesses that work closely with an accountant or bookkeeper.

- Best For: Small businesses and startups that prioritize a modern user interface and robust third-party integrations.

- Pricing: Plans range from Early (~$15/mo) to Established (~$78/mo).

- Key Feature: An intuitive bank reconciliation process and a large, versatile app marketplace.

- Website: https://www.xero.com/us/pricing-plans/

8. Expensify

Expensify streamlines one of the most tedious aspects of business finance: expense management. It excels at automating the entire process from receipt capture to reimbursement, making it a go-to for companies looking to eliminate manual expense reports. Using its patented SmartScan technology, employees can simply take a photo of a receipt, and Expensify automatically transcribes the details and categorizes the expense.

The platform’s strength lies in its user-friendly mobile app, which encourages quick adoption among employees, leading to more timely and accurate expense submissions. For managers and finance teams, it offers customizable approval workflows, corporate card reconciliation, and direct integrations with major accounting systems like QuickBooks and Xero. This seamless connection ensures that approved expenses flow directly into the company’s general ledger, saving significant administrative time.

Key Details & Considerations

While remarkably simple for end-users, setting up more complex approval policies and spend controls can require a dedicated configuration effort. Additionally, some of its most powerful automation features, like real-time expense notifications, work best when paired with the company’s own Expensify Card. However, its new flat-rate pricing models offer predictability for growing teams.

- Best For: Individuals and businesses of all sizes seeking to automate expense tracking and reimbursement.

- Pricing: Free plans for individuals; paid plans for teams start at around $10 per user/mo.

- Key Feature: Patented SmartScan OCR for effortless receipt capture and automated report creation.

- Website: https://www.expensify.com

9. Amazon – Accounting & Finance Software

While not a tool itself, Amazon’s software marketplace is a massive distribution hub for a wide array of financial management tools. It serves as a one-stop shop for purchasing boxed software, digital download codes, and subscription key cards for everything from personal finance applications like Quicken to small business accounting platforms. This makes it an excellent resource for comparing prices across different sellers and finding deals on physical or downloadable versions of popular software.

The primary advantage is convenience and competitive pricing, often supplemented by user reviews that provide real-world insights into a product’s performance. For those who prefer owning a physical copy or need a non-subscription version of a specific tool, Amazon remains one of the few large-scale retailers offering these options with the benefit of fast Prime shipping.

Key Details & Considerations

Navigating the marketplace requires careful attention, as listings can include outdated legacy software alongside the latest versions. Buyers should always verify system requirements and ensure they are purchasing from a reputable seller. Despite this, it’s a valuable platform for securing financial software, especially when promotional discounts are available from various merchants.

- Best For: Individuals and businesses looking to purchase physical or downloadable financial software, often at competitive prices.

- Pricing: Varies by product and seller; includes one-time purchases and subscription key cards.

- Key Feature: Extensive selection of new and legacy financial software with user reviews and competitive pricing.

- Website: https://www.amazon.com/Best-Sellers-Software/zgbs/software

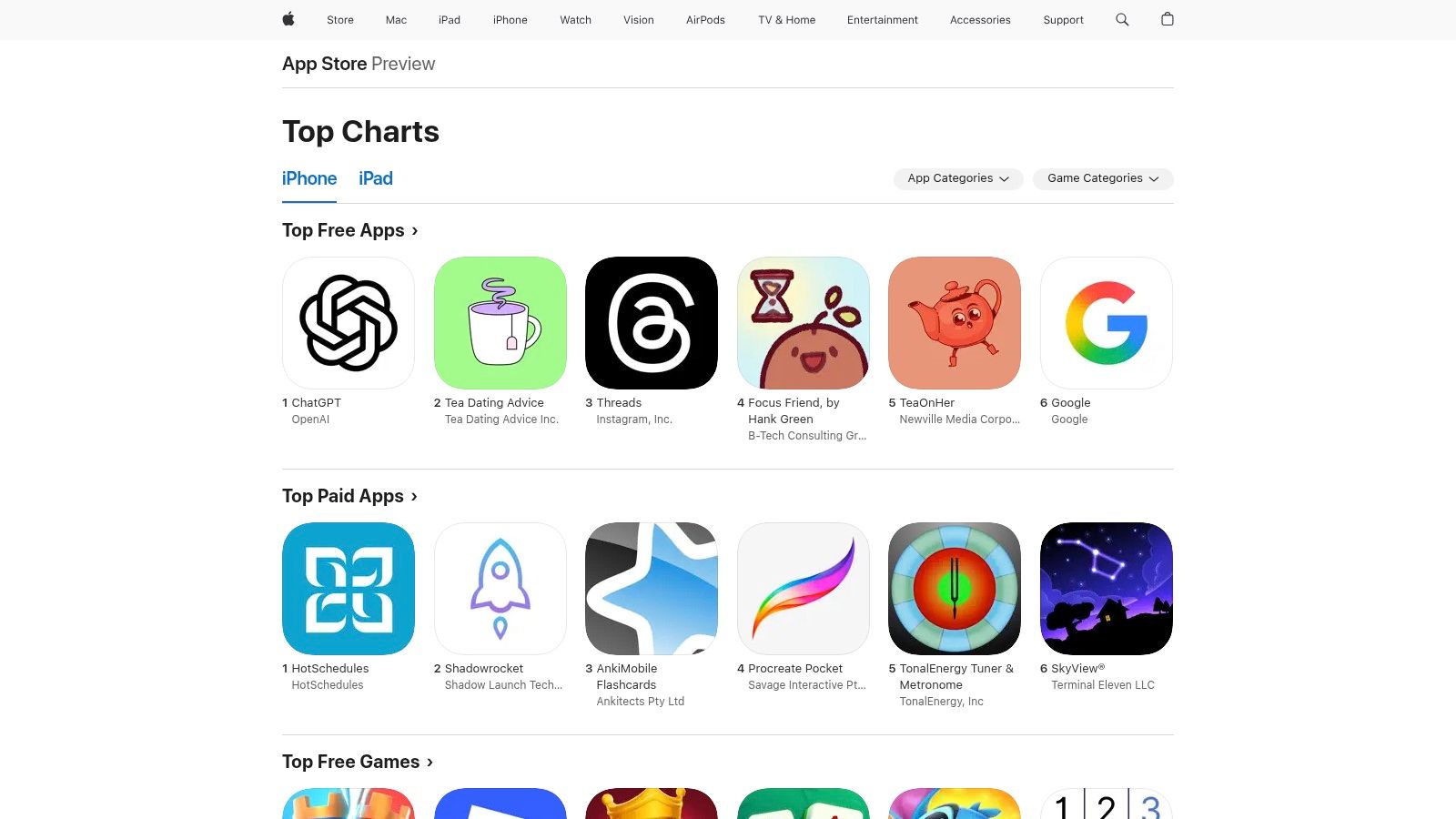

10. Apple App Store – Finance Category (US)

While not a singular tool, the Apple App Store’s Finance category is a vital marketplace for anyone managing their money on an iPhone or iPad. It serves as a curated, secure gateway to hundreds of specialized financial management tools, from personal budgeting and investing platforms to small business accounting and tax preparation apps. Apple’s editorial team often highlights innovative new apps and creates collections, making it easier to discover tools tailored to specific needs like expense tracking or retirement planning.

The platform’s primary advantage is its integration within the Apple ecosystem, offering secure downloads, straightforward subscription management via your Apple ID, and user reviews to gauge an app’s quality. This centralized system simplifies finding and trying new mobile-first finance solutions with a high degree of privacy and security oversight.

Key Details & Considerations

The App Store provides an unparalleled discovery engine, but users should be aware of its limitations. In-app subscriptions can sometimes be more expensive than purchasing directly from a developer’s website due to Apple’s commission fees. Additionally, many mobile-first applications found here may not offer the full feature set available on their desktop or web-based counterparts.

- Best For: Apple users seeking a secure, centralized marketplace to discover and manage a wide range of mobile finance apps.

- Pricing: The App Store is free to browse; individual app pricing varies from free to premium subscriptions.

- Key Feature: Strong security and privacy controls, with editorial curation and transparent user reviews to guide discovery.

- Website: https://apps.apple.com/us/genre/ios-finance/id6015

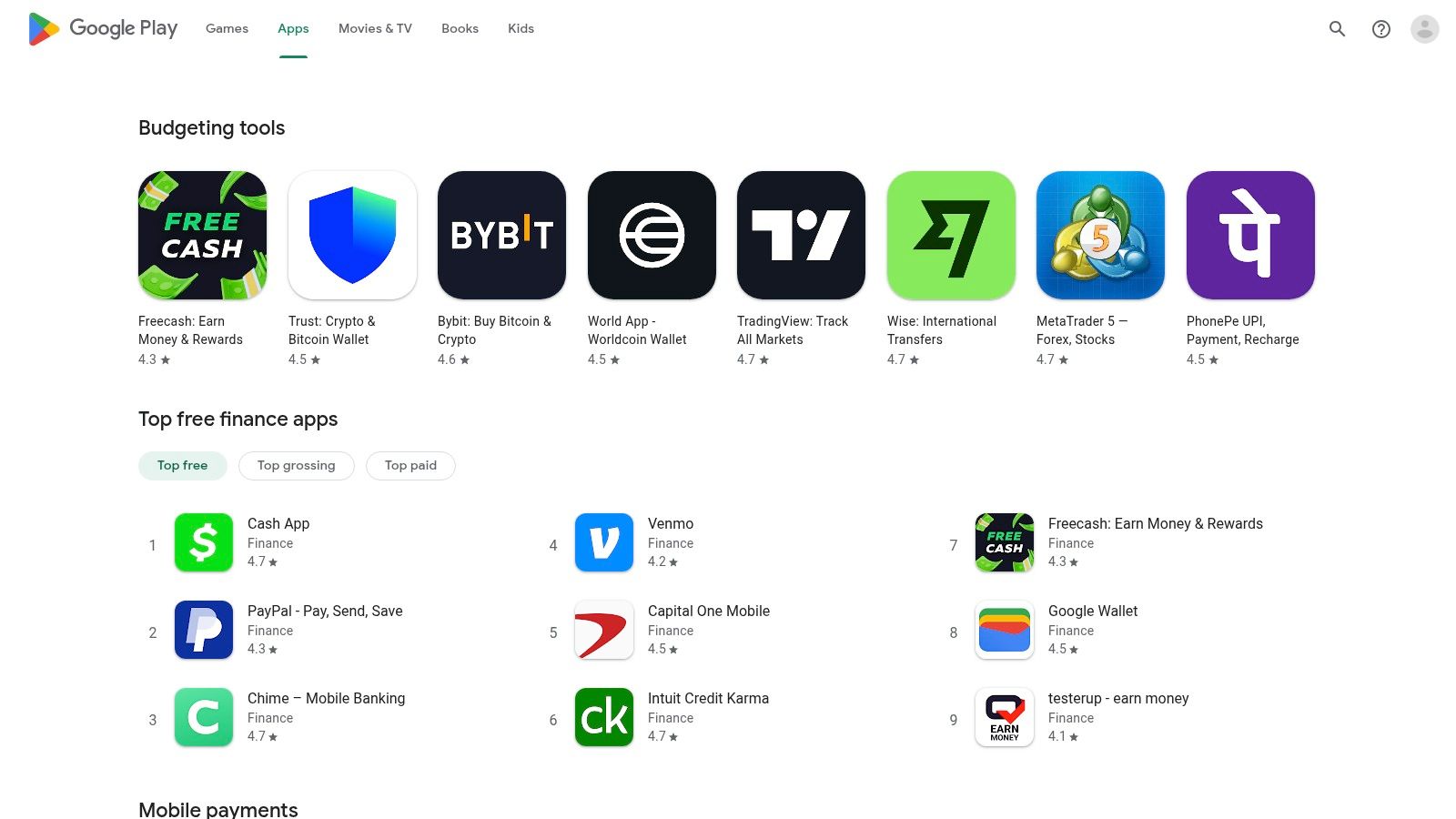

11. Google Play Store – Finance Category (US)

While not a singular tool itself, the Google Play Store’s Finance category is an essential gateway for any Android user seeking to improve their financial management. It serves as the official marketplace for an extensive array of applications covering everything from personal budgeting and expense tracking to sophisticated stock trading and cryptocurrency management. The platform allows for easy discovery, providing user ratings, download metrics, and developer update history to help users vet potential tools.

Its primary advantage is the sheer breadth of its catalog, which caters to nearly every financial niche and strategy. Integrated features like Google account-based subscription management and Family Library sharing simplify the administrative side of using paid apps. Beyond general finance apps, if you’re looking to start your investment journey, consider exploring the best investing apps for beginners that simplify the process.

Key Details & Considerations

The open nature of the marketplace means app quality can vary significantly, making it crucial for users to read recent reviews and scrutinize app permissions before installing. Many popular apps rely on third-party data aggregators like Plaid, which can sometimes experience synchronization delays with certain financial institutions.

- Best For: Android users looking for a centralized, secure platform to discover, compare, and manage a wide range of financial applications.

- Pricing: Varies by app; many are free, offer freemium models, or require a subscription.

- Key Feature: Massive selection of financial tools with user-generated ratings and seamless integration into the Android ecosystem.

- Website: https://play.google.com/store/apps/category/FINANCE

12. Capterra – Financial Management Software Directory

Capterra isn’t a direct financial management tool but rather an indispensable resource for finding the right one. It functions as a massive, vendor-neutral B2B software directory where businesses can compare hundreds of options, from enterprise-level ERP finance suites to specialized budgeting and reporting applications. Its value lies in bringing transparency and user-driven data to the complex software selection process.

The platform’s strength is its robust filtering system and verified user reviews. Users can narrow down options by company size, specific features, deployment type, and pricing models. This allows teams to create a tailored shortlist of relevant financial management tools, read authentic user feedback, and access buyer’s guides to make an informed decision without visiting dozens of vendor websites individually.

Key Details & Considerations

While incredibly useful, users should be mindful that sponsored placements can appear at the top of lists; it’s wise to analyze the entire list, not just the initial results. Capterra facilitates research and comparison but does not sell software directly, instead linking out to vendor sites for trials or purchases.

- Best For: Businesses and finance teams conducting due diligence to select the best-fit financial software.

- Pricing: Free for users to browse and compare software.

- Key Feature: Extensive, filterable directory with verified B2B user reviews and detailed buyer’s guides.

- Website: https://www.capterra.com/financial-management-software/

Top 12 Financial Management Tools Comparison

| Product | Core Features / Integration | User Experience & Quality ★★★★☆ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 PopaDex | 15,000+ banks, multi-currency, manual & auto sync | Intuitive dashboards, multilingual UI | Free manual plan + €5/mo Premium 🚀 | Individuals, investors, expats | AI co-pilot (upcoming), disposable income calc |

| Intuit QuickBooks Online | Accounting, invoicing, inventory, multi-user | Accountant-friendly, robust US market | Tiered pricing, promos for first 3 months | Small to medium businesses | Large integrations ecosystem |

| Quicken (Classic & Simplifi) | Budgeting, investments, bank sync | Classic desktop + modern web/mobile | Subscription-based, with pricing changes | Personal finance enthusiasts | Deep reports (Classic), mobile-first (Simplifi) |

| YNAB (You Need A Budget) | Rule-based budgeting, bank sync, shared accounts | Clear methodology, strong education | Subscription, higher than free alternatives | Budget-conscious individuals | Envelope budgeting, habit building |

| Monarch Money | Multi-aggregator connectivity, budgeting, collaboration | Strong UI, power user flexibility | Competitively priced annual plan | Power users, goal-focused folks | Unlimited account connections, custom reports |

| Tiller | Auto bank feeds into Sheets/Excel | Spreadsheet-driven, highly customizable | Subscription required | DIY financial modelers | Granular control, budget & cashflow templates |

| Xero (US) | Accounting, invoicing, bank reconciliation | Intuitive UI, solid reconciliation | Tiered pricing, price hikes planned | Small businesses, startups | Multi-entity & advisor collaboration |

| Expensify | Expense capture, approvals, corporate card support | Simple for SMBs, automated reports | Flat-rate Collect plan for SMBs | Individuals & SMB expense teams | SmartScan receipts, travel booking integrations |

| Amazon – Accounting & Finance Software | Marketplace for boxed/subscription finance software | User reviews, competitive pricing | Various, often competitive | Personal & SMB software buyers | Physical key cards, fast shipping |

| Apple App Store – Finance Category (US) | Curation, secure downloads, subscription management | Strong privacy, iOS ecosystem | In-app subscriptions may cost more | Apple device users | Editorial curation, family sharing |

| Google Play Store – Finance Category (US) | Centralized Android finance apps | Wide selection, user ratings | Free & paid apps, variety in quality | Android users | Family Library, early app beta access |

| Capterra – Financial Management Directory | Vendor-neutral comparison, buyer’s guides | Verified reviews, detailed filters | Free to use, leads to vendor purchases | B2B finance software buyers | Transparent methodology, extensive filters |

Take the Next Step Toward Financial Mastery

Navigating the landscape of modern financial management tools can feel overwhelming, but the journey to clarity and control is more accessible than ever. We’ve explored a diverse range of platforms, each designed to address specific needs and financial philosophies. From the zero-based budgeting rigor of YNAB to the spreadsheet automation of Tiller, and the robust small business accounting of QuickBooks, the right solution exists for every situation.

The core takeaway is that no single tool is universally “the best.” Your ideal platform depends entirely on your personal context. The choice hinges on your financial complexity, your primary goals, and even your personality. What works for a self-employed professional tracking irregular income (like a QuickBooks or Xero user) will differ significantly from a young professional focused on aggressive saving and debt reduction (a perfect fit for Monarch Money or Quicken Simplifi).

Choosing Your Path Forward

To make a confident decision, shift your focus from features to outcomes. Don’t just ask what a tool does; ask what it will empower you to do.

- For Budgeting Discipline: If your main goal is to gain control over spending and align it with your income, tools like YNAB and Monarch Money offer structured, goal-oriented frameworks that enforce financial discipline.

- For Holistic Net Worth Tracking: If you are an investor, an expat with multi-currency assets, or simply want a high-level overview of your entire financial picture, a dedicated aggregator like PopaDex is unparalleled. It consolidates everything from bank accounts and investments to real estate and crypto into a single, intuitive dashboard.

- For Ultimate Customization: Tech-savvy users who want complete control over their data and reporting will find Tiller’s Google Sheets and Excel integration to be a powerful, flexible solution.

- For Business and Freelance Needs: When your finances involve invoicing, payroll, and tax preparation, dedicated accounting software like QuickBooks, Xero, or Expensify is non-negotiable.

Implementing Your New Tool for Success

Once you’ve selected a tool, remember that implementation is key. Don’t try to connect every single account and categorize a decade of transactions on day one. Start small. Connect your primary checking and credit card accounts. Track your spending for one month to establish a baseline. The goal is to build a sustainable habit, not to achieve immediate perfection.

Ultimately, the most effective of all the financial management tools is the one you consistently use. By leveraging technology to automate tracking and provide clear insights, you free up your mental energy to focus on what truly matters: making strategic decisions that build wealth, reduce stress, and help you achieve your most important life goals. Your financial future is not a spectator sport; it’s time to get in the game.

Ready to see your complete financial picture in one place? PopaDex provides a powerful, intuitive platform to track your net worth across all your accounts, investments, and assets, giving you the clarity needed to make smarter financial decisions. Start your journey to financial mastery with PopaDex today.