Our Marketing Team at PopaDex

Mastering Financial Workflow Automation for Business Growth

Imagine your finance team drowning in a sea of invoices. Each one needs to be manually keyed in, checked against a purchase order, and then chase down approvals through an endless chain of emails. It’s a slow, mistake-ridden process that hamstrings any growing business. Financial workflow automation is what turns this chaos into a smooth, hands-off system.

Moving Beyond Manual Finance Operations

Now, picture this instead: an invoice lands in your inbox, and a system instantly reads the data, matches it to the right PO, and sends it off for approval. The moment it’s approved, the payment is scheduled—all without anyone lifting a finger. That’s the real power of financial workflow automation. It’s about completely rethinking your financial processes so they can run themselves.

This isn’t just about moving faster. It’s about transforming your finance department from a reactive cost center into a strategic partner that fuels business growth. When you free your team from the grind of repetitive admin work, you unlock their true potential to focus on what matters: analysis, forecasting, and smart decision-making.

The Soaring Demand for Automation

Making the switch from manual to automated isn’t just a passing trend; it’s a massive shift in how businesses operate. The rapid adoption of these tools shows a clear and urgent need for more efficient financial services across the globe.

The financial automation market was valued at around US$8.1 billion and is projected to more than double, hitting an estimated US$18.4 billion by 2030. That’s a compound annual growth rate (CAGR) of about 14.6%.

This explosive growth is happening because businesses are finally realizing that old-school manual processes just can’t keep up anymore. They are actively looking for tools to stamp out errors, tighten up compliance, and get a leg up on the competition. You can learn more about the projections for the financial automation market and see how AI-powered tools are at the forefront of this expansion.

What Problems Does It Solve?

At its core, financial workflow automation takes a direct shot at the most common headaches that plague finance teams. These systems are specifically designed to fix things like:

- Manual Data Entry: It completely gets rid of the soul-crushing (and error-prone) task of typing in information from invoices, receipts, and other documents.

- Approval Bottlenecks: Messy email threads are replaced with clean, automated approval flows that ping the right people at the right time to keep things moving.

- Poor Visibility: You get a single, real-time dashboard showing all your financial activities, so you’re never left wondering about the status of a payment or report.

- Compliance Risks: Every transaction leaves a perfect digital footprint, creating a clear audit trail that makes compliance a breeze and cuts down on the risk of human error.

This guide will walk you through exactly how to make this change happen, turning these everyday frustrations into your company’s greatest strengths.

How Financial Workflow Automation Actually Works

So, what’s really going on under the hood with financial workflow automation? Let’s start with an analogy.

Imagine your current, manual financial process is a bucket brigade. It’s slow, messy, and prone to spills—which, in this case, are costly errors. Everyone just passes the bucket to the next person in line. If one person stumbles, the whole operation grinds to a halt.

Financial workflow automation is like swapping out that bucket brigade for a modern, interconnected plumbing system. It uses software, artificial intelligence (AI), and Application Programming Interfaces (APIs) to build a network of digital “pipes” that move financial data smoothly from one point to the next, with no spills.

The Core Components of Automation

At its heart, every automated financial workflow is built on three simple but powerful ideas. Once you grasp these, the whole concept clicks into place, and you see how even advanced automation is within reach for any business.

-

The Trigger: This is the starting gun. It’s a specific event that kicks off the entire workflow. A trigger could be a new invoice landing in an email inbox, an employee submitting an expense report, or a customer payment hitting your account.

-

The Actions: Once a trigger fires, the system gets to work on a series of pre-defined tasks. These actions might include pulling data from a PDF, matching an invoice to a purchase order, sending a document to the right person for approval, or scheduling a payment.

-

The Logic: This is the brain of the operation. It uses simple “if-then” rules to steer the workflow. For example, if an invoice is over $5,000, then it must be routed to the department head for approval. If it’s under that amount, it can be approved automatically.

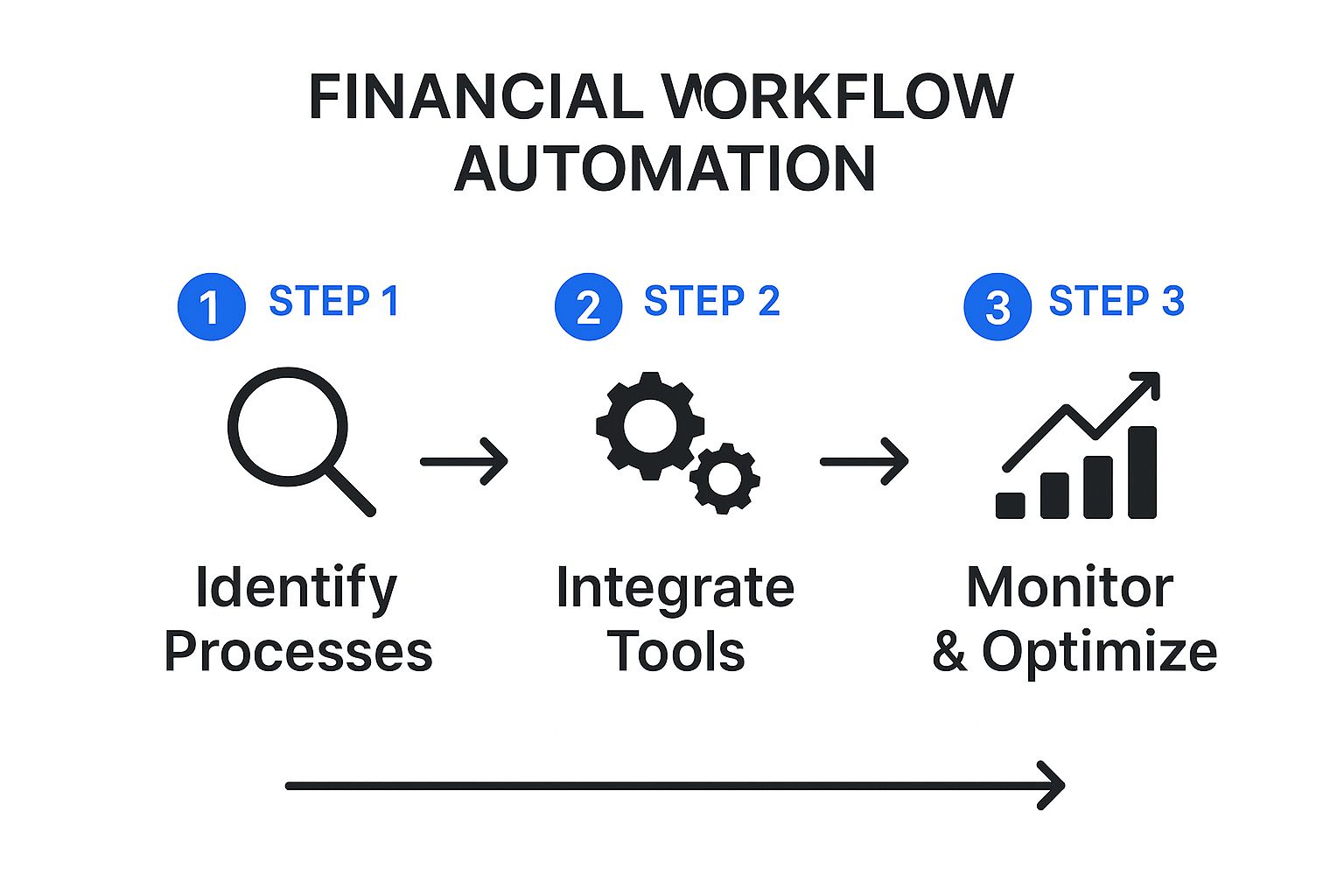

This infographic gives a great high-level view of how these concepts come together during implementation.

As the visual shows, the journey is all about spotting the right opportunities, connecting the right tools, and then constantly fine-tuning the system to get the best performance.

Putting It All Together

Let’s walk through a real-world example. An invoice for $750 arrives. The system is triggered. It instantly reads the vendor name, invoice number, and amount.

The logic then kicks in, checking the amount and seeing it’s below the $1,000 threshold for a manager’s review. It immediately moves to the next action: scheduling the payment for its due date. No one had to type anything in, chase down approvals, or send a single email. It was just a smooth, hands-off process.

If you want to go deeper into the nuts and bolts of automating financial paperwork, checking out resources on Financial Document Automation offers some fantastic insights. Think of these systems as the digital pipes connecting your entire financial world.

The real power isn’t in any single component, but in how they work in concert. A well-designed financial workflow automation system orchestrates dozens of these small trigger-action-logic sequences to handle complex processes from start to finish, all without human intervention.

The True Benefits of Automating Financial Tasks

When people talk about financial workflow automation, the conversation often starts and ends with saving time. And sure, reclaiming a few hours is nice. But the real story is much bigger. The true impact runs deep, fundamentally changing how your finance team operates and what it can contribute to the entire business.

Think about it. Cost savings aren’t just about trimming the fat. It’s about taking the thousands of hours your team spends on mind-numbing data entry and redirecting that brainpower toward high-value strategic analysis. It’s the difference between an employee spending all day keying in invoice numbers versus one who’s analyzing spending patterns to find a new way to cut costs.

Beyond Speed to Strategic Impact

The first thing everyone notices is the speed. Processes that once took days now take minutes. It’s an immediate, satisfying win. But honestly, that’s just scratching the surface. The real magic happens when automation starts improving the quality and reliability of your financial operations.

Take accuracy, for instance. We’ve all seen it happen—a single misplaced decimal or an incorrect vendor code creates a domino effect of chaos. It can lead to overpayments, strained supplier relationships, and even hefty compliance fines. Automation practically eliminates these human errors, ensuring your data is solid from start to finish. This newfound accuracy builds a foundation of trust that every business leader craves.

To see just how transformative this shift has been, let’s look at the numbers.

Impact of Automation on Finance Departments

The data speaks for itself. Companies adopting these tools are seeing measurable improvements across the board, moving from reactive problem-solving to proactive strategy.

| Metric | Improvement / Statistic |

|---|---|

| Workflow Adoption | 60% of companies now use automation in their workflows. |

| Finance Task Automation | Finance departments are on track to automate up to 80% of transactional tasks. |

| Hours Saved (Payments) | Payment automation alone frees up over 500 hours annually per finance team. |

| Cost Reduction | Automation can reduce processing costs by as much as 80%. |

These figures show a clear trend: automation isn’t a “nice-to-have” anymore; it’s a core component of an efficient, modern finance department.

Creating an Ironclad Audit Trail

Another game-changing benefit is the automatic creation of a rock-solid audit trail for every single transaction. In a manual world, tracking an invoice from receipt to payment is like a frustrating detective novel—you’re digging through old emails, clunky spreadsheets, and maybe even a few sticky notes.

With financial workflow automation, every touchpoint is logged instantly. Who approved it? When did they approve it? What data was used? It’s all there. This digital footprint isn’t just a matter of convenience; it’s a compliance necessity.

This makes audit prep surprisingly painless. Instead of a last-minute scramble to gather documents, you can pull a complete, time-stamped history of any transaction in seconds. It simplifies compliance with regulations like SOX or GDPR, dramatically reducing risk and giving leadership some much-needed peace of mind. The power of document workflow automation shines here, creating a seamless and transparent process from top to bottom.

Empowering Your Finance Team

This is where it all comes together. When you automate finances, you free your skilled professionals from the daily grind. They’re no longer stuck being “bean counters”—they’re elevated to proactive business partners.

With their time back, your team can finally focus on what really moves the needle:

- Analyzing Financial Trends: Spotting patterns in spending, revenue, and cash flow to shape smarter business strategies.

- Improving Forecasting: Building more accurate financial models to guide future investments and growth.

- Guiding Key Decisions: Delivering the data-backed insights that help leadership navigate choppy waters and pounce on new opportunities.

This pivot from administrative overload to strategic influence is the ultimate payoff. It’s how you turn your finance department from a cost center into a powerful engine for growth. To learn more, see our guide on how to https://popadex.com/automate-finances/ and unlock your team’s hidden potential.

Financial Workflow Automation in Action

Understanding the theory behind financial workflow automation is one thing, but seeing it solve real-world problems is where the lightbulb really goes on. It’s time to move past the concepts and look at how businesses are using these systems to fix their most painful financial processes.

These aren’t futuristic ideas. They’re practical, on-the-ground applications turning chaotic manual work into something smooth and efficient. Let’s dive into four core areas where automation makes a night-and-day difference, highlighting the specific headaches they eliminate.

Transforming Procure-to-Pay Cycles

The procure-to-pay (P2P) process is a classic source of friction. It covers everything from an employee needing to buy something to the vendor getting paid. Done manually, it’s a swamp of paperwork, missed emails, and frustrating delays.

The Manual Headache:

- An employee fills out a paper or PDF purchase form.

- They hunt down their manager for a signature, who might be busy for days.

- Finance manually creates a purchase order (PO), hoping there are no typos.

- The vendor’s invoice arrives later and has to be painstakingly matched against the PO and delivery slips. It’s tedious and a magnet for errors.

- One tiny mismatch brings everything to a grinding halt, resulting in late payments and souring vendor relationships.

The Automated Solution: With automation, an employee just fills out a digital request in one central place. The system knows exactly who needs to approve it based on rules you’ve set (like department or dollar amount). Once approved, a PO is instantly created and sent.

When the invoice comes in, AI-powered software scans it, pulls out the key data, and does the three-way match automatically. If it all lines up, the payment is scheduled. Just like that. This gets rid of bottlenecks and lets your accounts payable team manage the exceptions, not the endless routine.

Accelerating the Order-to-Cash Process

On the flip side, you have the order-to-cash (O2C) cycle. This is all about getting paid—from the moment a customer places an order to when the money hits your account. A slow O2C cycle is a direct hit to your cash flow, which makes automation here incredibly powerful.

The Manual Headache: A salesperson types up a sales order, maybe introducing a few mistakes along the way. The finance team uses that order to manually create an invoice and then emails it out. Then you wait. If the invoice becomes overdue, it’s up to someone to remember to chase it up—a task that easily gets forgotten in the daily rush.

The Automated Solution: The moment a deal closes in your CRM, a workflow kicks off. It generates a perfect sales order and zips it over to your finance system, which then creates and sends an accurate invoice. No human touch needed. To see how this works in practice, you can explore common challenges like automating invoicing and billing.

But it doesn’t stop there. The system keeps an eye on payment status. If a due date is getting close, it sends a friendly reminder. If it goes past due, the reminders can become more frequent based on a schedule you define. This guarantees consistent follow-up and drastically shrinks how long it takes to get paid.

Streamlining Employee Expense Reporting

Ah, expense reports. A universal source of groans from employees and finance teams alike. The old way of doing things is slow, clunky, and a masterclass in tedious data entry.

The Manual Headache: An employee returns from a trip with a wallet stuffed full of crumpled receipts. They then spend an hour taping them to a form and typing everything into a spreadsheet. They submit the stack of paper, the manager reviews it, and then the finance team has to re-enter every single line item into the accounting system before cutting a check.

The Automated Solution: Today, an employee just snaps a photo of a receipt with their phone. Optical Character Recognition (OCR) technology instantly reads the vendor, date, and amount. The expense gets categorized and added to a report automatically.

They submit it with a single tap. The system sends it to the right person for approval. Once approved, the reimbursement lands via direct deposit, and all the data is already in your accounting software. A process that once ate up hours now takes minutes.

Simplifying the Month-End Close

For most finance teams, the month-end close is a high-stress, caffeine-fueled sprint. It’s a mad dash to reconcile accounts, check transactions, and generate statements, often bleeding into nights and weekends.

The Manual Headache: Accountants spend days manually ticking off transactions between bank statements and the general ledger. They chase down information from other departments, wrangle data from a dozen different spreadsheets, and painstakingly build financial reports from scratch. The whole thing is a frantic scramble where errors from exhaustion are almost guaranteed.

The Automated Solution: Financial automation changes the game entirely. The system can run bank reconciliations daily, flagging issues as they happen instead of letting them pile up. It automatically pulls data from all your other systems—your CRM, payroll, and ERP—into one place. For this to work smoothly, it’s crucial to understand financial data aggregation and how it creates a unified view.

With all the data in one spot, standardized reports can be generated with a click. It transforms a week-long ordeal into a predictable, orderly process.

Your Roadmap to Implementing Automation

Diving into financial workflow automation can feel like a huge undertaking, but it doesn’t have to be. The trick is to break it down. By following a structured, step-by-step approach, you can turn what seems like a massive project into a series of clear, manageable tasks.

Think of it like assembling new furniture. You wouldn’t just tip the box of screws and panels onto the floor and hope for the best. You’d start with the frame, follow the instructions, and build it piece by piece. This roadmap will guide you through a similar process, from the initial idea to a fully optimized system.

Step 1: Identify Your Best Automation Opportunities

Before you even think about software, you need to do some detective work. Talk to your team and take a hard look at your current processes. Where are the biggest headaches? What tasks are sucking up the most time and causing the most groans?

You’re looking for processes that are:

- High-Volume: Tasks that repeat constantly, day after day, like processing vendor invoices or matching purchase orders.

- Repetitive and Rule-Based: Mind-numbing work that follows the same script every time and requires little to no human judgment.

- Prone to Human Error: Any area where a simple typo can snowball into a major headache down the road.

- Creating Bottlenecks: The one step that always seems to grind everything to a halt, like waiting around for manual approvals.

Accounts payable and employee expense reporting are often the perfect places to start. They’re usually packed with manual work and offer a chance to score some quick, highly visible wins for the team.

Step 2: Map Your Current Processes

Once you’ve picked your target, you need to understand it inside and out. Grab a whiteboard or a digital tool and map out every single step, from beginning to end. Who does what? What information do they need? Where does the data come from, and where does it go?

This exercise is always an eye-opener. It will immediately shine a spotlight on hidden delays, redundant handoffs, and the exact points where work gets stuck. You can’t build a better road until you have an accurate map of the old, bumpy one.

The goal here is brutal honesty. You need to document the process as it actually works today, not how it’s supposed to work in theory. That clarity is the foundation for designing an automated workflow that solves real-world problems.

This kind of operational focus is becoming a top priority for businesses everywhere. The demand is massive, driven by an estimated 32 million small businesses in the U.S. alone who are hunting for efficiency gains and cost savings, a trend that only accelerated with the shift to remote work.

Step 3: Choose the Right Technology Stack

With a clear map in hand and a specific problem to solve, it’s finally time to look at tools. Your “tech stack” doesn’t need to be a single, all-in-one system. More often than not, it’s a smart mix of connected software that plays nicely together.

Your options typically fall into a few buckets:

- Standalone Apps: These are specialist tools designed to do one thing exceptionally well, like receipt scanning or invoice processing.

- Integrated Platforms: These are more comprehensive solutions that can handle entire workflows, like the procure-to-pay cycle. Platforms like PopaDex are built to act as a central hub for your financial operations.

- Integration Connectors: Tools like Zapier or Make act like digital glue, letting you link different apps to create custom workflows without writing a single line of code.

The right choice comes down to your unique needs, your budget, and the systems you already have. Always lean towards tools that integrate smoothly with your existing accounting software to avoid creating new data silos.

Step 4: Design and Test Your New Workflow

Now for the fun part: building your new, automated process. But don’t go all-in at once. Start small with a pilot program. Involve just a few team members or a specific type of transaction. This creates a safe space to iron out the kinks without disrupting the entire finance department.

During this pilot phase, be a sponge for feedback. Is the new workflow intuitive? Is it actually saving time? Did any unexpected problems pop up? Use this direct input to fine-tune the automation before you even think about a wider rollout.

Step 5: Roll Out and Optimize

Once your pilot is a proven success, you can roll out the new workflow to the whole team with confidence. But your job isn’t done on launch day. The final—and most important—step is to continuously monitor and improve.

Focus heavily on getting your team on board. Provide clear training, document the new process, and be sure to highlight the benefits for them (e.g., “You’ll never have to manually enter invoice data again!”). The most brilliant automation is worthless if nobody uses it correctly.

Finally, keep a close eye on your metrics. Are cycle times getting shorter? Are error rates dropping? Always be looking for small tweaks to make the workflow even better. Once you’ve nailed data collection, the next logical step is to improve your analysis. A huge part of that is learning how to automate financial reporting to turn all that fresh data into genuine business insights.

Common Questions About Financial Automation

As you start to explore financial automation, it’s natural for a few key questions to pop up. Getting clear answers to these is the first step toward moving forward with confidence and making the right decision for your business. Let’s tackle some of the most common ones we hear.

Financial Automation vs. Robotic Process Automation

One of the biggest points of confusion is the difference between financial workflow automation and Robotic Process Automation (RPA). While they’re related, they aren’t the same thing, and it’s an important distinction to make.

Think of RPA as a very specific tool—a digital worker you hire for one job. An RPA “bot” is software programmed to mimic a repetitive human task on a computer, like copying numbers from a PDF and pasting them into a spreadsheet. It’s incredibly useful, but it’s focused on a single task.

Financial workflow automation, on the other hand, is the entire strategy. It’s the full blueprint for redesigning a whole financial process, from beginning to end. This bigger-picture approach often uses RPA as one of its tools, but it also pulls in system integrations, AI-powered decisions, and smart logic to create a seamless, end-to-end flow.

- RPA: A bot that automates a task (like typing in invoice details).

- Financial Workflow Automation: A system that automates the whole process (like receiving the invoice, extracting the data, routing it for approval, and scheduling the payment).

Is Automation Only for Large Corporations?

This is a stubborn myth that needs busting. A decade ago, this was largely true. Powerful automation was the playground of Fortune 500 companies with giant IT teams and even bigger budgets. That reality has completely flipped.

The rise of affordable, cloud-based software and user-friendly integration platforms has leveled the playing field for everyone. Today, powerful financial workflow automation is well within reach for small and medium-sized businesses (SMBs). Many of the best tools offer scalable, subscription-based pricing, so you don’t need a massive upfront investment to get started.

The key takeaway is this: you no longer need a dedicated IT department or deep technical know-how to get going. Modern platforms are designed to be intuitive, empowering smaller teams to unlock the same efficiency gains once reserved for corporate giants.

How Do I Keep My Financial Data Secure?

Handing sensitive financial data over to any new system is a big deal, and security should be your top priority. Protecting that information is non-negotiable, and any automation strategy worth its salt is built on a rock-solid foundation of security.

When you’re evaluating solutions, there are three critical pillars to focus on to ensure your data stays safe:

- Vendor Security: You have to partner with technology vendors who live and breathe security. Look for providers who offer strong end-to-end encryption, enforce strict access controls, and are transparent about their security measures and protocols.

- Regulatory Compliance: Your automation solution must help you comply with data privacy regulations like GDPR or CCPA. This means having clear policies for how data is handled and ensuring your automated workflows are built to respect data protection principles from the ground up.

- Regular Audits: Security isn’t a “set it and forget it” project. It’s an ongoing commitment. You should conduct regular security audits of your automated systems. This proactive approach helps you find and fix potential weak spots before they can ever become a problem, keeping your most critical financial information locked down.

Ready to take control of your complete financial picture? With PopaDex, you can consolidate all your accounts into one clear dashboard and track your net worth with confidence. Start your free trial today at PopaDex.com and see how easy it is to manage your wealth.