Our Marketing Team at PopaDex

How Much to Save for Retirement A Complete Guide

A classic rule of thumb you’ll hear is to aim for a retirement nest egg that’s 10 times your final annual salary. So, if you’re earning $100,000 when you hang it up, you’re looking at a target of $1 million. It’s a simple multiplier, but it gives you a powerful starting point to wrap your head around what it takes to retire comfortably.

Setting Your Retirement Savings Benchmarks

While that “10x salary” rule is a fantastic first target, your personal retirement number isn’t one-size-fits-all. Think of it as a helpful signpost on a long road trip—it confirms you’re headed in the right direction, but your final destination is entirely unique. Your ideal savings will ultimately be shaped by your dream lifestyle, when you want to retire, and what you expect your expenses to look like.

To make that huge number feel less intimidating, financial planners often break it down into smaller milestones based on age. This approach is way more practical. It lets you track your progress throughout your career and make tweaks to your savings strategy when you need to, turning a distant goal into a series of achievable steps.

Savings Goals by Age

Having age-based targets is a great way to see if you’re on the right track. These benchmarks, usually expressed as a multiple of your current salary, act as a quick financial health check. They’re designed to account for the incredible power of compounding, where the money you save earlier has much more time to grow.

For example, having 1x your salary saved by age 30 might not sound like a lot, but it builds an incredibly strong foundation for the future. That goal grows to 3x by 40 and 6x by 50, showing you just how much momentum you can build over the decades.

Let’s say a 40-year-old is earning $80,000 per year. Their goal should be to have about $240,000 (3 x $80,000) saved. This gives them a clear, actionable target right in the middle of their career.

Here’s a quick reference guide to see how these benchmarks stack up at different stages of your working life.

Retirement Savings Benchmarks by Age

This table offers a simple way to gauge your progress by showing how much you should aim to have saved as a multiple of your annual salary at key milestones.

| Age | Savings Goal (Multiple of Salary) |

|---|---|

| 30 | 1x your annual salary |

| 40 | 3x your annual salary |

| 50 | 6x your annual salary |

| 60 | 8x your annual salary |

| 67 | 10x your annual salary |

Of course, these numbers aren’t rigid rules—they’re flexible guidelines. If you get a later start on saving, you might need to tuck away a higher percentage of your income to catch up. On the flip side, an early start means you get the full, amazing benefit of compound interest over a much longer timeline.

For a much more personalized calculation, you can use a detailed retirement nest egg calculator to plug in your own numbers and assumptions. This is how you translate these general benchmarks into a concrete plan tailored specifically to your financial situation and future goals.

Defining Your Post-Work Lifestyle

Before you even touch a calculator, the most important retirement question has nothing to do with numbers. It’s this: What do you actually want to do when you stop working? Forget complex formulas for a minute. The real first step is getting a clear vision of your future life, because that vision dictates the financial target you’re aiming for.

Your financial picture is going to change, and probably in some big ways. Some of your largest current expenses might just vanish. Think about it—that mortgage you’ve been chipping away at for decades could finally be paid off. You’ll also stop funneling a piece of every paycheck into retirement accounts. Just those two changes can free up a surprising amount of cash.

But of course, new expenses will pop up to take their place. Will you finally take that three-month trip through Europe? Maybe you’ll pour more time and money into hobbies like golf, gardening, or woodworking. Now is the time to be brutally honest about these dreams.

The Income Replacement Rule of Thumb

A great starting point for this whole exercise is a concept called income replacement. The idea isn’t to perfectly replicate your pre-retirement salary. Instead, the goal is to generate enough income from your savings to cover all your expenses and maintain the lifestyle you’ve envisioned.

A widely accepted benchmark is to aim for replacing 80% of your pre-retirement income. This figure works because it naturally accounts for the expenses you’ll be shedding—like saving for retirement itself and paying certain payroll taxes.

So, if you’re earning $90,000 a year right before you retire, the 80% rule suggests you’ll need about $72,000 annually to live comfortably. That number becomes the foundation for all the other math.

This is a solid guideline, but it’s not set in stone. Your personal number might be higher if you’ve got big travel plans, or lower if you intend to downsize and live more simply. It’s a global concept, too. Financial planners across Europe and other Anglophone countries often recommend a 70% to 90% replacement rate. Even in places with robust state pensions like the Netherlands and Denmark, personal savings are critical, a point underscored by analyses like the Mercer CFA Institute Global Pension Index.

From Vague Dreams to a Concrete Budget

To really dial in your number, you need to translate that lifestyle vision into a line-by-line budget. This goes beyond guessing; it’s about seeing how your spending habits will realistically shift.

Start by listing your potential retirement expenses in detail.

- Housing: Will your mortgage be gone? Are you staying put or downsizing? Don’t forget to budget for property taxes, insurance, and the inevitable home maintenance costs.

- Healthcare: This is the big unknown for many. Medicare is a huge help, but it doesn’t cover everything. You need to factor in premiums, copays, and the potential for long-term care costs down the road.

- Travel and Hobbies: Get specific. How many big trips per year? What are the real costs of your favorite pastimes? Be honest with yourself here.

- Daily Living: Groceries, utilities, and car expenses aren’t going anywhere. Your commuting costs might disappear, but other costs could rise.

- Family: Do you plan to help out kids or grandkids financially? This could be anything from helping with college tuition to just being generous with gifts.

A Tale of Two Retirements

Let’s look at how this plays out for two different people. The lifestyle choices they make have a massive impact on their savings goals.

Scenario One: The Homebody’s Haven Meet Sarah. She’s planning a quiet but comfortable retirement. Her mortgage is paid off, she loves to garden, and her travel plans involve driving to see her grandkids a couple of times a year. After mapping it all out, her estimated annual expenses come to $50,000.

Scenario Two: The Globetrotter’s Adventure Now, let’s consider David. His dream is to see the world. He plans to spend three months abroad every year, take up scuba diving, and keep his apartment in the city. His projected annual expenses are much higher, landing around $95,000.

These two paths demand completely different nest eggs. Sarah’s more modest spending means her savings goal will be significantly lower than David’s. This is why defining your post-work life first is so critical—it turns an abstract goal into a tangible number you can actually plan for.

Practical Formulas to Find Your Number

Once you have a clear vision of what you want your post-work life to look like, it’s time to move from dreaming to doing. Let’s translate that ideal lifestyle into a concrete number.

You don’t need a degree in finance for this part. A couple of trusted, back-of-the-napkin formulas can give you a surprisingly accurate target to aim for. These methods are popular for a reason: they’re simple, effective, and grounded in decades of financial market data.

The Multiply by 25 Rule

This is probably the quickest and most straightforward way to get a baseline for your retirement number. The rule is simple: figure out how much annual income you’ll need in retirement, and then multiply it by 25. That’s it. The result is the total nest egg you need to have saved.

Why does this work? It’s essentially the inverse of another core concept in retirement planning—the 4% Rule. It’s built on the idea that you can safely withdraw 4% of your portfolio each year without running out of money over the long haul.

Let’s walk through a quick example.

- Desired Annual Income: You’ve run the numbers and figured out you need $70,000 a year to live comfortably.

- The Calculation: $70,000 (annual income) x 25 = $1,750,000

Just like that, you have a target. Your retirement savings goal is $1.75 million. This is the amount you need in your portfolio to generate the income you’re aiming for, all based on a sustainable withdrawal rate.

The 4% Rule Explained

The “Multiply by 25” rule is the “how,” but the “4% Rule” is the “why.” This guideline came out of extensive research on historical stock and bond returns. It suggests you can withdraw 4% of your starting retirement portfolio balance in your first year of retirement. After that, you just adjust the amount you withdraw each year to account for inflation.

Sticking to this strategy gives you a very high probability that your money will last for at least 30 years, and often much longer. It’s become the bedrock of modern retirement planning because it provides a clear, reliable way to turn a lump sum of savings into an income stream you can count on.

Let’s flip our example around and look at it through the lens of the 4% Rule.

- Your Target Nest Egg: You did it. You saved $1,750,000.

- The Calculation: $1,750,000 (total savings) x 0.04 (4%) = $70,000

See how it works? The math confirms that your $1.75 million nest egg is large enough to give you that $70,000 income in your first year. This rule provides the confidence that your portfolio can support your lifestyle without the constant fear of running out of cash too soon.

Key Takeaway: The “Multiply by 25” and “4% Rule” are two sides of the same coin. One helps you set a clear savings goal, while the other shows you how to draw an income from that goal once you’re retired. Together, they create a powerful and easy-to-understand framework for your financial plan.

Important Assumptions Behind These Rules

While these formulas are incredibly useful, they aren’t magic. They’re based on a few key assumptions that are important to understand. Knowing what’s under the hood helps you see why they work and when you might need to tweak things for your own plan.

These rules generally assume:

- A 30-Year Retirement: The original research was based on a 30-year timeframe. If you plan on retiring early or think you’ll have a much longer retirement, you might want to be more conservative and use a lower withdrawal rate, like 3.5%.

- A Balanced Portfolio: The calculations are modeled on a portfolio with a healthy mix of stocks and bonds, often around 60% stocks and 40% bonds. If your portfolio is too conservative (heavy on cash) or too aggressive, the results could be different.

- Historical Market Returns: The rules are built on how the U.S. market has performed in the past. While history is our best guide, future returns are never guaranteed.

The concept of a safe withdrawal rate is what ties all of this together. It’s the percentage of your savings you can spend each year without a high risk of your money running out before you do. While 4% is the classic benchmark, understanding the factors that influence your personal rate is crucial. To dig deeper, our complete guide on finding your ideal safe withdrawal rate for retirement can offer more tailored insights.

Ultimately, these formulas aren’t rigid commands. Think of them as powerful starting points. They cut through the noise and give you a tangible, achievable number to work toward, transforming a vague future wish into a clear financial mission.

Don’t Forget Retirement’s Hidden Costs

Running the numbers with a formula is a great first step, but a retirement plan that actually works in the real world has to account for the unexpected. There are a few powerful, almost invisible forces that can quietly drain your savings over decades.

Spotting these hidden costs ahead of time is what separates a plan that looks good on a spreadsheet from one that can actually support you for a lifetime.

Three of the biggest culprits you need to plan for are inflation, healthcare, and simply living longer than you might have guessed. Each one can seriously erode the buying power of your nest egg if you’re not prepared.

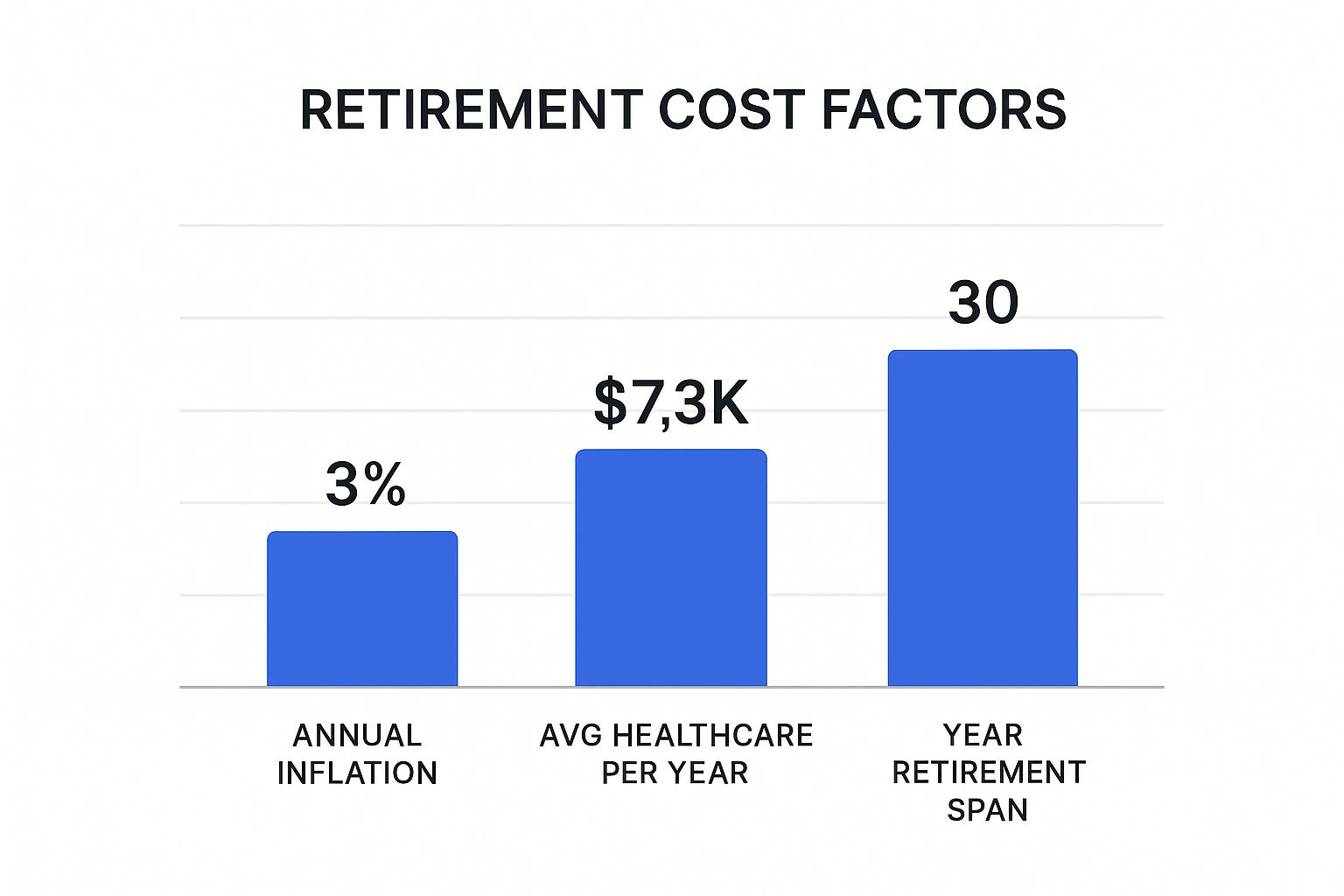

The infographic below really puts these three factors—inflation, healthcare costs, and a long retirement—into perspective.

You can see how manageable costs like annual inflation or healthcare look in a single year. But the sheer length of a modern retirement amplifies their impact enormously over the long haul.

The Slow Burn of Inflation

Inflation is the quietest wealth-killer out there. That $70,000 annual income that feels perfectly comfortable today won’t get you nearly as far in 10, 20, or 30 years. With an average inflation rate of 3%, the cost of living essentially doubles every 24 years.

What this means is your retirement income can’t just be a static number; it has to keep growing. Good retirement strategies, like the 4% Rule, already factor this in by adjusting your withdrawals for inflation each year. But it’s critical to understand that this is why your portfolio has to keep growing even after you’ve stopped working.

The High Cost of Staying Healthy

Healthcare is easily one of the biggest and most unpredictable expenses you’ll face in retirement. Medicare is a huge help, but it’s not a blank check. You’ll still be on the hook for premiums, deductibles, co-pays, and many costs that aren’t covered, like dental, vision, and long-term care.

Recent studies estimate that a healthy 65-year-old couple might need hundreds of thousands of dollars just for medical expenses throughout their retirement. That’s a staggering figure that can quickly wreck an otherwise solid financial plan.

One of the best ways to prepare for this is with a Health Savings Account (HSA). If you have a high-deductible health plan, an HSA gives you a powerful triple tax advantage:

- Contributions are tax-deductible.

- Your money grows completely tax-free.

- Withdrawals for qualified medical expenses are also tax-free.

Think of an HSA as a dedicated retirement account just for healthcare. It’s an incredible tool for building a buffer against these rising costs.

The New Reality of Longevity

It’s great news: thanks to modern medicine, we’re all living longer than ever before. Financially, though, this presents a real challenge. Your savings now have to last longer, too. A retirement that stretches for 30 years or more is no longer an exception—it’s a realistic possibility for many of us.

This is a huge reason why financial planners often push for a more conservative withdrawal rate or a bigger overall savings goal. You simply need a larger cushion to make sure your money outlasts you.

The paradox of modern retirement planning is clear. While total retirement assets in the United States reached a record $45.8 trillion, many households feel less prepared than ever. Concerns about inflation and healthcare costs are causing a growing number of workers to delay their retirement plans. You can find more details on this trend in the latest ICI statistical report on retirement assets.

Building a buffer for these hidden costs isn’t about being pessimistic; it’s about being realistic. When you factor them into your calculations, your plan transforms from a rough estimate into a durable, real-world strategy. By acknowledging inflation, planning for healthcare, and preparing for a long and healthy life, you build a financial foundation strong enough to support the retirement you’ve worked so hard for.

Actionable Strategies to Boost Your Savings

Knowing your retirement number is a huge first step. But that number is just the destination—now it’s time to start the engine and hit the road. Getting there requires more than just stashing cash; it’s about putting a smart, consistent plan into motion that makes your money work as hard as you do.

The best part? The most effective strategies aren’t complicated. By focusing on a few high-impact moves, you can seriously accelerate your savings and build the kind of momentum that carries you straight to your financial goals.

First Things First: Maximize Your Employer Match

If your company offers a 401(k) match, this is your absolute top priority. Think of it as 100% free money. You won’t find another investment out there that offers an instant, guaranteed return like this.

Let’s be clear: if your employer matches 100% of your contributions up to 4% of your salary, you need to contribute that 4%. Anything less is like literally turning down a raise. Before you put a single dollar anywhere else, make sure you’re capturing every penny of that match.

This single action can supercharge your savings from day one. It’s the lowest-hanging fruit in retirement planning and the most critical step for building a strong financial foundation.

Put Your Savings on Autopilot

Want to know the secret to consistent saving? Take willpower out of the equation entirely. Automating your contributions is the simplest, most effective way to make sure you’re always paying yourself first.

When the money moves from your paycheck to your retirement accounts before you can even touch it, you’ll naturally learn to live on the rest. It’s a classic “set it and forget it” strategy that builds great financial habits without any daily effort.

You can automate contributions to:

- Your 401(k) or 403(b): This is the easiest, as it’s usually deducted right from your paycheck.

- Your Traditional or Roth IRA: Just set up a recurring monthly transfer from your checking account.

- A taxable brokerage account: A great option for saving beyond your dedicated retirement accounts.

Automating your savings ensures you’re making progress even when life gets chaotic. If you feel like you’re behind, our guide on how to catch up on retirement savings offers more targeted strategies to help you get back in the game.

Choose the Right Retirement Accounts

Not all retirement accounts are created equal. Understanding the key differences is crucial for making your savings as tax-efficient as possible. The right choice for you often comes down to your income today versus what you expect it to be when you retire.

The main options are workplace plans (like a 401(k)) and personal accounts (like an IRA). Let’s quickly break down what makes each one tick.

Comparing Retirement Savings Accounts

Each account type has its own rules for taxes on contributions and withdrawals, which can have a huge impact on your long-term wealth.

| Account Type | Tax Treatment on Contributions | Tax Treatment on Withdrawals | Key Benefit |

|---|---|---|---|

| Traditional 401(k)/IRA | Tax-deductible now, lowering your current taxable income. | Taxed as ordinary income in retirement. | Reduces your tax bill today, which is great if you’re in a high tax bracket. |

| Roth 401(k)/IRA | Made with after-tax dollars; no immediate tax deduction. | Completely tax-free in retirement (including growth). | Gives you tax-free income down the road, protecting you from future tax hikes. |

A popular and effective strategy is to contribute to your 401(k) just enough to get the full employer match. After that, many people shift their focus to maxing out a Roth IRA for its incredible tax-free withdrawal benefits. Once the IRA is maxed, they circle back to dump any extra savings into their 401(k).

Increase Your Savings Rate Annually

Here’s a small trick with a massive payoff: commit to increasing your savings rate by just 1% every single year. This strategy, sometimes called “contribution escalation,” is one of the most painless ways to boost your nest egg.

If you time this tiny bump with your annual raise or cost-of-living adjustment, you’ll barely even feel the difference in your paycheck. But the long-term impact is huge. A 1% increase on a $75,000 salary is only about $63 a month, but over 30 years, compounding can turn that small change into tens of thousands of extra dollars for retirement. Check your 401(k) plan—many even let you set this up to happen automatically.

Tackling the Tough Retirement Questions

Even with the best formulas, retirement planning is full of “what ifs.” It’s completely normal to have questions, especially if you feel like you’re playing catch-up or just trying to make sense of how all the pieces fit together. Let’s get into some of the most common concerns I hear all the time.

The reality is, almost no one has a perfectly straight line to their retirement goals. Life throws curveballs. What matters is knowing how to adjust your swing.

What If I Started Saving Late?

This is easily the number one worry on people’s minds, and the anxiety is real. If you’re in your 40s or 50s and the numbers aren’t where you want them to be, the most important thing you can do is not panic. You can’t change the past, but you have complete control over what you do starting today.

Your strategy now needs to shift from standard advice to something more aggressive and focused. That standard 15% savings rate? You’ll likely need to push that closer to 25% or even higher.

Here’s where to focus your energy immediately:

- Max Out Catch-Up Contributions: The moment you turn 50, the IRS lets you add extra “catch-up” contributions to your retirement accounts. For 2025, that’s an extra $7,500 for a 401(k) and $1,000 for an IRA. This is free ground—make sure you take it.

- Re-evaluate Your Lifestyle: To find that extra savings percentage, you might need to make some hard calls. This could mean downsizing your home once the kids are gone, slashing major discretionary spending, or putting off big purchases.

- Consider Working Longer: This one is a powerhouse. Working just two or three extra years can make a colossal difference. It gives your money more time to compound and shortens the number of years you’ll be drawing down your savings.

Starting late feels like a steep hill to climb, but a high-intensity savings plan over 15-20 years can still build a very comfortable nest egg.

How Should Social Security Factor into My Plan?

Think of Social Security as the foundation of your retirement house—it’s essential, but it can’t be the entire structure. For the average retiree, Social Security benefits only replace about 40% of pre-retirement income. It’s a crucial safety net, but it was never meant to fund your whole retirement.

Your personal savings are what will bridge the gap between what Social Security provides and the lifestyle you actually want.

When you run your numbers using the 4% Rule or the Multiply by 25 method, you can approach it in two ways. You can calculate a total nest egg that covers all your expenses. Or, you can first subtract your expected annual Social Security income from your needs and then calculate a savings goal for the smaller amount. The second option often gives you a much more manageable and less intimidating target.

Don’t forget that timing is everything. You can claim benefits as early as 62, but your monthly check will be permanently smaller. If you can wait until your full retirement age (usually 67) or even delay until 70, your monthly benefit will be significantly larger for the rest of your life.

How Do I Know if My Investments Are Right?

Knowing how much to save is only half the battle. Making sure that money is working hard for you is the other half. Your investment mix, or asset allocation, should change as you get older.

- Younger Savers (20s and 30s): You have decades on your side, so you can afford to be more aggressive. A portfolio heavily weighted in stocks, maybe 80-90%, is common because you have plenty of time to ride out any market downturns.

- Mid-Career Savers (40s and 50s): As retirement gets closer, you’ll want to start dialing back the risk. This is a good time to gradually shift to a more balanced 60/40 or 70/30 split between stocks and bonds.

- Nearing Retirement (60s): At this stage, protecting the wealth you’ve built becomes the top priority. Your allocation will likely lean more heavily toward bonds and other less volatile assets to shield your portfolio from major shocks.

If actively managing this feels like too much, target-date funds are a fantastic, set-it-and-forget-it solution. These funds automatically rebalance and become more conservative as you get closer to your target retirement year. It’s a simple way to keep your investments aligned with your timeline without needing to constantly tinker with them.

Global retirement data shows that feeling behind is a common experience. A comprehensive Fidelity Global Retirement Survey across major economies like the U.S. and UK found that most households are not fully on track, with readiness scores often in the low 70s out of a possible 150. This is a big reason why a growing number of people expect to delay retirement.

Ready to stop guessing and start building a clear path to your goals? PopaDex gives you a consolidated view of your entire net worth in one place. Link your accounts, watch your investments grow, and get the confidence you need to build the future you deserve. Start your free trial today at popadex.com.