Our Marketing Team at PopaDex

How to Calculate Net Worth: A Simple Step-by-Step Guide

At its core, calculating your net worth is a pretty simple exercise. You just add up everything you own (your assets) and subtract everything you owe (your liabilities). The final number you get is a clear, honest snapshot of your financial position, neatly summarized by the formula: Assets - Liabilities = Net Worth.

Your Financial Health Check: Why Net Worth Matters

Before we start crunching numbers, let’s reframe what net worth actually means. It’s easy to see it as a score to compare against friends or strangers on the internet, but that’s not the point. Think of it as your own personal financial health report. It’s the clearest, most unfiltered picture of where you stand today.

Knowing this one number is the key to setting meaningful goals, making smarter calls on debt and investments, and actually seeing your progress over time. For a lot of people, this is ground zero for achieving financial independence, because it gives you a solid baseline to build from.

Free to start

Ready to track your net worth?

Connect your accounts and see your complete financial picture in under 2 minutes.

Turning Data Into Decisions

When you calculate your net worth regularly, you’re turning vague feelings about your finances into hard data. It’s no longer about feeling like you’re doing okay; it’s about knowing. This kind of clarity empowers you to:

- Spot trends: Is your asset column growing faster than your debt?

- Set real targets: It’s much easier to plan a route when you know your exact starting point.

- Stay motivated: Honestly, nothing keeps you on track like watching that net worth number tick up month after month.

To do this right, you need to get comfortable with understanding your personal balance sheet, which is just a structured way of listing out your assets and liabilities. This is more than some stuffy corporate tool; it’s your personal financial roadmap.

Your net worth is more than just a number—it’s a reflection of your financial journey. It tells the story of your past decisions and provides a compass for your future ones, highlighting both your strengths and areas needing attention.

Ultimately, the goal goes beyond learning the formula. It’s about using that knowledge to build a more secure future. This calculation gives you the insight you need to move forward with purpose, making sure every financial choice you make is another step in the right direction.

Tallying Up Your Assets: A Complete Checklist

Before you can get an accurate net worth figure, you have to get real about everything you own. This means creating a detailed inventory of your assets—all the resources you have that hold monetary value. This isn’t a time for guesswork; it’s about systematically gathering the facts to build the first half of your financial picture.

Think of it like a business taking stock of its inventory. You need to know exactly what you have and what it’s worth today. Let’s break this down into a few manageable categories so you don’t miss anything important.

Your Liquid and Invested Capital

The easiest place to start is with your cash and investments. These are typically the most straightforward assets to value because their worth is updated constantly, and you can find the numbers with a quick login or by checking a recent statement.

First, round up all your liquid assets. This is the stuff you can get your hands on quickly.

- Checking Accounts: The current balance in any accounts you use for day-to-day spending.

- Savings Accounts: This includes your high-yield savings, emergency funds, and any other cash you have parked.

- Certificates of Deposit (CDs): Be sure to note the current value, not just what you initially deposited.

- Cash on Hand: Don’t forget that stash of physical cash you might have tucked away.

Next, shift your focus to your investments, which represent your stake in various financial markets. Their values can change by the minute, so always aim for the most current figures you can pull.

- Retirement Accounts: Log into your 401(k), 403(b), IRA, or Roth IRA portals to grab the latest balance.

- Brokerage Accounts: Tally up the value of your individual stocks, bonds, mutual funds, and ETFs.

- Cryptocurrency: Check your digital wallet or exchange balance for the current market value of your holdings.

A classic mistake is to use old statement values or just round things off. For an accurate net worth calculation, you need the most recent, precise figures you can find. A few dollars here and there really do add up.

Valuing Your Real and Personal Property

This next category covers your biggest physical possessions. Figuring out their value takes a bit more legwork than checking an account balance, but it’s absolutely critical for getting the full picture.

Your primary home is probably your largest asset. To find its current market value, you can use online estimators like Zillow or Redfin, or just see what similar homes in your neighborhood have sold for recently. If you own investment properties, knowing how to calculate After Repair Value (ARV) can also give you a solid valuation metric.

Beyond real estate, you’ll want to account for other significant property:

- Vehicles: Use a resource like Kelley Blue Book or Edmunds to find the current private-party resale value of your car, truck, or motorcycle.

- High-Value Collectibles: This could be art, jewelry, antiques, or anything else with a real resale market. It’s best to be realistic here and use conservative estimates unless you have a recent professional appraisal.

It’s easy to get bogged down in the details. The trick is to focus on items with substantial value—don’t waste your time trying to price every book on your shelf. For a more structured way to keep these figures organized, you can grab our simple net worth tracking spreadsheet here: https://popadex.com/net-worth-tracking-spreadsheet/

This table breaks down the common asset types and points you to the best places to find their current market value.

| Asset Category | Specific Examples | How to Find Current Value |

|---|---|---|

| Cash & Equivalents | Checking/Savings Accounts, CDs, Money Market Funds | Check your latest bank or account statements online. Use the exact balance. |

| Investments | Stocks, Bonds, Mutual Funds, ETFs, 401(k)s, IRAs | Log into your brokerage or retirement account portal for real-time balances. |

| Real Estate | Primary Residence, Rental Properties, Land | Use online estimators (Zillow, Redfin), check recent comparable sales (“comps”), or get a professional appraisal. |

| Vehicles | Cars, Trucks, Motorcycles, RVs | Consult online valuation guides like Kelley Blue Book (KBB) or Edmunds for the private party sale value. |

| Personal Property | Jewelry, Art, Antiques, High-End Electronics | For high-value items, get a professional appraisal. For others, research prices on eBay or other resale marketplaces. |

Putting this list together gives you a tangible sense of what you’ve built. Once you have these numbers, you’re halfway to calculating your true net worth.

Listing Your Liabilities: What You Owe

Now that you have a complete picture of everything you own, it’s time to face the other side of the equation—your liabilities. This part isn’t about feeling overwhelmed by debt; it’s about gaining control through total awareness.

Honestly acknowledging exactly what you owe is the first and most powerful step toward managing it effectively. To keep things clear, we’ll break your debts down into two main buckets: secured and unsecured. Getting the difference is key to an accurate net worth calculation and seeing the true structure of your financial obligations.

Identifying Your Secured Debts

Secured debts are pretty straightforward: they are loans tied to a specific piece of collateral. Think of it as an asset the lender can claim if you fail to pay. These are often your largest liabilities, so getting the numbers right here is absolutely crucial.

Your most common secured debts will likely include:

- Mortgage Loans: This is probably the biggest number on your list. Log into your lender’s online portal to find the current principal balance. Don’t use your original loan amount; you need the up-to-the-minute figure.

- Home Equity Loans or HELOCs: If you’ve borrowed against your home’s value, find the outstanding balance for these as well.

- Auto Loans: Same deal here. Check your car loan statement or online account for the exact amount you still owe.

- Other Secured Loans: This could include loans for things like boats, RVs, or other valuable assets you’ve financed.

Your goal is precision. A ballpark estimate won’t give you the clear financial snapshot you need. Take the extra five minutes to log in and find the exact principal balance for each loan.

Cataloging Unsecured Debts

Unlike secured debts, unsecured liabilities are not backed by any collateral. These debts represent a promise to repay and are usually related to personal spending, education, or medical costs. It’s shockingly easy for these smaller debts to add up, so a thorough and honest review is essential.

Gather the current balances for all of the following:

- Credit Card Balances: Go through each of your credit card accounts—yes, even the store cards—and write down the current statement balance.

- Student Loans: Whether federal or private, log into your loan servicer’s website to get the total outstanding balance. For many of us, this is a significant liability that heavily impacts the final net worth number.

- Personal Loans: Be sure to include any unsecured loans from banks, credit unions, or online lenders.

- Medical Debt: Tally up any outstanding bills from hospitals, clinics, or other healthcare providers that you’re responsible for.

To make this crystal clear, it helps to see how these two liability types stack up against each other and what they mean for your bottom line.

Understanding Secured vs Unsecured Liabilities

| Liability Type | Definition | Common Examples | Impact on Net Worth |

|---|---|---|---|

| Secured | A debt backed by a tangible asset (collateral) that the lender can repossess upon default. | Mortgages, Auto Loans, Home Equity Loans | Directly tied to a corresponding asset, creating a clear asset-liability link on your balance sheet. |

| Unsecured | A debt not backed by any collateral; based solely on the borrower’s creditworthiness. | Credit Cards, Student Loans, Personal Loans, Medical Bills | Reduces your net worth without being linked to a specific asset, directly impacting your overall financial health. |

Seeing your debts laid out like this removes the emotion and just gives you the facts. It shows you which liabilities are tied to an asset you’re building equity in (like a house) and which are pure drains on your financial health (like high-interest credit card debt).

Once you have this complete list of what you owe, you’re ready for the final step: putting it all together to calculate your true net worth.

The Net Worth Formula in Action

You’ve done the legwork—you’ve cataloged what you own and what you owe. Now for the satisfying part. This is where we plug everything into that simple, powerful formula: Assets - Liabilities = Net Worth. It’s time to turn those lists into a single, concrete number that tells you exactly where you stand financially today.

To make this real, let’s walk through an example. Meet Alex, a 30-year-old professional navigating the same financial waters as many of us. Alex has a mix of assets (like a 401(k) and a car) and liabilities (student loans and a bit of credit card debt). We’ll use the numbers we gathered in the previous sections to do the math.

Alex’s Financial Snapshot

First, we’ll tally up everything Alex owns. After pulling statements from bank accounts, investment portals, and checking the car’s value, the asset side looks like this:

- Savings & Checking Accounts: $15,000

- 401(k) Retirement Account: $40,000

- Brokerage Account (Stocks/ETFs): $25,000

- Home Equity: $50,000

- Car (Current Resale Value): $12,000

Adding it all up, Alex’s Total Assets come to $142,000.

Next up, the liabilities. We’ll sum up everything Alex owes by looking at the latest loan and credit card statements:

- Remaining Mortgage Balance: $200,000

- Student Loan Debt: $35,000

- Auto Loan Balance: $8,000

- Credit Card Debt: $4,000

This brings Alex’s Total Liabilities to $247,000.

Now, let’s plug those totals into our formula:

$142,000 (Assets) - $247,000 (Liabilities) = -$105,000 (Net Worth)

Alex’s current net worth is -$105,000. If seeing a negative number feels a little jarring, don’t let it. It’s an incredibly common starting point, especially for anyone juggling a mortgage or student loans. Think of it not as a failing grade, but as your baseline—the starting line for your financial growth.

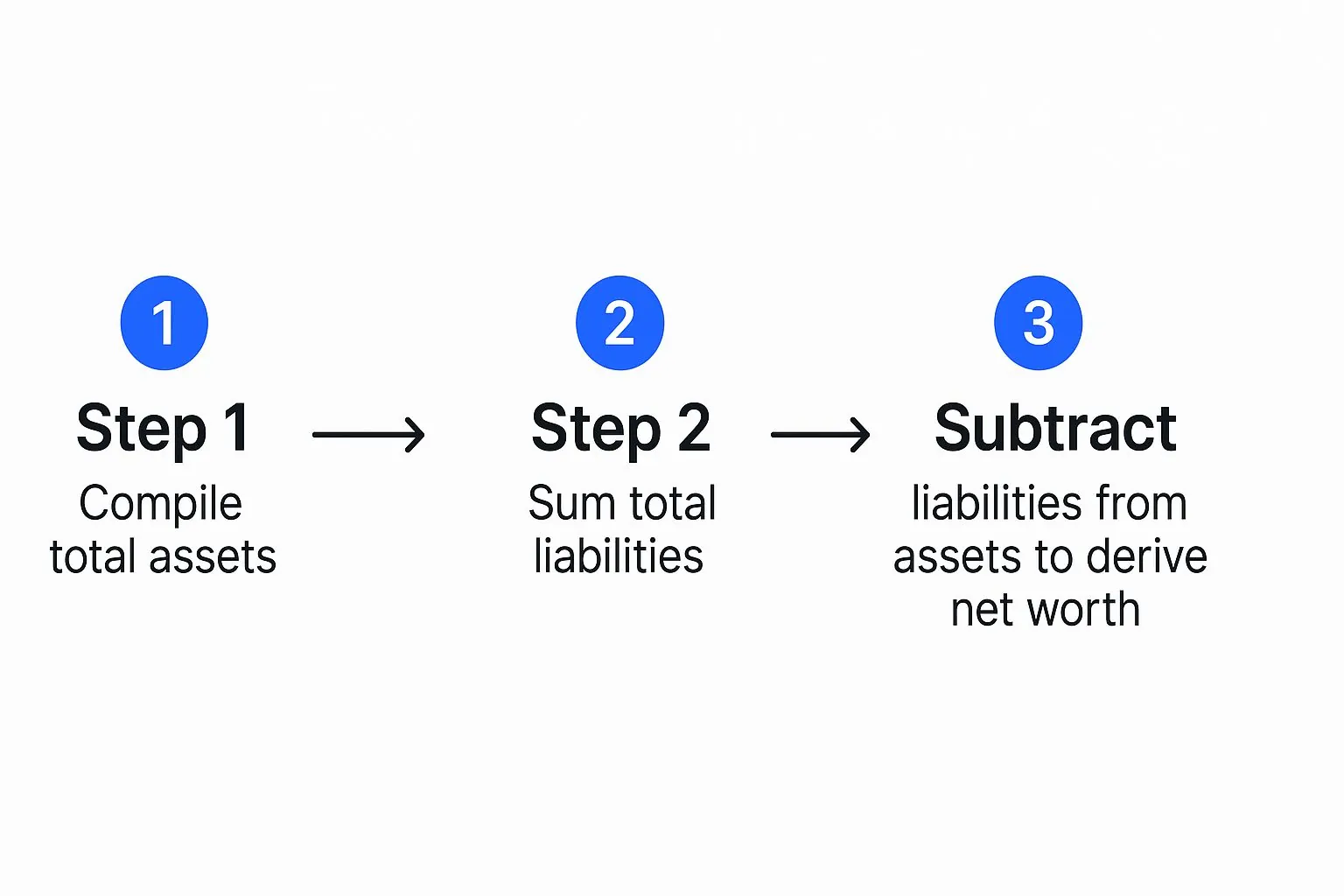

This visual shows just how simple the process really is.

It’s a straightforward exercise of gathering your numbers and doing one simple subtraction.

It’s a straightforward exercise of gathering your numbers and doing one simple subtraction.

What Your Final Number Really Means

It’s human nature to want to see how your number stacks up, but context is everything here. Net worth can vary wildly depending on where you live. For example, the average net worth per capita in countries like Denmark and Belgium was over $350,000 back in 2021, which just shows how different economic landscapes can be. You can dive into more global wealth averages on worldpopulationreview.com to see how these figures differ.

But the only comparison that truly matters isn’t with a national average, but with your past self. Your net worth is a personal progress report, a tool to guide your own journey, not a competition.

Whether your number is positive, negative, or somewhere in between, the real power is in what you do next. A positive net worth shows you’re on the right track with wealth-building. A negative one simply shines a light on where to focus your energy, like tackling high-interest debt.

This calculation is your starting point. From here, you can set clear goals, fine-tune your financial strategy, and start the rewarding process of watching that number grow.

How to Track and Grow Your Net Worth

Calculating your net worth once is just a snapshot. It’s useful, but the real power comes from turning that one-time calculation into a consistent habit. Think of it less like a photo and more like a time-lapse video of your financial life.

When you track it over time, you start to see the story unfold. You can pinpoint exactly what’s working—maybe that extra payment on your car loan made a real dent—and what isn’t. This ongoing feedback is what helps you stay motivated and make smarter decisions, turning raw data into an actual strategy for building wealth.

Creating a Sustainable Tracking Habit

So, how often should you check in? You need a rhythm that works for you. For most people, a quarterly update hits the sweet spot. It’s frequent enough to catch important shifts and make course corrections, but not so often that you get bogged down by the day-to-day noise of market swings.

If that feels like too much, an annual review is the bare minimum. This gives you a great high-level view of your progress year-over-year and is perfect for bigger-picture planning. The key isn’t the specific interval, it’s consistency. Pick a schedule and make it a non-negotiable part of your financial routine.

Your net worth is a dynamic figure, not a static score. The true value lies not in the number itself, but in its trajectory. Consistent tracking is what illuminates that path, showing you where you’ve been and guiding you where you want to go.

Using Tools to Simplify the Process

Let’s be honest, manually updating a spreadsheet with numbers from ten different accounts can get old, fast. This is where a dedicated tool can completely change the game by automating the grunt work.

Platforms like PopaDex are built specifically to make this process painless. Instead of logging into multiple bank, investment, and loan websites, you can link your accounts to one central dashboard. This lets you use PopaDex as your go-to net worth tracker, freeing you up to focus on what the numbers mean rather than spending all your time just trying to find them.

From Tracking to Strategic Growth

Once you have clear, consistent data at your fingertips, you can shift from just watching your net worth to actively growing it. This is where you can spot opportunities to really accelerate your progress. For example, you might see that a single high-interest loan is dragging your numbers down and decide to attack it with everything you’ve got.

It also helps to understand the bigger economic picture. For instance, global financial wealth recently hit a record high of $305 trillion, with assets growing by over 8%. But this growth is shaped by complex factors, including the migration of wealth—a record 142,000 millionaires are expected to move to a new country in 2025.

While your personal finances are what matter most, seeing these larger trends provides context. It helps you understand the environment you’re operating in. Tracking your net worth is more than an accounting chore; it’s the foundation for building a proactive, informed, and ultimately successful financial life.

Common Questions About Calculating Net Worth

Even after you’ve crunched the numbers, it’s normal to have a few questions lingering. Calculating your net worth seems straightforward, but the details can leave you wondering if you’ve got the full picture. Let’s clear up some of the most common sticking points so you feel confident in your final number.

This isn’t just about getting a number; it’s about understanding what that number truly means for your financial story.

How Often Should I Calculate My Net Worth?

For most people, a quarterly check-in is the sweet spot. It’s frequent enough to see meaningful progress and make timely tweaks to your budget or investment strategy, but not so often that you’re obsessing over minor day-to-day market swings.

If that feels like too much, an annual calculation is the bare minimum. This gives you a clear year-over-year view of your progress and is essential for long-term planning. The most important thing is consistency—just pick a schedule you can stick with.

What if My Net Worth Is Negative?

Seeing a negative number can feel like a gut punch, but it’s incredibly common—especially early in your career. If you’re carrying significant student loans or a new mortgage, your liabilities can easily overshadow your assets for a while.

A negative net worth isn’t a report card on your financial discipline. Think of it as your starting line. It’s the baseline from which you build a smart plan to tackle debt and strategically grow your assets.

Should I Include My Car in My Net Worth?

Absolutely. A car is often a significant asset, and it belongs on your list. The key, however, is to be realistic about its value. You should always use its current resale or market value, not what you paid for it. A quick look at a site like Kelley Blue Book or Edmunds will give you a solid, up-to-date number.

At the same time, don’t get lost in the weeds trying to value every piece of furniture you own unless it’s a high-value collectible with a clear market price. The goal is to be thorough, not exhaustive.

How Does My Net Worth Compare to Others?

It’s human nature to wonder how you stack up against national averages, but try to resist the urge. Everyone’s financial journey is completely unique, shaped by different careers, life events, and opportunities. The only comparison that truly matters is you versus you.

Are you making consistent progress toward your own goals? That’s the real measure of success. Focusing on your own trajectory is far more productive than comparing your Chapter 5 to someone else’s Chapter 20.

Ready to ditch the spreadsheets and start tracking your net worth automatically? PopaDex brings all your accounts into one simple, clear dashboard so you can see your full financial picture in real-time. Start your free trial today and take control of your financial future.