Our Marketing Team at PopaDex

How to Calculate Savings Rate The Right Way

At its core, calculating your savings rate is simple. It’s just the percentage of your income that you manage to tuck away for the future. The most basic formula looks like this: (Total Savings / Net Income) x 100.

Think of this single number as your financial GPS. It tells you exactly where you are right now, so you can start mapping out a route to where you want to be.

Why Your Savings Rate Is the Most Important Number in Personal Finance

We get bombarded with financial metrics—credit scores, investment returns, net worth. And while they all have a role to play, your savings rate is the one thing you have almost complete, immediate control over. It’s a real-time indicator of your financial habits.

Honestly, it’s the single most powerful lever you can pull to fast-track your journey to financial freedom.

Knowing how to calculate your savings rate gives you an honest, unbiased look at how you’re balancing spending and saving. It cuts through the noise of complicated budgets and spreadsheets to answer one simple, crucial question: “Am I living within my means and actively building for my future?” The clarity that comes from this is incredibly empowering.

Fundamentally, this calculation is all about figuring out what slice of your take-home pay is being set aside instead of spent. Governments track this on a national level, too. For instance, the U.S. personal saving rate recently hovered around 4.6% of disposable income. You can dig into the official data from the Bureau of Economic Analysis to see how that number moves with the broader economy.

What Goes Into the Calculation

Before you can get an accurate number, you need to decide what you’re counting as “savings” and what you’re using for “income.” Nailing down these definitions is key to avoiding common mistakes and making sure you’re measuring your progress consistently from month to month.

Getting a firm grip on these components is the first step in truly understanding where your money is going, which is the whole point of learning how to track your cash flow.

Your savings rate isn’t just a number; it’s a reflection of your priorities. A higher rate means you’re buying yourself future freedom with today’s discipline. It’s the ultimate trade-off between present consumption and future security.

The goal isn’t to judge yourself based on the initial number you get. It’s about establishing a baseline. From there, you can set realistic goals and watch your progress over time. Whether you start at 5% or 50%, just the act of measuring it is the first, most important step toward mastering your money.

To make sure you’re comparing apples to apples, let’s break down what typically goes into each part of the savings rate formula. Getting this right from the start prevents confusion later on.

Savings Rate Formula Components at a Glance

| Component | What to Include | What to Exclude |

|---|---|---|

| Savings | Contributions to retirement accounts (401k, IRA), brokerage account transfers, cash savings, extra debt payments | Standard debt payments (e.g., minimum mortgage or car payment), transfers between your own checking accounts |

| Income | Your take-home pay (after taxes), side hustle income, any other regular cash inflows | Pre-tax (gross) salary, investment gains (unless realized as cash income), one-off windfalls like inheritances |

This table gives you a solid starting point for the standard calculation. As you’ll see later, you can tweak these definitions depending on what you want to measure, but consistency is always the most important thing.

Choosing Your Formula: Gross vs. Net Savings Rate

When you start tracking your savings rate, one of the first decisions you’ll make is what income figure to use. Should you base it on your pre-tax (gross) income or your take-home pay (net)? There’s no single right answer. Each approach tells a slightly different story about your financial habits.

Using your net income gives you a real-world, practical look at your budgeting chops. This is the actual cash that lands in your bank account after taxes and other deductions. A net savings rate shows you exactly how much of your spendable money you’re managing to put away each month. To get this right, you first need a solid handle on how to calculate net income.

On the flip side, calculating a gross savings rate offers a more holistic, big-picture view of your financial discipline. By measuring your savings against your total compensation before taxes, you get a clearer sense of your overall wealth-building efficiency. This method rightfully treats things like taxes and pre-tax 401(k) contributions as major parts of your financial picture.

Seeing Both Formulas in Action

Let’s walk through an example to see how this plays out. Meet Alex. We’ll use their numbers to calculate the savings rate both ways.

Here’s Alex’s monthly financial snapshot:

- Gross Income: $6,000

- Taxes & Deductions: $1,500

- Net Income (Take-Home Pay): $4,500

- Total Monthly Savings: $1,200 (This is made up of a $500 pre-tax 401(k) contribution plus $700 moved to a savings account).

Now, let’s crunch the numbers.

Net Savings Rate: ($1,200 Savings / $4,500 Net Income) x 100 = 26.7% This tells Alex that they’re successfully saving over a quarter of their available cash. It’s a powerful indicator of excellent budgeting and cash flow management.

Gross Savings Rate: ($1,200 Savings / $6,000 Gross Income) x 100 = 20% This figure shows Alex is socking away one-fifth of their total earnings. It provides a wider perspective on how they’re building wealth relative to their entire compensation package.

Which Method Should You Choose?

So, which number is better? Honestly, neither. They just answer different questions.

- Go with Net Income if: Your primary goal is to tighten up your monthly budget, get a handle on spending, and see how much of your usable cash you’re actually saving.

- Go with Gross Income if: You want that 30,000-foot view of your progress toward huge long-term goals like retirement, since it includes those important pre-tax contributions.

Your choice really boils down to your personal financial philosophy. Many economists, for instance, prefer focusing on disposable income, which is very similar to net income. We see this in large-scale economic data, too. For example, the household saving rate in the euro area was recently around 15.5%, calculated against disposable income.

The most important thing? Just pick one method and be consistent. Sticking with the same formula is the only way to accurately track your progress over time without muddying the waters. If you’re a bit fuzzy on calculating your income to begin with, our guide on how to calculate disposable income is a great place to start.

Advanced Calculations for Real-World Finances

The basic savings rate formula is a fantastic starting point, but let’s be honest—real-world finances are rarely that simple. Life gets complicated. We have retirement accounts, debt to pay down, and income streams that don’t always arrive like clockwork.

To move from a rough guess to a truly accurate measure of your financial health, you need to account for these moving parts.

What About Retirement Contributions?

One of the biggest questions I get is how to handle retirement savings. Money flowing into a traditional, pre-tax 401(k) or IRA is absolutely savings, even though it’s deducted before you even see your take-home pay.

For the most complete picture, you should add these pre-tax contributions back into both your Savings (the numerator) and your Income (the denominator) if you’re using gross income. This gives you credit for your total savings effort, not just what you save from your paycheck.

Post-tax savings, like a Roth IRA or Roth 401(k), are a bit simpler. Since you fund them with your net (after-tax) income, you just add the amount you contributed directly to your savings total.

Should I Count the Employer Match?

This is where personal philosophy comes in. There are two main schools of thought on counting your employer’s 401(k) match:

- The Big Picture View: Yes, count it. An employer match is a core part of your total compensation and dramatically accelerates your wealth-building. Including it shows the full scope of your growing retirement nest egg.

- The Personal Discipline View: No, leave it out. Some people prefer their savings rate to reflect only their own contributions and habits. They see the match as a fantastic bonus, but not a direct result of their personal savings discipline.

And then you have Health Savings Accounts (HSAs). If you’re using your HSA as a long-term investment vehicle for future healthcare costs (which is a great strategy!), it’s fair to count your contributions as savings. However, if you regularly dip into it for current medical bills, it’s acting more like a specialized checking account. In that case, you should only count the net increase in the account’s balance each month as savings.

Ultimately, the goal is to create a calculation that reflects your financial reality and what you want to measure. Consistency is king. Pick a method for handling these variables and stick with it month after month.

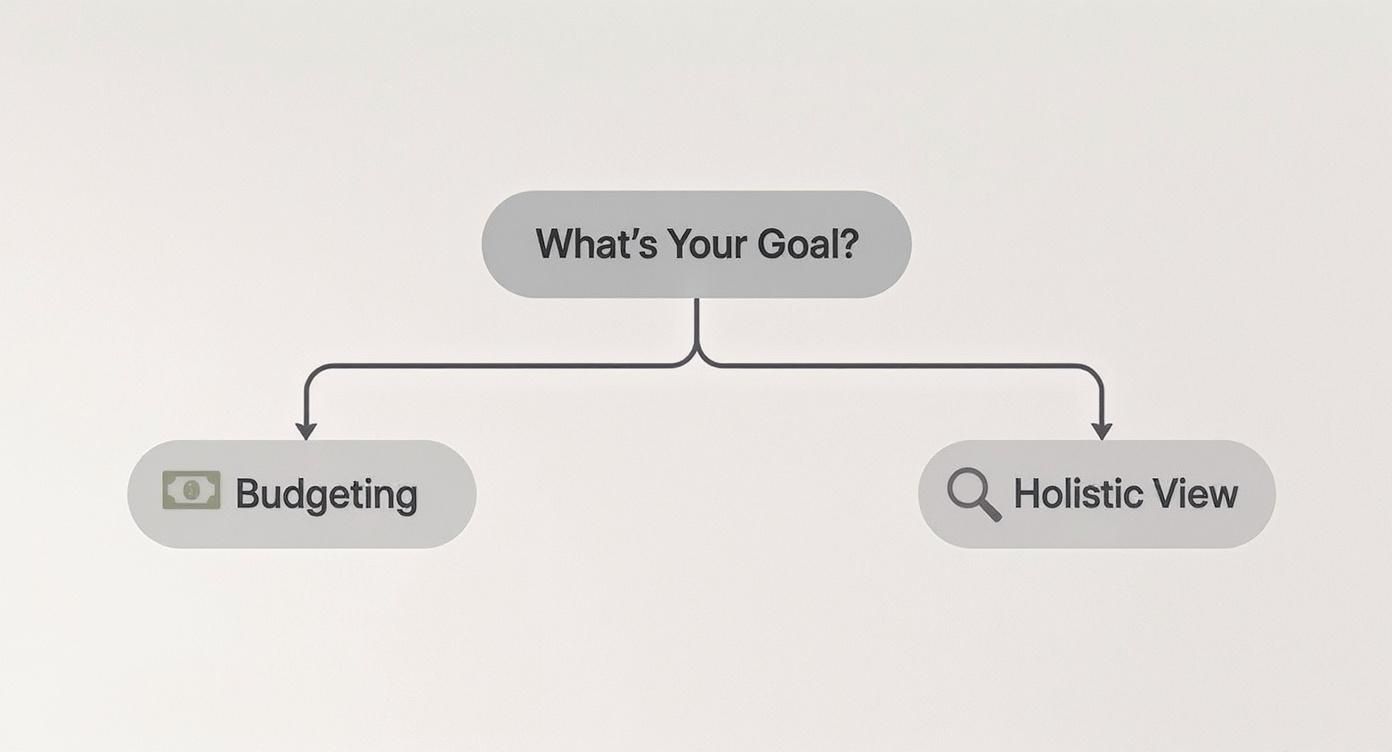

This handy decision tree can help you figure out which approach fits your goals.

As the infographic shows, a simple formula works great for day-to-day budgeting. But if you’re aiming for a complete financial overview, you’ll need to pull in more of these elements.

Tackling Debt and Irregular Income

Aggressively paying down high-interest debt, like credit cards or student loans, is another one of those gray areas. While your minimum payments are just another expense, any extra payments you make toward the principal are actively boosting your net worth. It makes a lot of sense to count these extra principal payments as part of your savings, because that money is directly improving your financial position.

What if you’re a freelancer, gig worker, or salesperson with an income that’s all over the place? Calculating a monthly savings rate can feel like a rollercoaster. A great month might show a 60% savings rate, followed by a dismal 5% the next.

To get a more stable and useful metric, switch to a rolling three or six-month average for both your income and your savings. This simple trick smooths out the peaks and valleys, giving you a much clearer view of your actual progress over time.

So you’ve calculated your savings rate. The first question that probably pops into your head is, “Okay… but is this any good?”

It’s tempting to look for a magic number, a universal benchmark that tells you you’re on the right track. But the truth is, the best target is deeply personal. A “good” savings rate is whatever aligns with your age, your income, and where you want to go in life.

Of course, there are some solid rules of thumb out there. You’ve probably heard of the popular 50/30/20 rule, which suggests putting 20% of your after-tax income toward savings and debt. That’s a fantastic starting point for building a strong financial foundation.

But your ideal rate might look completely different. Someone gunning for early retirement in their 40s? They might need to crank that rate up to 40% or even higher. On the flip side, if your main goal is a down payment in five years, a steady 15-20% might be the perfect sweet spot, letting you save without sacrificing your entire life today.

Think of your savings rate less like a grade on a report card and more like a tool for designing your future. The “right” number is simply the one that gets you to your goals on a timeline that feels both ambitious and sustainable.

Finding Your Personal Benchmark

Instead of fixating on a single number, take a step back and look at your own life and what you’re trying to achieve. Your target should be a direct reflection of your priorities.

- Your Age: If you’re young, time is your superpower. A consistent 15% saved over decades can work absolute wonders thanks to compounding. Closer to retirement? You might need to ramp things up to 25% or more to play catch-up.

- Your Income: Let’s be real—it’s easier to save a bigger percentage of a higher income. As your earnings grow, the key is to resist lifestyle creep. Try to save the majority of any raise instead of just spending more.

- Your Goals: Big, audacious goals demand a bigger savings rate. Becoming financially independent in 15 years requires a much higher contribution than just building up an initial safety net. For that first crucial goal, our emergency savings calculator can help you figure out exactly what to aim for.

Sometimes it helps to zoom out and see the bigger picture. On a national level, the concept looks a little different. A country’s gross saving rate is its total savings as a percentage of its GDP. According to World Bank data, Qatar has hit a staggering 57% in the past. On a global scale, domestic savings recently tallied up to about $28.8 trillion USD. These numbers are massive, but they show how saving is a fundamental engine of economic health.

The table below gives you a rough idea of how different savings rates can dramatically change your timeline to financial independence.

Savings Rate Goals for Different Financial Timelines

This table isn’t meant to be a strict prescription, but rather a guide to illustrate the powerful connection between how much you save and how quickly you can reach major financial milestones.

| Savings Rate (%) | Years to Financial Independence (Approx.) | Associated Goal |

|---|---|---|

| 10-15% | 40-50 years | Traditional retirement path, slowly building a nest egg over a full career. |

| 20-25% | 30-37 years | A solid rate for a comfortable, potentially early retirement. |

| 30-40% | 20-28 years | Accelerating towards financial freedom, often a target for the FIRE curious. |

| 50%+ | 10-17 years | Aggressively pursuing early retirement or other major near-term financial goals. |

Seeing the numbers laid out like this makes it clear: small increases in your savings rate can shave years off your working life.

Ultimately, the best savings rate for you is the highest one you can stick with consistently without feeling totally deprived. This is a marathon, not a sprint. Start with a target that feels realistic, track how you’re doing, and don’t be afraid to adjust it as your life and goals inevitably change.

Common Mistakes When Calculating Your Rate

It’s easy to think calculating your savings rate is just simple math, but a few common slip-ups can give you a number that looks great on paper but doesn’t actually reflect your financial reality. Getting this calculation right is the final, crucial step to make sure you’re tracking a metric you can actually trust for planning your future. Think of this as your final accuracy check before you start setting goals.

One of the most frequent mistakes is confusing money movement with actual saving. It feels productive to transfer a chunk of cash from your checking to your high-yield savings account and count it as “savings” for the month. But if you’re just shuffling funds between your own accounts, you haven’t actually saved anything new. It’s just moving money from one pocket to another.

Key Takeaway: True savings represent new money set aside from your income. Simply moving existing cash between your accounts doesn’t increase your net worth and shouldn’t inflate your savings rate calculation.

Forgetting Irregular Expenses

Another classic pitfall is overlooking those predictable but infrequent costs. You might feel fantastic about your 30% savings rate in October, but what about the holiday spending blitz coming in December? Or that annual car insurance premium that hits every March?

When you ignore these lump-sum expenses, you artificially inflate your monthly rate, which can lead to a false sense of security. Suddenly, a big bill comes due, and your “savings” have to cover it, revealing your true rate was much lower all along.

The simple fix here is to create “sinking funds.” Tally up the total annual cost of these items, divide by twelve, and treat that monthly amount as a regular expense. This smooths out your budget and gives you a much more honest picture of your real savings capacity year-round.

Misinterpreting Investment Gains

It’s an amazing feeling to watch your investment portfolio climb, but those unrealized gains are not part of your savings rate. Your rate measures the active contributions you make from your income—the money you consciously decide to put away. Market fluctuations are passive gains (or losses) and need to be kept separate from this calculation.

Here are a few other common errors to watch for:

- Counting Gross, Saving Net: Be consistent. If you use your gross (pre-tax) income as your denominator, make sure your numerator includes pre-tax savings like 401(k) contributions for an accurate picture.

- Ignoring Debt Principal: Only extra payments you make toward loan principal count as savings. Your minimum required payments are just expenses.

- Double-Counting: This one is sneaky. Be careful not to count a 401(k) contribution when it leaves your paycheck and again when it lands in your retirement account.

By steering clear of these simple mistakes, you ensure the number you calculate is a reliable tool. An accurate savings rate is your best guide for making smart financial decisions and confidently tracking your progress toward your biggest goals.

Savings Rate Questions We Hear All The Time

Even after you get the hang of calculating your savings rate, some specific questions almost always come up. Let’s tackle the most common ones to clear up any confusion and get you tracking with confidence. Think of these as the final pieces of the puzzle for making this metric a core part of your financial routine.

How Often Should I Calculate My Savings Rate?

While consistency is what truly matters, a great place to start is monthly. This rhythm lines up perfectly with most paychecks and budgeting cycles, giving you fast feedback on how your habits are playing out.

Calculating it monthly helps you spot trends before they become problems. You can see the immediate hit from a big, unexpected expense or, on the flip side, the satisfying boost from a “no-spend” week. For anyone with a more unpredictable income—freelancers, gig workers, you know who you are—a quarterly calculation using a three-month average can smooth out the bumps and give you a more stable, less stressful view of your progress.

What If My Savings Rate Is Negative?

First off, don’t panic. A negative savings rate just means you spent more than you earned in that specific time frame. It can happen to anyone. An emergency car repair, a planned vacation, or just a slow month for income can easily throw you into the red temporarily.

A one-time negative rate is just a data point, not a judgment on your character. But if you see a negative trend stretching across two or three months, that’s a clear signal your expenses are consistently outrunning your income. This is your cue to pull up your budget, see what’s going on, and figure out where you can dial things back to get into positive territory.

Your savings rate is a diagnostic tool, not a report card. A negative number is just the tool pointing directly at the area that needs your attention to improve your financial health.

Should I Focus More on Increasing Income or Cutting Expenses?

Honestly, it’s both. But where you start really depends on your specific situation. If you’ve already trimmed your budget down to the bone and there’s not much left to cut, your biggest lever is increasing your income. That could mean asking for a raise, learning a new skill to switch careers, or firing up a side hustle.

On the other hand, if you bring in a good income but still find saving to be a struggle, your energy is best spent on optimizing your expenses. Simply tracking where your money goes can reveal some surprising “leaks” you can plug, freeing up a lot more cash than you’d think. Ultimately, the winning combination is always a mix of earning more while also being intentional about where that money goes.

Ready to stop guessing and start tracking your financial progress with real precision? PopaDex pulls all your accounts into one clear dashboard, making it simple to see your savings grow and your net worth climb. Get started for free today and take control of your financial future.