Net Worth Tracker for Google Sheets

A Google Sheets template to track your net worth and plan your finances. Add your accounts, investments, property, and debts. See exactly where you stand.

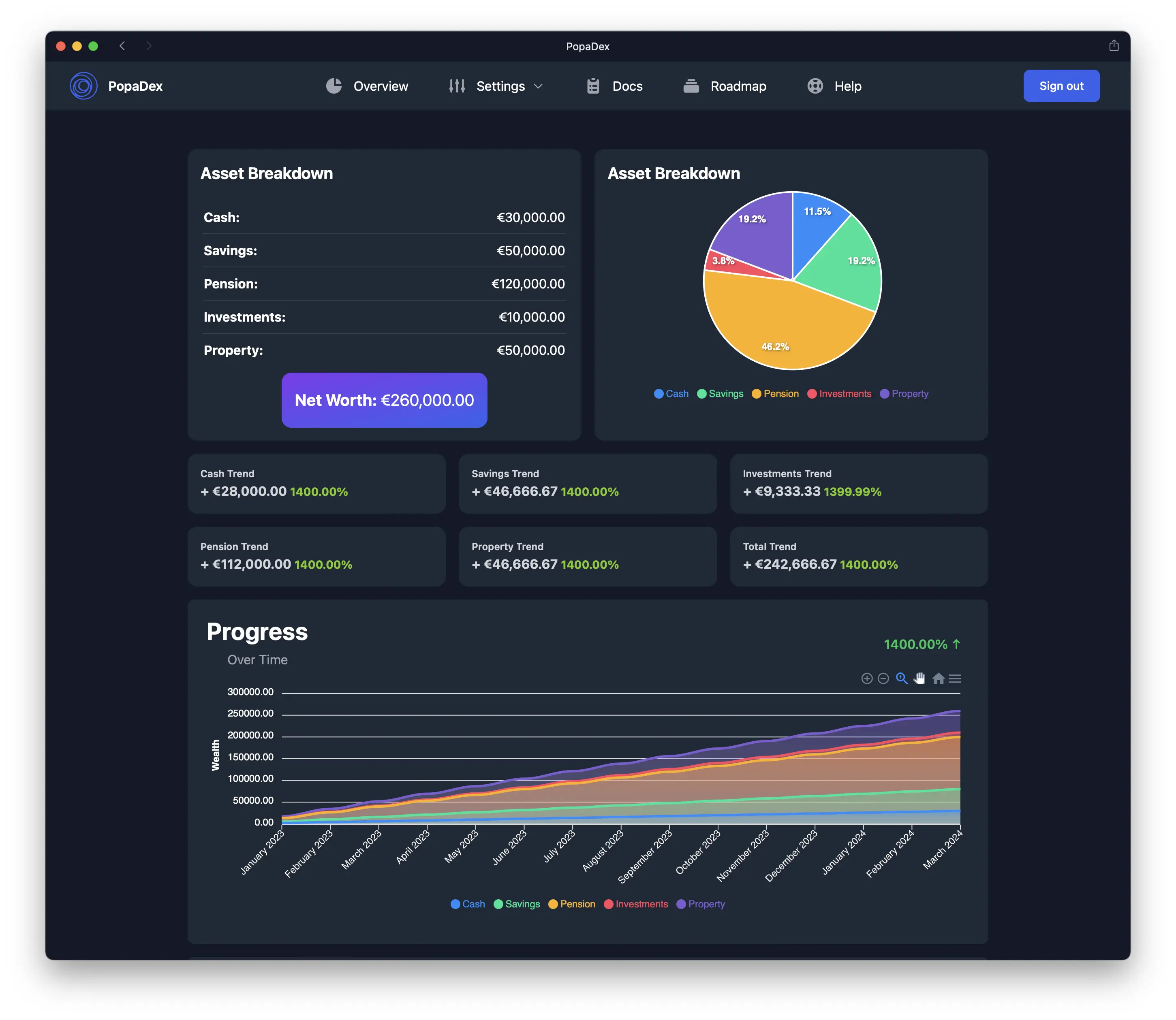

- Net Worth Tracker with Charts

- Assets and Liabilities Breakdown

- Early Retirement (FIRE) Calculator

- Sankey Diagram Generator Premium

- Rent vs Buy Calculator

- Monthly Budget Planner

Total Net Worth

$127,450

$45,200

+$1,200

$82,250

+$8,500

-$15,000

-$2,000

Get Your Google Sheets Template

Choose the version that fits your needs. Both work in Google Sheets or Excel.

Basic

Get started at no cost

- Net Worth Time Series

- Basic Asset Categories

- Basic Liability Categories

- Easy Export to PopaDex

Premium

One-time purchase, yours forever

- Everything in Basic

- Early Retirement Planning

- Real Estate Buy vs Rent Calculator

- Monthly Budgeting

- Sankey Cash Flow Diagrams

- Curated Personal Finance Resources

Want Automatic Bank Syncing?

If you prefer automatic updates instead of manual entry, try the PopaDex app. It connects to 15,000+ banks across 30+ countries and keeps your net worth up to date automatically.

Learn About PopaDex App

How to Use the Net Worth Tracker

Get started in under 10 minutes with these simple steps.

Make a Copy

Click the link, then File → Make a copy to save to your Drive

Add Assets

Enter bank accounts, investments, property, pensions

Add Liabilities

Enter mortgages, loans, credit cards, other debts

See Your Net Worth

Your total wealth is calculated automatically

Track Monthly

Update each month to see your wealth grow over time

Frequently Asked Questions

Common questions about tracking net worth with Google Sheets.

How do I track my net worth in Google Sheets?

Download a net worth tracker template, make a copy to your Google Drive, then enter your assets (bank accounts, investments, property, pensions) and liabilities (mortgages, loans, credit cards). The spreadsheet calculates your net worth automatically. Update it monthly to track progress over time.

Is the PopaDex Google Sheets template really free?

Yes, the Basic version is completely free with no signup required. It includes net worth tracking, asset and liability categories, and historical charts. The Premium version ($5 one-time) adds FIRE retirement planning, rent vs buy calculator, Sankey budget diagrams, and monthly budgeting tools.

What should I include when calculating net worth?

Include all assets: bank accounts, savings, investments (stocks, bonds, funds), retirement accounts (401k, IRA, pensions), property values, vehicles, and valuables. Subtract all liabilities: mortgages, car loans, student loans, credit card debt, and personal loans. The difference is your net worth.

How often should I update my net worth tracker?

Monthly updates work best for most people. This frequency captures meaningful changes without being overwhelming. Some people prefer quarterly updates if their finances are stable, whilst active investors may track weekly.

Can I use this template in Excel instead of Google Sheets?

Yes, you can download the Google Sheets template as an Excel file (File > Download > Microsoft Excel). Alternatively, PopaDex offers a dedicated Excel net worth tracker template optimised for offline use.

What is a good net worth for my age?

Net worth targets vary hugely based on income, location, and circumstances. A common rule of thumb is to have 1x your annual salary saved by 30, 3x by 40, and 6x by 50. However, the most important thing is tracking your progress over time rather than comparing to others. Use the template to see your personal growth trajectory.

How do I calculate my net worth manually?

Net worth = Total Assets − Total Liabilities. Add up everything you own (bank balances, investment values, property equity, pension pots) and subtract everything you owe (mortgage balance, loans, credit card debt). The result is your net worth, which can be positive or negative.

Learn More About Net Worth Tracking

Explore our guides to get the most out of your financial tracking.