Our Marketing Team at PopaDex

Net Worth: What It Means and How to Calculate It

Comprehending your net worth is essential for evaluating your financial health. When valuing your assets, exact figures aren’t necessary—ballpark values work well, particularly for tangible and illiquid items like collections. Key assets to consider include cash, retirement savings, investments, businesses, life insurance, your home, and property. Utilize online calculators, check market prices, consult guides, and err on the side of caution when estimating values. Net worth is the difference between your assets and liabilities, serving as a key indicator of financial status. To boost your net worth, you can either increase your assets or reduce your debts. According to the Federal Reserve’s Survey of Consumer Finances, net worth can vary based on income, age, race, and education. High-net-worth individuals often attract wealth managers keen to optimize their financial planning.

Understanding Net Worth

:max_bytes(150000):strip_icc()/net-worth-4192297-1-6e76a5b895f04fa5b6c10b75ed3d576f.jpg)

Credits: investopedia.com

Net worth is a financial metric that represents the difference between what you own (assets) and what you owe (liabilities). Essentially, it measures your financial health by providing a snapshot of your overall financial position at a specific point in time. Calculating your net worth involves summing the total value of all your assets and subtracting the total value of all your debts.

Knowing your net worth is important because it helps you understand your financial stability and plan for the future. It can act as a reality check, showing whether you are on track to meet your financial goals or if you need to make adjustments in your spending or saving habits. Monitoring your net worth over time can also highlight your progress and help you stay motivated to improve your financial situation.

The components of net worth include assets and liabilities. Assets can be classified into liquid assets (like cash and investments), and non-liquid assets (such as real estate and personal property). Liabilities encompass any debts you owe, including mortgages, personal loans, and credit card balances. Ensuring a good balance between your assets and liabilities is crucial for maintaining a healthy net worth.

Calculating Your Net Worth

Start by listing your assets, which include everything you own that has monetary value. This might be your house, car, stocks, bonds, bank accounts, and personal belongings like jewelry and electronics. Estimating the current market value of these items can give you a clearer picture of your total assets.

Next, list your liabilities. These are your financial obligations or debts. Include your mortgage, car loans, student loans, credit card debt, and any other outstanding debt. Make sure to write down the current balance for each liability.

Finally, subtract your liabilities from your assets to calculate your net worth. The resulting number gives you your net worth. It’s a crucial figure that can help you understand your overall financial health and plan for future financial goals. If the number is negative, it means you owe more than you own and may need to take steps to reduce debt.

Types of Assets to Consider

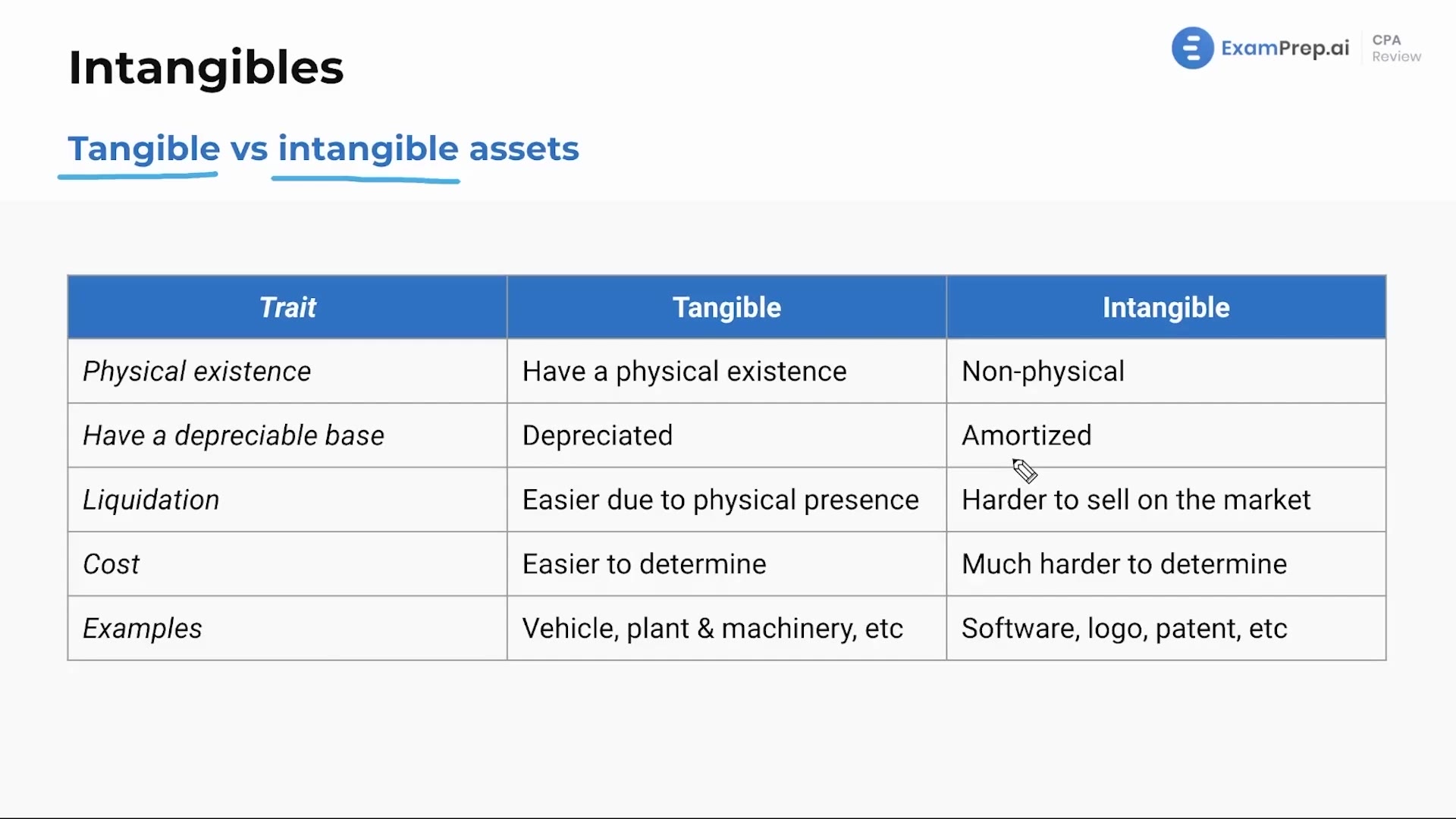

Credits: cpa.examprep.ai

When evaluating your net worth, it’s important to understand the difference between tangible and intangible assets. Tangible assets are physical items you can touch, such as real estate, vehicles, and jewelry. Intangible assets, however, are non-physical items like stocks, bonds, or intellectual property. Both types of assets contribute to your overall net worth but may require different methods for valuation.

Another critical aspect is distinguishing between liquid and illiquid assets. Liquid assets can be easily converted to cash with little impact on their value, such as checking accounts or publicly traded stocks. Illiquid assets, on the other hand, are harder to sell quickly without potentially losing value. Examples include real estate, collectibles, or shares in a private company. Understanding the liquidity of your assets helps in accurately assessing your financial situation.

Valuing your assets can be a bit tricky and generally requires a mix of methods. For tangible assets like real estate or vehicles, you can often find market values through listings or appraisals. Intangible assets might need more specialized valuation techniques, like discounted cash flow analysis for business interests or market comparisons for stocks and bonds. Ensuring accurate valuations will provide a more reliable picture of your net worth.

| Asset Type | Examples |

|---|---|

| Tangible Assets | Real Estate, Vehicles, Jewelry |

| Intangible Assets | Stocks, Bonds, Patents |

| Liquid Assets | Savings Accounts, Cash |

| Illiquid Assets | Property, Art Collections |

Using Tools for Estimating Net Worth

Online calculators provide a quick and simple way to estimate your net worth. You input your assets, such as your home, car, savings, and investments, and then list your liabilities, like loans and mortgages. These calculators then subtract liabilities from assets to provide an estimated net worth. These tools often update in real time with current market values, making them reliable and convenient.

Consulting professional guides can offer deeper insights into calculating your net worth. These guides typically include step-by-step instructions on how to properly assess the market value of various assets and accurately evaluate liabilities. They may also cover less obvious elements like retirement accounts, collectables, and business interests, providing a more comprehensive view.

Checking current market values is essential for an accurate net worth estimation. Market values fluctuate, so regularly updating the value of your assets can give a more precise figure. This involves looking at real estate appraisals, stock market indices, and other relevant financial information. Staying informed helps in making better financial decisions and knowing your true net worth.

Improving Your Net Worth

Increasing your assets is essential to improving your net worth. Start by regularly saving and investing in assets that appreciate over time, such as stocks, real estate, and retirement accounts. Diversifying your investments can also help reduce risk and enhance growth potential. Additionally, consider increasing your income by seeking career advancements, taking on side gigs, or creating passive income streams.

Reducing your liabilities is equally important in improving your net worth. Paying down high-interest debt, like credit card balances and personal loans, can free up more of your money for savings and investments. Create a budget to manage your spending and ensure that you live within your means. Prioritize essential expenses and look for ways to cut unnecessary costs.

Planning for long-term growth involves setting financial goals and creating a roadmap to achieve them. Regularly review and adjust your financial plans to ensure you stay on track. Consider consulting with a financial advisor to create a tailored strategy that aligns with your goals. By focusing on both short-term gains and long-term objectives, you can steadily build and maintain a robust net worth.

Factors Affecting Net Worth

Income levels significantly impact net worth. Higher income allows for increased savings, investments, and asset accumulation. Conversely, lower income often leads to higher debt and less opportunity to save. Financial stability and job security also play crucial roles in shaping one’s net worth over time.

Age and life stages are crucial in determining net worth. Younger individuals often have lower net worth due to student loans and entry-level salaries. As people age, they typically accrue more assets, such as property and retirement savings, boosting their net worth. However, major life events like buying a home or starting a family can temporarily impact net worth.

Educational background can greatly influence net worth. Higher education often leads to better job opportunities and higher earning potential. Individuals with advanced degrees tend to have higher incomes, which can translate to greater net worth. On the other hand, those with less education may face limited job prospects and lower income, affecting their overall financial health.

Net Worth and Financial Health

![]()

Credits: slideteam.net

Understanding your net worth is crucial for tracking your financial progress. It provides a clear picture of your current financial standing by subtracting your liabilities from your assets. Using a net worth calculator helps you see where you are and plan for where you want to be. Regularly updating this information ensures that you stay on top of your financial health.

Benchmarking your net worth against similar profiles can offer valuable insights. It allows you to see how you compare to others in similar situations. This comparison can reveal strengths and weaknesses in your financial strategy, providing guidance for adjustments. It can also offer motivation to continue positive financial behaviors or to correct course if needed.

Setting financial goals is an essential part of improving your net worth. Specific goals provide direction and make it easier to track progress. Whether you want to save for retirement, pay off debt, or invest in assets, having clear objectives makes it easier to achieve financial success. Using a calculator for net worth regularly can help you measure the impact of these goals on your overall financial health.

Frequently Asked Questions

1. What is net worth?

Net worth is the total amount of money you have after subtracting your debts from your assets.

2. Why is calculating net worth important?

It’s important because it gives you a clear picture of your financial health and helps you plan for the future.

3. How do you calculate net worth?

To calculate net worth, add up the value of everything you own, then subtract everything you owe.

4. What can I include as assets when calculating net worth?

Assets can include things like your house, car, savings, investments, and personal belongings.

5. What kinds of debts should I consider for my net worth?

Debts include things like your mortgage, car loan, student loans, credit card debt, and any other money you owe.

TL;DR: Net worth is the difference between your total assets and liabilities. It’s crucial for understanding financial health, guiding investment and saving strategies. To calculate, list assets and liabilities, and subtract liabilities from assets. Assets can be tangible (property) or intangible (stocks), and liquid (cash) or illiquid (real estate). Online tools and professional guides help estimate values. Improve net worth by increasing assets and reducing liabilities, planning for growth. Factors like income, age, and education influence net worth. Track progress, compare with peers, and set goals for financial well-being.