Our Marketing Team at PopaDex

Your 2025 Retirement Planning Checklist: 9 Essential Steps

Retirement isn’t an age; it’s a financial number. But reaching that number feels far less daunting when you have a clear, actionable plan. This comprehensive retirement planning checklist is designed to be your definitive, step-by-step guide, moving beyond generic advice to provide the specific strategies you need to build a secure and fulfilling future. It’s a blueprint for transforming abstract financial goals into concrete, achievable milestones.

Forget vague tips and surface-level suggestions. In this guide, we will break down the essential components of a robust retirement strategy. You will learn how to precisely calculate your financial needs, maximize every available retirement account, and develop a sophisticated investment portfolio. We will cover critical, often-overlooked areas such as planning for healthcare costs, minimizing your tax burden in your later years, and creating an estate plan that protects your legacy. Each item on this checklist is a crucial building block for your financial independence.

To effectively follow this checklist, you need a complete and real-time picture of your financial health. This is where modern tools become indispensable. For instance, using a comprehensive dashboard like PopaDex allows you to consolidate and track all your assets in one place, from your 401(k) and brokerage accounts to real estate and international investments. Seeing your total net worth grow as you tick off these items provides the clarity and motivation needed to stay on track. This guide gives you the what and the why; a unified financial view gives you the power to execute with confidence. Let’s begin building your personal blueprint for a secure retirement.

1. Calculate Your Retirement Needs

The foundational first step in any effective retirement planning checklist is determining exactly how much money you will need to live comfortably. This calculation goes beyond simple guesswork; it requires a detailed analysis of your future expenses, lifestyle aspirations, and potential financial changes. Without a specific target number, you are essentially saving without a map, making it difficult to gauge progress or make informed investment decisions.

How to Estimate Your Retirement Income Target

A widely accepted guideline, popularized by financial institutions like Fidelity and Vanguard, is the 70-90% income replacement rule. This suggests you will need to generate 70% to 90% of your pre-retirement annual income to maintain your current standard of living. For instance, a household earning $150,000 annually should aim for a retirement income between $105,000 and $135,000.

However, this is just a starting point. Your personal target may differ based on your specific circumstances:

- Lower Needs: If you plan to have your mortgage paid off, no longer have dependents, and anticipate lower work-related expenses (like commuting), you might only need 60-70% of your pre-retirement income.

- Higher Needs: Conversely, if your retirement vision includes extensive travel, expensive hobbies, or significant financial support for family, you may need 100% or even more of your pre-retirement income to fund that lifestyle.

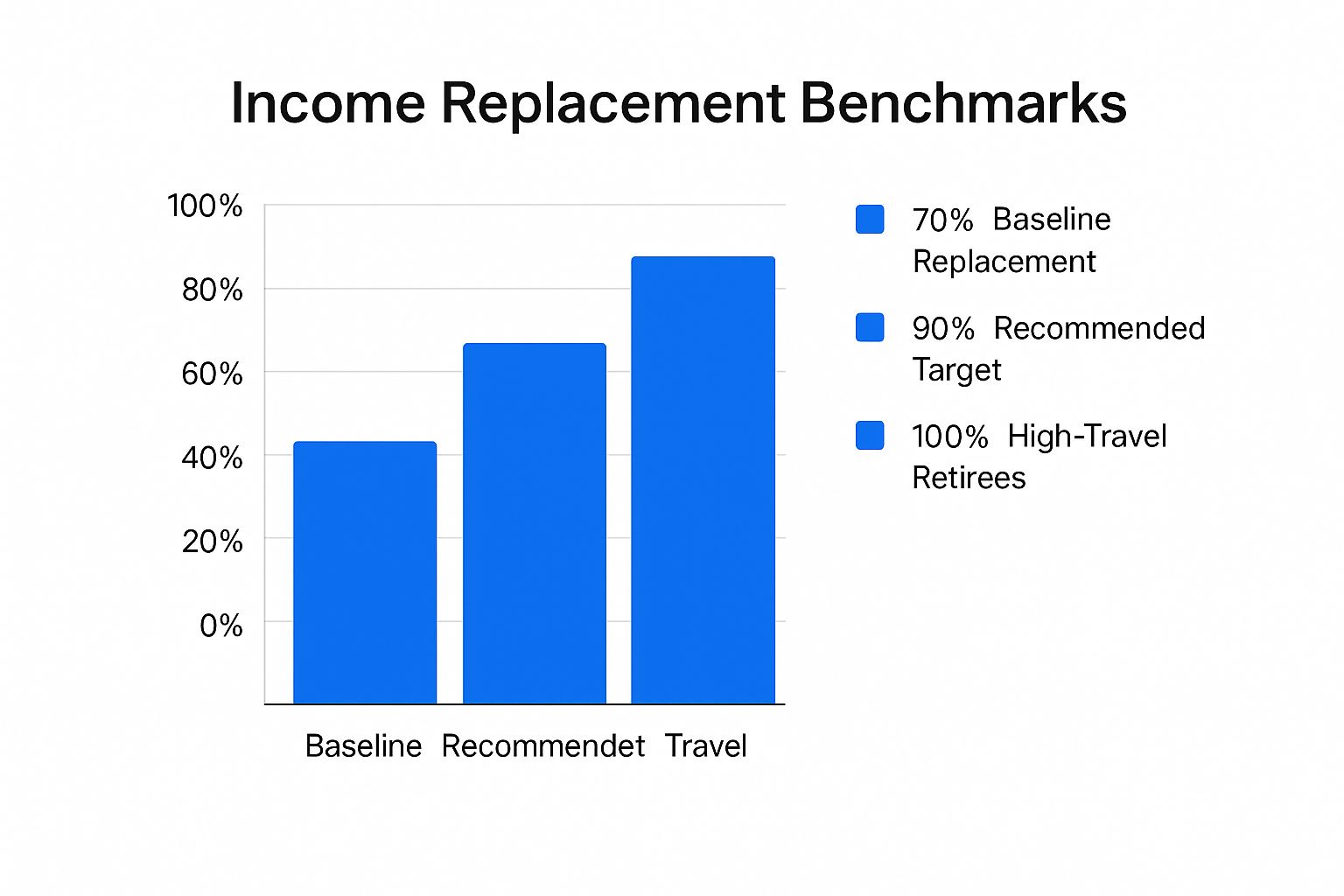

This bar chart compares common income replacement benchmarks to help you visualize different retirement goals.

The chart clearly shows that while a 70% replacement is a solid baseline, aiming for 90% or higher provides a significant buffer for discretionary spending and unexpected costs. For more guidance on setting your financial targets, explore our guide on financial planning for beginners.

2. Maximize Employer-Sponsored Retirement Plans

After establishing your target number, the next critical step in your retirement planning checklist is to leverage employer-sponsored plans like a 401(k), 403(b), or 457. These accounts are powerful tools designed to accelerate your savings through tax advantages, automated contributions, and, most importantly, the potential for an employer match. Ignoring these benefits is like turning down free money that could significantly compound over your career.

How to Make the Most of Your Workplace Plan

The single most important rule is to contribute enough to receive the full employer match. Many companies offer a matching formula, such as a dollar-for-dollar match up to 6% of your salary. If you contribute less than that 6%, you are leaving a guaranteed 100% return on your investment on the table. For example, on a $70,000 salary, contributing 6% ($4,200) could instantly become $8,400 with a full company match.

Consider these strategies to optimize your contributions:

- Automate Increases: Commit to increasing your contribution percentage by 1-2% each time you receive a pay raise. This “pay yourself first” strategy boosts your savings without impacting your take-home pay.

- Explore Roth Options: If your employer offers a Roth 401(k) or 403(b), evaluate if it fits your strategy. Roth contributions are made with after-tax dollars, meaning your qualified withdrawals in retirement are tax-free. This can be advantageous if you expect to be in a higher tax bracket later in life.

- Government & Non-Profit Plans: If you are a government or non-profit employee, you may have access to a 457(b) plan. In some cases, you can contribute to both a 457(b) and a 403(b) or 401(k) simultaneously, effectively doubling your tax-advantaged savings potential.

Regularly review your plan’s investment options and rebalance your portfolio at least annually to ensure your asset allocation aligns with your risk tolerance and retirement timeline. These plans, popularized by administrators like Fidelity and TIAA-CREF, are the bedrock of a successful retirement savings journey.

3. Open and Fund IRAs (Individual Retirement Accounts)

Beyond your employer-sponsored plan like a 401(k), an Individual Retirement Account (IRA) is an essential tool in a comprehensive retirement planning checklist. IRAs offer powerful tax advantages and significantly more investment flexibility, allowing you to build a diversified portfolio outside of your workplace plan. Opening an IRA gives you direct control over your retirement savings, making it a critical step for anyone serious about achieving financial independence.

How to Choose and Fund Your IRA

Financial services giants like Charles Schwab, Fidelity, and Vanguard have popularized IRAs as a go-to vehicle for personal retirement savings. The primary decision is choosing between a Traditional IRA and a Roth IRA. A Traditional IRA may offer a tax deduction on your contributions today, with taxes paid on withdrawals in retirement. A Roth IRA, funded with after-tax dollars, offers completely tax-free growth and tax-free withdrawals in retirement, a benefit heavily advocated by financial experts like Suze Orman.

Your personal circumstances will guide your choice:

- Traditional IRA: This is often a good fit if you are in a high tax bracket now and anticipate being in a lower one during retirement. The immediate tax deduction can provide significant savings.

- Roth IRA: Ideal for young professionals or anyone currently in a lower tax bracket. Paying taxes now allows you to lock in tax-free withdrawals later when your income and tax rate will likely be higher.

- SEP or SIMPLE IRA: These are excellent options for self-employed individuals or small business owners, as they allow for much higher contribution limits than traditional or Roth IRAs.

To maximize your IRA, consider setting up automatic monthly contributions directly from your bank account. This strategy automates your savings and takes advantage of dollar-cost averaging. Another effective tip is to use unexpected windfalls, like a tax refund or a bonus, to make a lump-sum contribution and get closer to the annual maximum limit. For those who exceed the income limits for direct Roth contributions, a “backdoor Roth IRA” conversion is a popular strategy to still access its tax-free benefits.

4. Develop a Diversified Investment Strategy

Once you have a retirement savings target, the next critical step in your retirement planning checklist is to build an investment strategy that can achieve it. Simply saving money is not enough; your capital must grow faster than inflation. A diversified investment strategy is the key to managing risk while pursuing long-term growth, ensuring your portfolio is resilient enough to weather market fluctuations.

How to Build a Diversified Portfolio

Diversification, the principle of not putting all your eggs in one basket, was famously formalized by Nobel laureate Harry Markowitz. It involves spreading your investments across various asset classes, sectors, and geographic regions. A well-diversified portfolio is tailored to your specific time horizon and risk tolerance.

Here are a few proven models for building your investment mix:

- The Three-Fund Portfolio: Championed by John Bogle, founder of Vanguard, this simple yet effective strategy involves investing in just three low-cost index funds: a total U.S. stock market fund, a total international stock market fund, and a total U.S. bond fund. This provides broad, cost-effective diversification.

- Target-Date Funds: These are “set it and forget it” funds that automatically adjust their asset allocation over time. They start with a higher concentration in stocks for growth when you are young and gradually shift toward more conservative bonds as your target retirement date approaches.

- The Rule of 100: A classic rule of thumb for asset allocation suggests subtracting your age from 100 to determine the percentage of your portfolio that should be in stocks. For example, a 35-year-old might allocate 65% to stocks and 35% to bonds.

The core principle is to avoid trying to time the market. Instead, create a balanced allocation and rebalance it periodically, typically annually or whenever an asset class drifts significantly from its target. This disciplined approach prevents emotional decision-making and keeps your strategy aligned with your long-term goals. To dive deeper into structuring your assets, explore our guide on portfolio analysis tools.

5. Estimate Social Security Benefits

A critical component of any comprehensive retirement planning checklist is understanding the role Social Security will play in your financial future. For the average retiree, Social Security replaces approximately 40% of pre-retirement income, making it a foundational element of your retirement funding. Accurately estimating these benefits and developing a smart claiming strategy is essential for maximizing your lifetime income and ensuring financial stability.

How to Estimate and Strategize Your Social Security Benefits

The Social Security Administration (SSA) calculates your benefit based on your 35 highest-earning years. However, the amount you receive is heavily influenced by when you decide to claim. While you can start as early as age 62, your payments will be permanently reduced. Waiting until your full retirement age (FRA), which is typically 67 for those born in 1960 or later, entitles you to your full benefit.

Delaying beyond your FRA provides a significant advantage:

- Delayed Retirement Credits: For every year you delay claiming past your FRA up to age 70, your monthly benefit increases by approximately 8%. Delaying from 67 to 70 results in a 24% higher monthly payment for the rest of your life.

- Spousal and Survivor Benefits: Your claiming decision can also impact the benefits available to your spouse. A higher primary earner’s benefit can lead to a larger survivor benefit, providing greater security for the surviving partner.

To get started, the first step is to visit the official Social Security Administration website. You can create a my Social Security account at ssa.gov to view your personalized statement, which includes your earnings history and estimated benefits at different claiming ages. Remember to factor in potential taxation; depending on your total income in retirement, up to 85% of your Social Security benefits may be taxable.

6. Plan for Healthcare Costs in Retirement

One of the most significant and often underestimated expenses in retirement is healthcare. Unlike predictable costs like housing, medical expenses can be volatile and substantial, making them a critical component of any comprehensive retirement planning checklist. Effectively planning for these costs involves understanding Medicare, evaluating supplemental insurance, and strategically using tax-advantaged accounts to build a dedicated health fund.

Neglecting to account for healthcare can quickly derail an otherwise solid financial plan, forcing you to draw down your savings much faster than anticipated. According to estimates from Fidelity, an average couple retiring today may need over $300,000 saved specifically for healthcare expenses throughout retirement, not including potential long-term care needs.

How to Prepare for Future Medical Expenses

The primary tool for most American retirees is Medicare, but it doesn’t cover everything. You must plan for premiums, deductibles, co-pays, and services that Medicare excludes, such as dental, vision, and most long-term care. A proactive strategy is essential.

Here’s how to build a robust healthcare plan:

- Maximize a Health Savings Account (HSA): If you have a high-deductible health plan, an HSA is a powerful retirement tool. It offers a triple tax advantage: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free. For 2024, you can contribute up to $4,150 for an individual or $8,300 for a family.

- Research Supplemental Insurance: Before turning 65, explore Medicare Supplement (Medigap) or Medicare Advantage plans. These policies help cover the out-of-pocket costs that original Medicare leaves behind, providing more predictable expenses.

- Consider Long-Term Care: The potential need for assisted living or in-home care is a major financial risk, with costs often exceeding $50,000 annually. Consider purchasing long-term care insurance in your 50s when premiums are more affordable.

By treating healthcare as a distinct and significant savings goal, you can better protect your retirement assets from being depleted by unexpected medical events. For tools to help you track and manage these specific savings goals, check out how PopaDex can help you manage your investment portfolio.

7. Minimize Taxes in Retirement

A crucial, yet often overlooked, part of any retirement planning checklist is developing a strategy to minimize your tax burden. How and when you withdraw your retirement savings can have a massive impact on how long your money lasts. Simply saving is not enough; you must also plan for a tax-efficient distribution phase to preserve your hard-earned wealth and maximize your net income.

How to Create a Tax-Efficient Withdrawal Strategy

The goal is to orchestrate withdrawals from your various accounts to keep your taxable income as low as possible each year. This involves understanding the three main types of accounts: tax-deferred (Traditional 401(k)s, IRAs), tax-free (Roth 401(k)s, Roth IRAs), and taxable (brokerage accounts). A common approach, advocated by tax experts like Ed Slott, is to “fill the tax brackets” by strategically combining withdrawals from each.

For instance, you might withdraw from your tax-deferred accounts only up to the limit of a low tax bracket, then supplement your income with tax-free Roth withdrawals or long-term capital gains from a taxable account, which are taxed at a lower rate.

Consider these powerful strategies:

- Roth Conversions: In years between retirement and age 73 (when Required Minimum Distributions begin), you may be in a lower tax bracket. This is an ideal time to convert funds from a traditional IRA to a Roth IRA, paying taxes now at a lower rate to enjoy tax-free growth and withdrawals later.

- Sequential Withdrawals: A popular strategy is to spend from your taxable brokerage accounts first. This allows your tax-deferred and tax-free accounts to continue growing for as long as possible.

- Managing Medicare Thresholds: Be mindful of your Modified Adjusted Gross Income (MAGI). Keeping it below certain thresholds can help you avoid higher Medicare Part B and D premiums, known as the Income-Related Monthly Adjustment Amount (IRMAA).

This strategic approach to withdrawals ensures you aren’t needlessly giving a large portion of your retirement funds to the IRS. For retirees living abroad or those with international assets, tax planning becomes even more complex. You can explore our guide on cross-border financial planning to understand these nuances better.

8. Create a Comprehensive Estate Plan

A crucial, yet often overlooked, part of a complete retirement planning checklist is establishing what happens to your assets after you’re gone. Creating a comprehensive estate plan ensures your wealth is distributed according to your wishes, protects your heirs from unnecessary taxes and legal complications, and provides clear instructions for your end-of-life care. Without a plan, state laws will dictate how your property is divided, a process that can be lengthy, expensive, and contrary to your intentions.

How to Structure Your Estate Plan

An effective estate plan is more than just a simple will; it’s a collection of legal documents that work together to manage your legacy. This process, often guided by estate planning attorneys or facilitated by online services like LegalZoom, involves several key components designed to provide security and clarity for your loved ones.

Your plan should be tailored to your specific financial situation and family dynamics. Key elements to consider include:

- A Will or Trust: A last will and testament outlines how your assets should be distributed. For more complex estates or to avoid the probate process, a revocable living trust is often recommended. Special trusts can also serve specific purposes, like a special needs trust for a disabled beneficiary or a bypass trust for a married couple to maximize estate tax exemptions.

- Powers of Attorney: Designate a trusted individual to make financial and healthcare decisions on your behalf if you become incapacitated. This includes a durable power of attorney for finances and a healthcare power of attorney.

- Beneficiary Designations: Retirement accounts (like 401(k)s and IRAs) and life insurance policies pass directly to the named beneficiaries, bypassing your will. It is critical to keep these designations updated, especially after major life events like marriage, divorce, or the birth of a child.

Regularly reviewing your estate plan, ideally every 3-5 years or after a significant life change, ensures it remains aligned with your wishes and current laws. Communicating your plans with your family can also prevent confusion and conflict in the future.

9. Plan Your Retirement Lifestyle and Timeline

Beyond the spreadsheets and account balances, a truly successful retirement planning checklist must address the human element: what do you actually want to do with your time? Defining your ideal retirement lifestyle and setting a target date are not just daydreams; they are critical inputs that directly shape your financial targets and saving strategy. This step transforms your plan from a purely financial exercise into a life-centric goal.

How to Define Your Retirement Vision

Conceptualizing your future lifestyle involves more than just deciding you want to relax. Books like ‘Your Retirement Your Way’ by Alan Bernstein and resources from AARP emphasize a detailed, life-first approach. You must decide where you will live, how you will spend your days, and when you want this new chapter to begin. A clear vision provides the motivation needed to stick to your financial plan.

Consider these common retirement lifestyle models:

- The Relocator: Moving to a lower-cost-of-living state, like Tennessee or North Carolina, to make your retirement savings stretch further. This often involves leaving a high-tax area for one with more favorable retirement income tax laws.

- The Snowbird: Splitting time between two locations, such as spending winters in a warm climate and summers near family. This requires budgeting for two residences or consistent travel.

- The Adventurer: Pursuing an active retirement filled with extensive travel, new hobbies, or even starting a small passion-based business. This model typically requires a higher income replacement percentage.

- The Volunteer: Dedicating significant time to community service or charitable causes, which provides purpose but may involve its own set of travel or activity-related costs.

To make your vision a reality, try to visit potential retirement locations at different times of the year, not just during peak season. You should also carefully assess proximity to quality healthcare facilities and family members. It is wise to perform a “trial run” by spending a few weeks or a month living like a local in your desired destination before making a permanent commitment. Factoring in these lifestyle details ensures your financial plan is built to support the life you truly want to live.

Retirement Planning Checklist Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Calculate Your Retirement Needs | Moderate – requires data gathering and regular updates | Low to moderate – mostly calculations and projections | Clear financial goals and retirement budget | Early to mid-career individuals planning savings | Helps prevent shortfall; adjusts for lifestyle and inflation |

| Maximize Employer-Sponsored Retirement Plans | Low – enrollment plus automatic payroll deductions | Moderate – payroll integration, plan administration | Increased retirement savings with tax benefits | Employees with access to employer plans | Employer match offers free money; tax advantages |

| Open and Fund IRAs (Individual Retirement Accounts) | Moderate – requires account setup and management | Low to moderate – personal funding and investment decisions | Increased retirement savings with tax flexibility | Those seeking supplemental retirement savings | More investment options; Roth offers tax-free growth |

| Develop a Diversified Investment Strategy | High – requires ongoing portfolio management | Moderate – diversified investments and rebalancing | Balanced risk and growth over long term | Investors wanting to manage risk effectively | Reduces volatility; captures multiple market gains |

| Estimate Social Security Benefits | Low to moderate – involves benefit projections | Low – mostly informational and claiming timing | Optimized lifetime Social Security income | Near-retirees planning benefits timing | Guaranteed, inflation-adjusted income; survivor benefits |

| Plan for Healthcare Costs in Retirement | Moderate – understanding Medicare and insurance options | Moderate to high – may involve additional insurance and HSA funding | Reduced risk of unexpected medical expenses | All retirees, especially those with health concerns | Tax-advantaged HSAs; coverage for major health costs |

| Minimize Taxes in Retirement | High – complex tax planning and monitoring | Moderate – requires tax knowledge and management | Lower lifetime tax burden and optimized withdrawals | Retirees with multiple income sources | Flexibility in income; potential tax savings |

| Create a Comprehensive Estate Plan | High – legal complexity and regular updates required | Moderate to high – legal and professional fees | Proper asset distribution and reduced estate taxes | Individuals with significant assets or dependents | Avoids probate, minimizes taxes, protects heirs |

| Plan Your Retirement Lifestyle and Timeline | Moderate – requires detailed personal planning | Low to moderate – may involve relocation or lifestyle costs | Improved retirement satisfaction and cost estimation | Anyone wanting a defined retirement vision | Clear goals; better cost and lifestyle preparation |

From Checklist to Confidence: Your Next Move

The journey from your first paycheck to your last day of work is long, and a secure retirement is the ultimate reward for decades of diligence. This comprehensive retirement planning checklist has provided you with a strategic roadmap, moving beyond generic advice to offer a granular, actionable framework. We’ve navigated the essential milestones: calculating your specific needs, maximizing tax-advantaged accounts, diversifying investments, and even planning for the less tangible aspects like healthcare and estate management.

Viewing this guide not as a one-time task but as a dynamic financial blueprint is the key to success. A checklist, by its nature, can feel static. However, your financial life is anything but. Market conditions shift, personal goals evolve, income levels change, and new opportunities arise. The true power of this retirement planning checklist emerges when it becomes a living document, a tool you revisit quarterly or annually to recalibrate your strategy and measure your progress.

The Power of Consistent Action

The difference between a vague retirement dream and a tangible, achievable goal is consistent, focused action. It’s not about making one perfect investment; it’s about the cumulative effect of thousands of small, disciplined decisions over time.

- From Abstract to Actionable: Instead of just “saving for retirement,” you are now equipped to “contribute the maximum allowable amount to my 401(k) and backdoor Roth IRA while maintaining a 70/30 stock-to-bond allocation.” This level of specificity transforms ambiguity into a clear set of instructions.

- Building Momentum: Tackling one item from this list today, such as using an online calculator to estimate your Social Security benefits or reviewing your 401(k) fund options, creates momentum. Each checked box builds confidence and makes the next step feel less daunting.

- The Compounding of Habits: Just as your investments compound, so do your financial habits. The discipline you build by regularly reviewing your retirement plan will spill over into other areas of your financial life, fostering a holistic sense of control and empowerment.

Key Takeaways for Your Financial Future

If you remember nothing else from this guide, hold onto these core principles. Mastering them is non-negotiable for anyone serious about achieving financial independence.

- Clarity is Your Greatest Asset: You cannot reach a destination you haven’t defined. The first step, calculating your retirement needs, is the most critical. It provides the “why” behind every subsequent action on this checklist. Without a clear target number, your efforts will lack direction and urgency.

- Automation is Your Best Defense: Willpower is a finite resource. Automate your savings and investments wherever possible. Set up automatic transfers to your IRA and automatic contribution increases in your 401(k). This strategy ensures you pay yourself first and protects your long-term goals from short-term emotional decisions or simple forgetfulness.

- A Holistic View is Essential: Retirement planning goes beyond investing. It’s an intricate web that includes tax strategy, healthcare planning, and estate law. Neglecting one area, like failing to create a will or underestimating medical costs, can severely undermine decades of diligent saving. A truly effective retirement planning checklist acknowledges and integrates all these interconnected pieces.

By systematically working through this guide, you are not just ticking boxes; you are building a fortress of financial security, brick by brick. You are transforming anxiety about the future into a well-founded confidence, backed by a clear strategy and measurable progress. Your future self will thank you for the foresight and discipline you commit to today. The path is clear, the tools are in your hands, and the rewarding journey toward a comfortable, worry-free retirement is yours to begin.

Ready to stop guessing and start tracking your progress with precision? PopaDex consolidates all your accounts, from 401(k)s and IRAs to international assets, into one powerful dashboard, giving you the real-time clarity needed to conquer your retirement planning checklist. Sign up for a free account at PopaDex and turn your financial plan into a visible reality.