Our Marketing Team at PopaDex

Calculate Down Payment on House With Confidence

So, you’re trying to figure out how much to put down on a house. The math itself is straightforward: take the home’s price and multiply it by your down payment percentage. For a $400,000 home with a 10% down payment, that’s simply $400,000 × 0.10, which comes out to $40,000.

Easy enough, right? The real challenge isn’t the calculation—it’s deciding on that percentage in the first place. This single number shapes how much cash you need upfront, what your monthly mortgage payment will be, and whether you’ll have to pay extra fees.

Quickly Estimate Your House Down Payment

Getting a handle on how different down payment percentages translate into actual dollars is the first step toward building a realistic home-buying budget. You’ve probably heard the “20% down” rule thrown around. It’s often touted as the gold standard, mainly because hitting that 20% mark lets you dodge Private Mortgage Insurance (PMI). But think of it more as a helpful guideline than a non-negotiable rule. Plenty of people buy homes with much less.

Free to start

Ready to track your net worth?

Connect your accounts and see your complete financial picture in under 2 minutes.

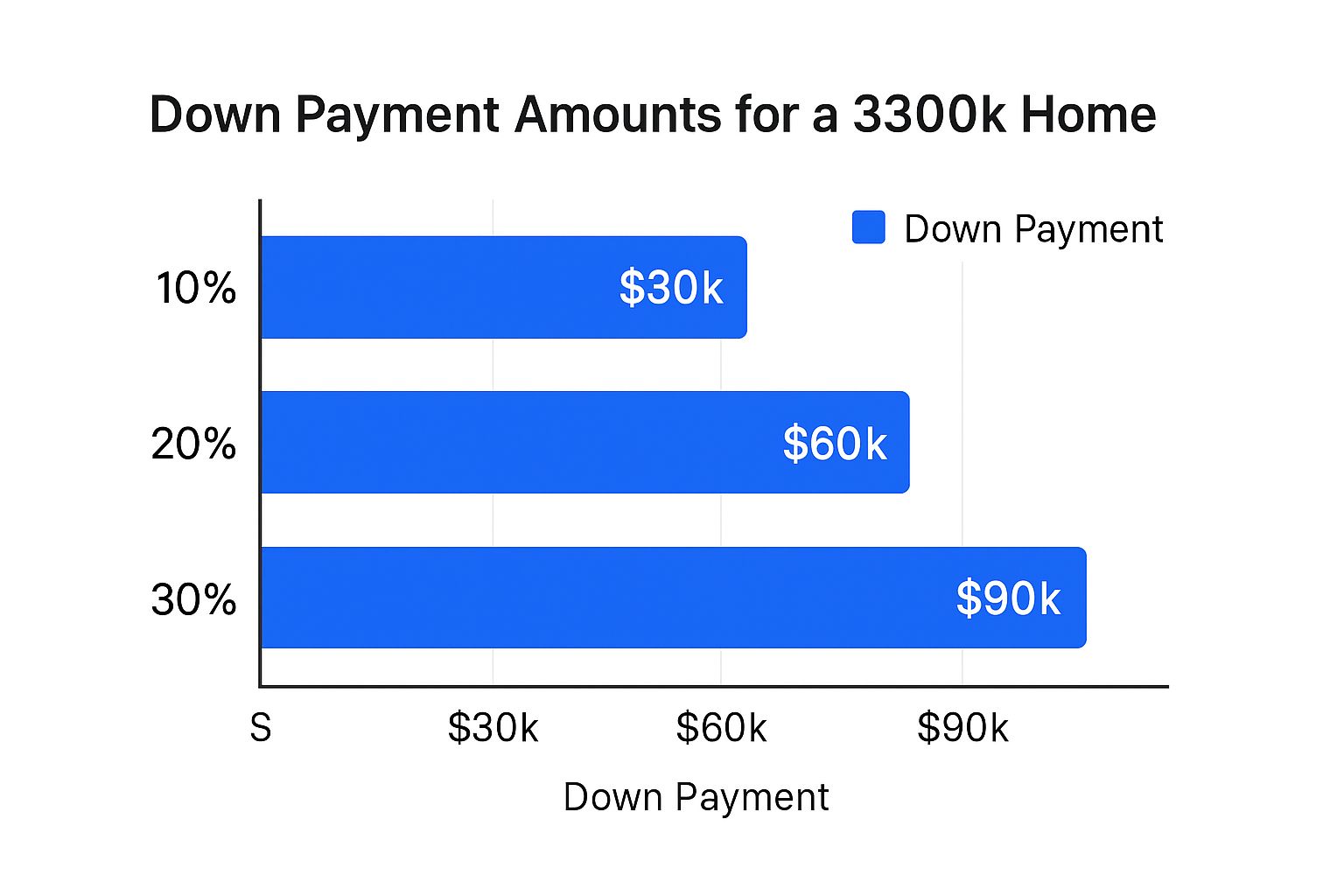

This image really puts it into perspective, showing how the cash needed for a $300,000 home changes with different down payments.

As you can see, jumping from a 10% down payment to 30% means you need to bring three times as much cash to the table. It’s a stark reminder of why smaller down payments are so appealing to many buyers.

What Is a Typical Down Payment?

The idea that every homebuyer is putting down a full 20% is one of the biggest myths in real estate. The reality is quite different, especially for younger, first-time buyers.

Across the board, the median down payment for all U.S. home buyers hovers around 13%. But for first-time buyers between the ages of 23 and 41, that number drops to a more manageable 8-10%. You can dig deeper into these trends and what they mean for your mortgage over at The Mortgage Reports.

Why the gap? It comes down to the wide variety of loan programs available, each with its own minimum requirements. Many people decide that getting into a home sooner is worth more than saving up for years just to avoid PMI.

Key Takeaway: Your down payment is a strategic choice, not a fixed requirement. It’s a personal balancing act between a lower upfront cost and a potentially higher monthly payment (thanks to PMI), based on your current finances and the market you’re in.

To help you visualize what this looks like for different price points, I’ve put together a quick reference table. It’s a great way to see how your down payment can change based on the home’s price and the percentage you choose.

Down Payment Scenarios for Common Home Prices

Use this table to quickly see how your down payment changes based on the home’s price and the percentage you decide to put down, from 3% to the traditional 20%.

| Home Purchase Price | 3% Down Payment | 5% Down Payment | 10% Down Payment | 20% Down Payment |

|---|---|---|---|---|

| $250,000 | $7,500 | $12,500 | $25,000 | $50,000 |

| $400,000 | $12,000 | $20,000 | $40,000 | $80,000 |

| $550,000 | $16,500 | $27,500 | $55,000 | $110,000 |

| $700,000 | $21,000 | $35,000 | $70,000 | $140,000 |

Seeing the numbers laid out like this makes it clear just how much flexibility you have. A 3% or 5% down payment can make homeownership accessible much sooner, even if it means a different long-term cost structure.

How Loan Types Influence Your Down Payment

The down payment you need for a house isn’t some fixed, universal number. It’s a moving target, and the biggest thing that shapes it is the type of mortgage you get. Different loan programs are built for different kinds of buyers, and each one comes with its own rulebook that can completely change how much cash you need upfront.

Think of it this way: your loan type is what dictates your down payment minimum. It’s the reason one person can buy a home with nothing down while someone else needs to bring tens of thousands to the table. Getting a handle on these options is the first real step to setting an accurate savings goal.

Comparing Common Mortgage Programs

Every loan has a different take on the down payment. You’ve got everything from zero-down options for military service members to government-backed loans designed to make homeownership more accessible.

Let’s break down the most common ones:

- Conventional Loans: These are the mortgages you get from a private lender, not backed by the federal government. While 20% down is the magic number to avoid Private Mortgage Insurance (PMI), it’s a common myth that you need that much. Many lenders offer conventional loans with as little as 3% or 5% down.

- FHA Loans: Backed by the Federal Housing Administration, these are a huge hit with first-time buyers. They make homeownership a real possibility by allowing down payments as low as 3.5%.

- VA Loans: This is a fantastic benefit for eligible veterans, active-duty service members, and surviving spouses. VA loans are one of the few options that typically require 0% down, completely removing one of the biggest financial hurdles.

- USDA Loans: If you’re looking to buy in a designated rural area, these government-backed loans are worth a look. They also offer a 0% down payment option for qualified buyers, encouraging growth in those communities.

A smaller down payment often means paying for mortgage insurance (like PMI on conventional loans). Don’t view this as a penalty. Instead, see it as a strategic tool that allows you to start building equity sooner rather than waiting years to save a larger sum.

Choosing the right loan goes far beyond just the initial payment—it shapes your entire financial journey as a homeowner. For a deeper look at getting your finances in order for such a huge purchase, check out our guide on how to budget money. It gives you a solid game plan for making sure your savings strategy lines up with your homeownership dreams.

Uncovering the Hidden Costs of Home Buying

It’s easy to get tunnel vision when you’re figuring out a down payment for a house. That one big number can feel like the only thing that matters. But if you focus too hard on it, you risk getting blindsided by the other major expenses that pop up at the end of the process. Your down payment is the star of the show, but closing costs are the expensive opening act you absolutely can’t skip.

These are all the fees required to finalize your mortgage and officially transfer the property’s title into your name. You can expect them to run between 2% and 5% of the home’s total purchase price. So, for a $400,000 home, you’re looking at an extra $8,000 to $20,000 that you need to have ready in cash. Ignoring this can turn the final days before you get your keys into a serious financial scramble.

Breaking Down Common Closing Costs

So, what exactly are you paying for with that extra chunk of change? While the specific fees will shift depending on your state and your lender, a few usual suspects appear on nearly every home purchase.

These aren’t just random fees tacked on; they’re designed to protect both you and the lender.

- Appraisal Fee: Your lender will hire an independent appraiser to confirm the home’s market value. This is non-negotiable, as it ensures they aren’t lending you more money than the property is actually worth.

- Title Insurance: This is a crucial one-time fee. It protects both you and the lender from any nasty surprises down the road, like a previously unknown heir or an old lien against the property.

- Loan Origination Fees: Think of this as the lender’s fee for doing all the administrative work—from underwriting your application to drawing up the final documents.

- Home Inspection: While sometimes technically optional, skipping a thorough inspection is a huge gamble. A good inspector can uncover hidden problems that could save you thousands in unexpected repairs later on.

For a buyer purchasing a bottom-tier home in a high-cost state like California, the monthly housing payment—including mortgage, taxes, and insurance—has seen an 87% increase since January 2020. Understanding every single cost, including closing fees, is more critical than ever to avoid financial strain.

Forgetting to budget for these extra expenses is a classic mistake, especially for first-time buyers. The best way to avoid this is to ask your lender for a “Loan Estimate” form as soon as possible. This document gives you a detailed breakdown of your projected closing costs and is your best friend for figuring out the total amount of cash you’ll really need to bring to the table.

A Real-World Home Purchase Calculation

Alright, let’s move past the theory and walk through a real-world scenario. This is where the rubber really meets the road, and you can see how to calculate a down payment and all the other costs that sneak in.

Imagine you’ve found a house you love listed for $400,000. After weighing your options, you’ve decided on a conventional loan and plan to put 10% down.

Figuring Out Your Initial Costs

First things first, let’s calculate the down payment. It’s the simplest part of the equation and the base number for everything else.

- Purchase Price: $400,000

- Down Payment Percentage: 10%

- Down Payment Amount: $400,000 × 0.10 = $40,000

Putting 10% down on a conventional loan means you’ll also have to pay Private Mortgage Insurance (PMI). That’s a recurring monthly cost you’ll pay until you’ve built up enough equity in your home. Before you get too far down the road, it’s a great idea to review a mortgage pre-approval checklist to make sure all your financial ducks are in a row.

Important Insight: Your down payment is just one piece of the puzzle. You also have to budget for closing costs—the fees needed to finalize the loan and officially get the keys.

Estimating Your Total Cash to Close

Closing costs can be a bit of a moving target, but they typically land somewhere between 2% and 5% of the home’s purchase price. For our $400,000 home, we’ll use a conservative estimate of 3%.

- Closing Cost Calculation: $400,000 × 0.03 = $12,000

Now, let’s add it all together. This gives you your “cash to close,” which is the total amount you’ll need to have ready on closing day.

- Down Payment: $40,000

- Estimated Closing Costs: $12,000

- Total Estimated Cash Needed: $52,000

As you can see, a 10% down payment on a $400,000 home requires a lot more than just the initial $40,000. This is a growing hurdle for many; recent data shows the typical down payment in the U.S. has climbed to 14.4% of the purchase price, largely because of rising home values.

Actionable Strategies for Your Down Payment Fund

Knowing your down payment number is one thing. Actually saving up that much cash? That’s the real challenge. But with the right game plan, you can build that fund faster than you might think. Let’s get past the usual “just spend less” advice and dig into strategies that actually move the needle.

Your first move should be opening a high-yield savings account (HYSA) just for your down payment. These accounts often have much better interest rates than what you’d get at a traditional bank, meaning your money is actually working for you while it sits. Even a small bump in the annual percentage yield (APY) can add hundreds of dollars to your savings over time without you lifting a finger.

Automate and Accelerate Your Savings

Consistency is everything here. A simple but powerful trick is to set up automatic transfers from your checking to your HYSA every time you get paid. This “pay yourself first” method builds your fund on autopilot.

You should also look into Down Payment Assistance (DPA) programs. Many state and local governments offer grants or even forgivable loans to help people buy homes. These programs can be a game-changer, seriously cutting down the amount you personally need to save.

A Quick Note on Gift Money: It’s common for family to chip in for a down payment. If this happens, your lender will need a formal “gift letter” to confirm the money isn’t a loan you have to repay. Getting this document in order is a small but crucial step for a smooth mortgage approval.

Even with a perfect plan, the market has its say. The U.S. housing market is expected to cool off a bit, with price hikes around 3% or less. While that’s good news, high home prices mean the down payment is still a major hurdle. J.P. Morgan’s research on the U.S. housing market outlook confirms this. For a deep dive into the nuts and bolts of building your fund, check out these strategies for saving for a house.

And as your savings grow, it’s smart to see how that fits into your total financial picture. Using a net worth calculator can give you that bird’s-eye view and keep you motivated as you get closer to your goal.

Common Questions About House Down Payments

Even after you’ve run the numbers and have a target down payment in mind, a few questions always seem to linger. Finalizing your financial plan for a home purchase is a huge step, and it’s completely normal to have some “what ifs.” Let’s tackle some of the most common ones I hear from buyers.

Is Putting 20 Percent Down Always the Best Move?

Honestly, not always. While putting 20% down is the gold standard for avoiding Private Mortgage Insurance (PMI) and snagging a lower monthly payment, it’s not a one-size-fits-all solution.

For some buyers, paying PMI for a while is a smart trade-off. It gets them into a home sooner, allowing them to start building equity, which is especially powerful in a housing market where values are on the rise. For others, holding onto that extra cash provides a crucial safety net for emergencies, other investments, or those inevitable home improvement projects that pop up. The right call really comes down to your personal financial situation, comfort with risk, and what you want to achieve in the long run.

Can I Use Gift Money for My Entire Down Payment?

Yes, you often can, but you have to play by the rules. Lenders are very particular about this. Most loan programs, including conventional and FHA loans, are perfectly fine with you using gift funds from a close relative to cover part or even all of your down payment.

The catch? You can’t just have someone hand you a check. Lenders will require a formal gift letter signed by the person giving you the money, stating clearly that it’s a true gift, not a loan that needs to be paid back. You’ll also have to show a paper trail, documenting the funds moving from their account into yours. My advice? Talk to your lender about this early in the process to make sure you follow their exact procedures and avoid any last-minute hiccups.

Key Takeaway: Using gift money is a fantastic option, but it demands careful documentation. Being proactive with your lender is the key to a smooth underwriting process.

What Exactly Are Down Payment Assistance Programs?

Think of Down Payment Assistance (DPA) programs as a powerful resource to help you get over the finish line. These programs are usually run by state, county, or city housing authorities to make buying a home more attainable for more people.

They generally come in a few flavors:

- Grants: This is the best kind of help—free money that you don’t have to repay.

- Forgivable Loans: These are loans that get forgiven over a certain number of years, as long as you stay in the home.

- Low-Interest Loans: These act as a second mortgage with low or deferred payments, helping you cover your upfront costs without draining your savings.

DPA programs are often geared toward first-time homebuyers or people who fall within specific income brackets. They’re designed for buyers who can comfortably handle a monthly mortgage but just can’t save up that massive lump sum for the down payment. It’s always worth investigating what your local DPA options are. Of course, this all works best when you have a solid grasp of your own finances, which is why it helps to first learn how to calculate disposable income to see what you can truly afford.

Ready to get a complete, real-time view of your financial life? PopaDex helps you track all your accounts, from savings and investments to property, in one simple dashboard. Take control of your financial goals by signing up for a free trial at https://popadex.com.