Our Marketing Team at PopaDex

How to Hedge Currency Risk Like a Pro

Hedging currency risk is all about protecting your money from the wild swings of the foreign exchange market. At its core, it means using financial tools like forward contracts or options to lock in an exchange rate for a future deal. This simple move can insure your portfolio against foreign exchange volatility, protecting your international investments or business revenues from getting wiped out by a bad currency day.

Why You Can’t Ignore Currency Risk

Ever had that sinking feeling when you check your international stocks, only to find your hard-earned gains have vanished? It’s easy to blame the company’s performance, but more often than not, the real culprit is the currency market. A sudden, unmanaged shift in exchange rates can quietly erase solid returns, turning a smart investment into a wash. This isn’t just bad luck; it’s an unmanaged risk that can seriously derail your financial goals.

Just crossing your fingers and hoping for the best is a losing game in today’s global economy. The sheer scale of the market is staggering—foreign exchange (FX) gross exposures have shot up by almost $2 trillion since the end of 2022. That surge shows you just how much money is flying around and how quickly things can change.

The Real Impact on Your Portfolio

Let’s paint a picture. Imagine you’re a U.S. investor who bought shares in a hot German tech company. The stock does exactly what you hoped, climbing 15% in euro terms. Fantastic! But over that same period, the euro tanks, weakening by 15% against the U.S. dollar. When it’s time to cash out and convert your investment back to dollars, that impressive 15% gain evaporates into thin air. You’re left right back where you started.

That’s currency risk in a nutshell. It adds a layer of volatility that has absolutely nothing to do with how good your investments are. Hedging is your buffer against this uncertainty.

Hedging is more than a defensive play to avoid losses. It’s a smart strategy for stabilizing your returns, taming portfolio volatility, and making your financial future a whole lot more predictable.

Stabilizing Returns Through Hedging

The point of hedging isn’t to chase extra profits; it’s to protect the ones you’ve already made. You’re essentially taking the unpredictable exchange rate out of the investment equation, letting you focus on the actual performance of your assets.

This brings a few powerful benefits to any global investor:

- Reduced Volatility: By locking in an exchange rate, you smooth out the rollercoaster highs and lows in your portfolio’s value that currency swings cause.

- Predictable Cash Flows: If you run a business with international customers, hedging ensures your revenue stays stable, making budgeting and planning far more reliable.

- Improved Risk-Adjusted Returns: Hedging does come with some costs, but it often leads to more consistent, dependable returns over the long haul.

The data backs this up. A long-term look at the MSCI ACWI Index revealed that currency hedging consistently reduced portfolio volatility by limiting the fallout from exchange rate swings. While its track record for outperforming unhedged positions was about 50/50, its real superpower was creating a much smoother ride for investors.

To really get a handle on managing these kinds of market forces, it helps to understand the bigger picture, which is covered well in a definitive guide to risk management in trading. Ignoring this risk is like leaving the back door wide open for the market to walk in and mess up your plans.

Pinpointing Your True Currency Exposure

Before you can hedge against currency risk, you have to know what you’re up against. A vague sense of worry about international markets won’t cut it. You need a precise, clear-eyed audit of your entire financial life to uncover every single source of foreign exchange (FX) exposure.

Only then can you build a strategy that actually protects your assets.

This process goes way beyond just glancing at your brokerage statement. Currency risk often hides in plain sight, embedded in assets and future plans you might not immediately consider. The goal is to create a complete inventory of everything you own (assets) and owe (liabilities) in a foreign currency.

Think broadly. Your exposure goes beyond stocks and bonds. You need to account for every corner of your financial world.

- International Investments: This is the most obvious one—stocks, bonds, and mutual funds denominated in currencies like the Euro (EUR), Japanese Yen (JPY), or Swiss Franc (CHF).

- Foreign Real Estate: Own a vacation home in Mexico or a rental property in London? The value of that property in your home currency swings daily with the GBP/USD or MXN/USD exchange rate.

- International Business Invoices: If you’re a freelancer or business owner with clients abroad, any outstanding invoices in a foreign currency represent direct exposure until they’re paid and converted.

- Future Financial Goals: Are you saving for a child’s university education in Canada or planning a big overseas trip? The funds you’re setting aside are exposed to every little shift in the CAD exchange rate.

Calculating Your Net Exposure

Once you have a complete list, the next move is to calculate your net exposure for each individual currency. This is a crucial step that prevents you from over-hedging or, even worse, under-hedging. The formula is refreshingly simple: just subtract your foreign liabilities from your foreign assets for each currency.

Net Exposure = (Total Assets in Foreign Currency) – (Total Liabilities in Foreign Currency)

This calculation gives you a single, actionable number. A positive net exposure means you win if the foreign currency strengthens and lose if it weakens. On the flip side, a negative net exposure (where liabilities exceed assets) means you actually benefit if the foreign currency weakens.

A Practical Scenario

Let’s bring this to life. Imagine a U.S.-based investor named Alex with a diverse international portfolio.

Here’s a simplified breakdown of Alex’s foreign assets and liabilities:

- Japanese Stocks: Valued at ¥15,000,000 (JPY)

- European Bonds: Valued at €75,000 (EUR)

- London Rental Property: Valued at £400,000 (GBP)

- Mortgage on London Property: A remaining balance of £150,000 (GBP)

Now, Alex calculates the net exposure for each currency:

| Currency | Assets | Liabilities | Net Exposure | Risk Profile |

|---|---|---|---|---|

| JPY | ¥15,000,000 | ¥0 | +¥15,000,000 | Exposed to JPY weakening |

| EUR | €75,000 | €0 | +€75,000 | Exposed to EUR weakening |

| GBP | £400,000 | £150,000 | +£250,000 | Exposed to GBP weakening |

With this clear risk profile, Alex no longer has a vague worry about “international markets.” Alex now knows the precise exposure to three different currencies and can make informed decisions about how to hedge each one.

This detailed audit is the foundation of any sound hedging strategy and a core component of effective cross-border financial planning. This clarity transforms abstract risk into a manageable variable, setting the stage for choosing the right hedging tools for the job.

Choosing the Right Hedging Tools for Your Goals

Once you have a clear picture of your currency exposure, it’s time to pick the right tools to manage that risk. The world of foreign exchange offers several instruments, each with its own personality, costs, and best-use cases. The key isn’t finding a single “best” option, but matching the tool to your specific financial situation, risk tolerance, and goals.

Think about it this way: a small business owner waiting on a payment from a European client in 90 days has totally different needs than a long-term investor holding a portfolio of Japanese stocks. One needs absolute certainty on a specific date, while the other requires a broader, more flexible strategy. Getting this match right is crucial for building a hedge that actually works.

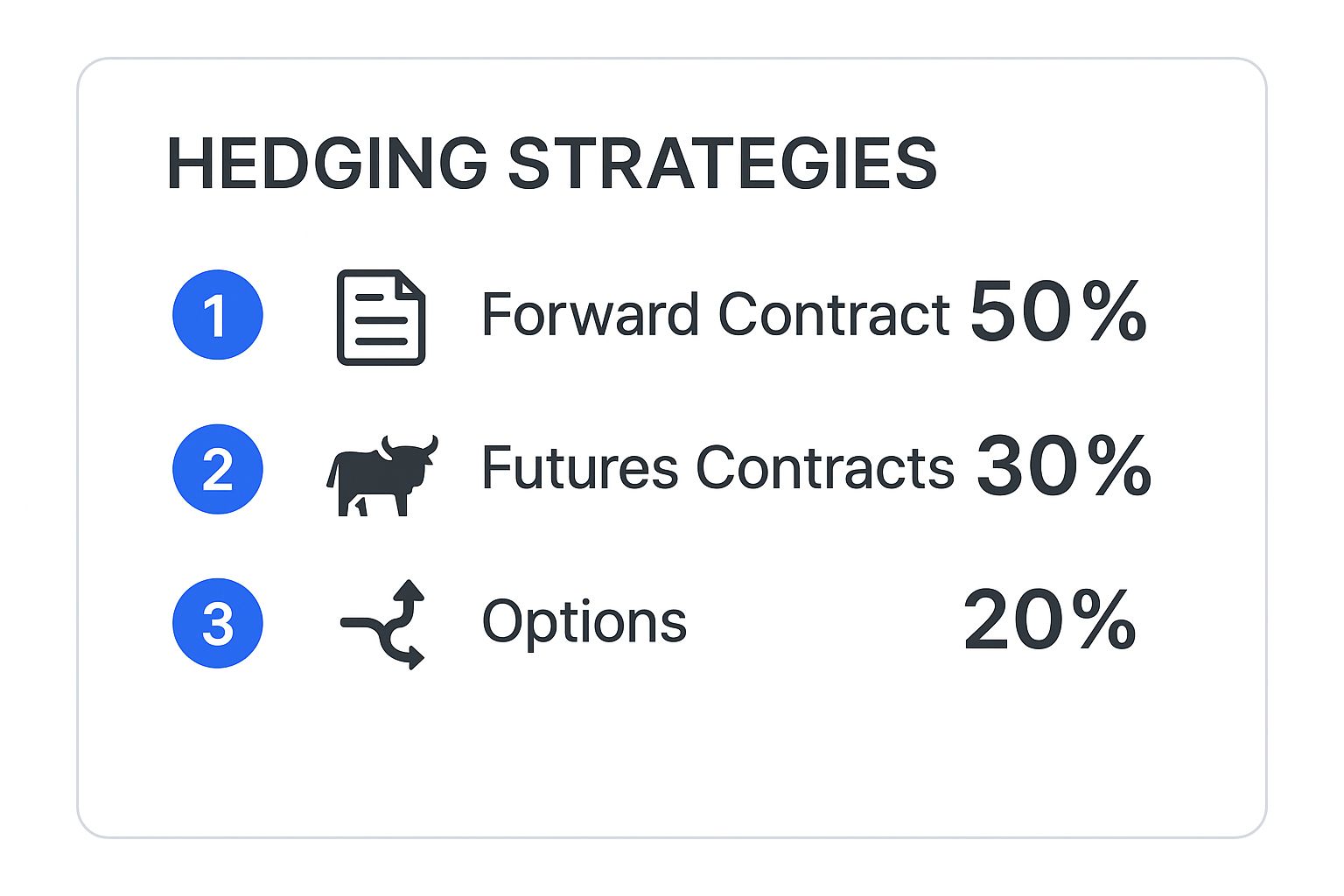

As you can see, forward contracts are the go-to choice for many, largely because they can be customized perfectly for commercial transactions. Let’s dig into why.

Forward Contracts: The Gold Standard for Certainty

A forward contract is a private agreement between you and a financial institution (like a bank) to swap a set amount of one currency for another on a future date, at a rate you agree on today. It’s the most direct way to lock in an exchange rate and kill any uncertainty about a future transaction.

Let’s say you’re a U.S. company that just sold goods to a British client and you’re due to receive £100,000 in three months. Your main worry is that the pound will weaken against the dollar, eating into your profits. You can enter a three-month forward contract to sell your £100,000 at today’s agreed-upon forward rate, say 1.2500 USD/GBP.

No matter what the GBP/USD spot rate does over the next three months, you are guaranteed to get $125,000. This level of certainty is invaluable for businesses that rely on predictable cash flow for budgeting and planning.

Forwards are ideal for specific, one-off transactions where you know the exact amount and date. Their biggest strength is taking all future exchange rate volatility completely off the table.

But there’s a catch. Because they’re custom-built, they aren’t very liquid. Trying to get out of a forward contract before it matures can be tricky and might cost you. If you’re just starting your financial journey, getting a handle on different asset types is a great first step. You can learn more by checking out our guide on how to start investing money.

A Quick Comparison of Hedging Instruments

To make sense of the main options, here’s a breakdown of the most common currency hedging tools. This table cuts through the jargon to help you decide which instrument fits your needs.

| Instrument | Best For | Key Advantage | Key Disadvantage | Typical Cost Structure |

|---|---|---|---|---|

| Forward Contracts | Businesses with specific, known future cash flows (e.g., invoices, payments). | Certainty. Locks in a future exchange rate completely, eliminating all risk. | Inflexible. Custom contracts are hard to exit or modify before maturity. | Spread between the spot rate and the forward rate. No upfront cost. |

| Futures Contracts | Speculators or those hedging standardized amounts who value liquidity. | High Liquidity. Easy to enter and exit positions on an exchange. | Standardized. Fixed contract sizes and dates may not match your exact need. | Brokerage commissions and potential for margin calls. |

| Currency Options | Investors wanting to protect against downside risk while keeping upside potential. | Flexibility. The right, but not the obligation, to transact. Capped downside. | Cost. Requires an upfront payment (premium) that is lost if the option expires unused. | The premium paid for the option, plus commissions. |

Each of these tools serves a different purpose. Forwards offer a perfect hedge for a known amount, futures provide liquid but less precise coverage, and options give you flexible protection at a price.

Futures Contracts: Standardized and Exchange-Traded

Like forwards, futures contracts also let you lock in an exchange rate for a future date. The big difference? Futures are standardized contracts traded on a public exchange, like the Chicago Mercantile Exchange (CME). This standardization brings its own set of pros and cons.

Here are the key features of futures:

- Standardized Sizes: Contracts come in fixed amounts (e.g., €125,000 or ¥12,500,000).

- Set Expiration Dates: They expire on specific, pre-determined dates during the year.

- High Liquidity: Since they’re traded on an exchange, you can buy or sell them easily before they expire.

The main drawback is the lack of flexibility. If you need to hedge €150,000, you can’t do it with a single futures contract. Futures also require a margin account, and your position is “marked-to-market” daily. This means if the currency moves against you, you could face a margin call, forcing you to deposit more money to cover potential losses.

Currency Options: Flexibility at a Price

A currency option gives you the right, but not the obligation, to buy or sell a currency at a set price (the “strike price”) on or before a specific date. You pay an upfront fee, called a premium, for this privilege. This flexibility is its greatest strength.

There are two main flavors:

- Call Option: Gives you the right to buy a currency.

- Put Option: Gives you the right to sell a currency.

Imagine you’re a U.S. investor with a portfolio of European stocks and you’re worried the euro will fall. You could buy a EUR put option. If the euro tanks, the value of your option goes up, offsetting the loss on your stocks. But if the euro strengthens? You can just let the option expire worthless. You only lose the premium you paid, while your stocks gain from the favorable currency move. It’s a structure that lets you protect your downside while keeping all the upside potential.

Putting Your First Currency Hedge into Action

Theory is one thing, but actually executing a currency hedge is where the lightbulb really goes on. Let’s walk through a real-world scenario to show you exactly how it’s done, taking you from a place of uncertainty to one of control.

Picture this: you’re a U.S.-based investor and a decent chunk of your portfolio is €100,000 worth of German automotive stocks. The gains have been great, but you’re starting to get nervous. The economic chatter coming out of the Eurozone is shaky, and you have a nagging feeling the Euro (EUR) might weaken against the U.S. dollar (USD), wiping out your hard-earned profits.

This is more than an imaginary worry. We’ve seen this movie before. During the 2008 financial crisis, for example, investors holding assets in the Korean won saw it plummet by 25.68% against the dollar. The Australian dollar wasn’t far behind, dropping 20.6%. Hedging was the key reason some international investors managed to sidestep those massive drawdowns. You can read more about how hedging dampens portfolio volatility when markets get rocky.

So, you decide it’s time to act. Your mission is simple: protect the dollar value of your €100,000 investment for the next six months.

Locking in a Rate with a Forward Contract

Your first move could be a forward contract—a straightforward and highly effective tool for this job. A forward contract lets you lock in an exchange rate today for a transaction that will happen down the road.

You’d start by calling a foreign exchange broker or the FX desk at your bank. You tell them you want to sell €100,000 for USD, with the deal settling six months from now. They’ll give you a six-month forward rate, which will probably be a little different from today’s “spot” rate due to the interest rate differences between the U.S. and the Eurozone.

Let’s say the broker offers you a six-month forward rate of 1.0850 USD/EUR. By shaking hands on this deal, you’ve just guaranteed that in six months, you will get exactly $108,500 for your euros (€100,000 * 1.0850).

The Takeaway: Just like that, the forward contract has eliminated your currency risk for the next six months. It doesn’t matter if the euro tanks to $1.02 or skyrockets to $1.15—your exchange rate is set in stone. You’ve created certainty.

Playing It Safer with a Currency Option

But what if you want a safety net without completely giving up the chance to profit if the euro strengthens? This is where a currency option comes into play. An option gives you the right, but not the obligation, to exchange your currency at a set price. Think of it like insurance.

To protect your position, you’d buy a EUR put option. This gives you the right to sell your euros at a predetermined “strike price.” Here’s the breakdown:

- Action: You buy a six-month put option covering €100,000.

- Strike Price: You select a strike price, say 1.0800 USD/EUR.

- Cost (Premium): This protection isn’t free. You’ll pay an upfront fee, known as a premium. It might be around 1.5% of the contract’s value, which in this case is €1,500 (or about $1,620 at today’s rate).

Now, let’s fast-forward six months and see how this plays out in two different scenarios.

Scenario A: The Euro Weakens The spot exchange rate has fallen to 1.0300 USD/EUR. If you hadn’t hedged, your investment would now be worth just $103,000. But since you have that put option, you can exercise your right to sell at the much better strike price of 1.0800, netting you $108,000. The hedge worked perfectly.

Scenario B: The Euro Strengthens The euro rallies, and the spot rate climbs to 1.1400 USD/EUR. In this case, exercising your option at 1.0800 would be a bad move. So, you simply let the option expire worthless. You’re out the $1,620 you paid for the premium, but you can now sell your euros on the open market for a cool $114,000. You got to keep all the upside, and the premium was just the cost of your insurance policy.

Deciding How Much to Hedge

The final piece of the puzzle is deciding whether to hedge the full 100% of your exposure. While hedging the entire €100,000 gives you maximum protection, it also has costs. And if you use a forward contract, it locks you out of any potential gains from a favorable currency swing.

This is why many investors choose a partial hedge. You might decide to hedge only 50% of your position (€50,000), for example. This approach gives you a middle ground—it softens the blow if the euro falls but still lets you participate if it strengthens.

Ultimately, the right percentage comes down to your personal risk tolerance and what you think the market will do next.

Managing Your Hedges for the Long Haul

Executing a currency hedge is a huge first step, but it’s definitely not the last. A solid hedging strategy isn’t something you can “set and forget.” Think of it less like building a permanent wall and more like actively steering a ship through constantly changing tides.

Your currency exposure isn’t a static number. It naturally shifts as your international investments grow or shrink, or as you add new foreign assets to your portfolio. This constant evolution means your initial hedge can quickly become outdated. You might end up under-protected or even over-hedged, which brings its own set of risks.

This is why regular check-ins are so critical. You have to make sure your strategy stays aligned with your actual exposure.

When to Reassess Your Hedging Strategy

The real key to long-term success is knowing when to make a move. Certain events should be immediate triggers, prompting you to pull up your portfolio and re-evaluate everything. If you wait too long, your protective measures might be useless right when you need them most.

You should plan to review your hedges on a set schedule—quarterly is a good rule of thumb—but you also need to be ready to react when the market sends a clear signal.

Here are some critical moments that absolutely demand a review:

- Significant Portfolio Changes: Anytime you buy or sell a substantial foreign asset, your net exposure changes. Your hedge has to be adjusted to reflect that new reality.

- Major Market Events: Geopolitical shifts, surprise election results, or big economic data releases can completely upend currency forecasts and force a strategic rethink.

- Central Bank Policy Shifts: When a central bank changes its tune on interest rates—either hiking them unexpectedly or signaling future cuts—it’s a massive red flag for currency markets. These moves directly impact the core drivers of exchange rates.

A common mistake is treating a hedge like a one-time transaction. The most effective programs involve a disciplined, calendar-based review process combined with the agility to respond to major economic news as it breaks.

The Lifecycle of a Hedge: Rolling Over Contracts

Many of the tools we use for hedging, like forward contracts and futures, come with fixed expiration dates. As a three-month or six-month contract approaches maturity, you’re faced with a choice: let it expire, or “roll it over”?

Rolling over a hedge simply means closing out the existing contract and immediately opening a new one for a future period. This is standard practice for maintaining continuous protection on a long-term investment. For instance, if your initial six-month forward contract on a EUR position is about to expire, you’d execute a new six-month contract to extend that protection without any gaps.

The rate for the new forward contract will be based on current market conditions, including the latest spot rate and the interest rate differentials between the two currencies. This process ensures your long-term assets remain shielded from currency risk. If you’re juggling various international assets, truly getting the hang of managing foreign exchange risk is fundamental to protecting your overall net worth.

Mastering the Psychology of Hedging

Perhaps the toughest part of managing a hedge is the mental game. It’s easy to stick with it when the currency moves against you; the hedge is making money and protecting your portfolio exactly as you planned.

The real test comes when the currency moves in your favor.

Imagine you’ve hedged your £250,000 UK stock portfolio against a fall in the British pound. Suddenly, the pound strengthens by 5%. While your stocks are now worth more in dollar terms, your hedge is showing a loss that cancels out that currency gain. The temptation to ditch the hedge and “let your profits run” can be overwhelming.

This is a classic behavioral trap. Abandoning your strategy mid-stream because of a short-term favorable move completely defeats the purpose of hedging in the first place. You’re reintroducing the very risk you wanted to eliminate. A successful long-term strategy requires the discipline to stick with your plan through both good and bad currency cycles, always remembering that its purpose is to reduce risk, not generate profit.

Common Hedging Mistakes and How to Avoid Them

The cheapest tuition in the world of investing is learning from other people’s mistakes. When you’re just getting the hang of currency hedging, it’s incredibly easy to stumble into a few classic traps. If you can sidestep these early on, your strategy will be far more effective right from the start.

The “Oops, I Hedged Too Much” Problem

One of the most common blunders is over-hedging. This is when your hedge is bigger than your actual exposure, which ironically creates a completely new risk you didn’t have before. It usually comes from a simple oversight—like hedging the full value of an overseas rental property but forgetting to subtract the mortgage you took out to buy it.

Suddenly, you’re not neutralizing risk; you’re making a speculative bet in the opposite direction. If the foreign currency strengthens, the loss on that oversized hedge could easily wipe out the gain on your actual net asset value.

The fix is simple: always, always base your hedge on your calculated net exposure, not the gross value of your assets.

Ignoring the “Hidden” Costs

Another major pitfall is not accounting for the real cost of hedging. Sure, a forward contract might look “free” because you don’t pay an upfront fee, but there’s always an embedded cost thanks to a concept called interest rate parity. This principle simply means the difference between today’s exchange rate (spot) and the future rate (forward) is tied directly to the interest rate difference between the two countries.

If you’re hedging a currency from a country with higher interest rates than your home currency, you can bet the forward rate will be less favorable. This creates a built-in cost that slowly but surely eats away at your returns. It’s a critical detail that trips up a lot of investors.

The real cost of hedging goes beyond the fees you can see. It’s baked into the economic reality of interest rate differentials. If you ignore this, you’re setting yourself up for some nasty surprises.

For instance, hedge costs—driven primarily by the interest rate gap between the USD and other major currencies—can swing wildly. These costs, calculated as the percentage difference between forward and spot rates, can make or break an investment. When costs are high, investors face a tough choice, as the expense can seriously erode returns. For a deeper dive, the Bank for International Settlements has some great insights on how interest rates impact hedging costs.

The Danger of Chasing the “Perfect” Hedge

Finally, a lot of investors get bogged down trying to create the “perfect” hedge. They start exploring complex options strategies or try to time the market perfectly, hoping to not only protect their downside but also score a profit from the hedge itself. This almost always backfires.

Remember why you’re hedging in the first place: it’s about managing risk, not generating profit. A successful hedge is one that smooths out the ride and makes your returns more predictable. It’s a defensive move, even if it means giving up a little potential upside.

To keep yourself out of trouble, just run through this quick checklist:

- Calculate Net Exposure First: Always subtract your foreign liabilities from your foreign assets before deciding how much to hedge.

- Understand All the Costs: Account for the obvious costs (like premiums) and the not-so-obvious ones that come from interest rate parity.

- Keep It Simple: Stick to straightforward strategies that align with your goals. There’s no prize for complexity.

- Focus on Defense: Your primary goal is to protect your portfolio’s value, not to place a bet on currency movements.

By keeping these points front and center, you’ll be well on your way to building a hedging strategy that actually does its job: protecting your investments from the wild swings of the FX market.

Common Questions About Currency Hedging

Once you move past the theory, the real-world application of hedging can feel a bit tangled. Let’s clear up some of the most common questions that pop up when you start putting these strategies into practice.

Is Currency Hedging Just for Big Institutions?

Not at all. While it’s true that large, custom forward contracts aren’t really accessible for individual investors, plenty of other tools are surprisingly affordable and easy to use.

Take currency-hedged ETFs, for example. They offer a straightforward, low-cost way to hedge your exposure in major international markets. The expense ratios are often just a fraction higher than their unhedged cousins, making them a go-to for many. On the other hand, options and futures come with direct costs like commissions and premiums and require a specialized brokerage account, so they’re better suited for seasoned investors with very specific goals.

Can I Actually Lose Money by Hedging?

Absolutely, and it happens through what’s known as opportunity cost. Let’s say you hedge to protect against the euro falling, but it rallies instead. Your investment in Europe is now worth more in your home currency, but your hedge will post a loss.

That loss is designed to offset the currency gain you would have otherwise pocketed.

The whole point of a hedge isn’t to make a profit. It’s to dial down uncertainty and protect you from nasty surprises. You’re effectively putting a cap on both your potential currency losses and your potential currency gains.

How Often Should I Revisit My Hedges?

Think of it as proactive maintenance, not a “set it and forget it” task. A good rhythm is to review your hedges quarterly or any time you make a big move in your portfolio, like buying or selling a significant foreign asset.

Big external events should also be a trigger. A central bank suddenly changing its interest rate policy or a major geopolitical event can scramble the currency landscape overnight. For hedges with an expiration date, like a three-month forward contract, you’ll need a plan to either close it out or “roll it over” as it gets close to maturity.

Ready to get a crystal-clear view of your total net worth, including all your multi-currency assets? PopaDex provides the tools you need to track everything in one place, so you can build a smarter, more effective hedging strategy. Start organizing your financial world today.