Our Marketing Team at PopaDex

Your Guide to a Net Worth Tracking Spreadsheet

A net worth tracking spreadsheet is so much more than a bunch of numbers in cells. Think of it as your personal financial dashboard—a single, powerful document that gives you immense clarity on where you stand and, more importantly, where you’re headed. It’s about taking true ownership of your financial story.

Why Your Spreadsheet Is Your Strongest Financial Ally

There’s a surprising psychological perk to engaging with your finances this way. When you manually enter your assets and liabilities, you develop a deep, almost intuitive feel for your financial health. It’s an intimacy that slick, automated apps can sometimes miss. Abstract goals suddenly become tangible progress you can actually see and measure.

This hands-on approach does wonders for reducing financial anxiety and firing up your motivation. Seeing your net worth tick up, even by a small amount, is powerful positive reinforcement. It’s the little push that encourages you to stick with your plan and make smarter money moves.

Free to start

Ready to track your net worth?

Connect your accounts and see your complete financial picture in under 2 minutes.

Fostering Financial Discipline

The simple act of opening your spreadsheet builds a routine. It forces you to look your spending, saving, and investing habits right in the eye, and to do it consistently. This ritual is what builds the discipline and accountability that are the bedrock of long-term wealth creation.

To really get the most out of your spreadsheet, you can pair it with the proven principles of wealth accumulation found in classic financial books. Your spreadsheet becomes the tool that tracks how well you’re applying these timeless strategies in your own life.

A Clear View of Your Progress

One of the best things about using a spreadsheet is the historical record it creates. By systematically capturing the end-of-month values for all your assets and liabilities, you build a timeline of your financial journey. This methodical tracking lets you see the real impact of your decisions—how paying down debt or making a new investment affects your overall wealth. It’s a game-changer. If you want a visual guide, you can see how to set up your sheet for historical tracking on YouTube.

By turning your financial data into a story, your net worth tracking spreadsheet moves from a simple calculator to a powerful motivator. It’s the difference between knowing your score and understanding the game.

This is more than data entry. It’s about building the narrative of your financial life, one month at a time.

Building Your Spreadsheet From the Ground Up

Alright, let’s roll up our sleeves and move from theory to practice. Starting with a blank Google Sheet or Excel file is genuinely the best way to create a net worth tracker that’s molded perfectly to your financial life. The goal goes beyond crunching numbers; it is to build a clear, logical dashboard that you can understand at a glance and update without any hassle.

At its core, everything hinges on one simple, powerful equation: Assets - Liabilities = Net Worth. We’re going to structure our entire spreadsheet around these two fundamental pillars. This is about more than just listing numbers; it’s about organizing your financial world in a way that tells a story.

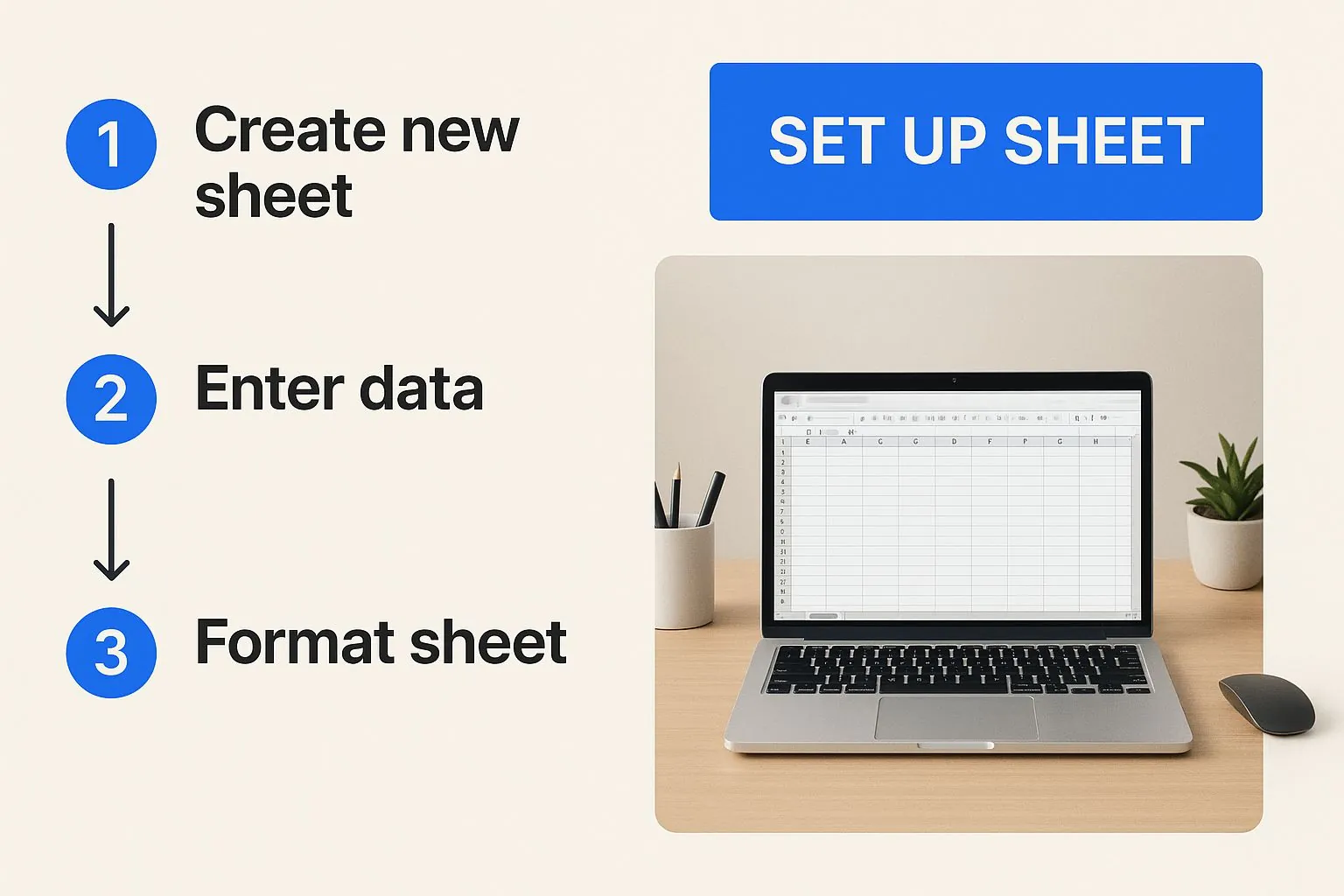

Ready to get started? The image below shows a clean, organized layout—the perfect blank canvas for your personal financial dashboard.

Think of this as the foundation. Once you have this basic structure on your computer, you can build anything on top of it.

First, Your Assets: What You Own

Let’s begin by creating a bold heading called “Assets.” This is the “plus” side of your financial ledger—everything you own that holds monetary value. To keep things clean and easy to read, we’ll break this down into a few logical subcategories.

A good starting point for most people includes:

- Cash & Equivalents: This is your most liquid money, the cash you can get your hands on quickly. Think checking accounts, savings accounts, high-yield savings accounts (HYSAs), and any money market funds.

- Investments: For many, this category becomes the engine of their net worth growth. You’ll want to list each investment account separately, such as your 401(k), Roth IRA, taxable brokerage accounts, or even a Health Savings Account (HSA).

- Real Estate & Physical Assets: Your primary home is often the biggest player here. You can also add investment properties, the current value of your vehicle, or even valuable collectibles if you have them. The key is to be consistent with how you value these items each month.

Under each subcategory, list the individual line items. So, under “Investments,” you might have separate rows for “Fidelity 401(k)” and “Vanguard Brokerage.” Once everything is listed, create a “Total Assets” cell at the bottom that sums it all up with a simple SUM formula.

Then, Your Liabilities: What You Owe

Next up, create a heading for “Liabilities.” This section is for your debts—everything you owe to others. Just like with your assets, categorizing your liabilities gives you a much clearer picture of your financial obligations.

I find it helpful to separate them by term:

- Short-Term Debt: This is where you’ll list things like credit card balances. I recommend listing each card on its own line. It’s a real eye-opener to see exactly where your high-interest debt is coming from.

- Long-Term Debt: This is for the big stuff with longer repayment timelines. Your mortgage, student loans, and auto loans are the most common examples.

For each liability, you’ll list the current outstanding balance. Your goal, of course, is to watch these numbers shrink over time. Finally, create a “Total Liabilities” cell and use another SUM formula to add up all your debts.

If you want a more automated way to pull all this together, PopaDex’s all-in-one net worth tracker can help organize these elements for you.

To help you get started, here’s a breakdown of common categories you can plug right into your spreadsheet.

Asset and Liability Categories for Your Spreadsheet

This table outlines common categories to include in your tracker, ensuring you capture a complete and accurate picture of your financial health.

| Category | Example Line Items | Why It’s Important |

|---|---|---|

| Cash & Equivalents | Checking Account, Savings Account, HYSA, Money Market | Tracks your liquidity and emergency fund. This is your most accessible capital. |

| Investments | 401(k), Roth IRA, Brokerage Account, HSA, Cryptocurrency | The primary engine for wealth growth. Separating accounts shows where your growth is coming from. |

| Physical Assets | Primary Home, Vehicle(s), Investment Property, Valuables | Often represents a significant portion of your net worth, especially real estate. |

| Short-Term Liabilities | Visa Credit Card, Amex Credit Card, Store Card | Highlights high-interest debt that can be targeted for quick pay-down. |

| Long-Term Liabilities | Mortgage, Student Loans, Auto Loan, Personal Loan | These are larger, foundational debts. Tracking them shows progress on major financial goals. |

Now for the magic moment. With your Total Assets and Total Liabilities calculated, the final step is the master formula. Find a prominent spot on your sheet—maybe right at the top—and create a cell that subtracts your “Total Liabilities” from your “Total Assets.”

That one number is your net worth. It’s the ultimate scorecard for your financial journey.

Creating Your Personal Financial Dashboard

A static spreadsheet is functional, but a dynamic dashboard is what truly brings your financial story to life. This is where we go beyond simple data entry and transform rows of numbers into visuals that motivate and inform. It’s about making your spreadsheet do the heavy lifting for you.

The first move is to create a new tab just for your historical data. I like to call mine “Monthly Log” or “Historical Net Worth.” At the end of each month, you’ll simply copy and paste the values for your total assets, total liabilities, and your final net worth figure. This small monthly habit is incredibly powerful—it builds an invaluable record of your financial journey over time.

Once you have a few months of data logged, you can build the most motivating visual of all: your net worth progress chart.

Visualizing Your Financial Progress

With your historical data ready, just select the columns for the date and your net worth. In either Excel or Google Sheets, head to “Insert” and pick a line chart. This simple graph becomes your single source of truth. Honestly, there’s nothing quite like watching that line climb upward to keep you laser-focused on your goals.

To make the data even easier to digest at a glance, let’s add some conditional formatting. This awesome feature automatically changes a cell’s color based on its value. For example, you can create a rule that highlights your monthly net worth change in green if it’s positive and red if it’s negative. It’s instant visual feedback on how you did that month.

Automating Your Investment Tracking

For those of you using Google Sheets, the GOOGLEFINANCE function is a game-changer. It can pull near real-time stock and ETF prices directly into your sheet. Forget manually updating the value of your VOO or TSLA shares—you can automate it.

The formula is pretty straightforward: =GOOGLEFINANCE("TICKER") * NumberOfShares.

So, if you own 10 shares of the Vanguard S&P 500 ETF (VOO), your formula would be =GOOGLEFINANCE("VOO") * 10. This brings a dynamic, real-time element to your investment tracking, cutting down on manual work and boosting accuracy. It’s a key part of building a truly effective net worth dashboard.

A great dashboard doesn’t just show you data; it gives you insight. It should answer the question, “How am I doing?” in seconds, using visuals and automation to highlight what matters most.

By adding these dashboard elements—historical logs, charts, conditional formatting, and live data—your net worth tracking spreadsheet evolves from a basic calculator into a sophisticated command center for your personal finances.

To see how to pull all these pieces together into a comprehensive tool, check out our guide on creating a net worth dashboard. This approach gives you the insightful, visual feedback you need to make smart decisions with minimal manual effort.

Keeping Your Financial Data Accurate and Consistent

Look, a pristine net worth tracking spreadsheet is only as good as the data you put into it. The real magic happens not when you build it, but when you commit to keeping it updated. This discipline is what turns a one-off project into a reliable financial compass you can trust for the long haul.

From what I’ve seen, the biggest hurdle people face is just falling off the wagon. The best way to beat this is to create a non-negotiable financial ritual. I’m a big fan of the “first Sunday of the month” approach. Block out 30 minutes on your calendar, pour your favorite drink, and make it a recurring date with your finances. It’s a simple habit that ensures you never get more than a few weeks behind.

How to Value Your Major Assets

While updating your bank and investment accounts is pretty straightforward, some assets need a bit more hands-on effort. The goal here isn’t pinpoint precision but consistent methodology. You need an apples-to-apples comparison month after month.

For your big-ticket physical assets, lean on reliable, third-party sources:

- Your Home: Use an online estimator like Zillow’s “Zestimate” or a similar tool. No, it’s not a formal appraisal, but it serves as a consistent benchmark for tracking market trends.

- Your Vehicle: Look up the private party value on a site like Kelley Blue Book (KBB). You can probably get away with updating this quarterly or semi-annually since car values don’t swing as wildly as your stock portfolio.

Using the same source every single time is the most important part. This makes sure any changes in your net worth are from actual market shifts or you paying down debt—not just because you switched up your valuation method.

Your spreadsheet’s accuracy comes down to a simple principle: GIGO, or “Garbage In, Garbage Out.” A consistent process for gathering and inputting your data ensures the output—your net worth—is a trustworthy snapshot of your financial health.

Avoiding Common Maintenance Pitfalls

Over time, it’s easy for small errors or forgotten details to creep in and mess with your data’s integrity. Just being aware of these common slip-ups is half the battle.

A frequent mistake is forgetting about small debts. That “buy now, pay later” plan for a new gadget or a small personal loan can be easy to overlook, but it definitely impacts your bottom line. Just do a quick mental scan each month for any new liabilities you might have picked up.

Another classic error is inconsistent valuation. If you use Zillow for your home value one month and then just a gut feeling the next, you’re introducing useless noise into your data. Stick to your chosen sources religiously to maintain a clean, reliable trend line.

To keep your net worth spreadsheet humming along, it’s worth adopting some essential spreadsheet best practices. Building good habits from the get-go will save you major headaches down the road. By committing to a consistent schedule and a repeatable process, you create a powerful tool that accurately reflects your financial journey, month after month.

Spreadsheet vs. Automated App: Which Is Right for You?

As powerful as a net worth tracking spreadsheet can be, you’ll eventually hit a fork in the road. Is it time to stick with your trusty, custom-built sheet, or should you switch to a slick, automated app?

This isn’t a simple case of one being better than the other. It’s about what fits your life right now. A spreadsheet offers you ultimate control, while an app delivers incredible convenience. The trick is knowing which one you need.

The main draw of automated apps is their “set it and forget it” magic. You connect your financial accounts just once, and the app takes over, constantly syncing your balances and transactions in the background. It’s a massive time-saver, especially if you’re juggling a bunch of different accounts. This hands-off approach completely removes the need for manual data entry and gives you a real-time financial snapshot whenever you want.

Of course, that convenience isn’t free. Most of the best apps come with a subscription fee, and you’re placing a significant amount of trust in a company to handle your sensitive financial data.

Evaluating the Pros and Cons

Let’s get practical and break down the differences to help you figure this out. A spreadsheet is king when it comes to customization and privacy. You can build it to track exactly what you want, how you want, with zero fees and total control over your information. It’s an amazing way to really learn the nuts and bolts of your finances.

On the flip side, automated apps come loaded with features that are a real pain to build into a spreadsheet. Think about things like:

- Automatic Account Syncing: No more logging into half a dozen different bank and investment portals every month.

- Investment Analysis: Powerful tools can break down your portfolio allocation and even spot hidden fees you didn’t know you were paying.

- Budgeting & Bill Tracking: Many apps bundle in spending analysis and send you reminders so you never miss a bill.

When you start looking at automated tools, you’ll often see comparisons between platforms like Quicken vs. QuickBooks, which offer deep financial tracking features that go way beyond a simple net worth number.

Making the Right Choice for You

So, when does it actually make sense to think about making a switch?

If your financial life has gotten more complicated—maybe you’ve added rental properties, started a side business, or built a diverse stock portfolio—the time you’ll save with an app could easily be worth the cost. Likewise, if you’re the kind of person who constantly forgets to update your spreadsheet, an app can provide the accountability and real-time data you need to stay on track. For a full rundown of your options, check out our guide to the best net worth tracker app.

The best tool is the one you’ll actually use consistently. If the manual upkeep of a spreadsheet feels like a chore, an automated app can keep you engaged with your financial progress.

Looking at the top trackers in 2025, Empower really stands out as a leading free option, boasting robust AES-256 encryption and some surprisingly deep investment analysis tools. Other tools, like Rocket Money, lean more into budgeting and typically charge a small monthly fee for their best features.

What’s clear is that the trend is moving toward all-in-one financial dashboards that combine net worth tracking with budgeting and investment monitoring. Ultimately, the choice between a spreadsheet and an app boils down to a personal preference: are you team control or team convenience?

FAQs About Your Net Worth Spreadsheet

Even the most straightforward spreadsheet can spark a few questions. I’ve been there. Getting these answers sorted out early on is the key to making this a lasting habit and ensuring your net worth tracking spreadsheet becomes a reliable financial compass.

How Often Should I Update My Spreadsheet?

This is probably the most common question I get. For just about everyone, updating your numbers once a month is the sweet spot.

A monthly check-in is frequent enough to keep you connected to your finances and spot any meaningful trends, but it’s not so often that it feels like a chore. Doing it monthly helps you ignore the distracting, day-to-day noise of market swings and see the real, long-term picture of your progress.

The secret to making it stick? Schedule it. Pick a time that works for you, whether it’s the last Friday of the month or the first Sunday. The specific day doesn’t matter nearly as much as making it a consistent financial ritual.

How Do I Value My Tricky Assets?

Okay, what about the stuff that doesn’t have a neat and tidy ticker symbol, like your house or your car? The goal here isn’t about finding some perfect, to-the-penny price—it’s about using a consistent source every single time.

- For your home: Pick an online estimator and stick with it. Zillow’s “Zestimate” is a popular, easy-to-use benchmark.

- For your vehicle: Pull the private party value from a site like Kelley Blue Book (KBB).

- For collectibles or private business equity: This is where you want to be conservative. Use the price you paid or a recent formal appraisal. If you have neither, make a conservative, good-faith estimate and use that same figure until you have a better one.

The key is consistency. Using the same valuation method every single month ensures that changes in your net worth reflect actual financial progress, not just a different way of guessing. This is what makes your data trustworthy over time.

What Are the Biggest Mistakes to Avoid?

Over the years, I’ve seen three pitfalls that can completely derail your tracking efforts: inconsistency, omission, and over-complication.

Being inconsistent with when you update or how you value assets will muddy your data, making it impossible to see your true progress. Forgetting things is just as bad; leaving out that small credit card debt or a new investment account gives you a dangerously false sense of security.

Finally, don’t over-complicate it. A spreadsheet with dozens of tabs and convoluted formulas might seem impressive, but it quickly becomes too much to maintain. Start simple, be thorough, and make consistency your number one priority.

Is It Safe to Use Google Sheets for Financial Data?

Yes, using a cloud spreadsheet like Google Sheets is generally safe, as long as you take a couple of common-sense security steps. Your sheet is protected by your Google account, so your first line of defense is a strong, unique password.

More importantly, you absolutely must enable two-factor authentication (2FA). This adds a critical layer of security that makes it incredibly difficult for an unauthorized person to access your account. As an extra precaution, never list full account numbers or other sensitive personal data in the spreadsheet, and be very careful about who you share access with.

Ready to move beyond manual entry and get real-time insights? PopaDex offers a powerful platform that connects all your accounts in one place, giving you an automated, live view of your complete financial picture. Start your free trial today and see just how effortless tracking your net worth can be.