Our Marketing Team at PopaDex

12 Best Personal Budget Spreadsheet Templates for 2025

In an age of sophisticated financial apps, the humble spreadsheet remains a powerhouse for personal finance management. Its unrivaled flexibility allows you to tailor every detail to your unique financial situation, from tracking daily expenses and irregular income to planning long-term wealth-building strategies. Unlike rigid apps that often come with subscriptions and privacy concerns, a personal budget spreadsheet template offers complete control and transparency, empowering you to truly understand your cash flow. This hands-on approach is fundamental to building strong financial habits.

This guide cuts through the noise to bring you the definitive list of the best personal budget spreadsheet templates available. We’ve curated top-tier options for Excel and Google Sheets, catering to everyone from gig-economy workers and young professionals to seasoned investors. Each entry includes a detailed analysis, screenshots, and direct download links to help you find the perfect tool to take command of your finances. While this guide focuses on leveraging spreadsheets for your personal budget, the foundation of financial well-being often starts much earlier. For insights into nurturing these crucial money skills from a young age, explore this comprehensive guide to financial literacy for kids. Let’s dive into the templates that will build your financial future.

1. Irregular Income Budget Template for Financial Stability

Best For: Freelancers, Gig Workers, and Contractors

Free to start

Ready to track your net worth?

Connect your accounts and see your complete financial picture in under 2 minutes.

The Irregular Income Budget Template from PopaDex stands out as a premier resource for a significant and often underserved demographic: individuals with variable monthly earnings. Traditional budget templates, built around fixed paychecks, falter when faced with fluctuating income. This specialized personal budget spreadsheet template directly addresses that gap, providing a robust framework engineered for financial unpredictability. It excels by helping users manage cash flow strategically across both high-earning and lean months.

This template empowers users to build a “buffer” and allocate funds based on realistic, rolling averages rather than static monthly figures. Its structure encourages a proactive approach, prompting you to set aside excess cash during prosperous periods to cover expenses when income dips. This methodology is critical for avoiding the common pitfall of lifestyle inflation during good months, which can lead to financial stress during slower times. By embracing income variability as a core principle, PopaDex delivers a tool that fosters genuine financial stability and peace of mind for the modern self-employed professional.

Key Strengths and Considerations

This resource is designed for easy download and integration, making it a highly practical choice. Its primary strength is its tailored design that moves beyond one-size-fits-all budgeting.

| Pros | Cons |

|---|---|

| Specifically engineered for fluctuating income streams. | Requires consistent manual updates of earnings and expenses. |

| Helps prevent overspending during high-income months. | Lacks the automated transaction import features of dedicated budgeting apps. |

| Provides a realistic framework for long-term financial stability. | The learning curve might be slightly steeper for absolute budgeting beginners. |

| Empowers freelancers to plan with confidence and reduce financial anxiety. | Best results are achieved when paired with separate income and expense tracking. |

Practical Tip: To maximize its effectiveness, dedicate a specific time each week to update the spreadsheet with your latest earnings and expenses. This consistent engagement is key to maintaining an accurate financial picture and making informed decisions. For a deeper dive into its features, you can explore the Irregular Income Budget Template for Financial Stability on popadex.com.

Availability: Free to download directly from the website. Link: https://popadex.com/irregular-income-budget-template/

2. Microsoft Create

For those already comfortable within the Microsoft ecosystem, Microsoft Create is an indispensable resource. It serves as an official hub for a vast collection of free, professionally designed templates directly from the source. This isn’t a third-party site; it’s Microsoft’s own library, ensuring seamless compatibility and a high standard of quality for anyone using Microsoft Excel.

The platform’s strength lies in its variety and official support. You can find everything from a simple monthly budget tracker to more complex household budget planners with charts and graphs. Because they are native Excel files, customization is straightforward. You can easily alter categories, change color schemes, and add formulas without worrying about compatibility issues. This direct integration is a significant advantage for users who prefer the robust functionality of a desktop application over a web-based one.

Key Features and Considerations

Microsoft Create excels at providing a reliable personal budget spreadsheet template for almost any need. The user experience is simple: browse, select, and download.

- Pros:

- Completely free to download and use.

- High-quality, professionally designed, and regularly updated templates.

- Perfect integration with Microsoft Excel for deep customization.

- Cons:

- Requires Microsoft Excel for full functionality, which is not free.

- Access is generally tied to having a Microsoft account.

To get started, simply visit the website, use the search bar to find “budget,” and filter by “Excel” to see the full range of options. If you’re looking to enhance your budgeting skills, you can find valuable insights on mastering budgeting for financial freedom.

Website: templates.office.com

3. BuyExcelTemplates.com

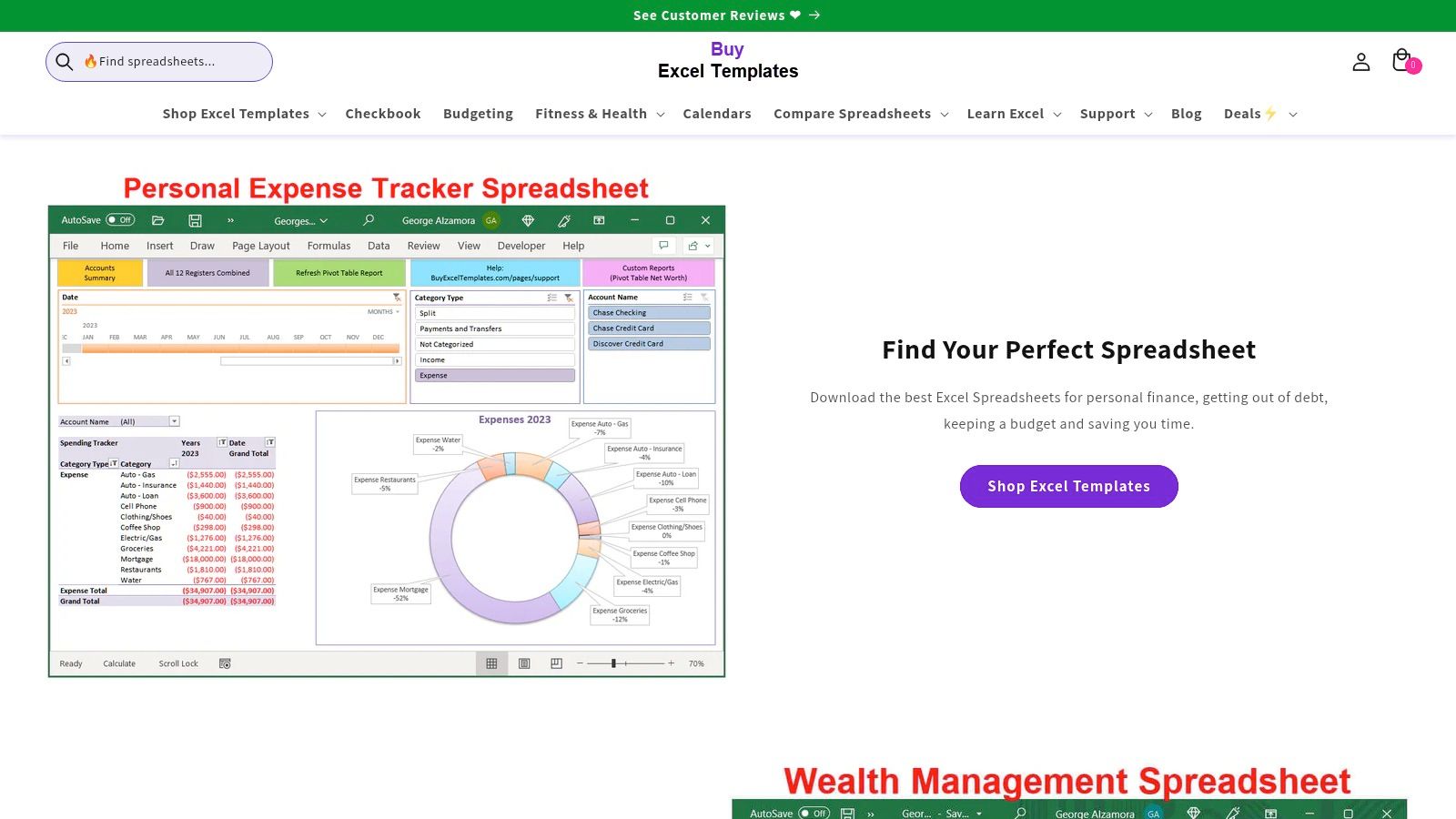

For users seeking a more powerful, specialized solution beyond free downloads, BuyExcelTemplates.com offers a premium marketplace. It specializes in advanced, feature-rich Excel templates that cater to detailed financial tracking. This platform is ideal for individuals who want a one-time purchase for a comprehensive tool without committing to a recurring subscription.

The site’s key differentiator is the depth of its products. Templates often go beyond simple expense tracking to include features like checkbook registers, detailed income vs. spending reports, and bill reminders. Each purchase comes with an instant digital download and detailed instructions, making implementation straightforward even for complex spreadsheets. This makes it a great middle-ground for those who have outgrown basic templates but aren’t ready for dedicated budgeting software. The responsive customer support is another significant advantage for troubleshooting or customization questions.

Key Features and Considerations

BuyExcelTemplates.com provides a robust personal budget spreadsheet template for users who need more than the basics. The one-time purchase model is particularly appealing for long-term value.

- Pros:

- One-time purchase with no recurring fees.

- Templates include advanced features like checkbook registers and detailed reports.

- Instant digital download and includes detailed instructions.

- Cons:

- Higher upfront cost compared to free alternatives.

- Templates are primarily designed for U.S. users, which may require adjustments for international currency or date formats.

To find the best fit, browse the “Personal Finance” category and carefully review the feature list of each template before purchasing.

Website: buyexceltemplates.com

4. byMarketers

For users who prefer the collaborative and cloud-based nature of Google Sheets, byMarketers offers a sleek and functional solution. This platform provides a specialized personal budget spreadsheet template designed to simplify financial tracking. Its strength lies in its automated dashboard and user-friendly interface, making it an excellent choice for individuals who want visual insights into their spending habits without a steep learning curve. The template is built for modern accessibility, allowing you to manage your finances from any device with an internet connection.

The core appeal of the byMarketers template is its dynamic dashboard that automatically updates as you input your income and expenses. This visual approach helps you quickly identify where your money is going. Customization is also a key feature, allowing you to tailor income and expense categories to fit your specific financial situation, whether you’re a freelancer with variable income or a student managing loans. The inclusion of lifetime support adds significant value, ensuring users have a resource to turn to if they encounter any issues or have questions.

Key Features and Considerations

byMarketers delivers a powerful yet simple personal budget spreadsheet template ideal for Google Sheets enthusiasts. The focus on automation and support makes it stand out.

- Pros:

- User-friendly data entry and an intuitive layout.

- Lifetime support is included with the template purchase.

- Accessible from any device, promoting on-the-go budget management.

- Cons:

- Exclusively for Google Sheets, so it is not compatible with Microsoft Excel.

- The dashboard experience is optimized for desktop or tablet views.

To get started, simply visit the website and purchase the template. You will receive a link to make a copy in your own Google Drive, making setup quick and easy.

Website: https://bymarketers.com

5. Spreadsheets Crafter

Spreadsheets Crafter offers an all-in-one Personal Finance Package that bundles multiple financial management tools into a single, comprehensive solution. This approach is ideal for users seeking a holistic view of their finances beyond simple monthly tracking. The package is designed for both Excel and Google Sheets, providing flexibility regardless of your preferred platform.

The primary appeal is its integrated nature. Instead of downloading separate templates for budgeting, bill tracking, and net worth, you receive a cohesive system where each tool complements the others. This makes it a strong contender for those serious about taking control of their entire financial picture. The one-time purchase model with free future updates also adds significant long-term value, ensuring your tools remain current without recurring subscription fees.

Key Features and Considerations

This platform excels by delivering a complete personal budget spreadsheet template within a broader financial toolkit. It’s designed for ease of use but offers powerful, interconnected features.

- Pros:

- Comprehensive package including budget planners, bill trackers, and more.

- One-time purchase provides lifetime access and free updates.

- Maintains data privacy as all information is stored on your local device or personal Google account.

- Cons:

- Requires a paid purchase, unlike free single-purpose templates.

- The initial setup for the entire package can be more involved than a simple budget sheet.

To get started, you select the package on their site, which grants instant download access to the files and detailed instructions.

Website: spreadsheetscrafter.com

6. Moneyzine

Moneyzine provides a collection of free, user-friendly budget templates that are notable for their cross-platform compatibility. Whether you’re a dedicated Excel user, prefer the cloud-based convenience of Google Sheets, or work within Apple’s ecosystem with Numbers, Moneyzine has a downloadable option for you. This makes it a great starting point for individuals or families who use different operating systems but need a consistent budgeting tool.

The platform stands out by offering templates tailored to specific needs, such as student budgets or comprehensive family expense trackers. Each personal budget spreadsheet template includes visual aids like charts and graphs, helping you quickly analyze where your money is going. The focus is on simplicity and immediate usability, allowing users to get started with budgeting without a steep learning curve. Customization is straightforward, so you can easily adjust categories to match your unique financial life.

Key Features and Considerations

Moneyzine is an excellent resource for anyone seeking a straightforward, no-cost budgeting solution with helpful visual components. The experience is as simple as visiting the site, choosing a template, and downloading it.

- Pros:

- Completely free to download and use across multiple platforms (Excel, Google Sheets, Numbers).

- Caters to diverse users, including students and families.

- Includes helpful budgeting guidance and visual charts for easy analysis.

- Cons:

- Lacks the advanced automation found in premium or software-based tools.

- All financial data must be entered manually, which can be time-consuming.

To get started, simply navigate to their templates section and select the one that best fits your financial situation, whether you need a monthly or weekly overview.

Website: moneyzine.com

7. TotalSheets

TotalSheets stands out for its extensive library of over 20 free budget templates designed for Excel, OpenOffice, and Google Sheets. This broad compatibility makes it a versatile choice for users regardless of their preferred spreadsheet software. The platform provides a rich variety of templates tailored to specific needs, from personal finance and family budgeting to planning for significant life events like a wedding.

The primary strength of TotalSheets is its user-friendly design and focus on practical application. Each personal budget spreadsheet template is built for clarity and ease of use, making them accessible even for those new to spreadsheets. The templates are straightforward to download and customize, allowing users to adapt categories, formulas, and visual elements to fit their unique financial situation without a steep learning curve. This makes it an excellent resource for anyone wanting a functional, no-frills tool.

Key Features and Considerations

TotalSheets delivers a practical and diverse selection of budgeting tools that cater to both everyday financial management and special occasions. The user experience is simple: find a template that fits your need, download it, and start tracking.

- Pros:

- Completely free to download and use across multiple platforms.

- Wide variety of specific-use templates, including for households and events.

- High compatibility with Excel, Google Sheets, and OpenOffice.

- Cons:

- Templates may not include the advanced charting or automation found in premium options.

- Official support for troubleshooting is limited.

To get started, browse the collection on their website. The straightforward layout makes it easy to find and select the right template for your financial goals.

Website: totalsheets.com

8. TemplateArchive

TemplateArchive is a broad repository offering a significant collection of documents, and its budgeting section is particularly robust. It stands out by providing over 30 distinct, free personal budget spreadsheet templates, catering to a wide array of personal finance tracking styles and preferences. This platform is ideal for users who want to explore different layouts and functionalities without committing to a single system, from simple expense logs to detailed family budget planners.

The primary advantage of TemplateArchive is its sheer volume and variety, coupled with detailed instructions accompanying each download. This guidance is invaluable for beginners who may feel intimidated by spreadsheets. The templates are available in multiple formats, ensuring compatibility for users across different software ecosystems, not just Excel. This flexibility makes it a versatile resource for anyone looking for a solid starting point in their budgeting journey.

Key Features and Considerations

TemplateArchive is a go-to source for a free and adaptable personal budget spreadsheet template. Its strength lies in offering diverse options that suit various budgeting needs, from individuals to families.

- Pros:

- Completely free to download and use without an account.

- Large and diverse selection of templates for different needs.

- Each template includes detailed instructions for ease of use.

- Cons:

- Many templates are foundational and may require user customization.

- Lacks the advanced automated features found in premium or software-integrated options.

To find the best fit, browse the budgeting category and review the previews and descriptions for each template to match one to your specific financial situation.

Website: templatearchive.com

9. ClickUp

While known primarily as a project management tool, ClickUp offers a surprisingly robust collection of free budget templates that extend its organizational power to personal finance. These templates are designed for both Excel and for direct use within the ClickUp platform, providing a unique blend of a traditional spreadsheet feel with modern, collaborative features. It’s an excellent choice for individuals who want to manage their finances with the same structured approach they use for work or personal projects.

The platform’s standout feature is its integration. You can download a standard Excel file or import the budget template directly into a ClickUp workspace. This allows you to set deadlines for bill payments, create tasks for financial goals, and view your budget alongside other life-planning activities. This holistic approach makes it more than just a numbers tracker; it turns budgeting into an actionable project.

Key Features and Considerations

ClickUp provides a versatile personal budget spreadsheet template for those who appreciate structure and integration. The user experience is clean and modern, whether you use the standalone file or the integrated version.

- Pros:

- Completely free to download and use as Excel files.

- Integrates budgeting into a powerful project management ecosystem.

- Templates are well-designed for tracking expenses and financial goals.

- Cons:

- Using the template within the platform requires a free ClickUp account.

- Can feel overly complex if you only need a simple, no-frills spreadsheet.

To access the templates, visit the website and browse the budget category. You can download them directly or add them to your ClickUp workspace to unlock advanced organizational features.

Website: clickup.com/templates/budget

10. TotalSheets Personal Budget Spreadsheet

For those just starting their budgeting journey, TotalSheets offers a straightforward and accessible solution. Its free personal budget spreadsheet template is designed with simplicity and intuition in mind, making it an excellent entry point for anyone intimidated by more complex systems. The clean layout strips away overwhelming features, focusing purely on the essentials of tracking income against expenses.

The primary strength of this template is its universal compatibility and ease of use. It works seamlessly with both Microsoft Excel and Google Sheets, catering to a wide range of users regardless of their preferred platform. The design supports yearly budget planning through clear monthly breakdowns, allowing beginners to easily see where their money is going over time. Because it avoids advanced automation, it forces a hands-on approach, which can be beneficial for truly learning one’s spending habits.

Key Features and Considerations

TotalSheets provides a foundational personal budget spreadsheet template that is perfect for building solid financial habits from the ground up. The experience is as simple as downloading the file and starting to fill it in.

- Pros:

- Completely free to download and use.

- Simple, intuitive design is ideal for beginners.

- Compatible with both Google Sheets and Microsoft Excel.

- Cons:

- Lacks advanced features like automatic transaction imports or detailed graphs.

- All data entry must be done manually.

To get started, you can download the template directly from their website. This no-frills approach makes it one of the quickest ways to begin managing your finances.

Website: totalsheets.com/personal-budget-spreadsheet

11. Vertex42

Vertex42 has long been a trusted name in the world of Excel templates, and its collection of budgeting tools is a primary reason for its popularity. The site offers a practical, no-frills approach to financial planning, providing a wide range of free templates that are both simple to use and highly effective. This makes it an excellent starting point for individuals who want a solid foundation for their financial tracking without a steep learning curve.

The platform’s strength is its focus on functionality over flashiness. Each personal budget spreadsheet template is thoughtfully designed to serve a specific purpose, from basic monthly budgets to more detailed money management systems that include expense tracking and goal setting. Because the templates are standard Excel or Google Sheets files, they are completely customizable, allowing users to tailor categories and formats to their unique financial situation.

Key Features and Considerations

Vertex42 provides robust tools for users who appreciate the control and familiarity of a traditional spreadsheet. It excels at delivering clean, user-friendly designs that get the job done efficiently.

- Pros:

- Completely free to download and use without needing an account.

- Clean, professional, and user-friendly designs that are regularly updated.

- Wide variety of templates for different needs, including personal, family, and business budgets.

- Cons:

- Requires manual data entry for all transactions.

- Lacks the advanced automation found in dedicated budgeting software.

To get the most out of Vertex42, browse their budget template gallery and read the detailed descriptions accompanying each download to find the perfect fit for your needs.

Website: vertex42.com

12. Smartsheet

Smartsheet takes a unique approach by blending project management with personal finance. While known in the business world, it offers a robust collection of free budget templates that bring professional-grade planning tools to your personal finances. This integration allows users to not only track expenses but also to manage financial goals as if they were projects, complete with timelines and milestones.

The platform’s strength is its structured, goal-oriented format. Instead of just a simple ledger, a Smartsheet template can help you organize everything from a basic monthly budget to a complex event budget. This makes it ideal for individuals who appreciate a more comprehensive and systematic approach to financial planning, connecting daily spending habits to long-term objectives. The interface is clean and more powerful than a standard spreadsheet.

Key Features and Considerations

Smartsheet provides a powerful personal budget spreadsheet template for those who enjoy structure and tracking progress over time. The experience feels less like simple data entry and more like active financial management.

- Pros:

- Completely free to download and use the templates.

- Integrates project management features for goal-oriented budgeting.

- User-friendly interface with templates for personal, business, and event use.

- Cons:

- Requires creating a Smartsheet account to access and use templates.

- The powerful features can have a learning curve for beginners.

To get started, explore their free templates page. If you’re looking to build a more dynamic overview of your finances, you can learn more about creating a personal finance dashboard.

Website: smartsheet.com/free-budget-templates

Top 12 Personal Budget Template Comparison

| Product | Core Features / Characteristics | User Experience / Quality | Value Proposition | Target Audience | Unique Selling Points | Price Points |

|---|---|---|---|---|---|---|

| Irregular Income Budget Template | Budgeting for fluctuating income | ✩ Easy to integrate | Affordable, reduces overspending | Freelancers, gig workers | Tailored for irregular income | Free |

| Microsoft Create | Wide range of Excel budget templates | ✩ Professional & updated | Free and customizable | Excel users, general public | Professionally designed, regularly updated | Free |

| BuyExcelTemplates.com | Diverse Excel templates with detailed reports | ✩ Detailed & supported | One-time purchase, no subscriptions | U.S. personal budgeters | Comprehensive templates with instructions | One-time purchase (varies) |

| byMarketers | Google Sheets budget template with dashboards | ✩ User-friendly, lifetime support | Access from any device | Google Sheets users | Automated dashboards, lifetime support | Purchase-based |

| Spreadsheets Crafter | All-in-one finance package for Excel & Sheets | ✩ Secure, customizable | One-time purchase, free updates | Excel & Sheets users | Multiple tools in one, privacy focused | One-time purchase |

| Moneyzine | Free Excel/Sheets/Numbers budget templates | Simple, chart visualizations | Free, easy-to-use | Students, families, beginners | Cross-platform, budgeting guidance | Free |

| TotalSheets | Variety of free templates for multiple platforms | Beginner-friendly | Free and customizable | Beginners, event planners | Event budgets + multi-platform compatibility | Free |

| TemplateArchive | Large collection of free budget spreadsheets | Diverse templates | Free and regularly updated | General personal budgeters | Multiple formats + detailed instructions | Free |

| ClickUp | Templates for personal/business with goal setting | ✩ User-friendly | Free with optional ClickUp integration | Personal/business users | Project management integration | Free |

| TotalSheets Personal Budget | Simple yearly budget with monthly breakdown | Intuitive and beginner-friendly | Free to use | Beginners | Yearly planning, multi-platform | Free |

| Vertex42 | Wide range of simple Excel templates | ✩ User-friendly, regularly updated | Free and customizable | Personal planners | Regular updates, goal setting features | Free |

| Smartsheet | Budget templates with project management integration | ✩ User-friendly | Free with Smartsheet account | Personal/business users | Integration with Smartsheet tools | Free |

Beyond the Spreadsheet: Automating Your Financial Big Picture

We have explored a comprehensive collection of resources, from the highly adaptable Irregular Income Budget Template to robust platforms like Smartsheet and ClickUp. Each personal budget spreadsheet template offers a unique pathway to gaining granular control over your financial life. The journey from financial uncertainty to clarity begins with the simple act of tracking where your money goes.

Whether you’re a freelancer managing fluctuating income, a young professional building foundational wealth, or an expat navigating multiple currencies, the right template serves as your command center. For tech-savvy users, options from Vertex42 and Microsoft Create provide powerful, feature-rich starting points, while minimalist templates from sites like Moneyzine offer straightforward simplicity. The key is recognizing that a spreadsheet is more than just a grid of numbers; it’s a dynamic tool for making informed decisions.

Choosing Your Ideal Budgeting Tool

Selecting the perfect template depends entirely on your personal context. Before you download, reflect on these critical factors:

- Your Financial Complexity: Are you tracking a single checking account and a few credit cards, or are you managing multiple income streams, investments, and business expenses? A gig worker needs a different level of detail than a salaried employee with predictable finances.

- Your Technical Skill Level: Be honest about your comfort with spreadsheet functions. If VLOOKUPs and pivot tables sound intimidating, a simpler, plug-and-play template like those from TemplateArchive is a much better fit than a complex, formula-heavy one.

- Your Time Commitment: Manual data entry is the Achilles’ heel of any spreadsheet system. Consider how much time you are willing to dedicate each week. If the answer is “very little,” your focus should be on templates that simplify input or considering tools that automate the process.

The most effective personal budget spreadsheet template is the one you consistently use. Start with a simple tool, build the habit of tracking, and then graduate to more complex systems as your needs and confidence grow. Remember, the goal goes beyond tracking expenses; it is to align your daily spending with your long-term aspirations.

The Next Step: From Manual Tracking to Automated Insight

While a spreadsheet provides an unparalleled level of detail for your budget, its greatest limitation is its manual nature. It captures a snapshot in time but often struggles to provide a real-time, consolidated view of your entire financial world, including investments, property, and liabilities. This is where you bridge the gap between detailed budgeting and high-level wealth management.

Your spreadsheet is the detailed street map for your daily financial journey. However, to see the entire landscape and navigate your long-term road trip toward financial independence, you need a live GPS. By integrating your detailed budget with an automated wealth-tracking tool, you create a powerful, sustainable financial management system. This synergy ensures that your meticulous daily efforts are directly contributing to your most ambitious financial goals, providing both control and clarity.

Ready to elevate your financial overview beyond the spreadsheet? PopaDex connects all your accounts in one place, automating your net worth tracking and giving you the big-picture insights needed to make smarter decisions. Sign up for a free account at PopaDex and see how automated clarity can transform your financial planning.