Our Marketing Team at PopaDex

A Practical Guide to Track Net Worth

To really get a handle on your net worth, you need a simple, consistent process: add up everything you own (your assets) and subtract everything you owe (your liabilities). That single number is the clearest, highest-level scorecard of your entire financial life. It shifts your focus from just your paycheck to building real, sustainable wealth.

Why You Should Track Your Net Worth

Honestly, tracking your net worth is so much more than a numbers game—it’s one of the most powerful habits you can build for your financial future. Think of it as the ultimate financial health check-up.

While your income statement shows what’s coming in and going out, your net worth gives you a true snapshot of your financial position at a single point in time. That distinction is crucial. It’s what moves your mindset from just earning money to strategically building wealth.

This single, powerful metric can drive some of your biggest life decisions. Seeing your liabilities shrink month after month can be a huge motivator to crush that debt even faster. On the flip side, noticing your investments are becoming a larger slice of your asset pie might be the signal you need to rebalance your portfolio.

Your net worth is your personal financial report card. It doesn’t judge; it simply measures. Consistent tracking turns abstract goals like “financial independence” into tangible milestones you can actively work toward.

A Clear Measure of Progress

One of the most compelling reasons I tell people to track their net worth is that it makes progress tangible. An abstract goal like “saving for retirement” suddenly feels a lot more real when you can see your net worth figure steadily climbing toward your target.

This regular check-in also keeps you accountable. It’s easy to ignore small spending leaks or forget about market ups and downs day-to-day. But when you look at your net worth monthly or quarterly, you see the cumulative impact of your financial habits. It forces you to answer the important questions:

- Are my savings efforts actually moving the needle?

- Is my investment strategy really working?

- How much is my debt holding back my financial growth?

A Global Perspective on Wealth

Understanding your own financial picture also connects you to a much larger economic story. Globally, personal wealth keeps growing, but that growth isn’t always spread evenly.

A report from UBS that analyzed over 92% of the world’s wealth found it jumped by 4.6% in just one year, continuing a long-term upward trend. By focusing on your own net worth, you’re taking control of your slice of that global pie and ensuring you’re an active participant in creating your own wealth.

Alright, time to roll up our sleeves and get our hands dirty. Before you can start tracking your net worth, you need to know what you’re working with. Think of it as a financial scavenger hunt—your mission is to round up the most current statements for everything you own and everything you owe. This is the bedrock of an accurate net worth picture.

First up, let’s gather everything on the “plus” side of the ledger: your assets. This goes way beyond just your main checking account. We need the full inventory.

- Bank Accounts: Pull the latest statements for every single checking, savings, and money market account you have.

- Investment Accounts: Find the most recent summaries for your 401(k), IRAs, brokerage accounts, and any other investment vehicles you’re using to build wealth.

- Property & Valuables: For your home, grab the most recent property tax assessment or a reliable online estimate (Zillow or Redfin work well). For your car, a quick search on a site like Kelley Blue Book will give you a solid market value.

Next, it’s time to face the music and compile a list of all your liabilities. The key here is to find the current outstanding balance for each debt, not what you originally borrowed. Hunt down the statements for:

- Mortgages and home equity lines of credit (HELOCs)

- Auto loans

- Student loans

- Credit card balances

- Personal loans

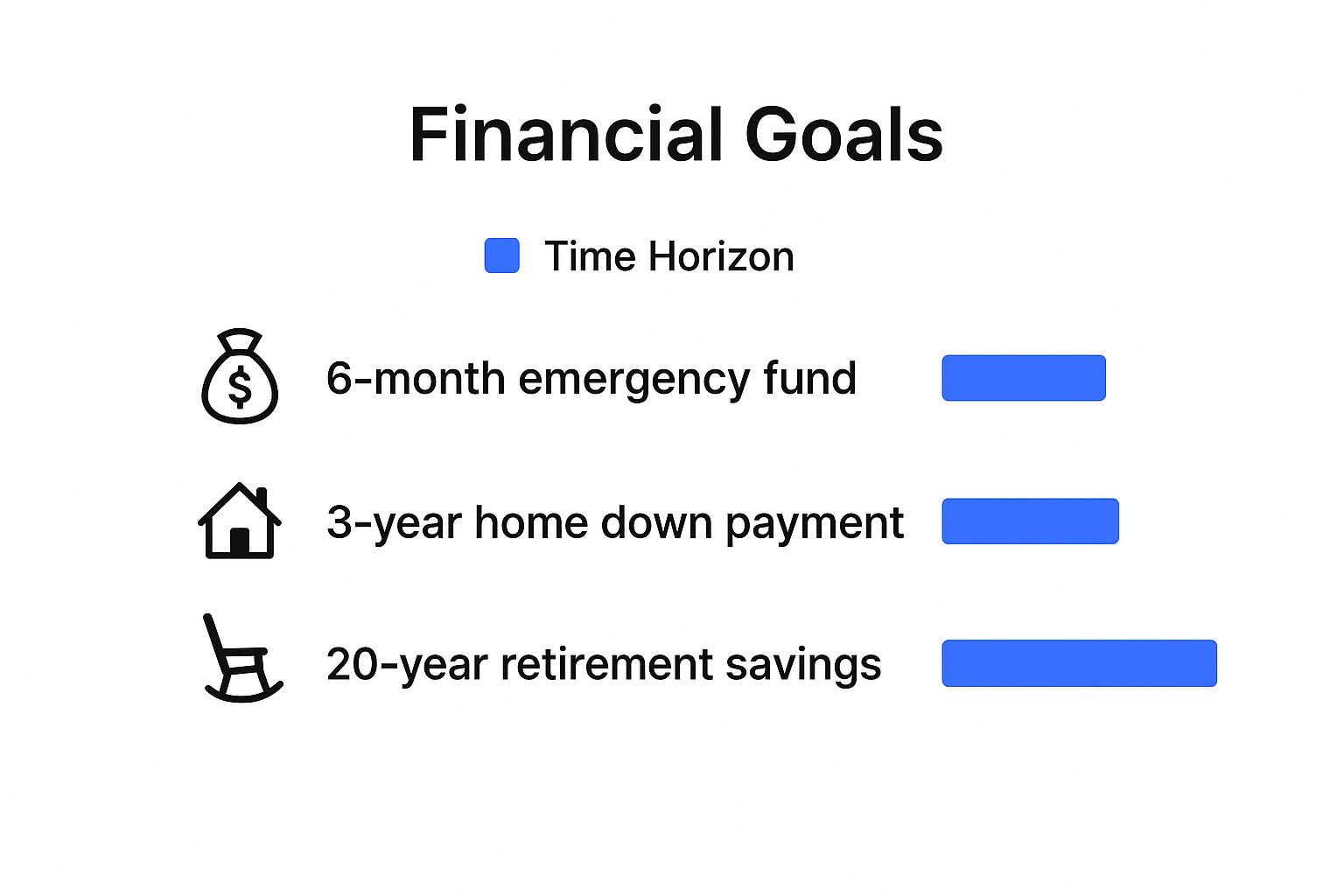

Getting all this on paper (or screen) is what lays the groundwork for figuring out the true scale of your financial goals. As you can see below, goals like building an emergency fund versus saving for retirement operate on vastly different timelines and require totally different strategies.

It’s pretty clear that long-term goals like retirement demand a much more sustained and consistent effort compared to hitting those short-term targets.

Choosing Your Net Worth Tracking Method

With all your documents in hand, you’ve hit your first major decision point: how are you actually going to track this stuff? You’ve got two main paths: the old-school manual spreadsheet or a modern, automated financial app.

Deciding between a spreadsheet and an app really comes down to your personality and how you like to manage your finances. Let’s break down the pros and cons of each to help you figure out which camp you fall into.

Choosing Your Net Worth Tracking Method

| Feature | Spreadsheet (e.g., Excel, Google Sheets) | Financial App (e.g., Mint, Personal Capital) |

|---|---|---|

| Control & Customization | Total control. You build it from scratch and decide exactly what to track and how. | Less control. Uses predefined categories, though some customization is often possible. |

| Cost | Free. All you need is software you likely already have. | Often freemium or requires a subscription for advanced features. |

| Privacy | Maximum privacy. Your data stays on your computer and is never shared. | Requires linking accounts, so you’re trusting a third party with sensitive data. |

| Time & Effort | Time-consuming. Requires manual data entry for every account, every update. | Highly automated. Syncs with your accounts to pull in data automatically, saving hours. |

| Accuracy | Prone to human error. It’s easy to mistype a number or forget to update an account. | More accurate. Real-time data syncs reduce the risk of manual mistakes. |

A simple spreadsheet in Google Sheets or Excel gives you complete and total control. You manually punch in your numbers, which forces a very hands-on, intimate understanding of your finances each month. It’s free, completely private, and you can tweak it endlessly. The downside? It demands discipline and can become a real chore, especially if you’re juggling a lot of different accounts.

On the other hand, automated tools offer a “set it and forget it” vibe. Our own net worth tracker, for example, connects directly to your financial institutions and pulls in real-time data automatically. This saves a massive amount of time and cuts down on the chances of human error. The big trade-off, of course, is that you’re trusting a third-party service with your financial data, though any reputable platform will use bank-level security to keep it locked down.

Ultimately, there’s no single “best” choice—only what’s best for you. If you’re a data nerd who loves getting into the nitty-gritty and wants absolute control, a spreadsheet might be your perfect match. But if you value convenience and want a seamless, always-current overview without the manual labor, an automated app is probably the way to go.

How to Accurately Value Your Assets

To track your net worth properly, you need to know exactly what your stuff is worth. It’s a simple concept, but getting it right is critical. If you inflate your asset values, you’re just giving yourself a false sense of security. On the flip side, underestimating what you own can be seriously demotivating.

So, let’s get down to the nitty-gritty of valuing your assets like a pro. We’ll split everything into three main buckets: liquid, invested, and personal assets. Each one needs a slightly different approach to get a number you can trust.

Valuing Liquid and Invested Assets

Good news—this is the easy part. Liquid and invested assets are usually the most straightforward to value because they have clear, current market prices.

-

Liquid Assets: This is your cash on hand. Think checking accounts, savings accounts, and money market funds. The value is just the current balance. Log into your bank’s website or pull up your latest statement. That’s your number.

-

Invested Assets: Here we’re talking about your 401(k)s, IRAs, brokerage accounts, and any other investment accounts you hold. Their value changes with the market every single day. For a real-time snapshot, just log into your investment platform. If you want to check individual stocks or ETFs, you can look up their ticker symbols (like VOO or AAPL) on any financial site for the current share price.

Key Takeaway: Always use the current market value for your investments, not what you paid for them. The goal is to capture what the asset is worth today. That’s the foundation of a reliable net worth calculation.

This isn’t some secret trick; it’s how millions of people keep tabs on their portfolios. In fact, the United States is home to 37% of the world’s millionaires, with over six million people holding at least $1 million in investable assets. They didn’t get there by guessing.

Estimating Personal Asset Values

This is where things can feel more like an art than a science. Valuing personal assets like your home or car requires a bit more legwork, but there are some fantastic tools out there to give you a solid estimate.

Your home is probably your biggest asset. For a quick and surprisingly accurate estimate, check out online tools like Zillow’s “Zestimate” or Redfin’s “Estimate.” They analyze recent sales of similar homes in your neighborhood to give you a ballpark figure. It’s not a formal appraisal, but it’s a great starting point for your net worth tracker. For a deeper look at this, check out our guide on net worth and how to calculate it.

When it comes to your car, Kelley Blue Book (KBB) and Edmunds are the gold standard. Just plug in your car’s make, model, year, mileage, and condition, and they’ll give you its current private party sale value.

But what about everything else? Honestly, most personal items like furniture and electronics depreciate so fast they aren’t worth including. The exception is significant collectibles. If you own valuable art or heirlooms, learning how to find the value of antiques is a must for getting your net worth number right.

Identifying and Listing Your Liabilities

Now that you’ve got a clear picture of what you own, it’s time to face the other side of the coin. Understanding what you owe is just as critical as valuing your assets when you track your net worth. Simply put, a liability is any debt or financial obligation you’re on the hook for.

I get it—cataloging your liabilities isn’t nearly as fun as tallying up your investments. But it’s a non-negotiable step for an honest financial check-up. This process brings much-needed clarity, revealing exactly where your money is going and which debts might be holding you back the most.

To get started, we’ll split your debts into two main buckets: secured and unsecured. This isn’t just for neat organization; the distinction matters because it usually ties directly to interest rates and how these debts should fit into your financial game plan.

Secured Debts Backed by Collateral

Secured debts are loans backed by an underlying asset—something the lender can take if you stop paying. These are often your largest and longest-term liabilities.

- Mortgage: This is the big one for most people. You need the current outstanding principal balance, not the original loan amount or what your home is worth today.

- Auto Loans: Just like your mortgage, list the current amount you still owe on your car.

- Home Equity Lines of Credit (HELOCs): If you’ve tapped into your home’s equity, be sure to include the balance you’ve actually drawn, not your total credit limit.

You can snag these exact numbers by logging into your lender’s website or just glancing at your most recent statement. It’s crucial to use the current balance for an accurate calculation.

An honest accounting of your liabilities is the first step toward creating a powerful debt-reduction strategy. Knowing exactly where you stand empowers you to make targeted decisions that accelerate your journey to being debt-free.

Unsecured Debts and Other Obligations

Unsecured debts aren’t tied to any specific asset, which means the lender is taking on more risk. Because of that, these debts almost always come with much higher interest rates, making them a top priority to attack.

Here’s what typically falls into this category:

- Credit Card Balances: List the total outstanding balance across all your cards. With their sky-high interest rates, these are particularly toxic to your net worth growth.

- Student Loans: Pull together the current total balance for all your federal and private student loans.

- Personal Loans: Include any loans you’ve taken out from banks, credit unions, or online lenders that aren’t secured by collateral.

- Medical Debt: If you have outstanding medical bills you’re paying off, add them to the list, too.

Aggressively paying down high-interest unsecured debt is one of the fastest ways to give your net worth a serious boost. Think about it: every dollar you throw at a 22% APR credit card balance is a guaranteed 22% return on your money. You’d be hard-pressed to find that kind of guaranteed return anywhere else. Prioritizing these debts isn’t just about shrinking what you owe; it’s a strategic play to build wealth faster.

Interpreting Your Net Worth Trend Over Time

Your first calculation is just a snapshot. A single data point. The real magic happens when you track your net worth over time, because that’s where the story unfolds. This ongoing trend line reveals the true impact of your financial habits, market movements, and overall strategy.

To see this story clearly, you need a sustainable rhythm for your check-ins. For most people, a monthly or quarterly update hits the sweet spot. Monthly updates keep you deeply engaged and help you catch any issues fast. Quarterly reviews offer a higher-level perspective, smoothing out the bumps from short-term market noise.

The frequency isn’t as important as the consistency. Just pick a schedule you know you can stick to, and make it a non-negotiable part of your financial routine.

Understanding the Ups and Downs

It’s completely normal to feel a sting if your net worth drops, but don’t panic. Not all decreases are created equal. The key is to dig into the “why” behind the number and connect your actions—or external forces—to the results.

Let’s say you crushed your savings goal and put away $1,000 this month, but your net worth still fell by $3,000. Frustrating, right? Before you get discouraged, a quick look at your investment accounts might reveal the stock market just had a rough few weeks, dragging your 401(k) down with it.

This isn’t a failure on your part; it’s just the reality of investing. You aced your savings habit—the part you can control. Market forces simply had a bigger, short-term say. Recognizing what you can and can’t control is a huge part of the mental game.

On the flip side, you might see your net worth climb even when your cash savings went down. How? Maybe you made an aggressive $2,500 payment on a high-interest credit card. Your cash asset dropped, but your liability (debt) shrank by the exact same amount. The immediate change to your net worth is zero, but you’ve scored a massive long-term win by stopping the interest bleed and freeing up future cash flow.

Reading the Broader Story

Analyzing these trends over several months is what helps you make smarter moves. If you notice your debts are stubbornly high despite your efforts, it might be time to switch up your repayment strategy. If your assets are growing but all your eggs are in one basket, that’s a clear signal to start diversifying.

Once you have a handle on your personal trend, you can explore ways to protect and accelerate it. This often involves looking into proven wealth preservation strategies to secure your financial future.

It’s also interesting to see how these trends play out on a larger scale. Different generations approach wealth differently. Baby Boomers, for example, currently hold a staggering share of global wealth—over $83 trillion—with much of it in traditional financial assets. In contrast, many Millennials are allocating more of their capital toward real estate and private business ventures. You can see more on these global wealth dynamics in the latest UBS report.

Ultimately, tracking your net worth isn’t just about crunching numbers. You’re writing your financial autobiography, one month at a time, and giving yourself the power to steer the plot toward the ending you want.

Got Questions About Net Worth Tracking? We’ve Got Answers

As you get into the rhythm of tracking your net worth, you’re bound to have questions. That’s a great sign—it means you’re really digging in and taking this seriously. Let’s tackle some of the most common hurdles people run into, so you can keep moving forward with confidence.

How Often Should I Update My Net Worth?

For most of us, a monthly or quarterly update hits the sweet spot. A monthly check-in is brilliant for staying engaged. You can see the immediate results of your saving habits or debt payments, which is a fantastic motivator.

Then again, a quarterly update can feel a lot less stressful. It gives you a bird’s-eye view of your long-term progress and smooths out the little bumps from day-to-day market moves. The most important thing is finding a schedule that you’ll actually stick to. The real prize is building a rich history of your financial growth.

Don’t let market volatility scare you away from regular tracking. Short-term dips are just part of the investing landscape. What really counts is the long-term trend over six months, a year, and beyond. As long as your overall trajectory is heading up and you’re sticking to your plan, you’re doing just fine.

Should I Include Personal Stuff Like Furniture or My Laptop?

My advice? It’s almost always best to leave most personal belongings out of your net worth calculation. Things like furniture, electronics, and clothes lose value fast, and figuring out what they’re really worth is a subjective mess. Plus, they aren’t easy to sell for cash (what we call poor liquidity).

Including them can give you a false, inflated sense of your financial health. Focus on the big-ticket items that have a clear, verifiable market value, such as:

- Real estate (like your home)

- Vehicles (your car or truck)

- Financial accounts (all your investment and savings accounts)

The only real exception is for authenticated, high-value collectibles with a provable market price—think fine art, rare coin collections, or classic cars. Otherwise, keep your numbers clean and honest by leaving the small stuff out.

What if My Net Worth Drops Because of the Stock Market?

It’s a gut punch to see your net worth fall, especially when you know you did everything right with your budget and savings. When this happens, it’s almost always due to stock market volatility, which is a perfectly normal part of being a long-term investor.

The key is not to panic over one bad month. You’re playing the long game here. The stock market has its downturns, but historically, its long-term trend has always pointed up. Concentrate on what you can control, like your savings rate and your plan for paying down debt. For more answers to common money questions, you can always check out a comprehensive FAQ section to get more guidance.

Just zoom out and look at your progress over a longer timeline. As long as you keep saving and chipping away at debt, your net worth will bounce back and continue to grow. Market dips are just bumps in the road on your path to building wealth.

Ready to take control and see your financial picture with total clarity? PopaDex provides the intuitive tools you need to track your net worth automatically, so you can focus on making smart decisions. Sign up for free and start your journey today!